Original Author: Alex Liu, Foresight News

Casino rake — exchanges; banks that do not pay interest — stablecoins. The analogy may not be entirely appropriate, but it sufficiently reflects how lucrative the business models of the two hottest sectors in the crypto industry are. The competition in the exchange sector is fierce, and structural opportunities are hard to find, while a new round of speculation around stablecoins seems to have just begun.

Recently, USDC issuer Circle became the first stablecoin to go public, attracting capital attention, with its closing price on the first day reaching three times the IPO price, and a market capitalization exceeding $20 billion. Behind this, the stablecoin payment chain Plasma, shadowed by Tether, raised $500 million in minutes, and some were even willing to pay tens of thousands of dollars in ETH network fees to deposit over $10 million.

Circle Stock CRCL Price

Why is stablecoin considered a good business? Even so, can retail investors participate? This article aims to analyze the current mainstream stablecoin operating models and profit levels, pointing out the reality that "those making money do not want to go public, and those that go public may not share profits," as well as the dilemmas faced by retail investors in this sector, and explore potential solutions.

Is Stablecoin a Good Business?

To conclude, whether stablecoins are a good business depends on the different players involved. Currently, the most profitable player is Tether, the issuer of USDT.

Using "banks that do not pay interest" to compare all stablecoins is not entirely accurate; the industry has interest-bearing stablecoins like sUSDe, sUSDS, sfrxUSD, scrvUSD, etc., where the earnings go back to depositors. However, looking specifically at Tether, it is even more extreme than a "bank that does not pay interest" — not only does it not pay interest, but redeeming USDT for dollars (withdrawing money) incurs a 0.1% redemption fee, with a maximum redemption fee of $1,000.

Unlike banks, the sources of income for stablecoins are diverse. The main income for banks comes from lending money to borrowers, earning the interest spread between lending and paying deposit interest. If borrowers default, there may also be bad debt losses. Mainstream stablecoin issuers like Tether earn risk-free returns by purchasing U.S. Treasury bills (T-Bills) with fiat cash, eliminating bad debt risk, which is a superior profit model compared to a "bank that does not pay interest."

On the other hand, stablecoin protocols like Ethena resemble complex fund management platforms, primarily profiting from the funding rates obtained through crypto asset staking and perpetual contract hedging, which correspondingly increases risk. Stablecoins launched by protocols like Curve, Sky, and Aave mainly profit from lending interest, also carrying corresponding risks. While some or all interest returning to depositors is beneficial for users depositing funds, it reduces the profitability of the underlying business model.

