一、基本面三事件重塑市场格局

ETF 审批再遇延期:美 SEC 延长对 Bitwise 狗狗币 ETF、灰度 Hedera ETF 及 VanEck Avalanche ETF 的审查周期,市场对合规资金入场预期降温。历史数据显示,ETF 审批延期常引发对应币种 5%-8% 短期回调。

Coinbase 上币动态:Sonic (S) 纳入上币路线图,作为 Solana 生态 Layer1 公链,S 币或复制 ARB 上币初期 30% 涨幅行情,需关注上线前 72 小时的流动性炒作窗口。

监管政策重大转向:SEC 正式废除 Gensler 时代的《托管规则》提案,标志着监管从 “高压执法” 转向 “合规引导”。这一转变将降低机构入场门槛(如养老金配置加密资产),预计 Q3 将有 5-8 家传统金融机构公布加密货币托管方案。

二、技术面破位后的多空博弈

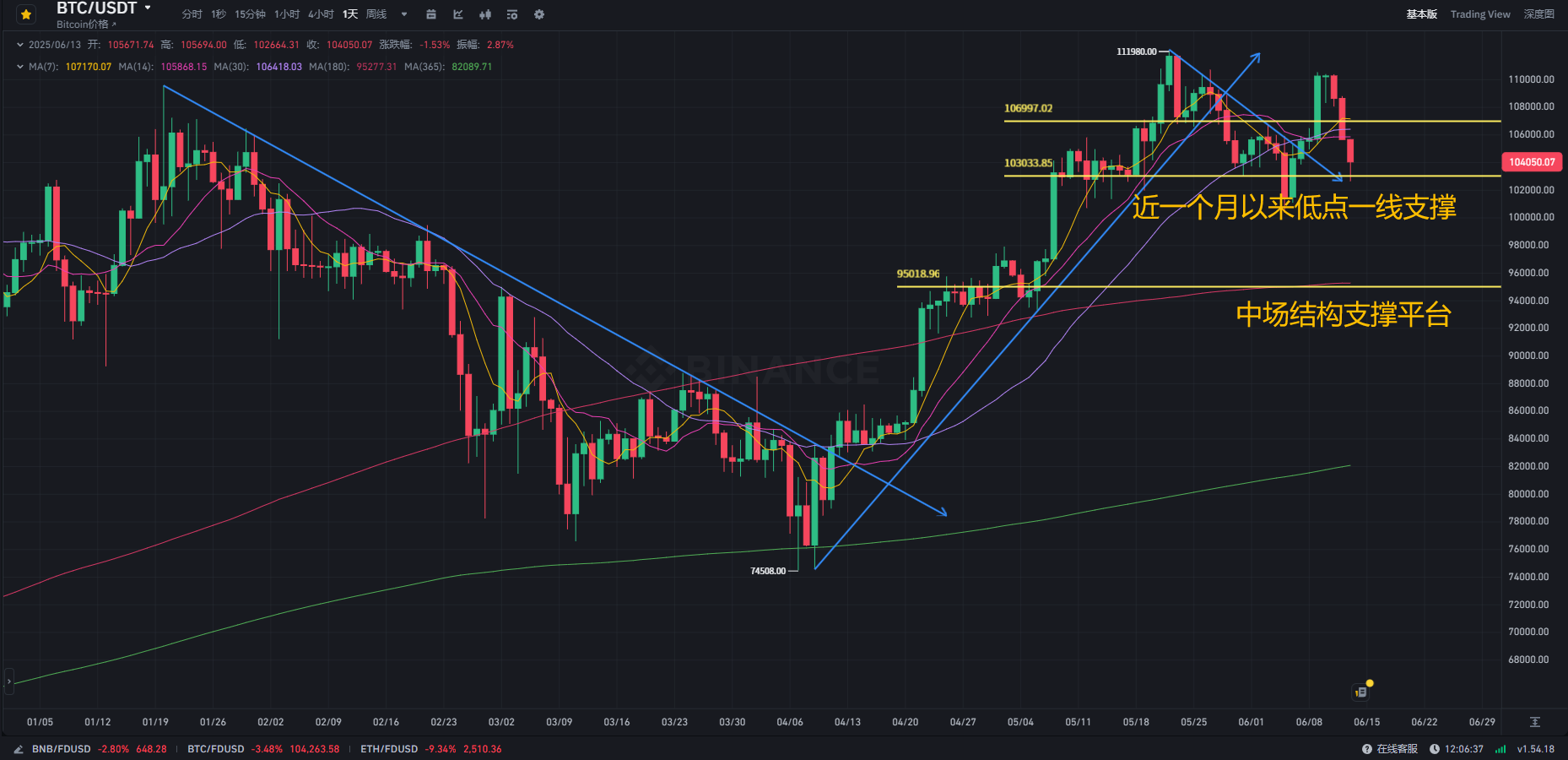

BTC:103000 支撑成牛熊分水岭

日线级别:放量击穿 105000 美元关键支撑,形成 “断头铡刀” 形态,5 日均线下穿 10 日均线死叉确立。近三日累计跌幅超 7%,主力资金净流出 12 亿美元,显示机构获利了结迹象。

短期关键位:

支撑位:102500 美元(200 小时均线)、95000 美元(2024 年 12 月起涨点)

压力位:105500 美元(前支撑反压)、108000 美元(斐波那契 38.2% 回撤位)

宏观传导逻辑:6 月议息会议维持利率不变,7 月降息预期推迟至 Q4,美元指数反弹至 103.5,加密货币作为 “高风险资产” 遭抛售。但需警惕油价突破 85 美元 / 桶时,比特币 “抗通胀属性” 可能重启。

ETH:2480 支撑位决定中期趋势

日线级别:冲高 2800 美元未果后回落,成交量放大 150%,显示多头止盈离场。当前价格测试 2480 美元箱体底部(近一个月震荡区间下轨),若失守将下探 2380 美元(50 周均线)。

周期推演:

短期(3 天):守住 2480 美元可轻仓试多,目标 2580 美元;

中期(2 周):站稳 2700 美元开启主升,配合 ETF 获批或冲击 3050 美元;

长期(Q3):突破 3050 美元进入牛市第二阶段,目标 3400-3500 美元。

三、山寨币策略:规避系统性风险,埋伏三大方向

风险预警:地缘冲突升级背景下,MEME 币(NEIRO、WIF)、AI 板块(WLD)、L2 扩容(ARB)出现 “断头铡刀” 形态,24 小时跌幅超 15%。历史数据显示,当比特币波动率指数(BVOL)突破 45 时,山寨币平均跌幅达主流币 1.8 倍。

布局窗口:

合规性蓝筹:COMP(DeFi 合规龙头)、MKR(MakerDAO 治理代币),监管松绑后机构持仓占比有望提升至 15%;

上币预期标的:跟踪 Coinbase 上币清单,S(Sonic)、JTO(质押协议)可能复制 UNI 上币行情;

抗跌性赛道:RWA(现实资产上链)板块,如 PENDLE(利率衍生品协议),与传统金融相关性低,波动率仅为 BTC 的 60%。

操作纪律:比特币跌破 103000 美元、ETH 跌破 2480 美元时,山寨币仓位需降至 10% 以下;等待美债 6 月下旬到期潮后,观察以太能否企稳 2700 美元再行布局。

和悦风控:已将山寨仓位减持至 5%,保留 BTC/ETH 对冲头寸,止损位分别设为 102000 美元、2450 美元。市场波动加剧,建议采用 “现金 + 主流币” 组合,等待宏观流动性拐点。

币市风云变幻,波动常在~以上分析仅为个人交易思路分享,不构成任何投资建议

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。