Coinbase 最新一季的财报数据公布后,分析员普遍认为数据并不理想,约 20 亿美元的总营收较上季下降 10%,而交易手续费收入 13 亿美元则环比下降了 19%,而因为有庞大的工程、合规、法律和市场团队,其运营费用更是环比增长了 7% 达 13 亿美元。

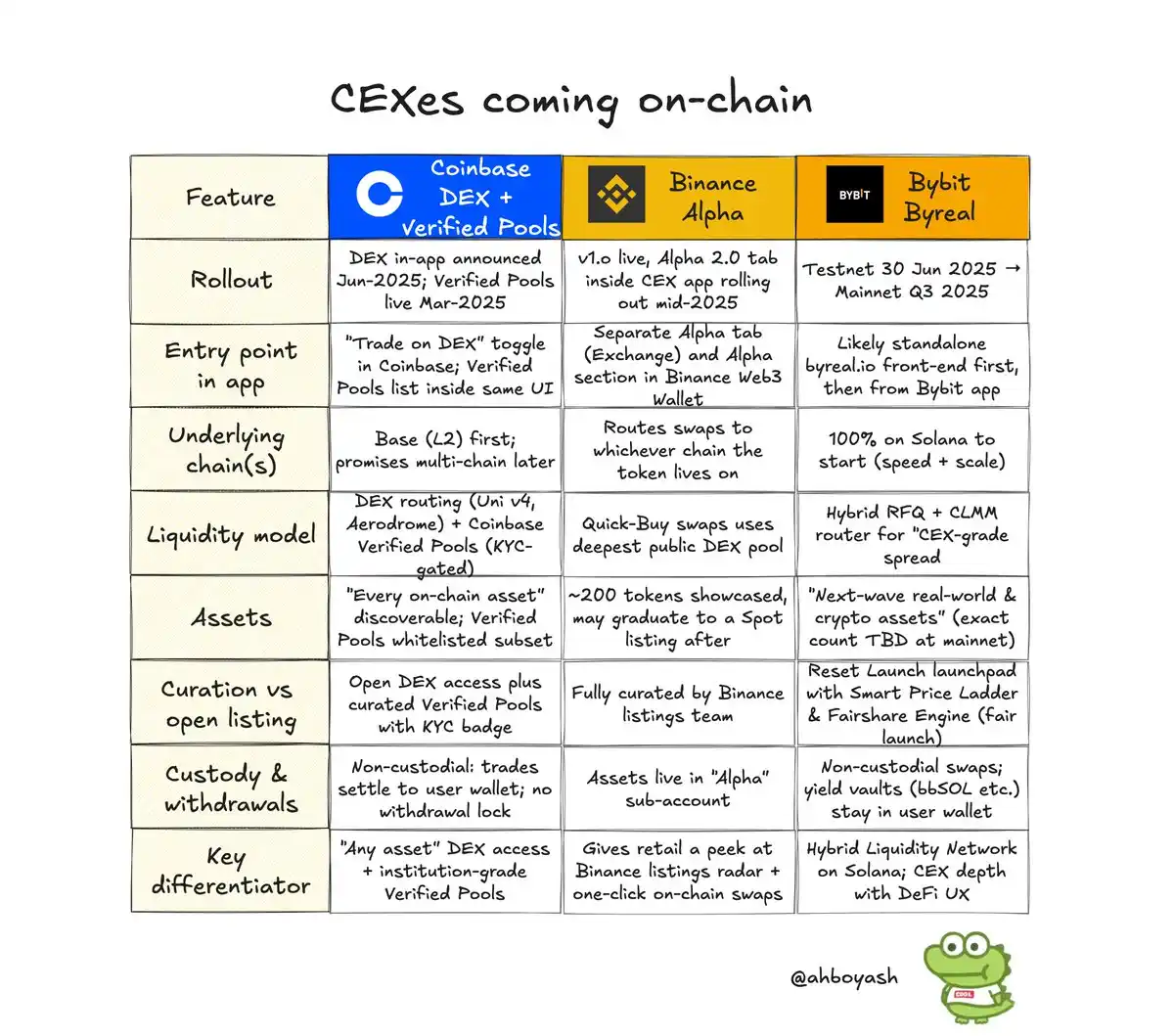

而这不仅仅是 Coinbase 一家面临相同的压力,几乎所有 CEX 都有相同的烦恼。用户数量、场内流动性的增长放缓等各种因素导致 CEX 不得不找到新的业务板块,而他们也纷纷选择把触手延伸至链上业务。知名 KOL ASH 在 X 上分析当越来越多的 DEX 完善自己的交易机制,催生出使用体验几乎可以媲美 CEX 的产品,但交易过程更透明时,CEX 也开始终于注意到了这一点将战略重心转移至无许可的模式,多家 CEX 开启了「链上 CEX」市场争夺战。

