Key Indicators: (June 23, 4 PM Hong Kong Time -> June 30, 4 PM Hong Kong Time)

- BTC against USD increased by 5.1% (from $102,000 to $107,600), ETH against USD increased by 6.9% (from $2,320 to $2,480)

Over the past few weeks, the coin price has been trading in a narrow flag pattern (except for a brief breakout above $100,000 due to the Israel-Iran situation). Currently, it feels like the market is ready for a surge, but it needs to find enough momentum to break through the strong resistance at $108,500 and then $112,500. However, if we fail to break through, we may slowly return to the bottom of the flag pattern, encountering trend support at $101,000 and stronger support at $98,000. If these levels are further breached, we could see a significant drop in coin prices to $90,000.

We remain optimistic and believe there will be a surge to $125,000 - $130,000 to complete the entire long-term trend.

Market Themes

After the easing of tense geopolitical situations, we experienced a very calm week with overall risk sentiment trending upwards. The market's focus has shifted to developments in the U.S. Trump announced the upcoming appointment of a new Federal Reserve Chair and assured the market that he would "lower interest rates," leading the market to quickly price in rate cuts (20% probability of a rate cut in July, with 2-3 cuts expected by the end of the year). The U.S. stock market faced little resistance, with the S&P 500 and Nasdaq indices reaching all-time highs. The market is clearly positioning for low volatility/risk investments for the summer holiday and seems unconcerned about the upcoming trade tariff deadlines.

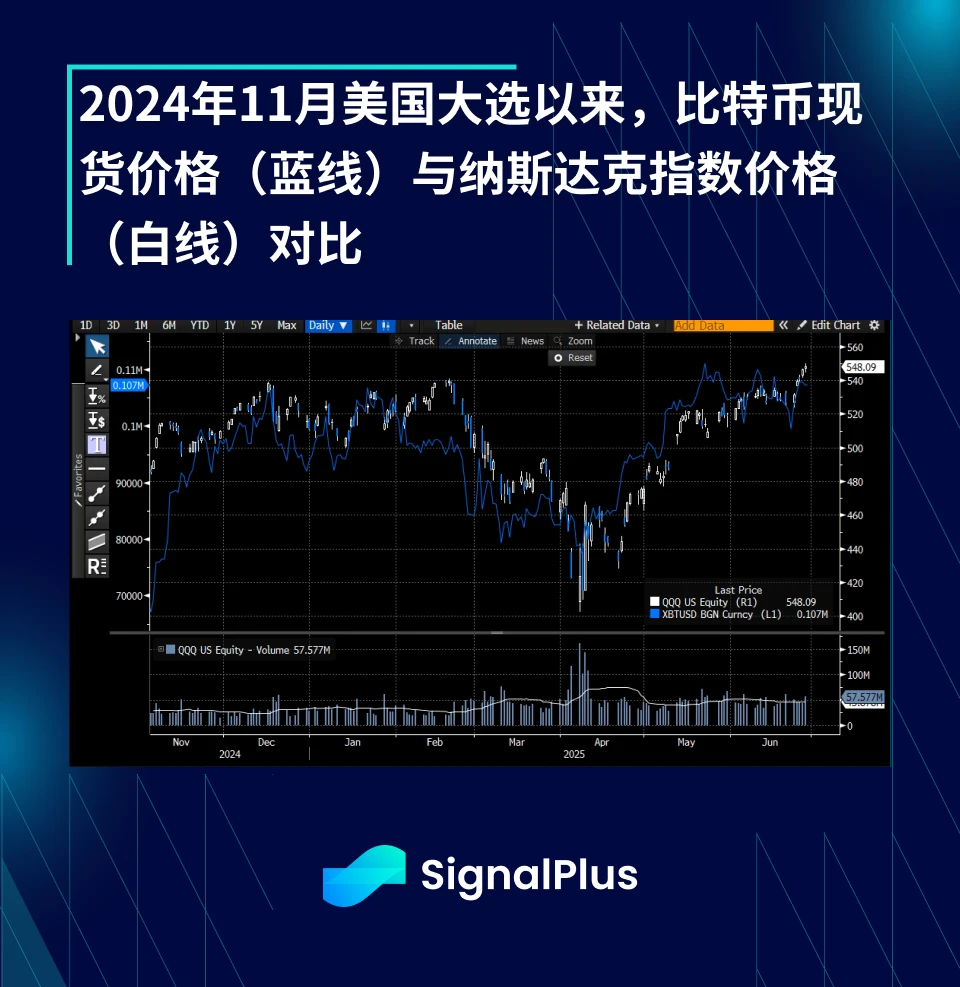

Compared to the overall rising risk sentiment, the performance of the cryptocurrency market has been very calm. Bitcoin's recent strong correlation with Nasdaq has lagged, as the market has accumulated too much long gamma and placed a pile of sell orders in front of the local resistance at $108,500 - $109,000. Smaller coins have also failed to join this risk rally, with Solana stagnating ahead of the anticipated ETF issuance this Wednesday.

