In June 2025, a group of technological idealists made an untimely yet deafening cry at the "Funding the Commons" event in Berlin. They pointed directly at the current meme market, valued at over $65 billion, calling it a "breeding ground for fraud," and urged a return of blockchain technology to its original intention of "serving the public good."

This public "rebellion" occurring in the heart of the industry is not only a critique of a popular track but also unveils a profound "route dispute" concerning the soul of the industry: Is the ultimate narrative of blockchain leading to a decentralized fair society, or has it devolved into an ever-open digital casino?

The "Dissidents" of Berlin: When "Public Interest" Confronts "Speculative Frenzy"

Among the many events during Berlin Blockchain Week, "Funding the Commons" has always been a unique presence. It resembles an academic seminar rather than an industry summit filled with commercial collaborations and project roadshows. The attendees are often builders and thinkers who care more about protocol sustainability, network externalities, and how to fund "digital public goods."

This year, the atmosphere here felt particularly sharp.

According to Dlews, a group of technicians, builders, and artists launched a fierce critique of the current mainstream trends in the industry at this event. Joshua Dávila, who identifies as a "socialist maximalist," is a representative figure among them. He and his companions targeted meme coins—this "star track" that attracted massive funding and attention between 2024 and 2025.

Their arguments are direct and brutal: statistics show that on the popular meme coin issuance platform Pump.fun on the Solana chain, as much as 98% of token projects ultimately proved to be fraudulent "rug pull" scams. With a market capitalization exceeding $65 billion, it is built on a game where speculators "pass the parcel" and project teams are always ready to run away. In their view, this is not only a tremendous waste of resources but also a betrayal of the potential of blockchain technology.

"We have a powerful tool that could be used to reshape cooperatives, provide humanitarian aid to sanctioned regions, and even redistribute wealth," Dávila and others lamented, "but we are using it to create and hype worthless 'Dogecoin' and 'Frogcoin.'"

The vision proposed by this group of "dissidents" represents "another path" for blockchain technology:

Support Digital Cooperatives: Utilize the DAO (Decentralized Autonomous Organization) framework to establish economic entities that are jointly owned and governed by members, breaking free from the exploitative structures of traditional corporations.

Empower Humanitarian Aid: Deliver aid supplies and funds directly to those in need through transparent, censorship-resistant on-chain transactions, bypassing corrupt or inefficient intermediaries.

Achieve Wealth Redistribution: Explore innovative mechanisms such as Universal Basic Income (UBI) and Quadratic Funding to ensure that the value generated from network development is more equitably returned to all participants, rather than concentrated in the hands of a few whales and early investors.

This series of politically and economically left-leaning demands stands in stark and awkward contrast to the liberal and even anarcho-capitalist ideologies that permeate the crypto world.

II. The Opposition of Routes: The Inescapable "Original Sin" of the Industry and Mainstream Narrative

The reason the voices from Berlin seem "lonely" is that they challenge a certain "original sin" on which the industry relies for survival and development—speculation.

From the very beginning of Bitcoin's birth, its disruptive technological narrative has been closely linked to the speculative story of "getting rich overnight." Speculation brought the first batch of users, the first influx of funds, and media attention, leading to subsequent larger-scale adoption. To some extent, speculation is the fuel for the cold start of the blockchain industry and the most effective means of attracting public attention.

Meme coins, in particular, are the ultimate embodiment of this speculative culture. They strip away all complex technical concepts and grand application visions, simplifying them into the purest cultural symbols, community consensus, and wealth effects. For the mainstream world, understanding Ethereum's vision of a "world computer" is difficult, but grasping a "Pepe Frog" that has risen 100 times is much simpler.

This simplistic logic has brought tangible benefits to the industry:

User and Traffic Entry: The rise of public chains like Solana is largely due to their low transaction costs and efficient processing capabilities, making them a paradise for meme coin speculation, thus rapidly gaining a large user base and ecological activity.

Catalyst for Capital: The astonishing returns of meme coins have attracted a flood of hot money, which circulates within the ecosystem, with some spilling over into more "constructive" areas like DeFi and infrastructure.

Network Stress Testing: The traffic surges caused by meme coin trading serve as the most rigorous real-world test of public chain performance, exposing many technical bottlenecks and forcing protocols to optimize and iterate.

At the same time, the mainstream voices in the industry are at odds with Berlin's "public interest faction." Coinbase CEO Brian Armstrong, as one of the industry leaders, has publicly criticized socialist ideas as "harmful to those they claim to protect." Meanwhile, Bitcoin's anonymous creator Satoshi Nakamoto left behind writings filled with distrust of centralized financial institutions, with roots closer to the libertarian ideals of the Cypherpunk movement. Although Ethereum founder Vitalik Buterin has profound thoughts on "public goods" and "social cooperation," proposing important concepts like Quadratic Funding, his political spectrum is far from being simply categorized as "socialist."

In this broader context, the call to "serve the public good" sounds more like an unrealistic utopian fantasy. In a world where "Code is Law" and the pursuit of maximizing personal wealth is the core driving force, asking participants to abandon speculation is akin to asking gamblers in a casino to give up gambling.