主攻基建发展的 OKX

2024 年 12 月 30 日的 OKX 年度信中表示,OKX 创始人 Star Xu 表示坚信「真正的去中心化将引领 Web3 的大规模普及」,并致力于构建连接传统金融与去中心化金融的桥梁。

而这话也并非空穴来风,OKX 是目前除 Binance 外,最早、最系统化布局链上基础设施的中心化交易平台之一。它不是零散地推出某个钱包或功能,而是用「全栈式建设」构建出一个可替代中心化场景的 Web3 操作系统,并让其与 CEX 用户资产形成闭环。

OKX 在近两年中持续推进其链上基础设施的战略性建设,试图从一家中心化交易平台转型为 Web3 操作系统的核心参与者。其建设的重心之一是 OKX Wallet(支持超过 70 条公链的非托管钱包),在 Web3 板块集成了 Swap、NFT、DApp 浏览器、铭文工具、跨链桥和收益金库等功能。

OKX Wallet 并非单一产品,而是 OKX Web3 战略的核心枢纽,不仅连接用户与链上资产,更打通了中心化账户与链上身份之间的通道,因其组件足够全面,许多在 2023 年前后才加入币圈的新人第一次接触链上用的都是 OKX Wallet。

另一方面,OKX 也在底层网络和开发者生态上持续投入。它早在 2020 年便启动 OKExChain(后更名为 OKTC)这一兼容 EVM 的 L1 公链,但该链并未受到市场的大力推崇。不过为了配合链的建设,OKX 同步推出区块浏览器、开发者门户、合约部署工具、水龙头服务等基础组件,鼓励开发者在其生态内构建 DeFi、GameFi 与 NFT 应用。

加之持续举办黑客松、启动生态扶持基金,OKX 正在形成一个拥有完整闭环的链上生态系统。虽然 OKX 从未公开披露过整体投入金额,但综合其钱包、链、桥、工具与激励体系的建设规模,市场普遍估计其链上基础设施方面的投入已超过 1 亿美元。

Binance Alpha,声望与流动性的变现

2024 年,加密市场在比特币现货 ETF 获批与 meme 狂潮的双重刺激下迎来了一轮牛市繁荣。尽管表面上流动性显著回暖,但隐藏在繁荣背后的是一级市场与二级市场之间定价机制的逐步失效。项目估值在 VC 阶段不断虚高,发币周期一再被拉长,普通用户的参与门槛持续抬升。而当代币最终上线交易平台,往往也只是项目方与早期投资者集中兑现的出口,留给散户的却是「开盘即巅峰」后的价格塌缩与高位接盘。

正是在这样的市场环境下,Binance 于 2024 年 12 月 17 日推出了 Binance Alpha。这个原本只是 Binance Web3 钱包中用于探索优质早期项目的实验性功能,很快演变为 Binance 重塑链上一级市场定价机制的关键工具。

Binance 联合创始人何一曾在一次回应社区争议的 Twitter Space 中,公开承认 Binance 上币存在「开盘即巅峰」的结构性问题,并坦言传统上币机制在如今交易体量和监管框架下已难以为继。过去,Binance 曾尝试用投票上币、荷兰拍卖等方式来修正新币上线后的定价失衡,但效果始终不尽人意。

Binance Alpha 的推出,某种程度上成为了在可控范围内对原有上币体系的策略性替代。自上线以来,Alpha 已经引入了来自 BNB Chain、Solana、Base、Sonic、Sui 等多个链生态的 190 余个项目,逐步形成一个由 Binance 主导的链上早期项目发现与预热平台,为交易平台重新掌握初级定价权提供了一个实验性路径。

而在 Alpha Points 机制上线后,更是成为散户「撸毛」的胜地,不仅是领域内的玩家,甚至破圈至更广域的 Web2,不错的收益让许多人甚至动员全家乃至全公司全村的人来参与。

