I. Triple Fundamental Pressures on the Market

The Crisis of Altcoins Continues to Ferment

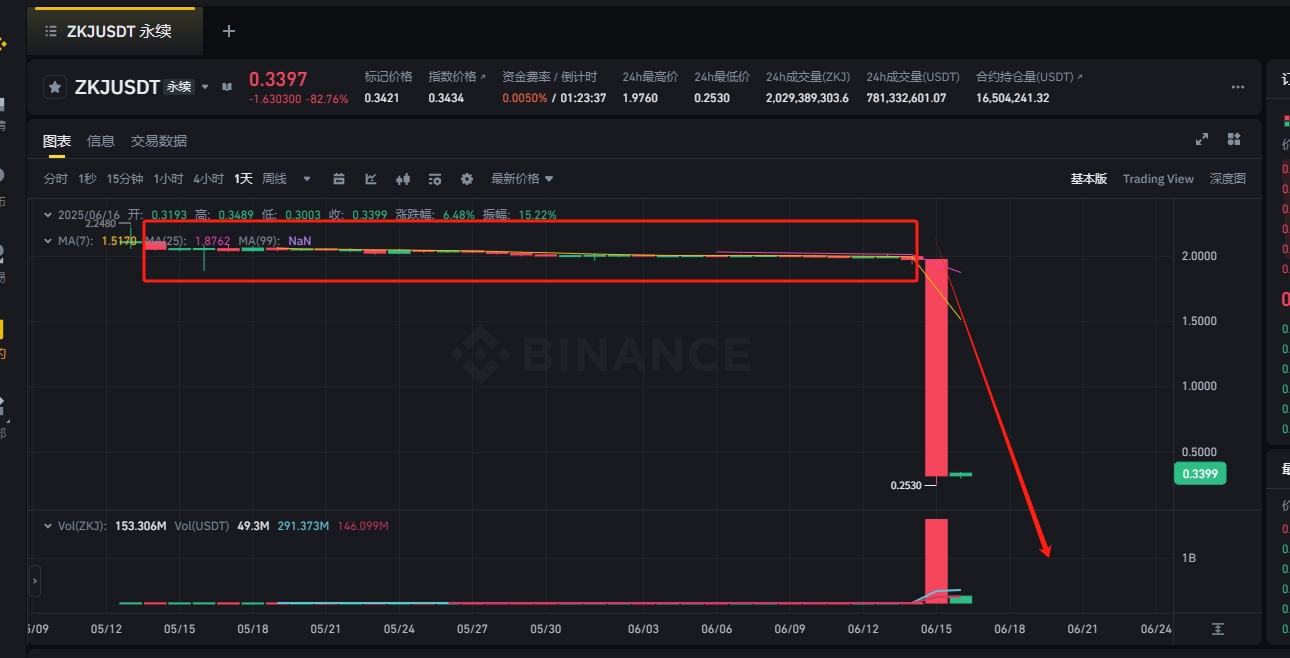

Two months after the collapse of ACT, ZKJ experienced a flash crash on the 14th at 23:00, plummeting 80% in one hour. On-chain data shows that whales withdrew $5.32 million in liquidity, combined with the unlocking of 2 million tokens (accounting for 18% of the circulating supply), triggering a panic sell-off. This incident exposed the vulnerability of incentive mechanisms and the insufficient on-chain depth of small-cap projects, and retail investors should be wary of the "high-yield mining + low lock-up" trap.

Unlocking Wave Heightens Panic

This week, popular tokens like ZK and ARB will face significant unlocks:

ZK (6.15) will unlock 12 million tokens (market cap $24 million)

ARB (6.17) will unlock 8.9 million tokens (market cap $10.68 million)

Historical data shows that the average decline in the 72 hours before token unlocks is 7.3%, with significant risks of liquidity withdrawal.

Geopolitical Conflicts Impact Risk Appetite

The escalation of the Israel-Palestine conflict has triggered global risk aversion, with cryptocurrencies, as high-risk assets, being the first to bear the brunt: the correlation between Bitcoin and gold has dropped to 0.31, undermining its "digital gold" attribute; funds are flowing into the US dollar (DXY rising to 103.8) and crude oil (Brent crude surpassing $85 per barrel). If the conflict spreads to the Middle East oil-producing regions, it may indirectly benefit cryptocurrencies through inflation expectations, but short-term pressure is intensifying.

