SEC的工作组与NYSE背后真正讨论的内容

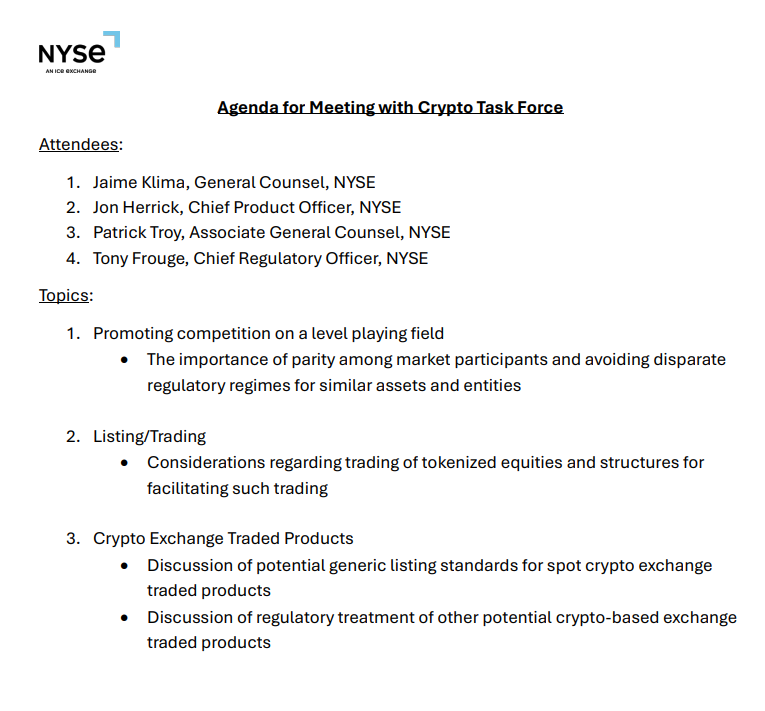

美国证券交易委员会SEC 正在积极推动加密监管的未来,特别是关于基于加密资产的代币化股票和交易所交易产品(ETP)。在2025年6月24日,SEC的加密工作组与纽约证券交易所(NYSE)的关键利益相关者举行了一次秘密会议,讨论根据美国证券法对数字货币的监管。