虽然到现在越来越卷,也有类似于 ZKJ 等代币上线 alpha 后暴跌的情况发生,让人担忧其「合规性」。社区对其褒贬不一,知名 KOL thecryptoskanda 对 Alpha 是赞赏有加,他认为 Binance Alpha 是继 Binance IEO 之后 Binance 第二伟大的活动创新,并从其在生态中的作用分析,「Binance Alpha 的历史使命是瓦解 A16Z、Paradigm 这些可以从 tradfi 几乎无成本募资的北美 VC 的一级定价权,并收回币安体系。并卷死其他交易平台的山寨上币市场,以防止类似 Grass 出现在 Bybit 之类导致热点旁落的可能性,同时将所有链的资沉都通过 BSC 变成币安的资沉。而 Alpha 很好的完成了这三个目标。」

Coinbase 接通 DEX,所内大户对 Base 的反哺

而跟随着 Binance 和 OKX 的脚步,Coinbase 也开始了自己集成链上生态的步伐,他们的初步策略是接入 DEX 交易以及已验证资金池。在近日举行的 2025 年加密货币峰会 Coinbase 消产品管理副总裁 Max Branzburg 宣布将把 Base 链上的 DEX 集成进 Coinbase 主应用程序,未来应用将内嵌 DEX 交易。

通过 Base 原生路由交易任何链上代币,并包装为经过 KYC 验证的资金池,让机构也能参与。Coinbase 现在拥有超一亿注册用户,而每月活跃交易用户 800 万,而根据 Coinbase 的投资人报告显示其平台上的客户资产价值为 3280 亿美元。

散户的交易仅占 Coinbase 上的 18% 左右,从 2024 年开始,Coinbase 的机构客户的交易量占比开始持续增高(2024 年 Q1 交易量为 2560 亿美元,占总交易量的 82.05%),而随着 Coinbase 集成 Base 上的 DEX,DeFi 的广度加上 TradFi 的合规标准,应该能够为数以万计的 Base 链上代币引入大量的流动性,更重要的是 Base 生态的大量产品将拥有 Coinbase 这个与现实世界合规通路的可能性。

而 Base 最大的原生 DEX Aerodrome 在这几天也成为了讨论的热点,作为首批内嵌在 Coinbase 主站的交易路由,近一周已经上涨了 80%,市值上涨了近 4 亿美元。

社区对此的态度也分为两部分,知名 KOL thecryptoskanda 并不看好 Coinbase 的策略,在讨论 Binance Alpha 时认为,Coinbase 模仿 Binance Alpha,开放 App 买 Base 链上资产只是学个皮毛。但 KOL 解构师 0xBeyondLee 认为这和 Binance Alpha 不是一个概念「Alpha 还有准入机制,并不是什么币都能上,Coinbase 修辞则是所有 Base 资产都能出现。就相当于可以直接在同花顺上交易楼下水果摊的股权一样离谱,无论是从流动性还是注意力上讲对于 Base 链的增益都是史无前例的。」

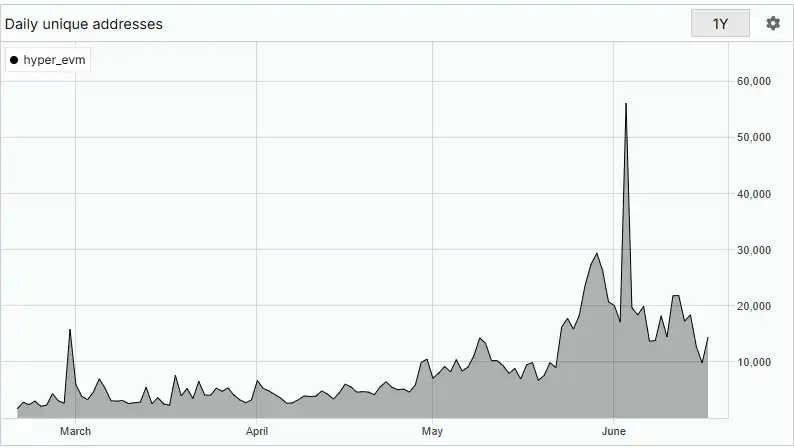

而 Coinbase 对链上流动性的进攻还不止于此,知名 KOL TheSmartApe「the_smart_ape」在社交媒体表示,因为 Coinbase 的举动,自己将开始出售自 TGE 持有至今的 $Hype。他进一步解释道,Hyperliquid 目前每天有大约 1 万到 2 万名活跃用户,而总用户数约为 60 万。其中 2 到 3 万名核心用户贡献了近 10 亿美元的收入,其中很大一部分来自美国。

