Today's homework is actually not very easy to write. Although there aren't many events, the troubles entangled together are quite a few. First, the non-farm payroll data released today should be the one with the largest gap from the ADP data in history. The unemployment rate and employment numbers not only did not worsen but actually improved. How else can we say that the data from the U.S. Bureau of Labor Statistics always surprises everyone?

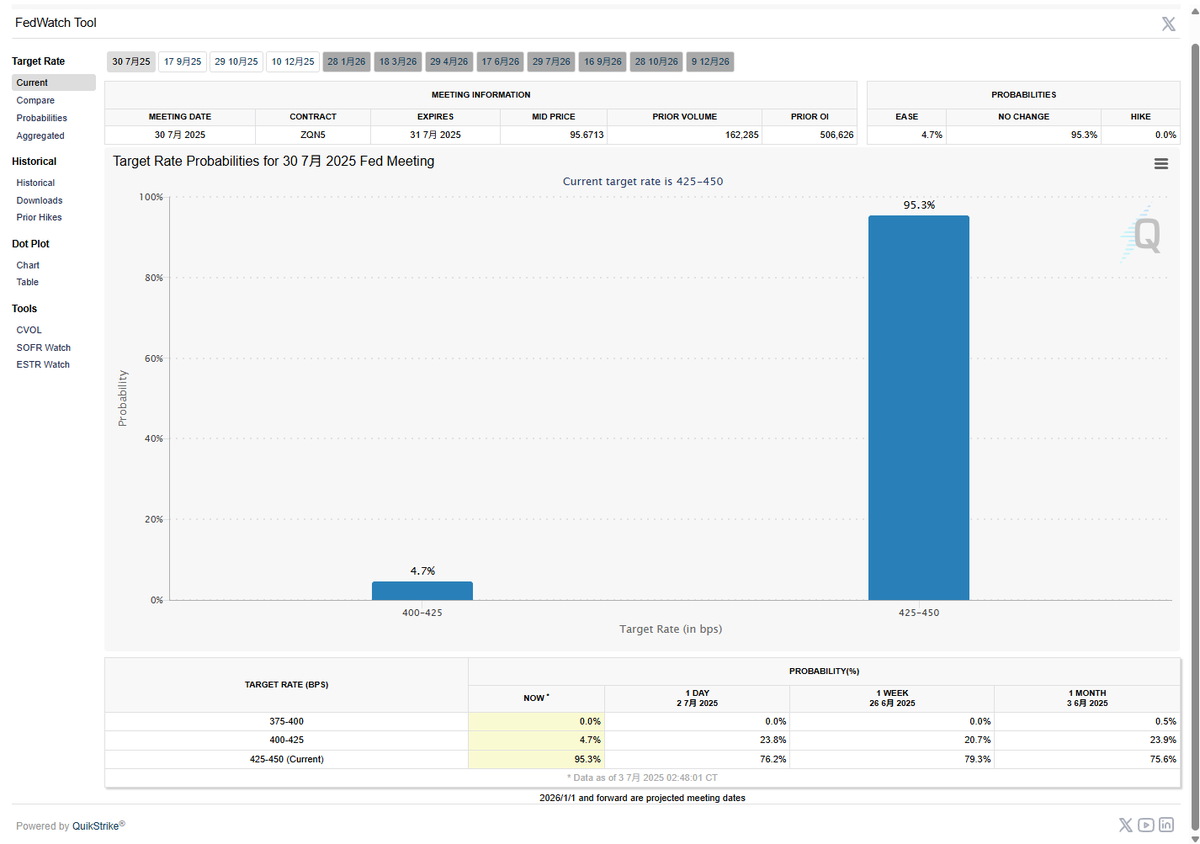

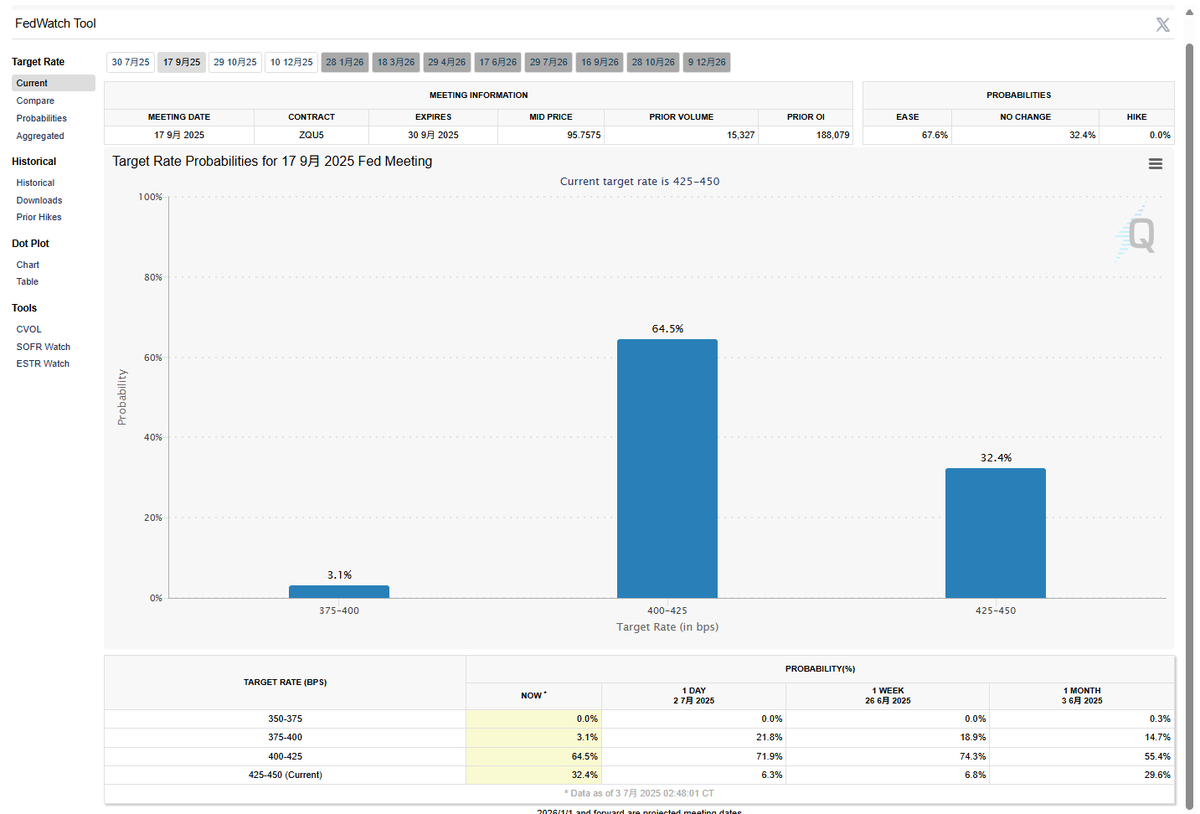

The decrease in the unemployment rate and the increase in employment numbers indicate that the resilience of the U.S. economy is still quite good. This also means that the probability of a rate cut in July continues to decrease, and even the probability of a rate cut in September is also declining. Currently, the CME has raised the probability of no rate cut in July to over 95%, an increase of 15% compared to yesterday. The probability of no rate cut in September has also risen to over 32%, an increase of 26% compared to yesterday.

Although this is not favorable for the Federal Reserve to cut rates, it indeed represents that the U.S. economy is still doing well. This data itself is good data; it's just that people don't particularly like it. Then there is Trump's tax cut and spending bill, which passed in the House of Representatives. This is the core of the "Big Beautiful" plan, so it is almost equivalent to the passage of the "Big Beautiful" plan. This bill is beneficial to the market in the short term, while in the long term, it increases the burden on the U.S. government. But let's enjoy the moment; we'll deal with tomorrow's issues tomorrow.

Next is Bessent's speech, which, aside from tariffs, expressed dissatisfaction with the Federal Reserve. This is understandable, but Bessent believes that if there is no rate cut in July, then the rate cut in September will be more significant. I somewhat disagree with this, but overall, today's events can be considered short-term positives, especially the passage of the "Big Beautiful" plan, which should boost market sentiment and inject some liquidity.