此次会议反映出建立公平和统一的传统与代币化金融工具指导方针的紧迫性日益增加。

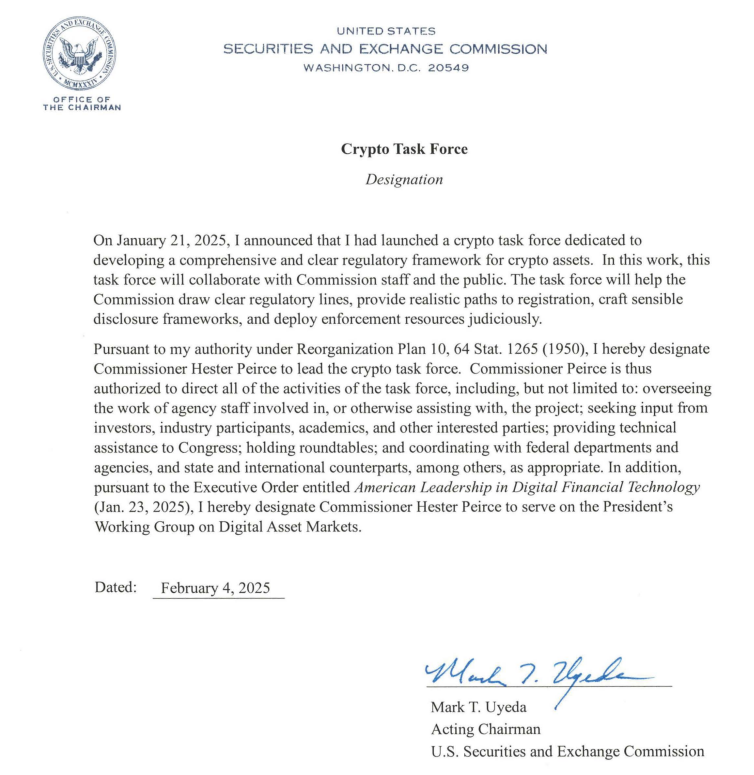

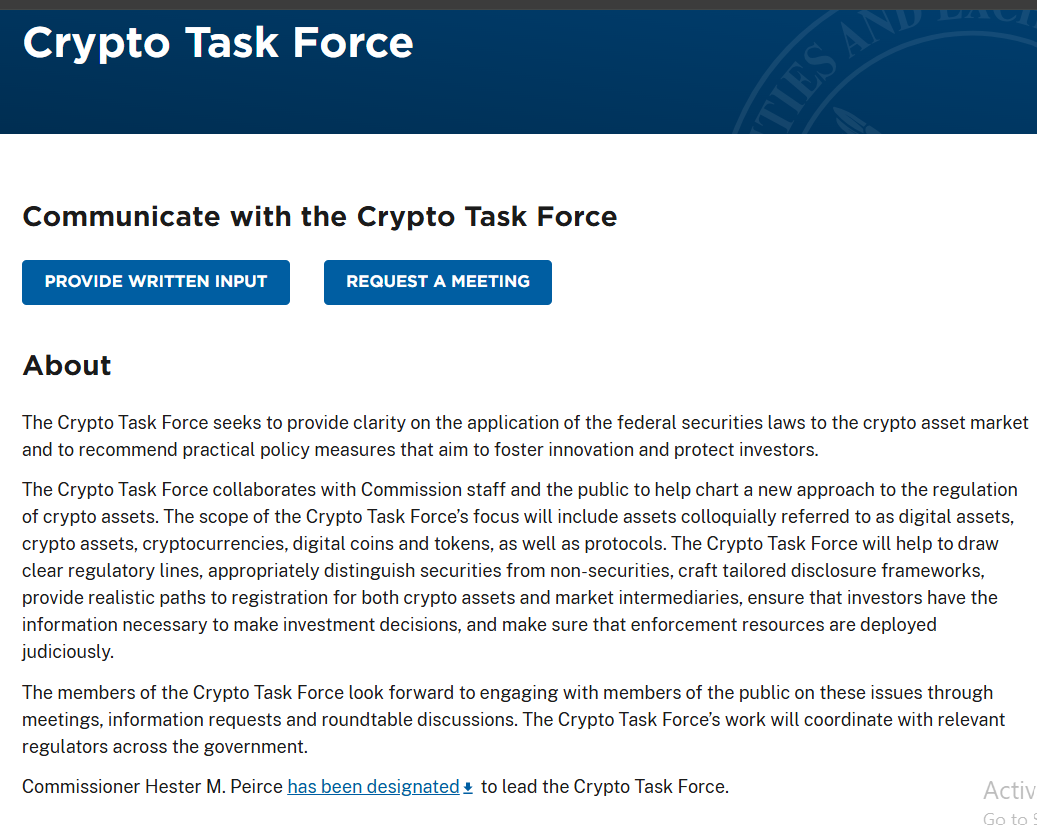

SEC加密工作组是通过2025年1月21日的指定信函成立的,目的是与利益相关者进行对话,确保人们理解联邦证券法如何处理数字货币。该工作组由委员Hester Peirce领导,专注于实现监管统一,解决加密特有问题,并建议政策改进。它还充当市场参与者的联系中心。

来源: 官方SEC指定信函

SEC为何希望为代币化资产创造公平竞争环境:

加密工作组由代理主席Mark Uyeda和委员Hester Peirce领导。该小组的成立旨在更好地管理数字资产在美国法律下的处理方式,并更好地告知投资者和企业相关规则。

最近,工作组与NYSE高管进行了会谈,讨论代币化资产的未来,并确保传统市场和数字市场的规则公平一致。

工作组的优先事项:

从执法转向明确性:建立促进创新而非限制创新的规则。

清晰的注册和披露路径:帮助数字资产公司使用定制框架合法注册资产。

确定加密的独特特征:将过时的规则应用于去中心化和自我保管模型。

调查豁免救济:Uyeda主张对新加密工作组项目提供临时监管救济。

吸引公众参与:讨论资产分类、交易模型和保管问题等广泛议题。

倾向于立法明确性,Pierce支持重新思考在证券法中使用的投资合同。

信息明确指出,SEC希望在建立一个更安全、更可预测的市场的过程中,将类似的金融工具视为平等,无论它们是否基于加密。

来源: Sec.gov

NYSE和SEC关注加密货币的重大突破

SEC的加密工作组成员与NYSE高级官员会面,讨论如何将代币化货币纳入现有的监管框架。

目标是平等对待数字货币,既不对传统资产进行过度监管,也不进行不足监管。

讨论的主题:

公平竞争环境,为等值资产类型提供相同的规则,无论是传统发行还是数字发行。

代币化股票交易:关于上市和交易基于区块链的股票的框架和问题。

关于现货数字货币交易所交易代币化股票的标准化指导方针进行了辩论。

讨论反映了SEC日益关注使数字货币成为一个更安全和更有序的环境。

代币化股票:传统市场能否适应转型?

讨论了如何以类似于普通股票的方式交易数字发行的公司股份,并使其在数字资产和实物资产之间保持公平。如何安全地上市和交易代币化股票?目标仍然是平等对待所有资产,同时保持市场的安全和透明。

但代币化股票可能会通过提供24/7交易和降低费用等优势干扰传统平台。投资者可能会发现代币化选项的便利性更具吸引力,这可能会侵蚀传统交易所的市场份额。

这些法规将对加密市场产生什么影响?

这些政策有望在数字货币市场中发挥重要作用,可能影响市场结构、投资者保护和可交易资产。

对市场的影响可能是:

市场结构: 这些法律可能会导致数字货币、交易和保管的变化,影响加密交易所和交易平台的结构。

投资者保护: 通过强制注册和披露,可能会增强投资者保护,并可能对某些活动设定上限。

资产分类: 当一个代币被分类为证券时,将会有更严格的规定,包括注册要求和披露责任。

市场波动性: 因为投资者会对新规则和市场动态的可能变化做出反应。

机构采用: 适当的监管可能会通过减少不确定性和明确的参与规则来促进机构对加密领域的投资。

创新: 一些人可能会追求某些创新;其他人则会发展一个更稳定和一致的环境,以促进长期增长和责任建设。

尽管具体细节尚未制定,但潜在的市场影响是相当大的,从资产的销售方式到能够蓬勃发展的项目类型。

来源: Sec.gov

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。