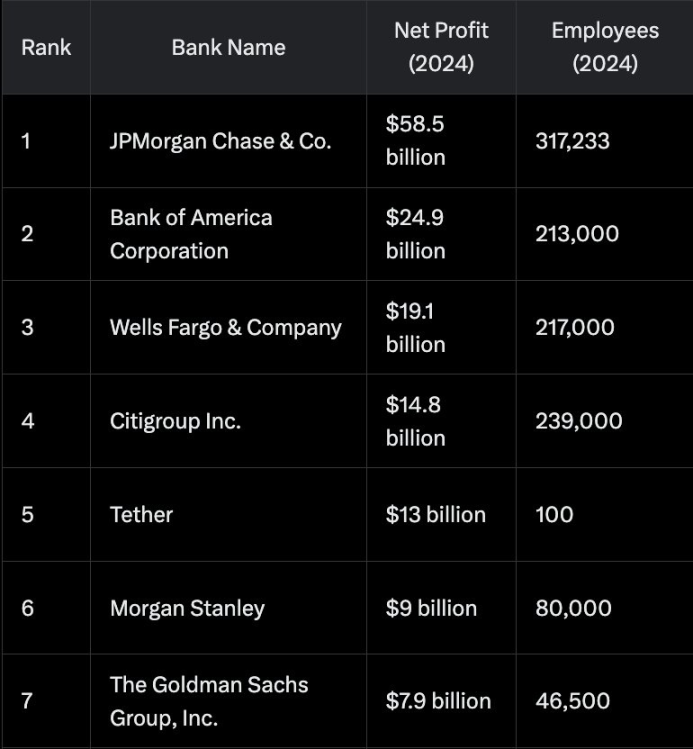

Net Profit and Employee Count of Some Companies

From this perspective, Tether, which has a low-risk, all-in income model, is indeed "making money while lying down." As shown in the chart, Tether's profit in 2024 was $13 billion, surpassing financial giants like Morgan Stanley and Goldman Sachs, while its employee count of 100 is only a fraction of the latter, reflecting an extremely high efficiency ratio. In contrast, Binance, a crypto exchange with a similar profit level, has over 5,000 employees globally, lagging in efficiency. Zhao Changpeng recently admitted on X that Binance is "far less efficient" compared to Tether. The reason is that Tether can focus solely on operating its core, most profitable USDT business, while USDT itself benefits from first-mover and network effects, with market demand continuously expanding, allowing for natural growth without much marketing effort. In contrast, crypto exchanges have complex and competitive operations, requiring new coin listings, customer maintenance, and marketing activities, consuming significant human and financial resources.

Tether's USDT is indeed a good business. Circle is the "number two player" in the stablecoin sector, with its USDC now valued at over $60 billion, nearly 40% of Tether's USDT, and should also be a "money printer," right?

The answer is no, at least not for now.

