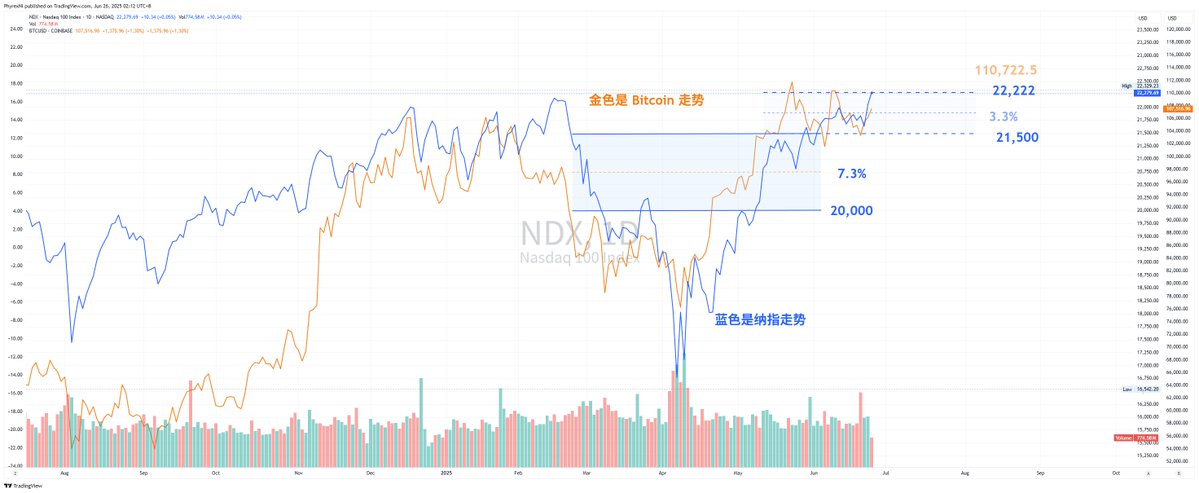

Some friends asked me why $BTC rose independently again today, wondering if there was any new positive news. In fact, if we compare Bitcoin with U.S. stocks like the Nasdaq, BTC has merely returned to the level of June 17, while the Nasdaq has broken its historical high today. Essentially, the decline in BTC was caused by the Middle East war last weekend, and it has not fully recovered yet, while the U.S. stock market, which does not trade on weekends, has perfectly avoided this.

By comparing the data of BTC and the Nasdaq, it can be seen that both are still highly aligned in the larger direction. According to the price comparison I drew earlier, the new high of the Nasdaq corresponds to Bitcoin reaching around $110,700, provided that the U.S. stock market remains stable enough.

Currently, the war in the Middle East has not completely ended, and Trump is once again managing the market with his words. I noticed that the price of WTI crude oil has slightly risen, but it’s not a big issue unless there is a real resumption of war, a blockade of the Strait of Hormuz, or an expansion of the scale of the conflict; otherwise, the impact on the current market should be minimal.

Additionally, I saw that $CRCL has already fallen for two consecutive days, and it may not hold above $200. Meanwhile, $Coin is still on an upward trend. In my understanding, Coin's rise is likely benefiting from CRCL's performance, but once CRCL's market cap significantly drops—having already fallen 30% from its peak—Coin's market cap may also be recalculated.

On the contrary, the price of $MSTR is still highly correlated with BTC. When BTC's price rises, MSTR performs well, but CRCL and COIN currently have a lower correlation with BTC.

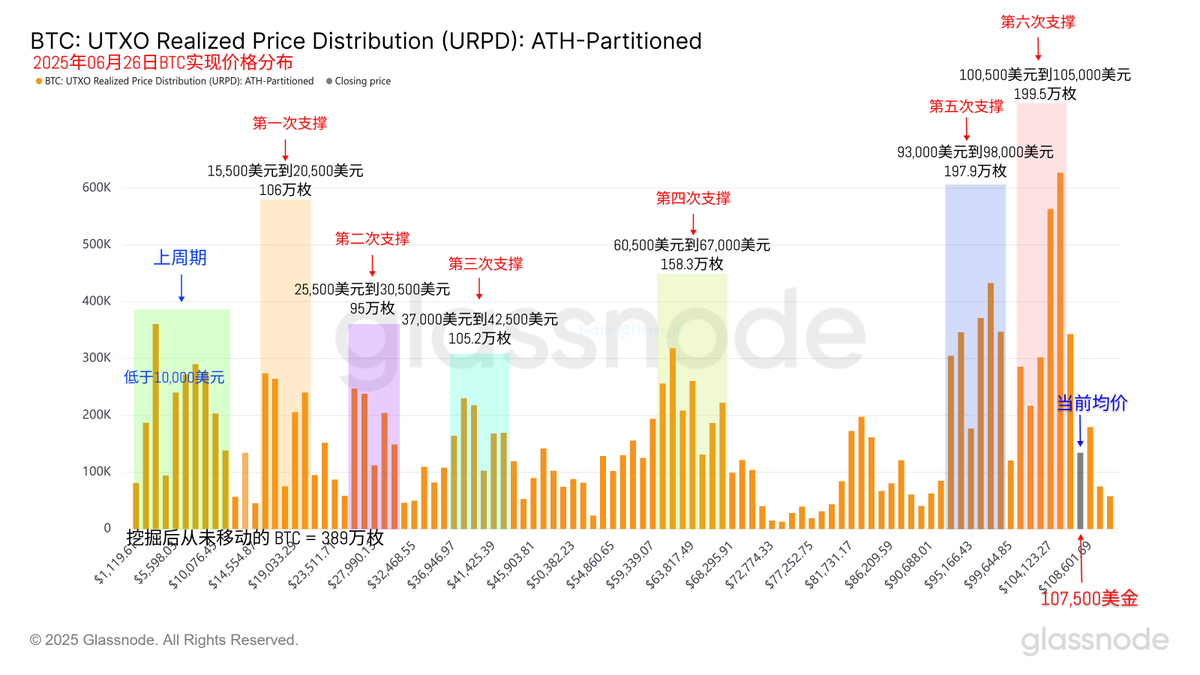

Looking back at Bitcoin's data, the price increase has led to a rise in trading volume, which is a normal behavior. It has been mentioned many times that low prices make it difficult for investors to sell their holdings; only when prices rise does the selling volume increase. Therefore, trading volume is often low at low prices, and short-term investors are still the main force in trading now.

The support levels have been discussed daily. The current two support levels are between $93,000 and $98,000, and between $100,500 and $105,000. The former is more stable, while the latter has greater volatility. The magnetic effect of concentrated chips is still effective in this price fluctuation.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。