Solana ETFs Include Staking Features in New SEC Filings Update

Seven companies hoping to launch a Solana exchange-traded fund (ETF) in the U.S. have filed or amended their S-1 forms with the SEC , bringing renewed attention to the possibility of a regulated Solana investment product. These updated filings have a new feature, called staking. However, ETF analysts say it may take more time before the SEC gives its green light.

Staking Included in All Solana ETF Filings

On June 13, major firms like Fidelity, 21Shares, Franklin Templeton, Grayscale, Bitwise, Canary Capital, and VanEck submitted S-1 filings for their planned Solana ETFs. Bloomberg expert James Seyffart said that all the filings mention language about holding. It is a process that allows token holders to earn rewards for assisting in securing the Solana network.

Holding in an Exchange Traded Fund is a big deal because it adds a way to earn passive income, not just track the price of SOL. For example, Bitwise and Canary stated that their SOL would be held in special “Trust Accounts” and could be staked through Coinbase Custody. The income from staking may come in the form of more Solana or cash and would go to the trust, potentially increasing the value of the ETF.

Grayscale also added staking to its ETF plan but included a condition. The organisation will only join in staking if particular rules, named as “Holding Condition,” are met. Grayscale disclosed a 2.5% management fee in the same filing, higher than most investment products, but some investors may find the yield-generating aspect worth the extra cost.

SEC Likely to Take More Time

In spite of these submissions, approval is not necessarily imminent. Seyffart explained that the SEC will probably have multiple rounds of comments before ruling. He reminded readers about the number of years it took for an in-spot Bitcoin ETF to be approved despite numerous redrafts and meticulous dialogue. Bitcoin ETFs were eventually approved in January 2024, more than a decade since the initial attempt.

Although lessons from previous approvals would accelerate the process, Seyffart explained that holding raises new questions. As it was not part of previous Bitcoin or Ethereum ETF approvals, the SEC will take additional time to learn and regulate it appropriately.

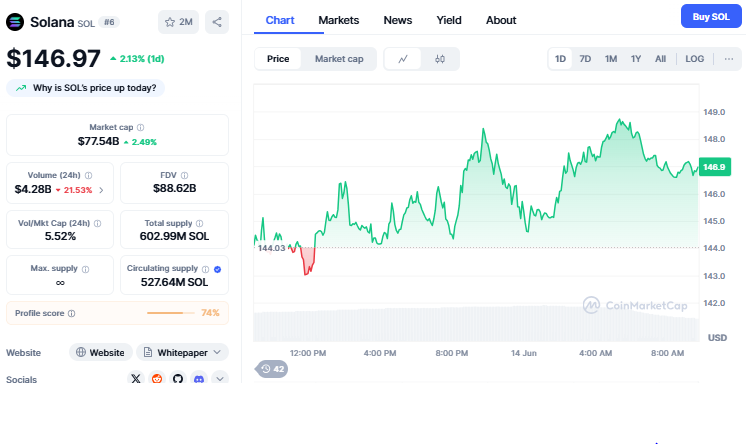

There is also speculation that if this process eventually becomes permitted for Ethereum and Solana ETFs will also receive approval in tandem. That would be the start of a new form of crypto investment product that not only represents price but also yields through network participation. Currently the price of Solana is at $146.97 with an increase of 2.13% within the last 24 hours. interest remains high, specifically after a $628 million transfer of SOL was spotted on-chain, possibly in anticipation of the ETF news as per the CoinMarketCap.

Source: CoinMarketCap

Big Changes Coming to Crypto ETFs?

Staking concept in ETFs is a significant transformation in the functionality of crypto funds. They are no longer simple price-tracking tools. With the introduction of this feature these ETFs currently provide investors with a method of generating passive income, which otherwise is only available to users that manage their own wallets.

Final Thoughts

For everyday investors, this is a chance to get involved in SOL without handling the technical side of staking. If approved, these ETFs could be the first of their kind in the U.S. to offer regulated staking rewards, possibly opening the door to a broader trend in yield-generating crypto investment products.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。