Original Title: Plasma: The Stablecoin Singularity

Original Author: Kairos Research

Original Translation: BUBBLE, BlockBeats

Plasma is a blockchain that exclusively supports stablecoins, redefining payment infrastructure with zero fees, Bitcoin-level security, and a vision aimed at mainstream finance. Kairos Research is an investor in Plasma. The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is for reference only and does not constitute investment advice, financial advice, trading advice, or any other form of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment assets.

The Rise of Stablecoins and the Necessity for Dedicated Infrastructure

Stablecoins have rapidly evolved from a niche application to one of the most significant innovations in the crypto market, becoming an emerging medium for global payments. In 2024 alone, dollar-pegged stablecoins represented by Tether's USD₮ processed transactions totaling up to $15.6 trillion, equivalent to 119% of Visa's payment volume during the same period. Additionally, recent data shows that USD₮ has approximately 400 million users in emerging markets. This surge heralds the arrival of the "stablecoin singularity": digital dollars flowing as freely as information, reshaping the way money moves.

We believe that fully integrating stablecoins into all aspects of the global payment system (including P2P, B2B, and P2B) has the potential to greatly improve people's daily lives. Ideally, blockchain can significantly shorten payment settlement times, bypassing intermediaries that charge high fees and can freeze funds at any time. However, current mainstream blockchains are not optimized for stablecoins, leading to high transaction fees on networks like Ethereum, forcing users to turn to more centralized alternatives like Tron with slightly lower fees.

This is where Plasma comes in—a blockchain tailored for stablecoins. Plasma focuses on one thing: making transfers of stablecoins (like USD₮) fast and free. Unlike general-purpose L1 chains that attempt to support various applications, Plasma concentrates on stablecoin payments, unlocking advantages on both technical and economic levels, and is poised to become the standard payment layer for global digital dollars. Because its functionality is limited to stablecoin payments, Plasma can maximize throughput, minimize latency, and completely waive transaction fees for USD₮ users. The ultimate goal is to achieve a transfer experience as simple and smooth as sending a text message, which may also have profound secondary and tertiary effects.

Zero-Fee USD₮ Transfers: A Powerful Magnet for Liquidity

Although Ethereum is currently the largest blockchain by stablecoin issuance, its architecture results in high transaction fees for stablecoin transfers, often requiring several dollars per transfer, pushing many users to the lower-fee Tron network. Tron has capitalized on this demand, promoting its low-cost transaction model in emerging markets. According to Artemis data, Tron processed approximately $5.46 trillion in USD₮ transfers through 750 million transactions in 2024. If Tron’s rise relies on its low-fee advantage, then Plasma’s "zero-fee" model takes it a step further, allowing applications to bypass the hassle of paying Gas fees, potentially triggering a wave of larger-scale adoption.

For users, "zero fees" is not just about saving money; it can also inspire new use cases: when sending $5 no longer incurs a $1 fee, micropayments become feasible. Cross-border remittances can also be free from high intermediary fees, arriving in full. Merchants can accept stablecoin payments without giving up 2-3% of the transaction amount to invoicing and credit card networks. In short, Plasma's free transfers break down the barriers that previously limited stablecoins to trading scenarios, opening pathways for everyday consumption. Thanks to the support of the Tether ecosystem, Plasma's incentive mechanism aligns perfectly with the promotion of USD₮. Liquidity attracts more liquidity; once users realize they can freely transfer value on Plasma, it may attract stablecoin flows from the entire crypto market, further solidifying its position as the preferred channel for digital dollars.

Moreover, the growing USD₮ deposits and native issuance capabilities on Plasma make it an ideal expansion ecosystem for existing DeFi protocols. Protocols focused on stablecoins, such as Curve and Ethena, have already announced plans to deploy on the EVM-compatible Plasma network. At the same time, USD₮, as a mainstream stablecoin, benefits from network effects, making it the default pricing unit for Bitcoin spot pairs on major exchanges. For example, since August 2017, the BTC/USD₮ trading pair on Binance has accumulated a total trading volume of $4.9 trillion. As cross-chain bridge technology for BTC matures and trust assumptions decrease, we believe that more liquid Bitcoin will enter the Plasma network, forming synergistic effects with the familiar pairing of USD₮, likely stimulating more trading activity, especially as users align centralized exchange and on-chain BTC prices through arbitrage.