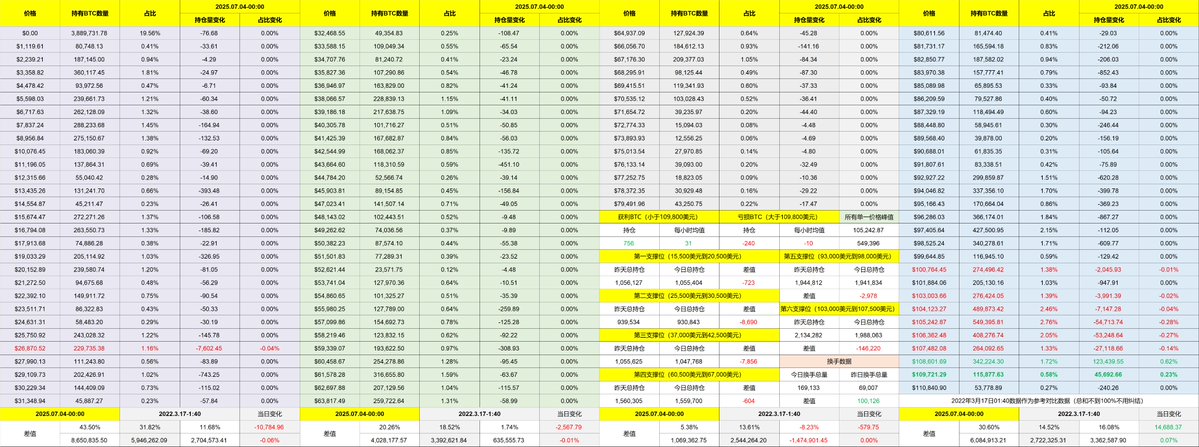

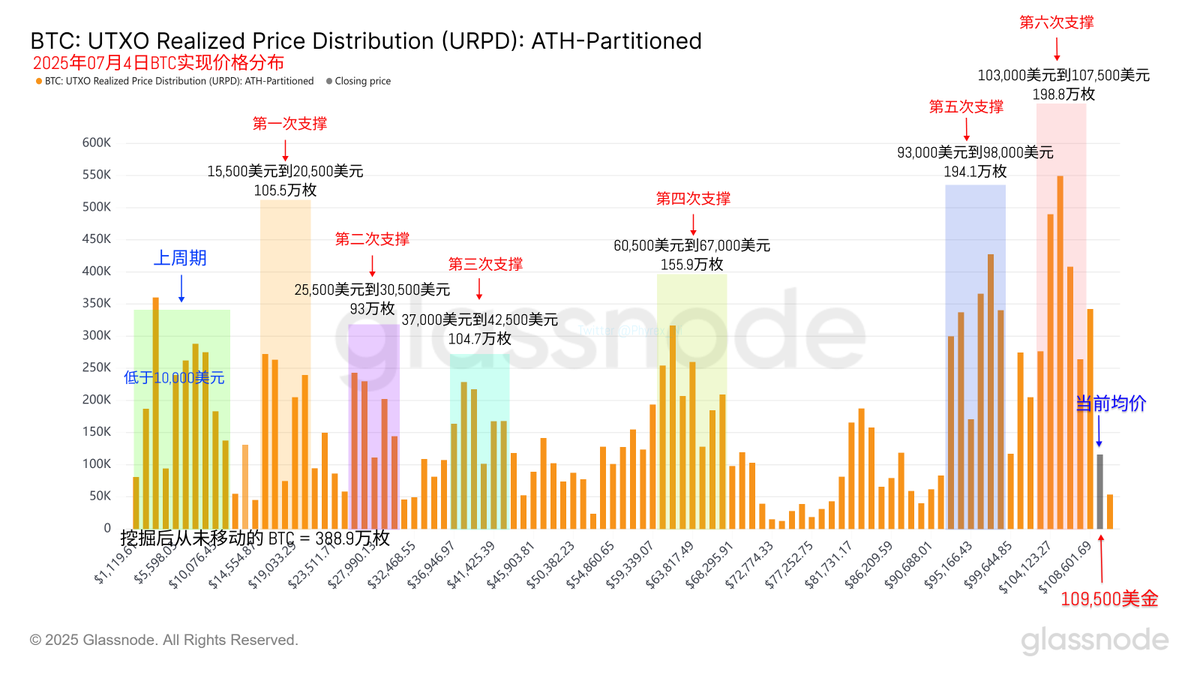

Looking back at Bitcoin's data, although today's price broke through $110,000, the volatility is relatively high due to many circumstances, and the turnover rate has also increased. Especially, more short-term investors are exiting, as many believe that the market may not perform well if there is no rate cut in July and choose to leave.

But overall, the U.S. market currently does not show systemic risks. Of course, the reciprocal tariffs next week are uncertain, but at least for now, things are still relatively good, so the stability of prices is somewhat guaranteed.

Especially from the supporting data, both ranges are very stable now, particularly between $93,000 and $98,000. Even when the turnover rate increases, this position has not changed much, and the support at the bottom is still very healthy.

Data link: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。