但大多数美国交易商使用 Hyperliquid 是因为他们没有更好的选择。他们被排除在币安和其他主要 CEX 之外,无法进行永续合约交易。但当 Coinbase 和 Robinhood 都宣布将在美国推出永续期货产品,对 Hyperliquid 来说将是巨大的打击,其大量核心用户中的很大一部分可能会转向 Coinbase 或 Robinhood。更安全、更便捷的访问方式,无需自我保管,没有复杂的 DeFi UX,并得到美国证券交易委员会 (SEC) 等监管机构的全力支持的 Coinbase 能够吸引大多数交易者,他们并不关心去中心化,只要够安全并好用他们就会使用它。

Byreal,Bybit 的链上二重身

Bybit 在链上战争中的动作相较于 Binance 和 OKX 更「克制」,不造链、不自建 Rollup。仅围绕「用户入口」、「链上交易」、「公平发行」三个方向轻量化推进。

首先,Bybit 从 2023 年起推进 Web3 品牌独立化,推出了 Bybit Web3 钱包,将用户引入链上的核心功能(Swap、NFT、铭文、GameFi)嵌入其中。钱包集成 DApp 浏览器、空投活动页面、跨链聚合交易等能力,同时支持 EVM 链与 Solana,目标是成为 CeFi 用户迁移至链上世界的轻量化桥梁。不过随着钱包市场竞争的「激烈化」,该项目并未掀起热潮。

Bybit 转而将目光放在链上交易和发行平台上,推出了部署在 Solana 上的 Byreal,Byreal 的核心设计理念是复刻中心化交易平台的「撮合体验」,通过 RFQ(Request for Quote)+ CLMM(集中流动性做市)混合模型实现低滑点交易,并嵌入公平发行(Reset Launch)与收益金库(Revive Vault)等机制。据称测试网将于 6 月 30 日启动。主网将于 2025 年第三季度推出。

而 Bybit 也在主站推出了 Mega Drop,目前已经进行了 4 期,而采取的是质押自动获取项目的代币空投的模式,当前的收益估算,约是质押 5000 美元 每期能获得约 50 美元左右的收益,但根据项目的优劣各有不同。

总体而言,Bybit 在链上战争中的策略是「用较低的开发成本、借力现有公链基础设施」,建立连接 CeFi 用户与 DeFi 场景的桥梁,并通过 Byreal 等组件拓展其链上的发现力与发行力。

这一轮由 Hyperliquid 引爆的去中心化衍生品浪潮,实则已经从技术范式的突破演化为一场交易平台间的博弈格局重塑。CEX 与 DEX 的界限正在被打破,中心化平台开始主动「上链」,而链上协议则在不断模拟中心化撮合体验。从 Binance Alpha 对一级定价权的回收,到 OKX 构建 Web3 全栈基础设施,再到 Coinbase 借助合规触达 Base 生态,甚至 Bybit 也通过 Byreal 建起自己的链上二重身,这场「链上战争」远不止是技术竞赛,更是用户主权与流动性主导权的争夺。

最终谁能占据未来链上金融的制高点,不仅取决于性能、体验、模式创新,更在于谁能构建起最强的资本流动网络和最深的用户信任通道。我们或许正站在 CeFi 与 DeFi 深度融合的临界点,而下一个周期的胜者,未必是最「去中心化」的那个,而可能是最「懂链上用户」的那个。

Hype!Hype!Hype!

