撰文:稳定币支付·布道所

最近我做了一趟「田野调查」,从中国小商品市场到黄金交易集散地深圳水贝,再线上和非洲一线贸易商进行了沟通了解,想和大家聊聊——稳定币到底在真实世界的跨境结算里走到哪一步了?

何为稳定币:稳定币 101:1 USDT ≈ 1 USD 吗?

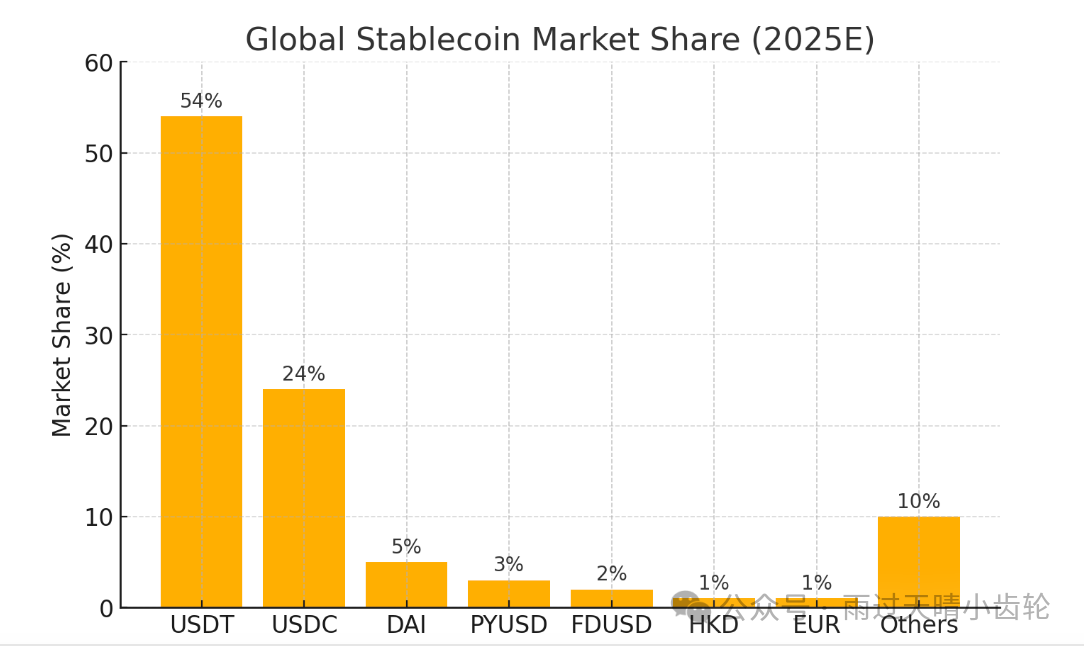

一句话:稳定币是「链上的法币储值券」(美元最主流,但港元、欧元等多币种版本也在快速增长),主流双雄 USDT / USDC占全球 85%+ 流通

- USDT(泰达币)

:市值超 800 亿美元,靠早期先发优势占据市场,主要用在加密货币交易、跨境私下结算,但储备透明度常被质疑(比如 2021 年曾被美国监管调查)。 USDC(美元硬币)由 Circle 和 Coinbase 联合发行,市值约 500 亿美元,合规性更强(每月审计储备,且只能用现金和国债背书),被摩根大通、高盛等机构接纳,近年在 DeFi(去中心化金融)场景里使用率反超 USDT。 锚定秘诀:发行方把对应法币现金、短期国债等高流动资产存托管银行,审计机构每月出报告,理论上 1:1 兑付。

企业实验室 & 先行者案例:

Visa × Circle(USDC 清算)2023‑09 官方新闻稿:

模式:Visa 通过集成 USDC,将传统银行卡网络与区块链结算打通。例如加拿大用户用 USDC 转账到拉美,资金通过 Circle 的链上清算(基于以太坊或 Solana),再由 Visa 合作银行兑换成本国法币,到账时间从传统电汇的 1-3 天压缩到 30 分钟内。