Comprehensively Surpassing Ethereum, Tron, and Traditional Payment Tracks

So, how does Plasma perform compared to existing crypto networks and traditional fintech infrastructure? It can be said that Plasma aims to surpass both on multiple dimensions.

Ethereum: Ethereum has a diverse DeFi ecosystem, but at the cost of tight block space and high Gas fees, with even simple USD₮/USDC transfers costing several dollars. While stablecoins started on Ethereum and account for a significant amount of on-chain usage (about 35-50%), they mainly involve large transactions, often excluding small users. Although Layer-2 Rollups help reduce fees, Plasma's approach is more radical—creating a chain specifically for stablecoins, optimizing for speed and cost from the ground up. By not needing to "support everything," Plasma can dedicate all resources to processing stablecoin transfers, thus avoiding congestion issues on general-purpose chains.

Tron: Tron has become the main network for stablecoins, capturing a significant volume of Tether transactions, thanks to its low fees and faster confirmation speeds. Tron’s TRC-20 USD₮ has accumulated a transfer volume of 22 billion times, far exceeding Ethereum's ERC-20 at 2.6 billion times, indicating that a quality user experience (especially low cost and fast transfers) can significantly enhance market share. Plasma takes user experience to new heights: while Tron still requires $2-3 in fees or staking TRX for free or discounted transactions, Plasma completely waives fees for USD₮ transfers.

Additionally, Tron’s DPoS architecture has long been criticized for being overly centralized, with only 27 "semi-permissioned" validation nodes, and its network relies on native tokens for fee payments and governance. In contrast, Plasma employs Bitcoin-level security mechanisms, allowing fees to be paid in stablecoins themselves (if needed), which is undoubtedly a more user-friendly design. If Tron is the current "stablecoin chain," then Plasma is preparing to surpass it with a better user experience and economic model.

https://gasfeesnow.com/

PayPal and Traditional Financial Payment Channels: Traditional payment processors and fintech platforms are also actively paying attention to the development of stablecoins. PayPal launched its own dollar stablecoin PYUSD in 2024 and plans to integrate it into over 20 million merchants by 2025, demonstrating a strong market demand for better digital dollar payment channels. However, PayPal's network, along with similar systems like Visa and ACH, still faces issues such as fees, transfer limits, processing delays, and geographic restrictions. Under the current system, PayPal merchants can face transaction fees of up to 5.4% + $0.30 per transaction, and cross-border payments must contend with exchange rate differences and waiting times. While PayPal's stablecoin will reduce friction costs associated with currency exchange, whether it will significantly lower merchant fees remains to be seen.

In contrast, Plasma addresses this issue from a crypto-native perspective: it employs an open infrastructure with no intermediaries and no "toll" on fund transfers. Anyone with a crypto wallet can easily use Plasma for stablecoin payments, just like using email, without needing a bank account or payment app as an intermediary. This openness and neutrality may attract fintech platforms and even traditional financial institutions to build clearing systems on Plasma, just as the TCP/IP protocol of the internet ultimately became the standard for data transmission.