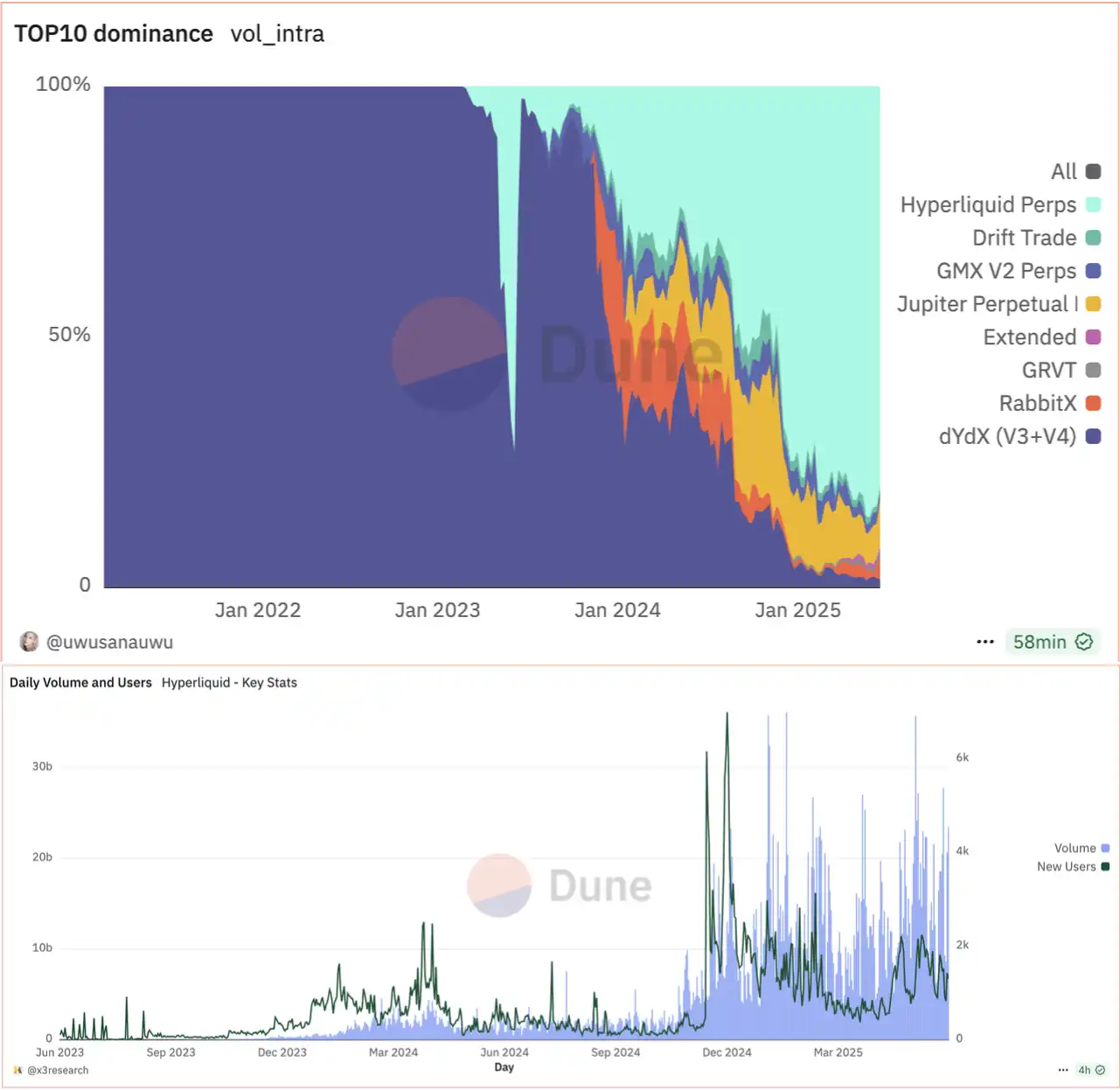

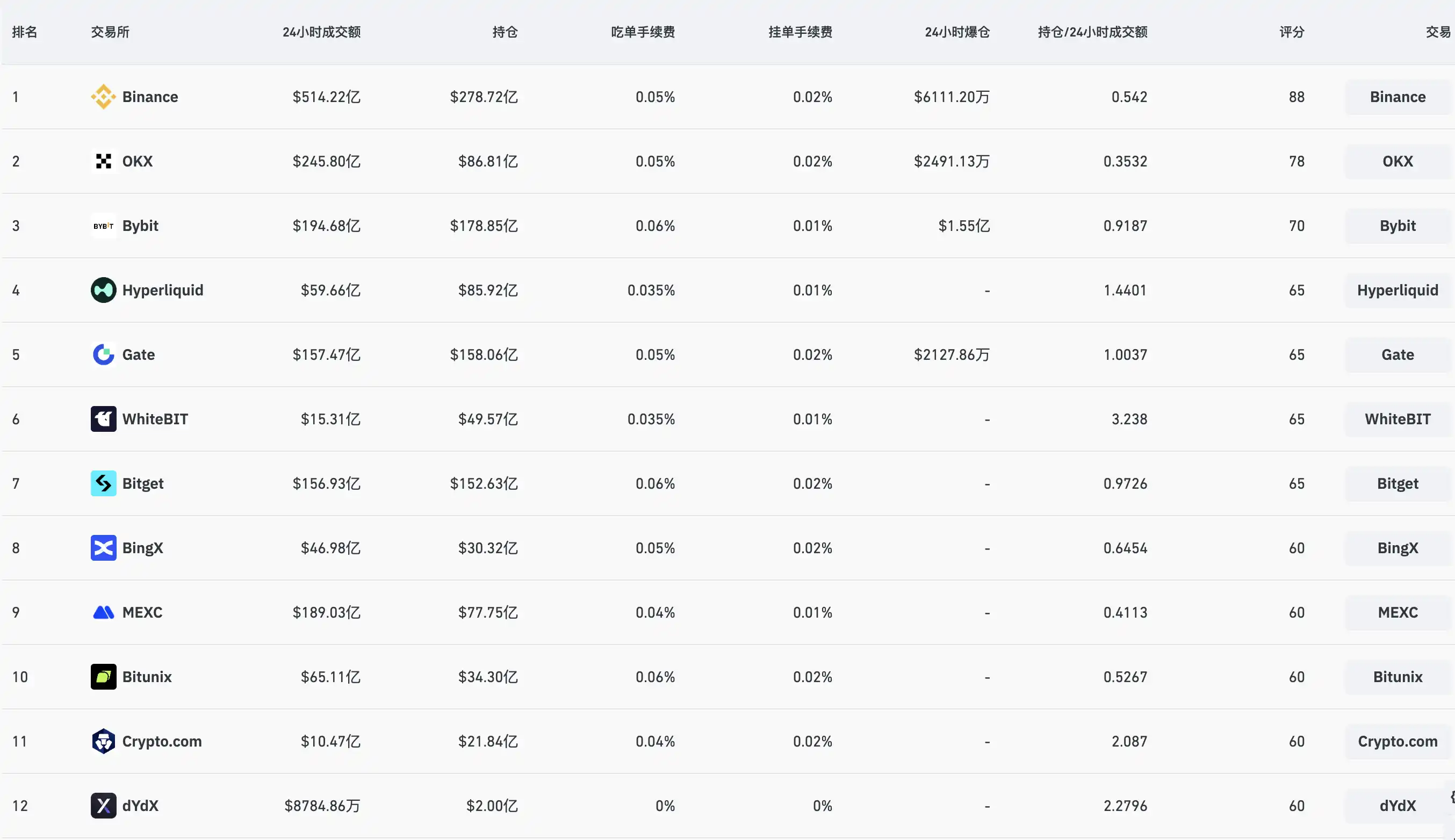

2020 年 4 月 dYdX 首次推出去中心化的永续合约交易对 BTC-USDC,就此开启了去中心化交易平台的衍生品之路。而市场历经 5 年的发展,到 Hyperliquid 出现让这一领域的潜力得到解放,至今为止 Hyperliquid 累计了超过 3 万亿美元的交易量,而日均交易量也已经接近 70 亿美元。

随着 Hyperliquid 的破圈,去中心化交易平台已经成为了中心化交易平台无法忽视的一股势力,而增长逐渐停滞的交易玩家加之被以 Hyperliquid 为首的去中心化交易平台的分流。让中心化交易平台急迫寻找下一个「增长锚点」,除了拓展稳定币或支付类的「开源」策略,首当其冲的便是夺回流入链上的合约玩家的「节流」策略,从 Binance 到 Coinbase,各大中心化交易平台开启融合自己在链上的资源。与此同时,社区的玩家对区块链的态度从纠结于「去中心化」到大部人更在乎「无许可」与「资金安全」,去中心化与中心化交易平台的边界正在变得模糊。