2024 年进展:拉美试点覆盖巴西、墨西哥,重点解决当地高通胀下的跨境汇款需求(如海外务工人员用 USDC 汇钱回家,规避本币贬值风险)。

Stripe Crypto Payouts:2022‑04 上线 USDC 薪酬方案,现覆盖 110+ 国家自由职业者。 • 接入平台:Twitter Creators、Braintrust、OpenSea 等。

场景:为全球自由职业者提供 USDC 发薪选项。例如美国公司通过Stripe向印度开发者支付薪酬,直接以 USDC 转账,开发者可在当地交易所兑换卢比,省去传统跨境转账的 SWIFT 费用(约 5%-10%)和汇率损耗。

数据:截至 2024 年,覆盖超 150 家企业客户,月均结算量超 2000 万美元,其中东南亚、非洲 freelancer 接受度最高。

PayPal & Venmo — PYUSD 生态2023‑09:首批 Venmo 用户可买、持、转 PYUSD,PayPal 内部转账免费秒级。 • 2024 全量开放,并支持链上充提(Ethereum/Solana)。 • 2025‑04 公布 3.7% 年化奖励 & 免手续费 Xoom 海外汇款;计划扩展至 Stellar。 → 意味着稳定币已打通「钱包‑消费‑汇款‑收益」全链路。

进展:2023 年推出锚定美元的稳定币 PYUSD,获美国货币监理署(OCC)监管许可,储备仅含现金和短期国债。目前主要用于机构间结算(如对冲基金用 PYUSD 支付交易佣金),2024 年计划开放给普通用户用于跨境购物。