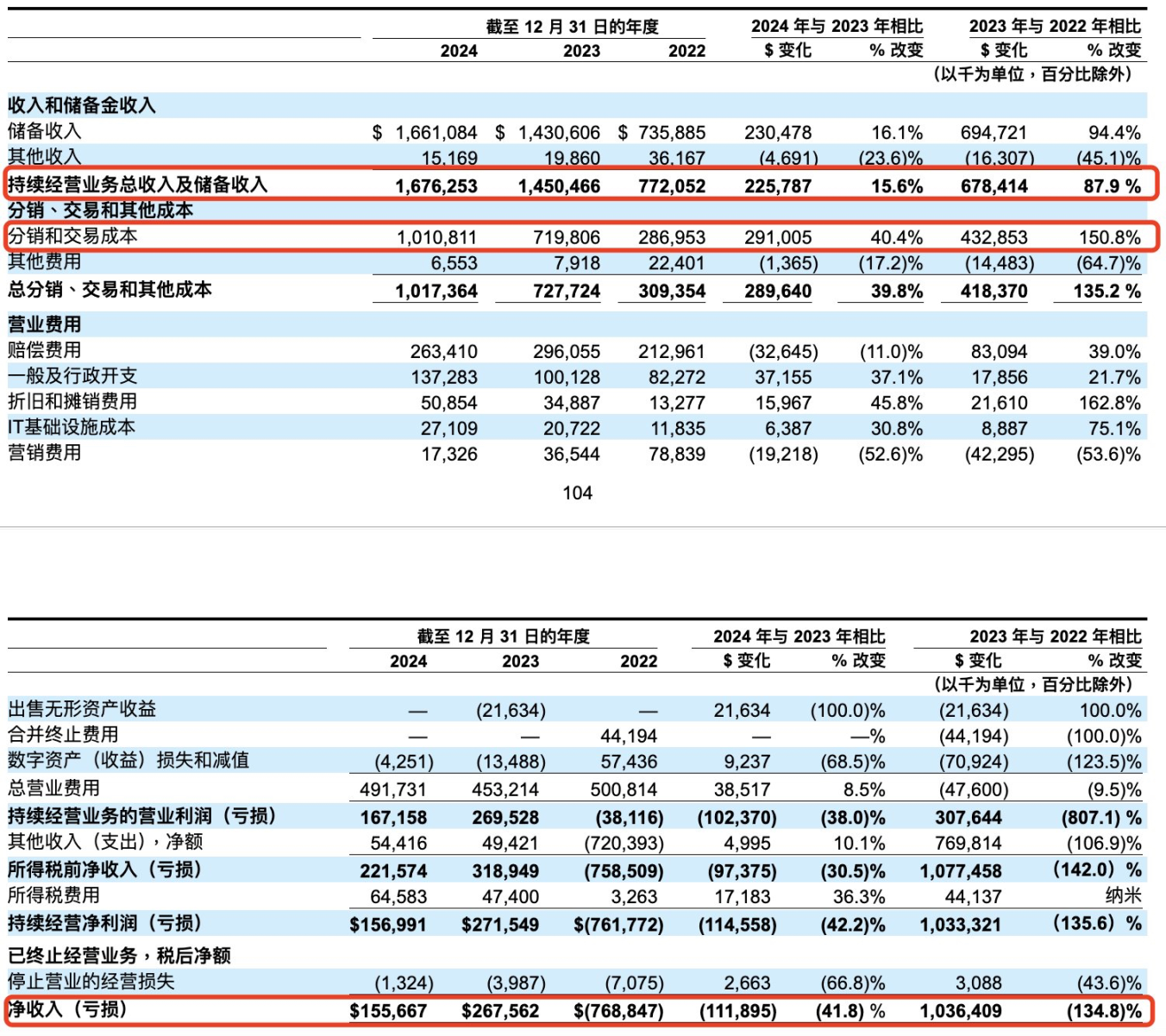

According to Circle's financial report, its net profit for 2024 is only $155 million (Tether's is in the tens of billions). This is because Circle has over $1 billion in distribution costs, with most of the gross profit shared with partners like Coinbase and Binance to promote USDC adoption. For example, the profits generated by USDC on Coinbase all belong to Coinbase (which distributes the earnings as interest to users), and Coinbase also receives half of the profits generated by USDC outside the exchange.

Circle Financial Report Table

Faced with competitors (whether USDT, which does not compete with USDC on compliance, or others like PYUSD, FDUSD, which also seek compliance), to maintain its adoption advantage, Circle's distribution costs are likely to remain high for the long term. In summary, Circle is a business full of potential but is currently struggling in a fiercely competitive environment and has not yet realized profitability.

The Dilemma of Retail Investors

From the above, it is clear that Tether, the "number one player" in the stablecoin sector, is undoubtedly a very worthwhile investment, but the reality is that retail investors cannot gain exposure at all.

Tether's CEO Paolo Ardoino tweeted on X, "If Tether goes public, the company's market value will reach $515 billion, surpassing Costco and Coca-Cola to become the 19th largest company in the world," and commented, "We currently have no IPO plans." With Tether's level of profitability, there is no need to bring in external capital. If you had exclusive operating rights to a casino in Macau, you would probably want to operate independently rather than bring in partners.

So, in the stablecoin sector, the most profitable players do not want to go public.

Should retail investors consider investing in the already listed "number two player" Circle? Very few investors can buy CRCL at the IPO price of about $30; what most retail investors face is a stock that surged to a market value of over $10 billion based on a net profit of $100 million at the opening, with a price-to-earnings ratio exceeding 100. Buying stocks with such a high price-to-earnings ratio is usually a "bet on the future," which carries considerable risk.

Moreover, as a high price-to-earnings ratio company in a rapid growth phase, long-term non-dividend distribution is the norm. Being a shareholder does not mean you can "make money while lying down."

Those making money do not want to go public, and those that go public may not share profits; "profits" are actually unrelated to retail investors. Faced with a lucrative sector but unable to gain exposure, this is the dilemma of retail investors.

Usual's Attempt

What retail investors may need is the Usual model.

Usual is a controversial stablecoin protocol that previously caused significant user losses due to USD0++ "de-pegging," severely damaging community trust in the project. However, the mechanism design of the Usual protocol itself has some highlights, making valuable attempts in distribution mechanisms and token economics.

The stablecoin issued by Usual is called USD0, with each USD0 backed by $1 worth of RWA (Real World Assets). The RWA here is actually interest-bearing stablecoins like USYC and M, which derive their earnings from U.S. Treasury bills (T-Bills) and are issued by licensed compliant RWA issuers like Hashnote.

Simply holding USD0 does not generate any interest; the underlying RWA asset's treasury yield is captured by the protocol. Similar to Tether, this is a good business.

However, Usual is not Tether. USDT has first-mover and network effects, forming real use cases that support demand — trading on exchanges, acting as a shadow dollar for payments in Southeast Asia, Africa, etc., leading people to voluntarily hold USDT. But why would anyone hold USD0, which does not pay interest?

Another role in the Usual ecosystem, USD0++, comes into play. The correct name for USD0++ is a liquidity-enhanced treasury bond, but its code includes USD, which can easily be misunderstood as a stablecoin. Users can stake USD0 to receive USD0++, with each USD0++ redeemable for 1 USD0 in four years (i.e., 2028). It is easy to understand that before the four-year maturity, the value of USD0++ should be less than 1 USD0 and gradually approach it over time.

This is the treasury bond model: I buy a 1-year treasury bond with a face value of 110 for 100, and upon maturity, I redeem the bond for 110, locking in a 10% annual yield at the time of purchase. Similarly, the bond approaches its face value as it nears its redemption date.

