Written by: Jessy, Golden Finance

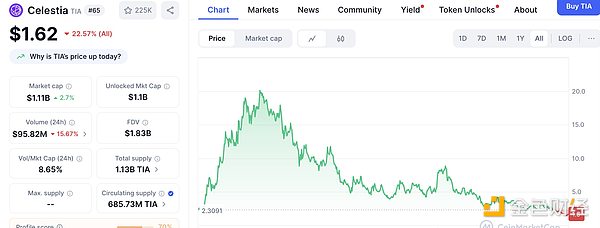

Once shining brightly with a tenfold increase after its listing on exchanges during the small bull market at the beginning of 2024, TIA has now fallen below its listing price. As of the time of writing, it is quoted at 1.62 USD, having dropped over 90% from its peak of around 20 USD. TIA, once a leader in modular blockchain, is now mired in negative public opinion due to founder sell-offs and internal management issues.

The fall from grace of the once-celebrated TIA token is not just a symbol of the decline of the modular blockchain sector. The collapse of a leading project that was once all the rage last year is merely the surface. The deeper truth is that the once-vibrant narratives in the crypto space are gradually being debunked.

On one side, the stock market is celebrating new highs in the Nasdaq, while on the other, the once-popular narratives in the crypto space are collapsing, leading to plummeting coin prices. The traditional narratives in the crypto world are no longer viable; the industry has reached a true moment of competition in terms of real-world application and implementation.

From Glory to Fall

TIA, short for Celestia, was one of the most talked-about modular blockchain projects from late 2023 to early 2024. During the small bull market at the beginning of 2024, the TIA token skyrocketed from single digits post-airdrop to a peak of 20 USD, with a vision to combine the sovereign interoperability of Cosmos with Ethereum's shared security in a summary-centric manner.

However, starting in the second half of 2024, as market enthusiasm waned and project ecosystem development slowed, governance and team issues within CelesTIA began to surface. The most controversial aspect was the collective cash-out by its executives. Twitter user @0xCircusLover revealed that as early as the beginning of October 2024, all C-level executives of CelesTIA had completed their unlocks and began selling tokens en masse, with co-founder Mustafa reportedly selling over 25 million USD worth of tokens off-market before quietly relocating to Dubai.

Meanwhile, CelesTIA's marketing operations faced backlash. KOL @ayyyeandy, who once promoted TIA, was exposed for receiving substantial promotional fees. Although media platform Bankless co-founder David Hoffman frequently recommended TIA, he contradicted himself on the critical question of "whether to hold the token," further raising community doubts about whether the project was merely a marketing product manipulated by capital.

Deeper internal rifts emerged from the management level, as former developer relations head Yaz Khoury was fired for alleged sexual harassment, sparking a public relations crisis. CelesTIA was reported to have bought out competitor Abstract for a seven-figure sum, forcing it to withdraw from its collaboration with EigenLayer. Such "exclusive acquisitions" sparked considerable controversy and revealed the team's anxiety over its expansion path.

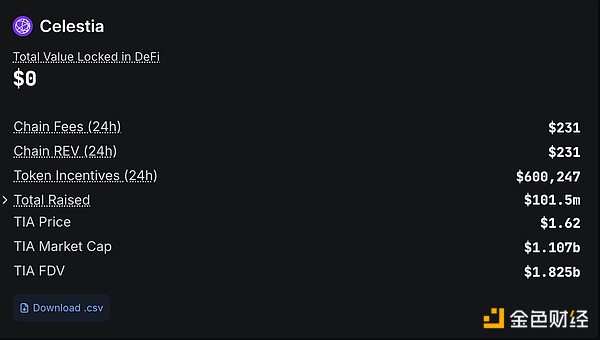

As the coin price plummeted and community trust neared collapse, co-founder John Adler proposed a radical governance model of "governance as proof" in early 2025, advocating for off-chain governance voting to replace traditional proof-of-stake mechanisms to address ongoing inflationary pressures. However, before this disruptive proposal could be implemented, the fact of the team's executives cashing out was gradually exposed, leading the community to widely perceive it as a guise to "stabilize prices and cover up issues." As of the time of writing, its price has fallen over 90% from its peak. On-chain activity is also dismal; according to defillama data, its on-chain gas revenue in the past 24 hours was only $231.

The Collapse of TIA and the Breakdown of Crypto Industry Narratives

However, TIA's demise is not just a failure of a project and token; it reflects a broader disillusionment with the new narratives in the entire crypto industry.

In the past cycle, modularization, AI agents, DePIN, GameFi, NFTs, and more have all inflated massive bubbles, leading to rounds of collective euphoria among capital and retail investors. Yet by 2025, we are witnessing the collective collapse of these once-popular narratives, with altcoins in disarray.

Similar to TIA, other once-popular projects like WorldCoin and Helium, which were heavily promoted by capital, rapidly accumulated significant traffic and saw soaring coin prices in a short period, only to cool off quickly after the initial hype.

The fall of these star tokens, including TIA, reflects a deeper crisis in the crypto industry: the lack of genuine technological innovation and user adoption leads to the repeated consumption and dilution of narratives and trust. After modularization, no new narratives have emerged at the public chain level. Looking at other sectors in the industry today, projects combining AI and blockchain mostly remain at the conceptual level, while RWA faces not only regulatory issues but also a profound question of "is there a real demand?"

Once-prominent trends are being debunked and quickly forgotten, while traditional financial markets continue to receive positive news. Whether in U.S. or Hong Kong stocks related to crypto compliance, such as stablecoins and compliant exchanges, there has been a sustained rise.

On one side, there is a lack of native innovation in crypto and plummeting coin prices; on the other, compliant crypto projects in Hong Kong and the U.S. are being fervently embraced by capital and the market. Some view this as a sign that "the industry is doomed," but I believe it serves as a warning to all project teams: true technological innovation and real-world application are what create genuine value. The old ways of storytelling, traffic manipulation, and pump-and-dump in the traditional crypto space can no longer be sustained. Like Web2 projects, today's Web3 projects must focus on implementation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。