US Stock $DXYZ is a closed-end fund listed in the US stock market, and now traders are treating it like SpaceX stock, trading at a 470% premium, which is insane.

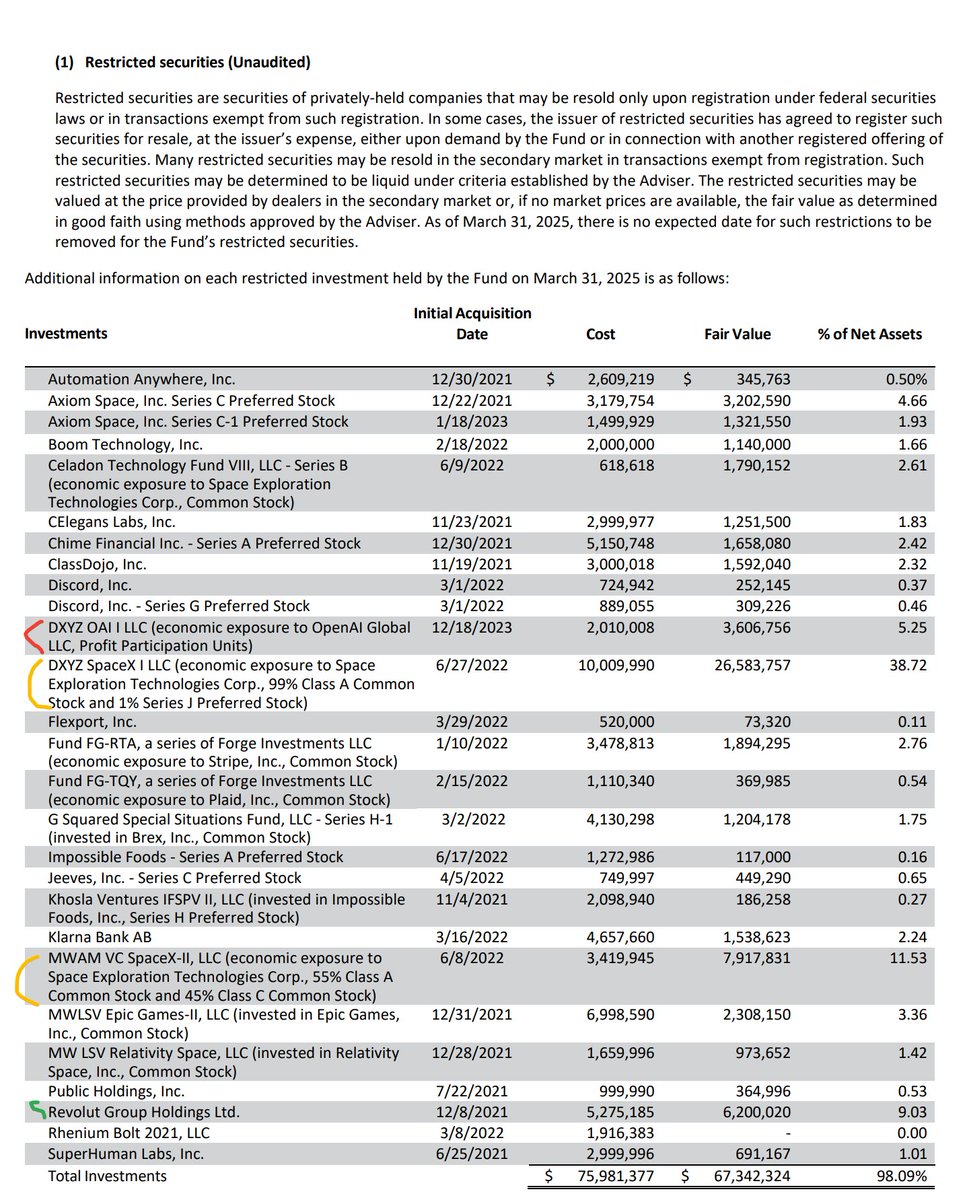

DXYZ holds approximately 50% (of the fund's shares) in SpaceX, 5% in OpenAI, and 9% in Revolut (a UK fintech giant). As of March 31, 2025, the net asset value of the fund is 67.56 million, slightly down from December 31, 2024. I see that the fair value of the SpaceX holdings is lower than the end of last year, but the fair value of OpenAI is somewhat higher than the end of last year.

The fair value calculation for SpaceX shares is based on an estimated valuation of around $350 billion. The SpaceX shares held by DXYZ are valued at approximately $34 million. DXYZ is currently trading at a market value of $388 million, with a 470% premium.

If you really believe in SpaceX, you might want to look at another fund, $XOVR. This ETF currently has a market value of $371 million, with no premium, holding 182,600 shares of SpaceX valued at $33.77 million, while the rest is mostly in mid to large-cap stocks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。