During the rapid development phase of the protocol, Usual exchanged USD0 and USD0++ at a 1:1 ratio, intentionally or unintentionally deepening the misunderstanding that USD0++ is a stablecoin, directly responsible for the subsequent damage caused by USD0++ "de-pegging." If it is not a stablecoin, it cannot be said to "de-peg," but holders did indeed incur losses.

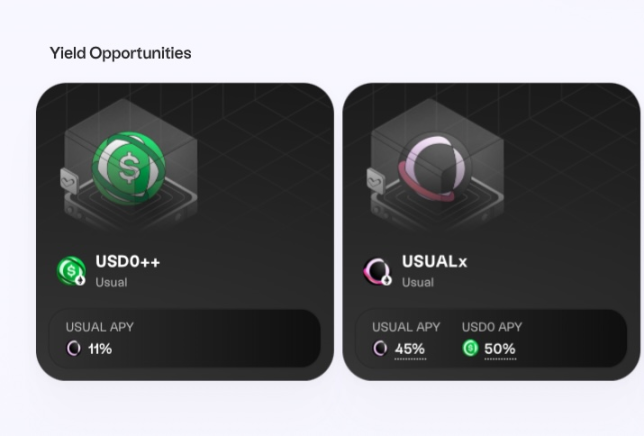

By staking USD0 to obtain USD0++, users are forfeiting the future four years of earnings on that capital. So why would users do this? Usual provides the USUAL token as "enhanced yield" for USD0++, which previously had annualized returns exceeding 100% when the token price was high, and is currently around 10%.

Usual Ecosystem Token Yields

This requires the USUAL token to have value, and what empowerment does the USUAL token provide? The underlying treasury bond yields captured by the protocol from USD0 will be distributed proportionally to USUAL stakers (holders of USUALx) every week, and USUAL stakers can also receive USUAL token emissions. Currently, Usual's TVL (Total Value Locked) is approximately $630 million, with about 520,000 USD0 allocated weekly to USUAL stakers (approximately 50% APY).

In short, without the Usual protocol, if I hold dollars to purchase treasury bonds, I receive the bond yields; with the Usual protocol, I hold USD0, and the underlying dollars are used to buy treasury bonds, but there is no interest. By staking USD0 for USD0++, I can obtain USUAL tokens, and by staking USUAL, I receive the underlying treasury bond interest.

The value of the USUAL token comes from the rights to the earnings of depositors' funds, creating a "self-mining" flywheel game that operates entirely around TVL. Theoretically, if TVL increases, the weekly profit distribution grows, driving up the price of USUAL, which brings higher USD0++ yields to attract more TVL. However, the flywheel can also work in reverse — a drop in token price leads to a decrease in USD0++ yields, and a reduction in TVL results in lower USUAL token distributions, causing further declines in token price.

This model heavily relies on token emissions to sustain itself. 90% of USUAL tokens will be released over four years through airdrops and as rewards for USD0++ tokens. The remaining 10% of the total token supply is held by the team and investors. So what happens when the tokens are fully released? After four years, when all USD0++ tokens mature, there will be no need for continued emissions of USUAL tokens.

What the Usual team needs to do is establish real use cases for USD0 during this four-year window of favorable regulatory conditions and before competitors fully enter the market, and use token incentives to turn the flywheel, accumulating a significant TVL advantage and network effects. After four years, Usual will revert to Tether's model, with the difference being that its profits will be distributed to USUAL token stakers.

This is essentially a four-year chip distribution period.

What advantages does this exploration have? Why is it said that retail investors may need the Usual model?

Usual provides retail investors with the possibility of gaining exposure to Tether-like profits through the USUAL token. The USUAL token, which can be obtained through saving, staking, and trading, lowers the investment threshold for the rights to the earnings behind Tether-like stablecoins. The token flywheel mechanism gives retail investors the opportunity to acquire chips at a low cost — USUAL tokens obtained at a lower TVL may significantly appreciate as the protocol grows. If one chooses to "self-mine" by only depositing funds without purchasing USUAL tokens, the worst outcome would simply be the loss of interest.

The stablecoin sector is clearly on the rise, and the failure of Luna is still fresh in memory. Can retail investors get a piece of the pie in this sector? Or will this lucrative opportunity ultimately fall into the hands of giants like Wall Street? We will have the privilege of witnessing this together in the coming years.

Related Disclosure: The author of this article is involved in the USUAL ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。