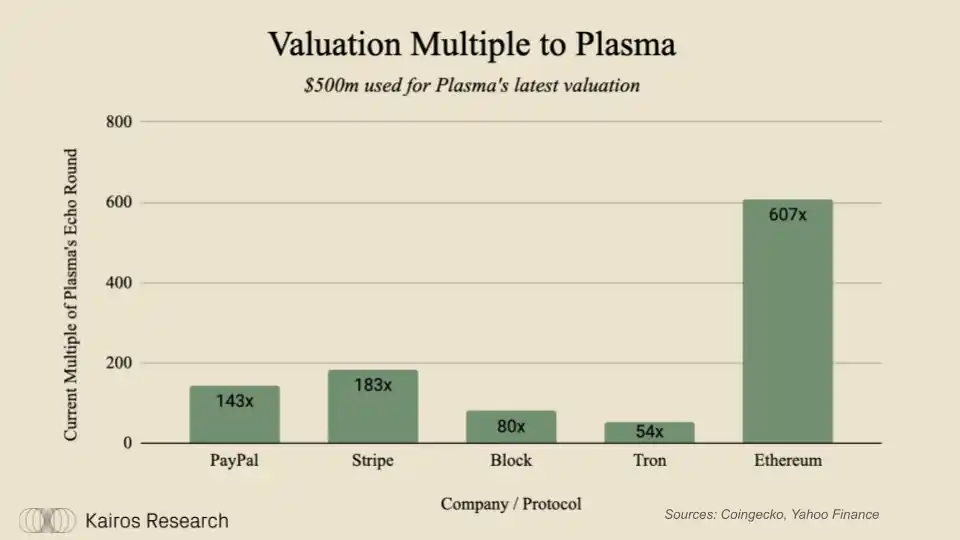

Plasma's fully diluted valuation (FDV) corresponding to valuation multiples

The Huge Market Opportunity for Stablecoin Payments

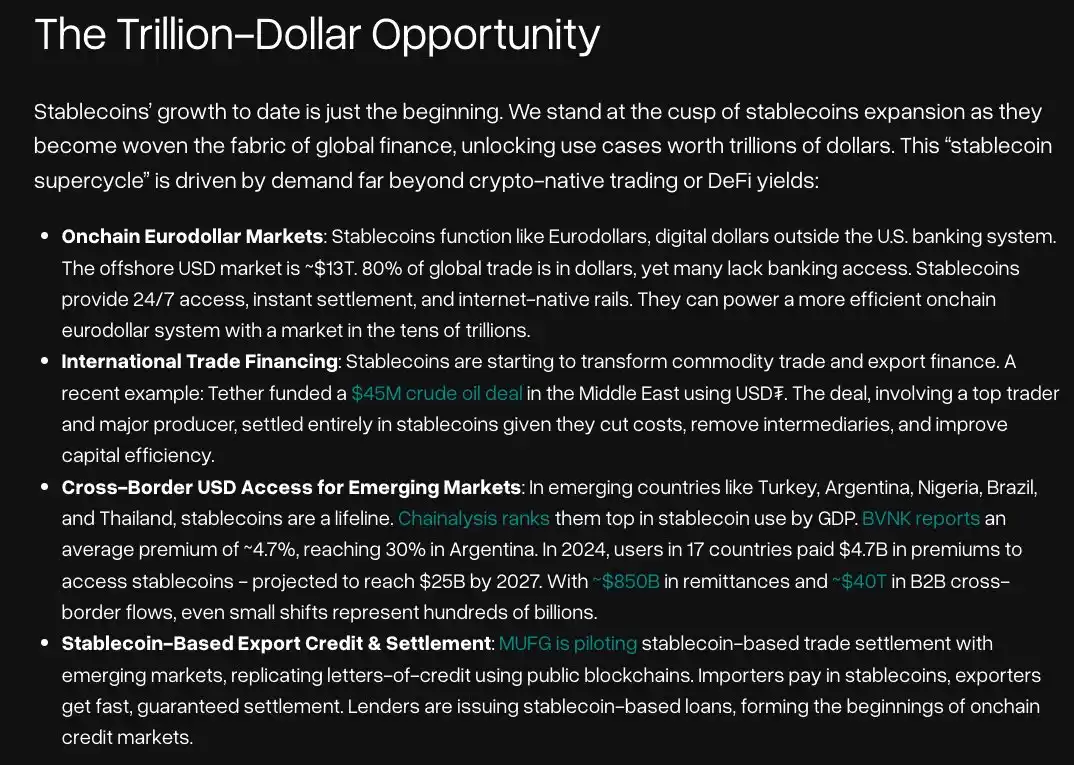

The timing of Plasma's launch is impeccable, as the payment market based on stablecoins is not only vast but also rapidly expanding. Currently, the total supply of stablecoins has exceeded $230 billion, accounting for about 1.27% of the U.S. M1 money supply and approximately 1.08% of M2. This may not seem large, but just this January, the supply of stablecoins grew by 14%, maintaining a compound annual growth rate of 38% since 2018. If this trend continues, the volume of stablecoins could approach the total currency amounts of some G20 countries within a few years.