SocGen‑Forge EURCV2024‑06 获欧盟 MiCA 首张欧元稳定币「EMI 级」牌照,面向机构国债 & 货币市场基金结算。

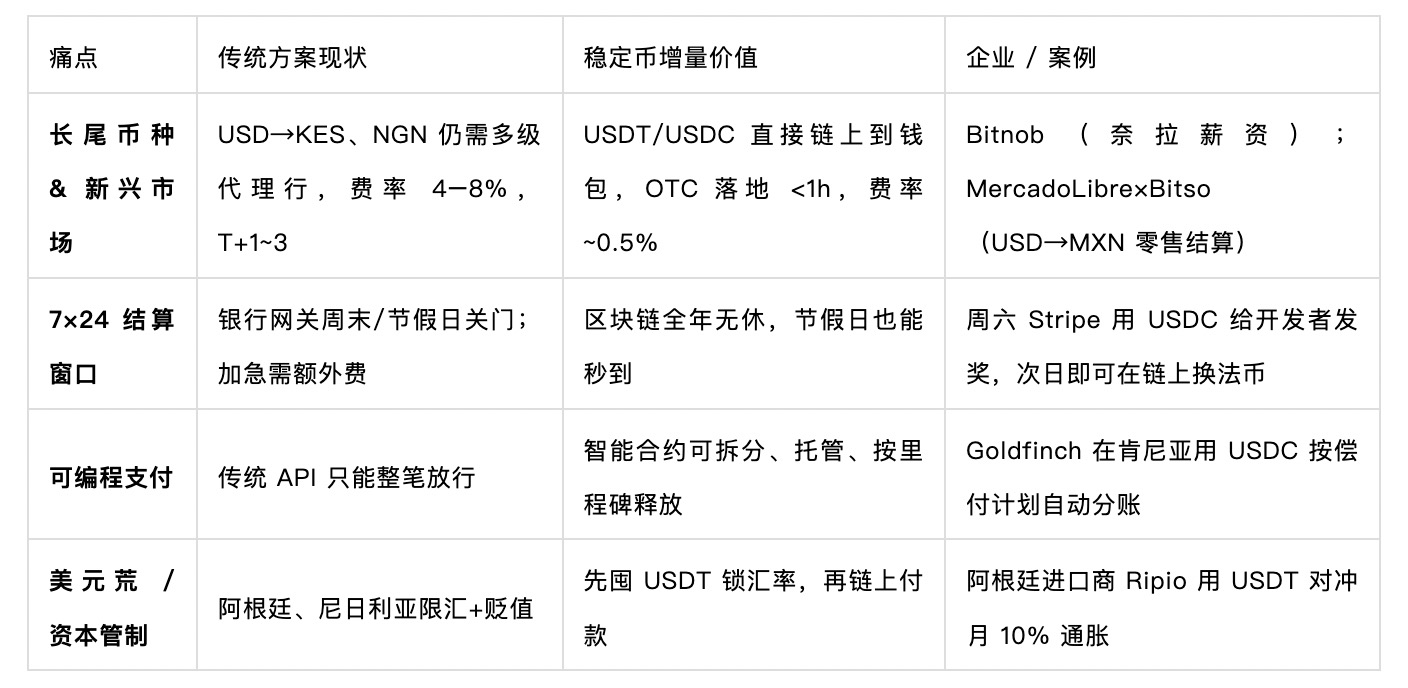

2. 为何跨境支付需要稳定币?

先辩证一句:在欧美日等主流货币区,Airwallex、Wise 甚至 SWIFT gpi 已能把 USD⇋GBP 做到 30 分钟,成本 0.4–1%。那稳定币还有什么价值?下面给出四个「增量场景」。

Bitnob(非洲工资发放):奈拉工资链上秒到,员工反馈「像收短信一样收美元」,OTC 换现平均 40 分钟完成。

MercadoLibre × Bitso(拉美零售巨头):卖家在周末也能实时收到 USDC 货款,退款窗口缩短 1.5 天,月省 20 万美元费率。

Stripe 周末赏金计划:一位越南开发者分享——周六晚上领到 50 USDC,10 分钟后链上换 VND,当晚就买了服务器,不用等周一银行开门。

Ripio(阿根廷进口商):老板说「囤 USDT 就像给公司加了美元保险」,去年对冲汇损 8% 以上。

新兴市场的特殊需求:抗通胀与支付便利

高通胀国家的 「货币替代」 需求

例子:阿根廷 2023 年通胀率超 100%,当地商家收比索后,一天内可能贬值 5%,而收 USDC 相当于 「持有美元资产」,保值性更强。布宜诺斯艾利斯的跨境电商卖家现在 60% 的订单要求用 USDC 结算。 逻辑:稳定币对他们来说不仅是支付工具,更是 「抗通胀储值手段」,类似津巴布韦人过去囤美元现金,现在囤 USDT。 无银行账户人群的支付入口

数据:非洲约 60% 人口没有银行账户,但有手机钱包(如肯尼亚 M-Pesa)。稳定币可通过 「法币→稳定币→法币」 的兑换链条,让无银行账户者用手机完成跨境支付。比如尼日利亚农民卖可可豆给欧洲买家,买家付 USDC 到农民的加密钱包,农民再在当地兑换成奈拉现金。

在G3 货币高速公路(即美元 USD、欧元 EUR、日元 JPY 这三大主流货币的成熟清算通道上),FinTech 已够快;但在长尾走廊、周末夜间、以及需要「钱随代码走」的场景里,稳定币仍能把时间从 T+1 压到 T+0,把费率从 4% 降到 0.5%。它不是取代银行,而是补齐盲区、铺平「最后一公里」。