在过去几年,DEX 代表的思想曾是反抗 CEX 权力垄断的象征,但随着时间推移,DEX 开始逐步借鉴甚至复制曾经「巨龙」们的核心手艺。从交易界面到撮合方式,再到流动性设计和定价机制,DEX 一步步重塑自己,向 CEX 学习,甚至走得更远。

在 DEX 成长到能完成 CEX 的各类功能后的当下,即使遭遇 CEX 的打压也无法消去市场对其未来发展的热情,他承载的已经不仅是「去中心化」,而是金融模式的转变以及其背后承载「资产发行」模式变化的。

而 CEX 似乎也发起反击,除了发展更多业务渠道,也企图将原本属于链上的流动性与自身的体系相绑定,以弥补被 DEX「偷去」日益减少的交易量与用户数。

当市场充满多样性的竞争时是最具创造力与活力的,不管是 DEX 还是 CEX 之间存在的竞争都是市场与「现实」不断妥协的结果,这场围绕流动性主导权与用户注意力展开的「链上战争」,已经远超技术本身。它关乎交易平台如何重构自身角色、捕捉新一代用户的需求、并在去中心化与合规之间找到新的平衡点。CEX 与 DEX 的界限日益模糊,未来的赢家属于在「体验、安全、无许可」三者之间走出最优路径的建设者。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。