美联储又按兵不动,但市场其实已经“想降息”了

2025年6月18日,美联储在议息会议上选择维持利率不变,依旧是4.25%到4.5%的目标区间。看上去一切风平浪静,符合市场预期,但别被表面骗了——这次会议之后,市场对9月降息的预期飙升到了71%!

什么意思?美联储不说,但市场已经“脑补”了未来的宽松剧本。而在这个背景下,美联储自己却上调了通胀预期(至3%),还下调了经济增长预期(到1.4%),一边喊着不急着降息,一边又摆出一副“经济可能顶不住”的架势。

鲍威尔在记者会上也继续玩“模糊语言”:通胀还是偏高,经济还是不确定,“我们会密切关注数据”——翻译一下:他们也没想好,市场情绪先行一步了。

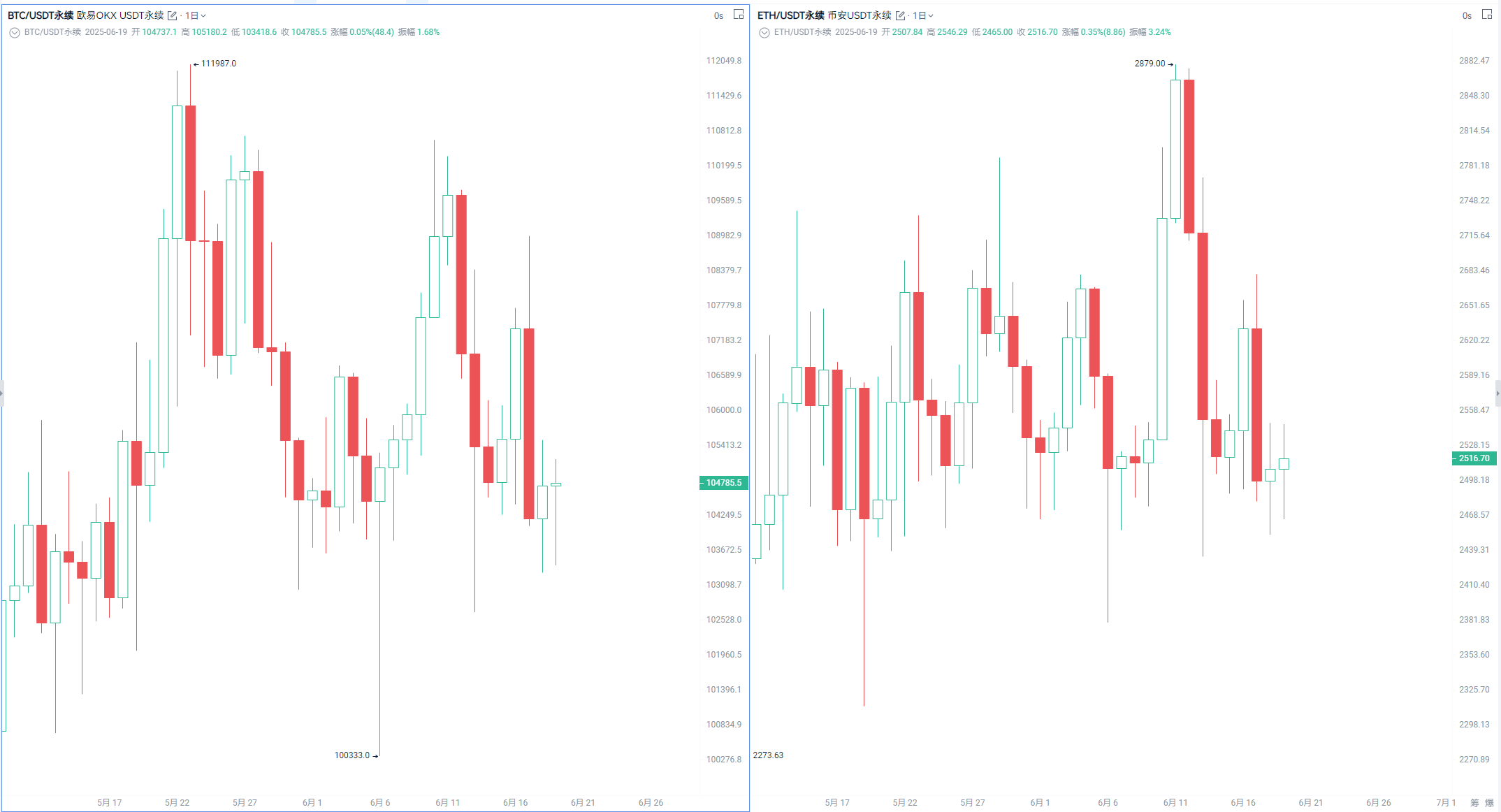

BTC 和 ETH 看起来稳,其实是被困在“等待区”

比特币最近稳稳地卡在104,000美元左右,以太坊也在2550美元左右横着走。从数据上看,BTC的30天波动率只有1.9%,ETH也仅3.17%,都属于历史低位区间。

换句话说:价格在走,行情在等。

市场正在进入一个“稳定期”,而这种稳定不是因为所有人都看涨或看跌,而是因为大资金都在观望:到底是等美联储下一步动作?还是等通胀数据继续走软?还是等哪个黑天鹅事件落地?

如果你这时候贸然追涨杀跌,可能会陷入“进退两难”的困局——所以我们需要搞清楚一个关键问题:

现在的市场,是在“酝酿新趋势”?还是已经“躺平震荡”?

搞清楚市场状态,才是交易的第一步

为什么说判断市场状态如此重要?因为策略的使用场景根本就不一样!

- 如果你判断市场有趋势,那你应该做的是追趋势,比如用MACD、移动平均线来顺势开仓;

- 但如果你判断市场在震荡,那你就应该反其道而行,高抛低吸,比如在区间上下轨做均值回归。

而现实是,大部分时候市场都处在一个模糊状态——你用趋势策略,它突然回头;你想做震荡,它却直接突破。

所以你需要一个“状态侦察兵”,它不预测方向,而是告诉你:你该用哪套战术。