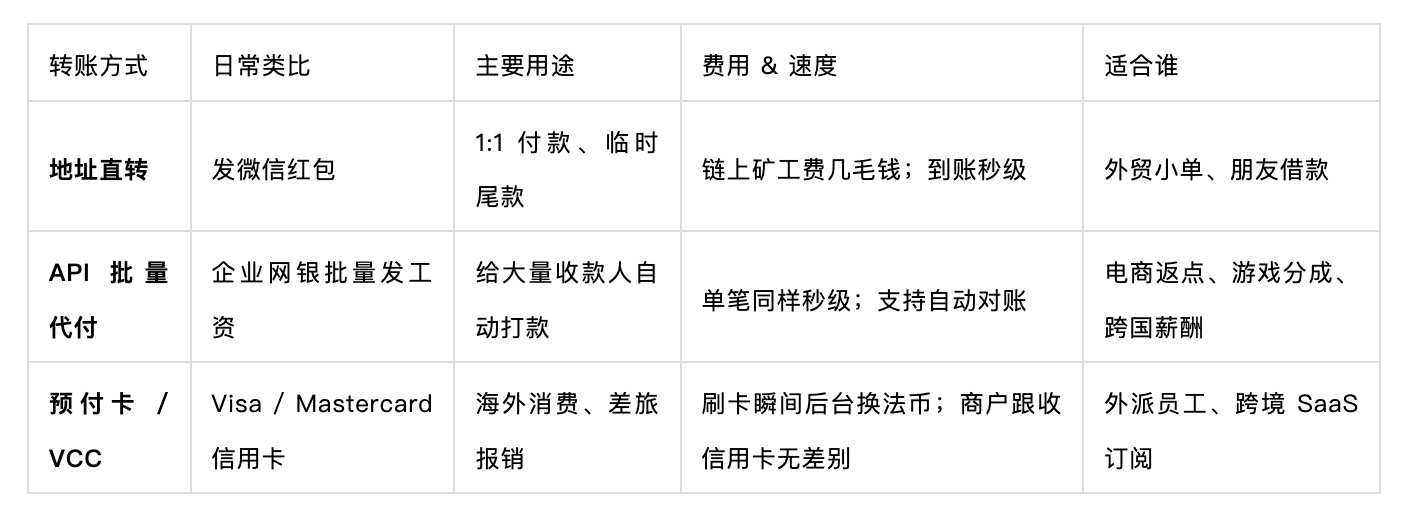

3.链上工具箱:三种最常见的「转账方式

把它们类比成我们每天用的支付/银行工具

想像你有三把钥匙:红包钥匙用来「点对点」小额互转;工资钥匙能一键把钱发给成百上千人;信用卡钥匙则把链上的稳 定 币变成全球可刷的 Visa/Mastercard。根据场景选钥匙,链上支付就这么简单。