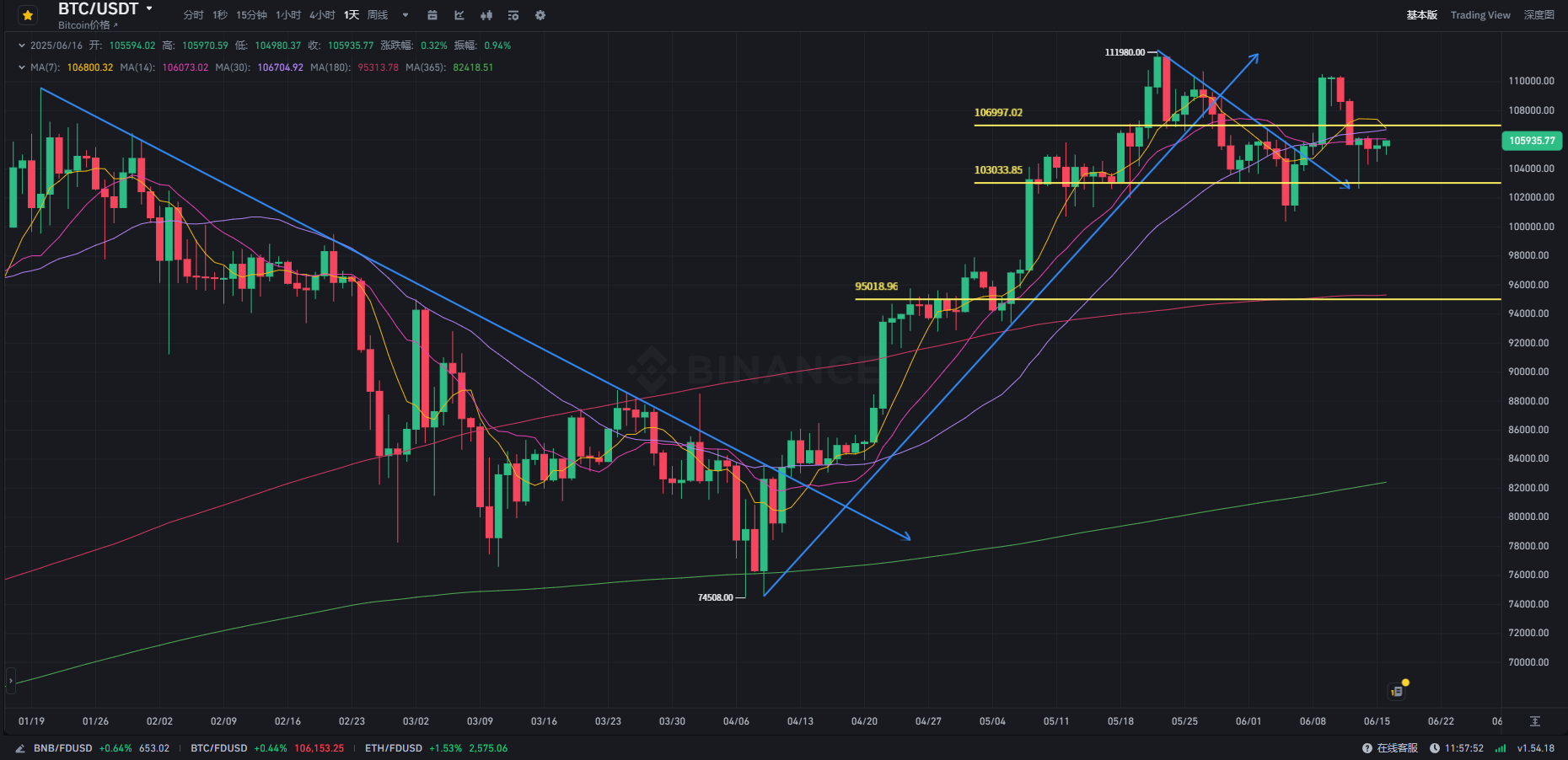

II. BTC: $103,500 Becomes a Key Defense Line

Weekly Level

: A long upper shadow bearish candle closed, breaking below the 7-week moving average ($105,800), creating a new two-month low. Starting from the 17th, although the maturity of US Treasury bonds theoretically releases liquidity, geopolitical risks may weaken capital inflows.

Daily Level

: Affected by the conflict, it dipped to $103,000, forming a "three-pin bottom" pattern, with the 200-day moving average ($102,500) serving as the last defense line. Strong resistance is at $106,500 (Fibonacci 38.2% retracement level), and a volume breakout is needed to reverse the downward trend.

4-Hour Level

: The rebound volume shrank by 42%, indicating cautious bottom-fishing. Focus on the pressure range of $106,500-$107,500 and support at $104,500-$103,500; a break below should be watched for accelerated declines.

III. ETH: $2,500 Support Under Test

Weekly Level

: A small bullish candle with a long upper shadow, oscillating around the 5-week moving average ($2,550), the upward trend remains unchanged but momentum is waning.

Daily Level

: After four consecutive bearish candles, it stabilized in the $2,480-$2,500 range, which is a dense trading area from December 2024. Volume has shrunk to 60% of the average, caution is advised for potential changes after "low volume meets low price."

4-Hour Level

: After a double bottom, it closed with a small bullish candle, but the RSI has not broken the 50 midline, limiting the rebound height. The key resistance is at $2,600 (Bollinger middle band), while support at $2,530-$2,500 needs close attention.

IV. Altcoin Strategy: Focus on Risk Aversion, Wait for Opportunities

Risk Control for Unlocking Tokens

: It is recommended for holders of unlocking tokens to reduce their positions by 50% 48 hours before the unlock, with a stop-loss set at 15% for the remaining position; watch for opportunities after the unlock when "bad news is fully priced in," but this should be assessed in conjunction with on-chain capital flows.

Current Market Situation

: The expectation for the Federal Reserve to delay interest rate cuts until Q4, combined with risk aversion, makes it difficult for high-risk altcoins to sustain momentum. Short-term opportunities are limited to concepts related to listings on Coinbase (Sonic, JTO) and regulatory beneficiaries (COMP, MKR).

Position Management

: Mainstream coins (BTC + ETH) should account for 50-60%, with additional purchases on dips; altcoin positions should be reduced to below 20%, participating only in blue chips; retain 30% cash to respond to black swan events, waiting for a liquidity turning point after the maturity of US Treasury bonds in late June.

Risk Warning: If Brent crude surpasses $95 per barrel, the global market may experience "liquidity withdrawal," leading to synchronized declines in cryptocurrencies and US stocks. Strictly implement stop-loss measures; if BTC falls below $102,500 or ETH below $2,450, decisive position reduction is necessary. (The cryptocurrency market is highly volatile; exercise caution when entering, this is personal opinion, not advice, for sharing purposes only.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。