混沌指数:教你判断“稳”到底是真稳还是假稳

这时候,混沌指数(Choppiness Index)就成了我们的好帮手。它的数值范围是0到100,不告诉你涨跌方向,只告诉你市场到底是在“走趋势”还是“混着震荡”。

简单来说:

- 如果你看到混沌指数高于61.8,那说明市场在“横”,适合做震荡;

- 如果低于38.2,那大概率是进入了“走”*的状态,适合追趋势;

- 而中间区域,就要结合其他信号再观察。

为了验证它在当前行情下的参考价值,小编借助 AiCoin 的自定义指标功能,对混沌指数进行了实盘构建和展示,并叠加到了1小时K线图上进行分析。

- 在阶段一,混沌指数明显靠近61.8这一高值区间,K线走势呈现横盘整理,缺乏明显方向,市场整体处于典型的震荡状态;

- 进入阶段二,混沌值快速回落,并围绕低位临界值32.8附近震荡,此时我们能清晰看到K线突破震荡区间,趋势特征开始显现;

- 而来到当前的阶段三,混沌指数再次回升,重新逼近60水平——这意味着市场很可能又回到了“横着走”的节奏中。这不就是我们之前感觉到的“稳定期”吗!

当然,值得强调的是:混沌指数本身并不提供买卖信号,也不告诉你该做多还是做空,它的核心功能在于——确认当前市场的结构属性,从而辅助我们选择合适的工具与策略。

如果需要定制你自己的行情判断指标,可以下载AiCoin进行尝试:https://www.aicoin.com/zh-Hans/features

行情稳定≠操作随意,下一篇我们聊聊怎么出手

所以总结一下:当下的市场,看起来波澜不惊,实际上正处于一个宏观不确定与技术压缩并存的状态。无论是稳中有变,还是变中藏稳,最重要的是别盲目套用策略,而要搞清楚自己面对的是怎样的行情结构。

这正是混沌指数的意义——帮我们拆解结构,明确方向,为策略选择打好基础。

至于具体该用什么策略?止损怎么设置才合理?

——我们下一篇就来聊聊针对目前市场的实战层面内容。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。