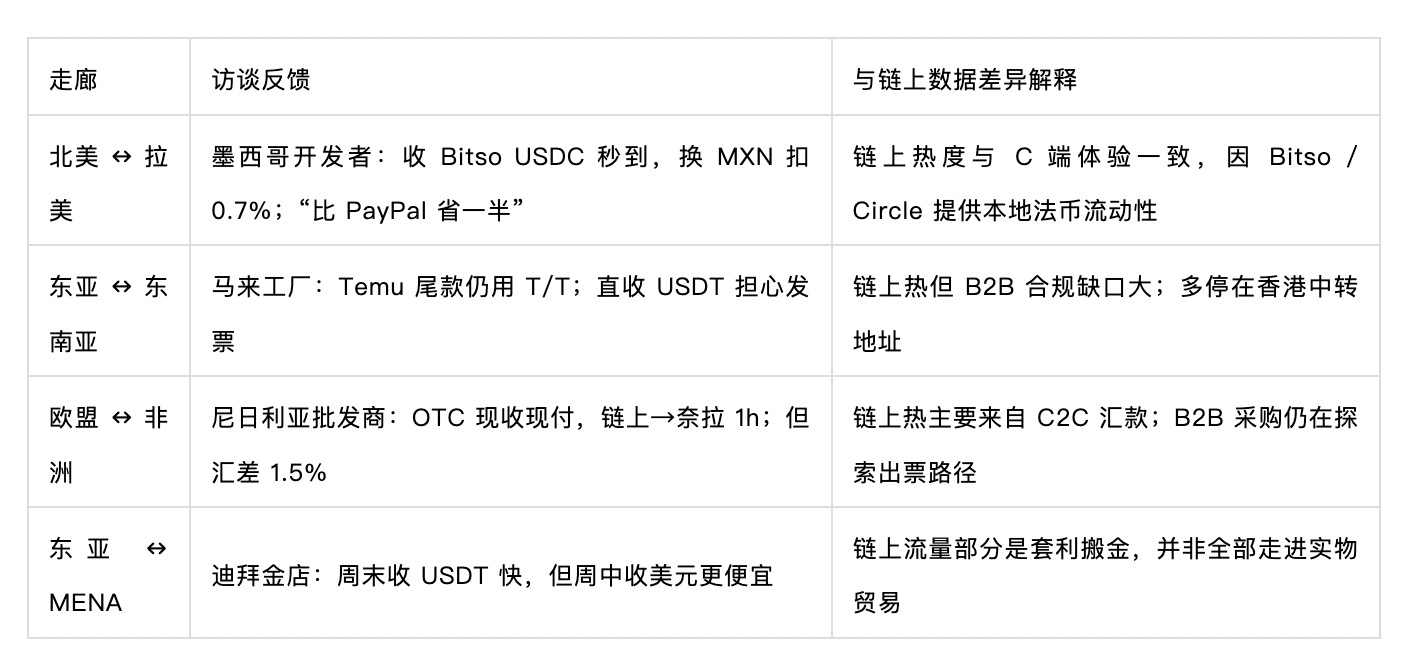

4.热力走廊:链上数据 vs. 现场观察

先用「链上望远镜」看哪条走廊最热,再用「田野显微镜」听当地商户怎么说。数据来自 Chainalysis2024-Q3Stablecoin Dashboard,金额为月均净流量,已聚合多链。

4.1 Top 5 资金走廊 & 场景案例

G3 货币(USD/EUR/JPY)的银行清算已很快,因此链上流量主要集中在「美元荒 + 费率高」走廊,特别是拉美、非洲、MENA。

4.2 现场观察 & 落差

4.3 Takeaway

钱往痛点最猛的地方跑:越缺美元、银行费率越高、越需要周末结算的国家,越爱用稳定币。

链上量≠落地量:要看流动性桥(OTC、合规 API)是否把 TxID 变成发票与法币。

增量机会:给「链上热、地面冷」的走廊,提供自动对账 + 本币落地 + 合规票据,最可能率先爆发。

5.四大典型场景拆解

5.1小额外贸尾款(义乌)

链上视角

Chainalysis 2024‑Q3 自定义标签(「Yiwu Commodity Market」+浙江进出口聚类)显示:月均稳定币净流入约 8.7 亿美元,折算年化 ~10.4 B 美元,其中USDT 占 92%。

华泰证券《义乌跨境收付研究》(2025‑06) 估算「义支付」链上收款 2024 全年> 40 亿美元。

谁在用?(访谈 + 媒体交叉 + 我的现场笔记)

支付流转链路(示例)

美国买家在 Discord 下单 → 用 Coinbase 把 600 USDT(TRC20)打进商户展示的地址。

商户冷钱包收 U → 周末一次性在香港 OTC 报价换成美元。

打款至义乌当地结汇账户 → 出口收汇;因金额低,报关行接受电子收款单截图 + 自印发票。

税务退税时,用链上 TxID + 电子水单匹配银行流水,合规难度目前由「义支付服务商」协助完成。

局限 & 风险

高度碎片化:单笔低于 1,000 USD,占用链上流量但对官方统计的外贸金额贡献有限。

合规真空:大宗出口仍需纸质海关单;链上收款多数停留在「现金替代」阶段。

易被误标:部分拼单或侵权货源打乱链上标签,造成数据噪声。

义乌小额贸易稳定币使用的 「三层真相」

数据标签的 「地域误判」

Chainalysis 标注的 「义乌 commodity market」 地址,实际包含:义乌本地商家钱包(占比 30%);深圳、广州货代公司钱包(收货后转款给义乌);香港换汇中介钱包(归集 USDT 后换人民币);案例:某 「义乌饰品厂」 地址实则为香港换汇商,每月归集 5000 万美元 USDT,再通过地下钱庄换人民币,被误标为 「义乌贸易结算」。

USDT 占比 92% 的 「成本驱动」

义乌小单首选 USDT 的原因:手续费低:波场 USDT 转账费 0.1 美元,适合 500 美元以下订单(手续费占比 0.02%);流动性强:非洲黑市 USDT 比 USDC 溢价低 3%,客户更愿意支付;对比:USDC 因合规审核严,小额转账常被拒,2024 年义乌 USDC 小额交易占比不足 5%。

40 亿美元估算的 「口径争议」:华泰证券统计的 「易支付上链收款」 包含:真实贸易:30%-40%(约 12-16 亿美元);地下换汇:50%-60%(约 20-24 亿美元);套利交易:10%(约 4 亿美元);

5.2平台返点 / 分润(跨境电商 & 内容平台)平台返点 / 分润(跨境电商 & 内容平台)

