I don't really understand geopolitical conflicts, but as I mentioned during the day, US oil $USOL, which is WTI, is a good reference benchmark. It can reveal the progress of conflicts to someone like me who doesn't understand geopolitical issues through "data." Tonight, the price of US oil has already fallen below $70, down 4.2%. Although it seems from the news that there is still no ceasefire, the oil price reflects that the market is no longer overly concerned about the geopolitical conflict.

Not only has $BTC returned to pre-conflict levels, but even US stocks have returned to last week's highs. I don't know if the impact of the conflict has ended, but indeed, from the price trends, market sentiment is still quite good. The most alarming thing is that $CRCL reached a high of $165 today; my perspective is still too narrow.

On Tuesday, the US retail data will be released. This data can be seen as a reflection of the purchasing power of the American public. From the current expected data, last month saw a 0.1% increase, while this month's expectation is -0.7%. At the same time, the increase in import prices has also turned into -0.2%. The former is not good, indicating a shrinkage in purchasing power, while the latter shows a decline in import prices, representing an economic slowdown, which puts pressure on the Federal Reserve.

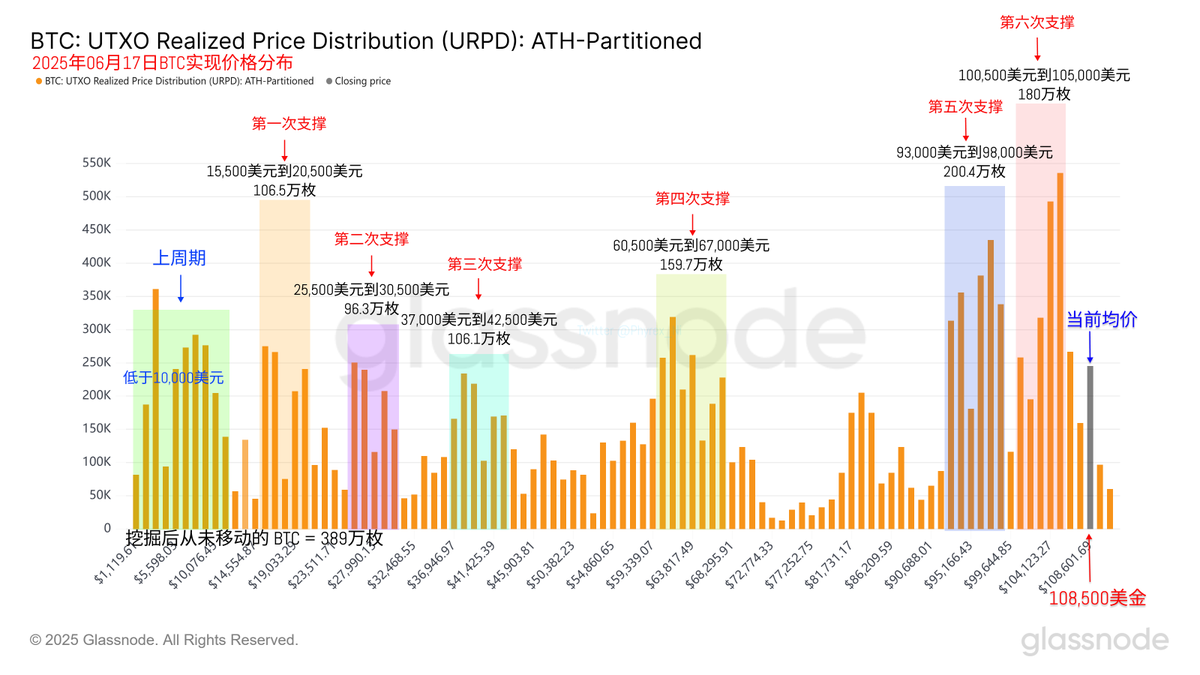

Looking back at Bitcoin's data, the price increase has led to an increase in turnover, especially in the last two days, where profit-taking investors who bought the dip are the main sellers. Earlier investors remain calm, which also validates the effectiveness of the data we obtained in the past week. Most investors are indifferent to short-term price fluctuations, and the decrease in exchange inventory indicates that most investors are more focused on BTC's long-term price trends.

In terms of support, there are still over 2 million BTC in inventory between $93,000 and $98,000. The rising price has not driven most support-level investors away, and investor sentiment remains very calm. Starting tomorrow, the more important considerations should be on macro data, including Thursday's dot plot.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。