III. Reconciliation or Division? Can the Speculative Engine Fuel Public Good Ideals?

So, are speculation and public good destined to be two parallel lines that never intersect? Is the outcome of this "route dispute" inevitably one side's victory and the other's demise?

Upon deeper reflection, the situation may be more complex. There may exist an uncomfortable relationship between speculation and public good that is both contradictory and symbiotic.

The value generated from speculative activities can passively fund public facilities. Take Ethereum as an example; whether through DeFi lending or meme coin trading, every on-chain activity requires the payment of gas fees. These fees constitute the income of validators, maintaining the network's security. A secure, decentralized network is fundamental for all applications (whether speculative or public-oriented) to operate. From this perspective, the frenzied trading of meme coins objectively "pays the bills" for the network security that supports Gitcoin (a well-known blockchain public fundraising platform).

Furthermore, the core issue may not be "speculation," but rather "fraud." The 98% fraud rate criticized by the Berlin "dissidents" at Pump.fun reveals the main contradiction in the current market: it is not that people should not participate in high-risk investments, but that the market lacks the most basic rules and protections, allowing wrongdoers to "hunt" at a very low cost.

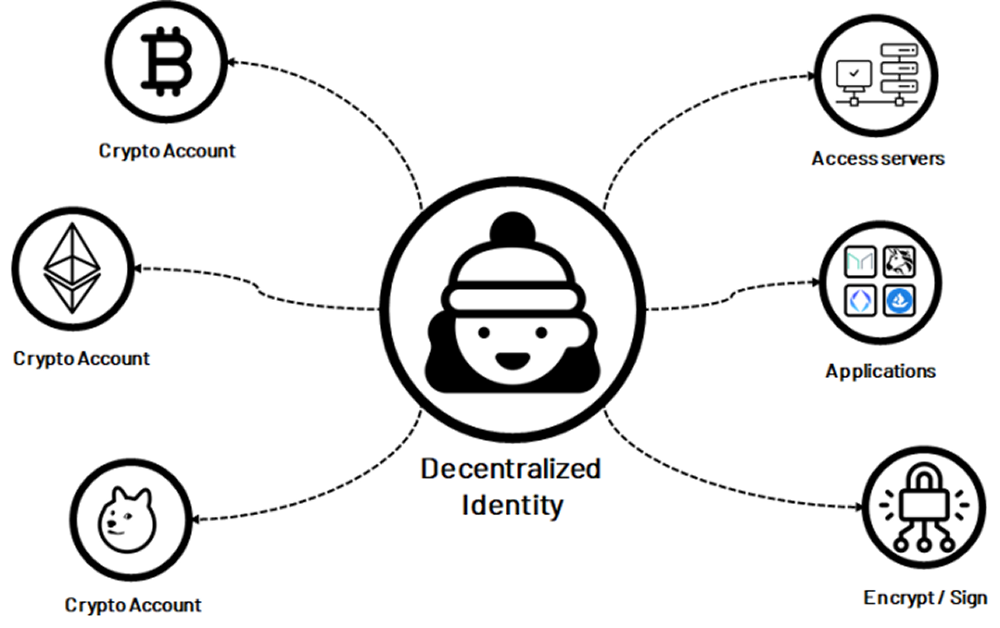

The focus of the struggle should perhaps shift from "anti-speculation" to "anti-fraud"—how to establish better reputation mechanisms, decentralized identity systems (DID), smart contract auditing tools, and community governance models to drive blatant scams out of the market.

Finally, some projects are attempting to combine the two. Some emerging meme coin projects have begun to introduce "charity wallet" mechanisms, automatically donating a portion of transaction taxes to specific organizations. Although this is largely still a marketing gimmick, it reflects the market's self-evolution, beginning to seek legitimacy beyond pure speculation.

A further exploration is whether it is possible to design a mechanism that systematically captures the externalities of speculative behavior and uses them to fund public goods, thus forming a virtuous cycle of "speculation → taxation → public good."

Conclusion: Soul-Searching at the Crossroads

The debate at Berlin Blockchain Week is not an isolated event. It marks a moment when, after experiencing multiple rounds of bull and bear markets and rampant growth, the blockchain industry is being forced into a stage of "self-examination."

Once the "possibilities" of technology have been fully explored, the question of "should" emerges. What kind of on-chain world should we build? What are the core values of this world?

The frenzy of meme coins and the ideals of "Funding the Commons" together form two distinctly different signposts at this crossroads. One leads to extreme capital efficiency, cultural revelry, and individualistic wealth adventures; the other points toward grand social cooperation, fair distribution, and collectivist utopian experiments.

This route dispute is unlikely to yield a clear winner in the short term. More likely, the industry will continue to move forward amid this sense of division. The casino will remain open, as human greed is hard to change; while idealistic builders will continue to push their boulders uphill like Sisyphus, striving to construct a fairer digital future in their minds.

Ultimately, the legacy of blockchain will be defined by which path it takes, depending not only on the technology itself but also on each of us within it, what we choose to believe in, and what we build for.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。