The holiday makes it hard to write assignments, it's too difficult. Today, there is actually only one thing worth paying attention to: Trump's and Bessent's statements on the path of reciprocal tariffs. It can be basically confirmed that the total tariff applicable to most countries will be 20%, with some countries possibly higher, and a very few could be extremely high.

But the key point is not how many countries have low tariffs, but rather the trade volume between these countries and the United States. For countries with a smaller trade scale with the U.S., the high and low points of tariffs won't have much impact. What will truly affect U.S. inflation are the countries that have significant trade with the U.S.

Moreover, even a 20% tariff is quite substantial. It's worth noting that the average tariff in the U.S. in 2024 is only 2.5%. The current basic tariff is four times that, and 20% is eight times that, which will definitely have an impact on the market.

This is not the most troublesome part. As Powell said, if tariffs are one-time, their impact on inflation is limited. However, Trump is clearly implementing a tiered tariff system. Whether some countries, especially those with high trade volumes, will also raise tariffs or even continue the trade war is uncertain, especially considering it's Trump.

Furthermore, it's unclear whether Trump will back down or stand firm. If it really is TACO, then fine, but prolonged confrontation might lead Powell to wait until retirement to lower interest rates or until the U.S. economy enters a recession.

But it's not all bad news. After all, the actual implementation of tariffs is on August 1, which is still nearly 20 days away. This time is a tug-of-war, and the harshest words could be exchanged. The key will be to see what the long-term implementation plan is. After entering July, it will inevitably reach a climax in the game of tariffs and monetary policy.

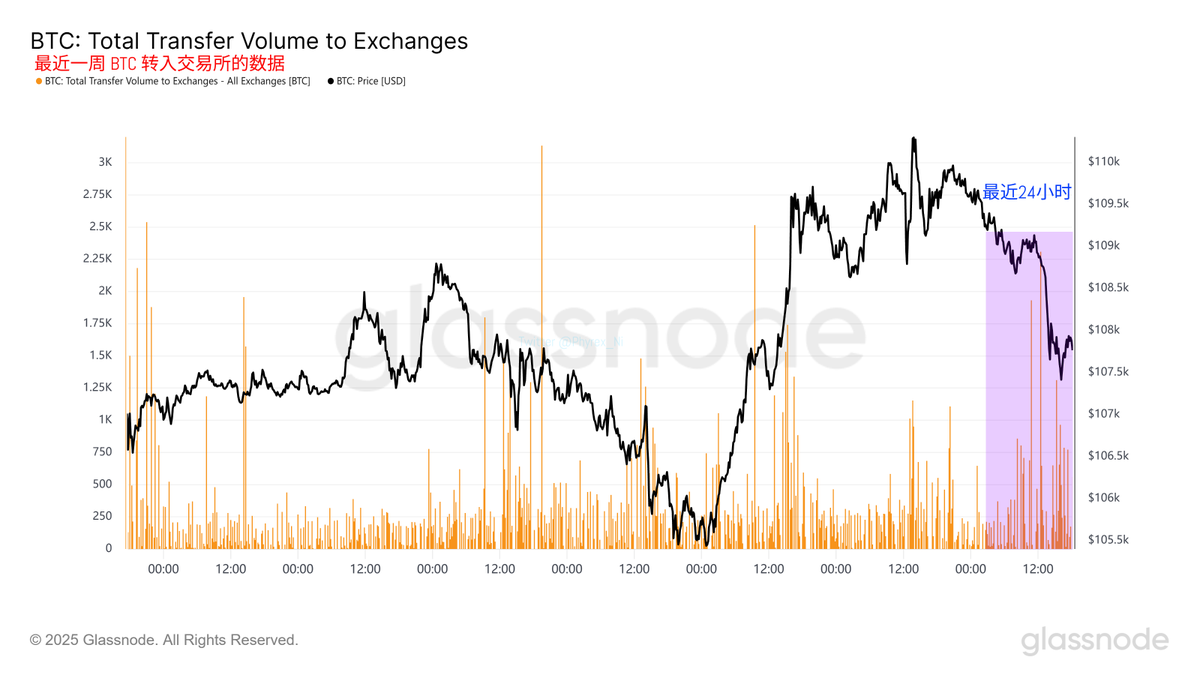

I really didn't expect the discussion about 80,000 $BTC to be so heated. Thinking back, it was a scare tactic for years in Mentougou, but there are no signs of this portion of Bitcoin entering exchanges. Moreover, if we really need to worry, I can tell you through data that there are still 3.8 million Bitcoins that have not moved in the early stages. No one knows how many are lost and how many people just don't want to move them.

There are indeed many concerns.

Looking back at the data of Bitcoin itself, the turnover rate during the holiday is still very low. If it weren't for the transfer of these 80,000 BTC, today would be a standard holiday state, so there's not much to say. After all, the key factor affecting price fluctuations today is still tariffs. Every weekend, Trump seems to stir things up, so let's see how the U.S. stock market reacts on Monday.

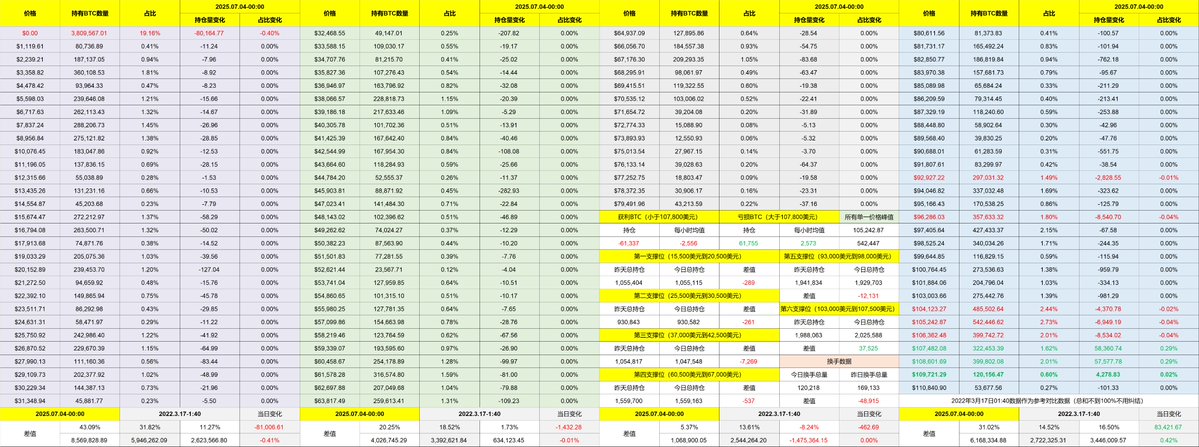

There hasn't been much change in support, so I won't elaborate further.

Data link: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。