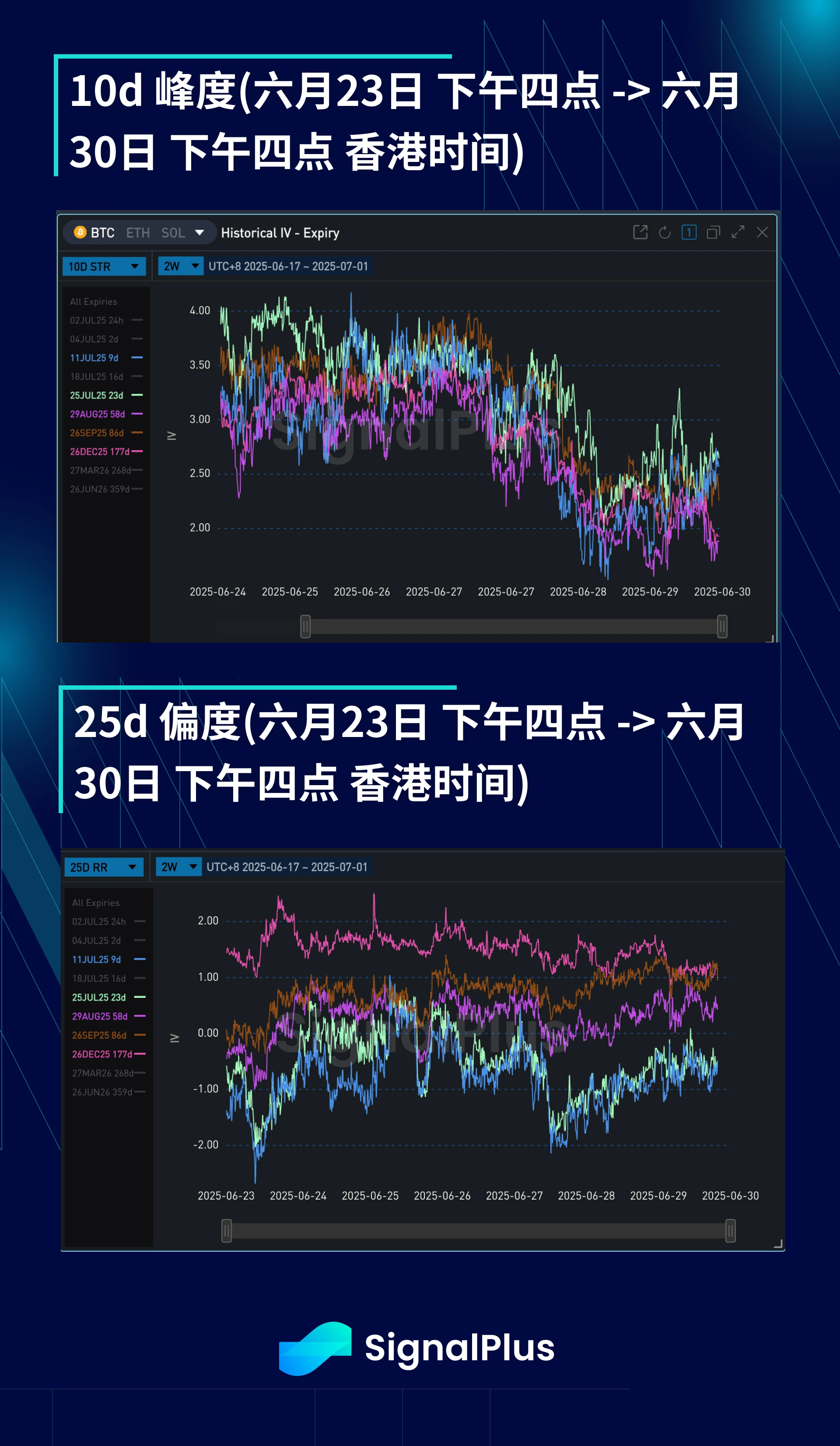

BTC ATM Implied Volatility

Last week, actual volatility quickly diminished. This was mainly because spot prices returned to a comfortable range between $110,000 and $112,000, where Bitcoin had previously stayed for over two months; at the same time, the market has clearly taken on a lot of long gamma, which has contributed to the price being confined within this range. Implied volatility has thus been significantly suppressed, and for the first time this year, we saw daily volatility priced below 30, even the implied volatility for March (expiration in September) was nearly below 40 points.

The term structure is quite steep within a one-month expiration, with daily volatility set at 27-28 points for the next few days, but expected to rise to 40 points before the end of July. The longer-term term structure has flattened significantly, as the market has completely lost consideration for a shift in actual volatility to a higher range, creating very attractive term trading opportunities.

BTC Skew/Kurtosis

Last week, skew prices remained largely flat, as there was no directional momentum in the spot market leading to a somewhat subdued trading of skew. Short-term expirations still lean downward considering that actual volatility tends to be more aggressive during declines, while longer-term expirations lean upward due to the market's lack of interest in downside Vega.

Kurtosis initially also remained flat but eventually declined. This was due to the accumulation of long positions in the market, with many sellers continuously selling to fund their longs. However, considering the tendency for actual volatility to shift to higher regions and the high volatility of volatility, we believe that in this environment, one should seize the opportunity to buy kurtosis during declines (especially considering that actual volatility has been underperforming locally).

Wishing everyone good luck this week!

You can use the SignalPlus trading sentiment indicator feature for free at t.signalplus.com/news, where AI integrates market information, making market sentiment clear at a glance. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant's WeChat, please remove the spaces between the English and numbers: SignalPlus 123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。