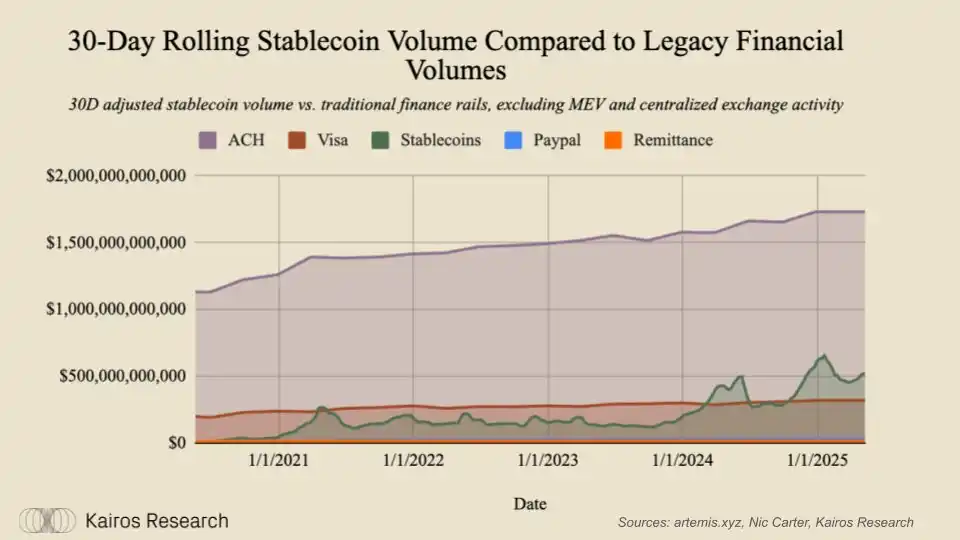

More tellingly, in 2024, the total transaction volume of stablecoin transfers has already surpassed several major card networks, second only to the Federal Reserve's ACH transfer system. This indicates that we are rapidly moving toward a reality where large-scale capital flows globally rely heavily on crypto infrastructure rather than traditional payment channels (despite still having high speculative elements).

30-day rolling stablecoin transaction volume compared to traditional financial solutions