Stripe Crypto Payouts:Twitter(现 X)的创作者奖励、Braintrust 远程工程师分润均通过 USDC 批量发放,覆盖 110+ 国,创作者反馈「周末也能秒到」 (ankr.com)。

传统方案痛点和稳定币方案对比:

跨境电汇:向 100 个国家的创作者付分润,需处理不同货币兑换,单笔手续费 5-10 美元,1000 笔需 3 天;

PayPal:抽成 2.9%+0.3 美元 / 笔,且部分国家(如尼日利亚)限制收款;

稳定币方案:用 USDC 通过 Stripe Crypto Payouts 批量转账,单笔手续费 0.1 美元,1000 笔 1 分钟到账,且支持自动分账。

Shopee Pay USDT 分润测试:东南亚某站内通告(内部灰度),马来、越南工厂可选链上收返利;官方称费率 0.4%,对账自动回写 ERP。(因尚在试点,数据未公开)

业务模式:印度电商平台 Shoppy Pie 向东南亚卖家返点(每单销售额的 5%),2023 年用 USDT 结算:卖家在平台绑定波场钱包地址;每单确认收货后,智能合约自动将 USDT 打入卖家钱包;卖家可在本地交易所兑换成印尼盾 / 泰铢,手续费比电汇省 60%;

数据对比:

传统电汇月成本 2 万美元,稳定币方案月成本 8000 美元,效率提升 75%。

核心痛点 → 稳定币优势:平台不用预留周末流动性;工厂可按日滚动收款,回款周期从 T+7 缩到 T+0.5。

5.3自由职业薪酬(全球 100+ 国)

Bitwage:美国外包公司用 Bitwage 直接把薪水换成 USDC/USDT,菲律宾、阿根廷、乌干达程序员平均比 PayPal 多拿 5% 实到手款

操作流程:

纽约广告公司用 Circle Pay 向肯尼亚设计师付 500 美元 USDC; 设计师收到 USDC 后,通过本地交易所 Luno 兑换成肯尼亚先令; 兑换成本 0.5%(比 PayPal 低 2.5%),到账时间从 3 天缩至 10 分钟; 数据对比: 传统路径月成本 2000 美元,稳定币方案月成本 800 美元,效率提升 60%。

Chainalysis 数据:尼日利亚 $3 B/季 稳定币小额交易中,自由职业者占比最高 。

真实反馈:肯尼亚设计师:USDC → M‑Pesa 落地 40 分钟,费率 1.5%,省下半天取现排队。

5.4进口采购对冲(高通胀国家)进口采购对冲(高通胀国家)

