XRP ETF 暂停,因 Ripple 法院案件推迟

Ripple 与美国证券交易委员会(SEC)之间的法律斗争仍在继续。现在,又出现了新的转折。

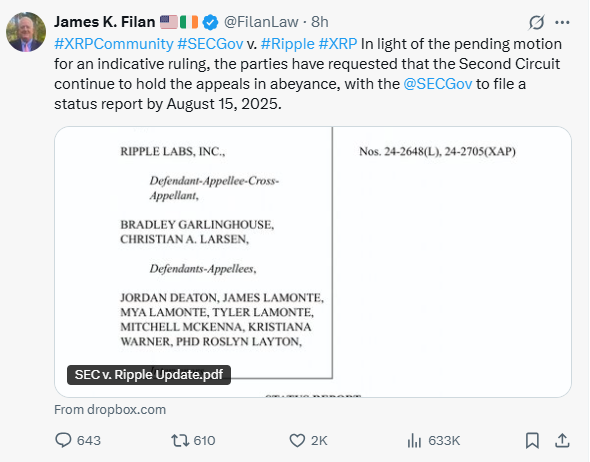

双方最近向第二巡回法院提交了一份新报告。在报告中,他们请求法院暂时暂停他们的上诉。为什么?因为他们仍在等待地区法院对他们长期诉讼的裁决。

来源: X

什么阻碍了 XRP ETF?

在 Ripple 与美国之间的法律案件继续进行时,许多 Ripple 投资者也在急切等待与 Ripple 相关的现货交易所交易基金(ETF)的更新。

在交易所交易基金中,一个主要问题是富兰克林·坦普顿的 XRP 基金,该基金的关键决策截止日期定于 2025 年 6 月 17 日。但由于 Ripple 与 SEC 的诉讼仍在进行中,专家们认为 SEC 可能会推迟对该交易所交易基金的任何决策。

这是第一次发生这种情况。多年来,专家和市场观察者一致认为,这起诉讼一直阻碍着 XRP 在美国获得更广泛的采用——尤其是在像交易所交易基金这样的金融产品方面。

黑石会是下一个吗?

ETF 专家 Nate Geraci 最近在社交媒体上分享了他的看法,预测黑石可能很快会申请 Solana 和 XRP 的现货 ETF。他建议 Solana ETF 的申请可能“随时会发生”。

Geraci 指出,申请可能会随之而来——但仅在 Ripple-SEC 案件最终解决后。因此,一旦法律迷雾消散,您可能会看到 XRP 加入越来越多的官方 ETF 申请的加密货币名单中。

加拿大正在推进 XRP ETF 上市

在美国拖延之际,加拿大正在向前迈进。新的 ETF 正式定于 2025 年 6 月 18 日在多伦多证券交易所(TSX)上市。

以下是您需要关注的代码:

XRPP(加元对冲)

XRPP.B(加元)

XRPP.U(美元)

该基金将为加拿大投资者提供直接的投资机会,这意味着它持有真实的 Ripple,而不仅仅是跟踪其价格。更好的是,它将可用于税收优惠账户,如免税储蓄账户(TFSA)和注册退休储蓄计划(RRSP)。

接下来会发生什么?

对于美国投资者来说,所有的目光都集中在法院上。在 Ripple-SEC 案件完全解决之前,您不太可能在美国看到获得批准的交易所交易基金。但一旦结束,可能会有来自黑石等主要参与者的一波活动。

目前,加拿大为投资者提供了一种新的投资方式——没有诉讼延误。

因此,无论您是在美国关注还是已经准备通过 TSX 投资,XRP 的旅程远未结束。接下来的几个月对于 Ripple 持有者和整个加密 ETF 世界来说可能会非常有趣。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。