今晚我们全员团队都在开会,讲讲霍尔木兹海峡封锁,潜在的全球金融市场影响,尽量讲的通俗易懂,主要涉及通胀影响以及相关投资机会:

🛢️霍尔木兹海峡封锁,意味着什么?

想象一下:全球石油的大动脉,被掐住了。

霍尔木兹海峡,是全球最重要的能源运输通道之一。全球大概20% 的原油、30% 的液化天然气(LNG)都得从这里过。这条海峡像一个“能源高速公路”的喉咙口,宽不过几十公里,一旦被封锁,全球油气供应立马“卡壳”。

💥一封锁,油价就飙!

如果霍尔木兹被真的封了,油轮出不去,市场立刻恐慌,供需关系紧张,油价飙升是必然的结果。

现在油价已经从4月的低点涨了35%,还没出事就这样了。如果真的冲突升级,从摩根大通的报告预测,油价可能一口气冲上每桶 120~130 美元。

📈油价涨,对通胀影响多大?

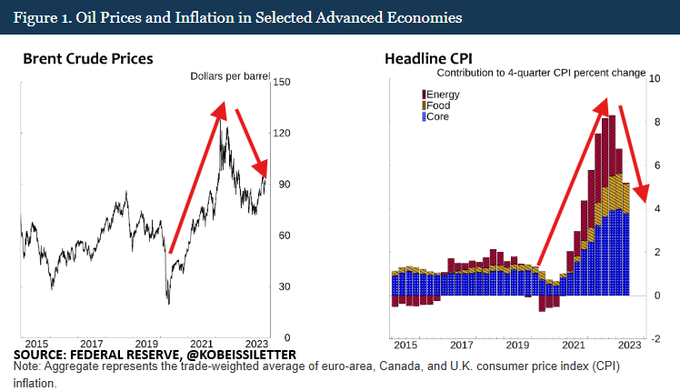

这里有一个关键数据:油价每涨 $10,美联储估计 CPI 就会升高 0.2%(20个基点)。

现在已经涨了差不多 $20,理论上已经推动通胀多了 0.4%(40 个基点)。

如果像预测的那样,油价涨到 $120~130,那通胀可能重新突破 5%。而我们都记得,上一次 CPI 达到 5%,是在 2023年,美联储当时还在加息!

💡通胀高了,美联储会怎么办?

这就很关键了。现在市场原本期待的是美联储今年降息两次,9月开始降息。

但油价上涨导致通胀反弹,等于把这条路“堵上了”:降息预期下调,对股市特别是科技股是利空;如果通胀恶化,美联储甚至可能重新考虑加息的可能性,或者至少维持高利率更久;债券市场也会紧张,美债收益率可能上升。

🧨不仅是油价,地缘政治风险也会全面推高市场波动

封锁海峡不是简单的经济问题,而是地缘政治升级的信号,意味着:

1️⃣全球风险资产受冲击(股市避险、黄金上涨、VIX波动率上升);

2️⃣中东能源国家收入激增,但全球进口国成本压力加大;

3️⃣避险资产上涨:比如黄金、美债、可能有 #BTC,毕竟中东迪拜土豪离霍尔木兹海峡都比较近。

📊投资者该怎么应对?

如果你是投资者,现在你得明白:这不是油价的小波动,这是全球金融系统的“风险再定价”时刻。

1️⃣要关注原油、能源股、通胀受益资产(如黄金、资源类ETF),还有巴菲特持有大仓位的西方石油;

2️⃣同时要防范高估值科技股、成长股的回调压力,山寨币回调;

3️⃣关注美联储官员的态度,如果他们开始变得“鹰派”,市场可能会快速调整;

建议:由于宏观避险情绪增强,波动率加剧,不宜重仓单一方向,组合配置,分散对冲风险。

总之:霍尔木兹海峡一旦封锁,不只是中东的事,它可能引爆的是全球市场的连锁反应。

从油价、通胀、美联储利率政策,到股市债市,全部都会受到影响。投资人必须把握住这条主线,防守与机会并存。🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。