Ripio & 阿根廷进口商:CEO 采访称有巴西企业用 USDT 向中国供应商付款,避开奈拉 & 比索双重贬值;Ripio 提供跨境网关 。

阿根廷电子零售:汇兑限制下,商家先囤 USDT,发货时「秒拆」支付给巴西工厂;一年对冲汇损 8–10%。

共性:要么追求「时间价值 > 手续费」,要么回避外汇/贸易合规摩擦。**:要么追求「时间价值 > 手续费」,要么回避外汇/贸易合规摩擦。

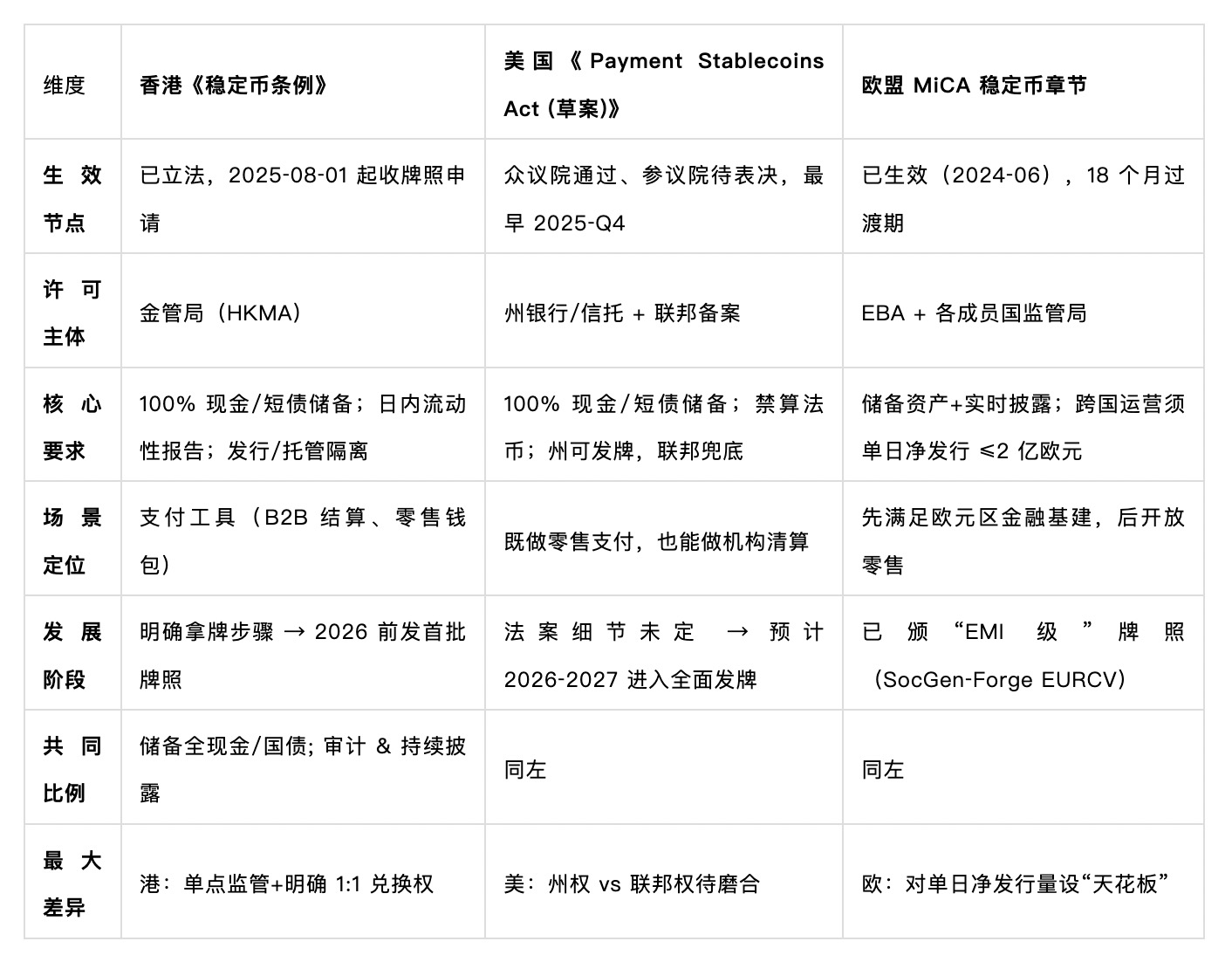

6. 监管风向标:港、美、欧怎么管?一张表 + 大白话

稳定币监管是「同题不同卷」:三大地区做法各有侧重,却也有共同底线。

6.1 一张速查表

6.2 通俗解读:换成「打车」比喻

香港像已经画好专用车道:只要你买到「合规车牌」(100% 储备 + 报告),就能直接上路载客(B2B / 零售支付)。

美国像几十个州各管一条街:州政府先给你「临牌」,但要想跑遍全国,还得去华盛顿备案;法案过不通过,车道还在铺。

欧洲像高速路已通车,但限速:每天跑 200 M 欧元以上就得上报;先跑欧元区内部物流,等真跑顺了才放零售车流。

香港 「专用车道」:牌照即通行证,可跨区但限车型

1. 车道规则

持牌车辆(合规稳定币):

需向香港金管局申请 「稳定币的士牌」(如 Circle 已拿牌),车辆(储备金)必须停在香港银行 「停车场」;

可在香港 「市区」(合法贸易场景)载客,也能开上 「跨境高速」(如 USDC 换人民币试点);

限制:禁止 「黑车」(非持牌稳定币)上路,2024 年查获某 USDT 「黑车」 团伙,罚款 2000 万港元;

乘客需是 「专业司机」(资产≥800 万港元),散户只能坐 「副驾」(通过合规平台间接使用)。

2. 行车案例

香港某黄金商开 「USDC 的士」:

持牌后,从深圳水贝拉 「黄金订单」 到迪拜,过 「海关关卡」(链上报关)时,出示金管局 「行车证」(合规报告),通关时间从 3 天缩至 4 小时;

对比 「黑车」(非持牌 USDT):被海关扣车(冻结资金)风险高 30%。

美国 「各州临牌」:跨州要换证,联邦车道在建

- 车道现状

州级车道:纽约州允许 「USDC 网约车」 在本地跑(需州银行牌照),加州只准 「Circle 专车」 接单;

佛罗里达州禁止 「算法稳定币摩的」 上路(如 UST 类产品);

联邦车道(《稳定币法案》):正在铺沥青(立法中),要求车辆(稳定币)必须加 「美联储汽油」(100% 美债储备);

建成后,「USDT 大货车」 需换联邦牌照才能跨州运货(全国流通)。

行车麻烦

美国某跨境电商开 「USDC 货车」:

在纽约州拿临牌,只能跑纽约 - 新泽西线;

想跑加州,需向加州车管所(州监管机构)再申请牌照,手续费多花 20%;

联邦车道没通时,跨州要绕路(如通过加拿大中转),运输成本高 30%。

欧洲 「限速高速」:先跑物流车,再放私家车

车道设计

东段(欧元区物流):

允许 「EUR Coin 重卡」 跑柏林 - 巴黎线,限速 100km/h(年交易额≤1 亿欧元);

车上需装 「欧盟 GPS」(实时监管系统),每 2 小时报一次货(储备金)量;

西段(零售车流):

还在修匝道(试点中),计划 2025 年允许 「散户轿车」 上路,但需通过 「KYC 收费站」(身份验证)。

行车效率

德国车企开 「EUR Coin 重卡」:从慕尼黑运零件到巴黎,过 「欧盟关卡」 时,GPS 自动报货(储备金),通关时间 10 分钟;

对比 「美元货车」:走 SWIFT 国道需 3 天,且过路费(手续费)高 50%;

限制:不能超速(超 1 亿欧元交易额),否则被拖走(监管沙盒审查)。

全球 「跨境路口」 的通关难题

美欧边境:美国 「USDC 货车」 进欧洲,需换 「EUR Coin 车牌」(资产兑换),手续费 2%,且排队 1 天(监管审核);

中美边境:香港 「USDC 的士」 进内地,只能走 「自贸区专用道」(浙江试点),且乘客(企业)需有 「白名单通行证」(试点资格);

非洲小路:正规车道少,「USDT 摩的」 遍地跑,虽灵活但易遇 「监管劫匪」(账户冻结),2024 年尼日利亚查扣 300 辆 「黑摩的」。

对贸易司机的建议:看路选车

短途急单(如义乌 - 非洲小单):

选香港 「USDC 的士」:专用道快,持牌合规,适合 5 万美元以下订单;

跨州长途(如美国 - 欧洲贸易):

等美国联邦车道通车后,换 「USDC 联邦货车」,但目前先用欧洲 「EUR Coin 重卡」 中转;

高风险路段(如阿根廷进口):

暂时用 「USDT 摩的」(非合规),但记得带 「代理换汇导航」(规避监管),未来等香港车道延伸过去。

6.3 不同阶段对应的「落地姿势」

一句话总结

「三地都坚持‘100% 储备 + 实时披露’,但车道宽度不一样。香港先把车道铺好等你发车;欧洲先限速跑起来;美国还在修高架。企业要先在香港/欧盟试运营,等美国法案落地后再全速扩张。」

7.风险、误区与下一步机会

7.1 常见风险 & 误区

稳 定 币就像「高速快车」,能省时省钱,但路标、限速、验票口还在升级。先开小车跑一圈,摸清规则,再开大巴全速前进。

「我看到的链上 10 亿美元流水,不一定全在正式合规框架内;但每一分追求‘秒级结算、低成本、全球通’的需求,都在倒逼支付基础设施进化。合规化跑通的那一天,才是真正的市场爆发点。」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。