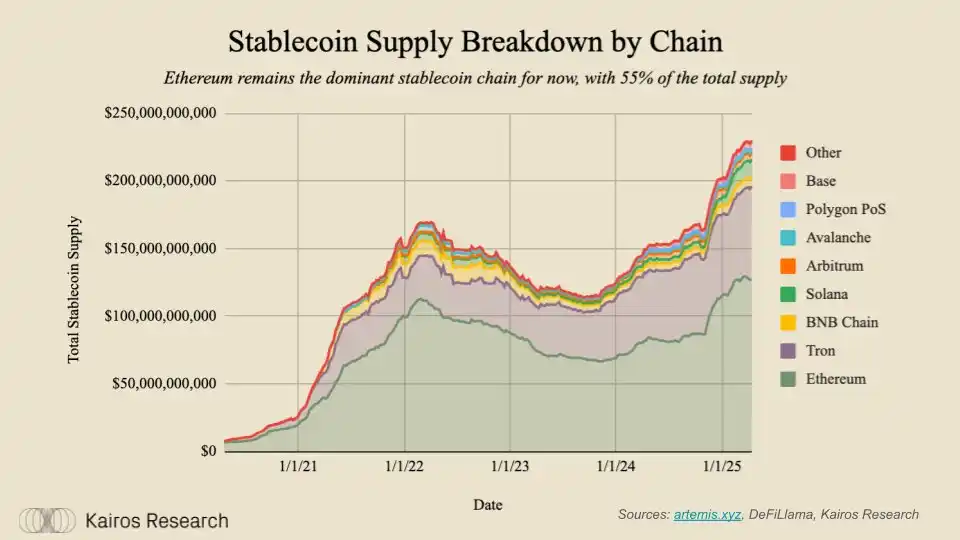

Composition of total stablecoin supply by chain

Although the dominant use of stablecoins is currently concentrated in trading and DeFi, the next significant growth area is traditional commerce and general payments. This sector encompasses various segments, from remittances (with a market size of approximately $700 billion annually) to e-commerce payments (tens of trillions of dollars globally each year) and B2B cross-border trade (exceeding $30 trillion). We have already seen stablecoins gradually entering retail and commercial payment scenarios. For example, PayPal emphasized the practical application value of stablecoins during its 2025 Investor Day. The company is working to encourage businesses to pay overseas suppliers using PYUSD, thereby avoiding actual fund transfers and completing settlements solely through updates between ledgers. This not only saves merchants processing time and costs but also keeps them within PayPal's ecosystem—this is crucial, as currently, up to 80% of merchant payments immediately flow out of the PayPal network into bank accounts after being received.

Considering Merchant Payment Scenarios

As mentioned earlier, merchants typically lose 2-3% in fees on each transaction. If stablecoins are used on a zero-fee network, this cost can be nearly eliminated. Assuming a merchant is willing to accept dollars or can exchange them for local currency through a crypto exchange, a merchant in Nigeria, for example, can directly settle in real-time with a German customer using dollar-pegged stablecoins via the Plasma network, without dealing with credit card fees or waiting for international wire transfers to arrive. In fact, Tether recently facilitated a $45 million oil transaction in the Middle East, demonstrating the efficiency of stablecoin settlements to both parties involved.

The global trade market exceeds $30 trillion, with the dollar deeply integrated as the global settlement currency, accounting for 80%-90% of global transactions. This is a massive pie; even if Plasma captures only a small portion of it, it could facilitate the transfer of billions of dollars in value daily, creating powerful network effects and gradually becoming irreplaceable.

Value Capture in Zero Fees: Rethinking Crypto Economic Models

Given that Plasma's core functionality is zero-fee USD₮ transfers, an obvious question arises: how does the network capture value? This involves a completely new economic model that prioritizes growth and utility, deferring monetization to indirect channels—similar to how Robinhood rapidly attracted a large user base and trading activity through "zero-commission trading."

In traditional smart contract chains, value accumulates through Gas fees (for example, Ethereum generates billions of dollars in fees annually, driving ETH burn and staking rewards; Tron accumulated $1.36 billion in fees within six months). Plasma disrupts this model by foregoing fees on USD₮ transfers to drive early growth. Its assumption is that a network carrying a large volume of dollar-denominated economic activity will achieve value capture through secondary and tertiary means, rather than charging users for each transaction.

This is also akin to the free platform expansion path of Web2—first providing free services to gain billions of users, then monetizing through peripheral means. For instance, Venmo does not charge for transfers but generates revenue through credit card payments, instant withdrawals, and cryptocurrency purchases. It is worth noting that even the most mainstream Web2 tools often have zero marginal usage costs.

For Plasma, we believe there are primarily two core value capture mechanisms

Issuance and Issuer Incentives

Stablecoin issuers have the motivation to mint and redeem on the most active chains, which is a significant advantage for Plasma. The deeper stablecoins are integrated into commercial and trade activities, the more frequent the minting and redemption will be. Millions of transactions daily, even if each incurs only a 1-cent on-chain fee, will quickly accumulate, forming sustainable network revenue. Additionally, with the launch of USD₮0 (achieving unified liquidity for USD₮ across multiple chains through LayerZero), Plasma is expected to become the primary issuance layer for USD₮.

DeFi + MEV (Maximal Extractable Value)

If the influx of BTC and stablecoins attracts DeFi applications, the entire Plasma ecosystem will thrive. Standard DEXs, lending platforms, and futures markets all require high-quality assets and collateral. Just as Solana has performed in terms of Real Economic Value (REV) in recent months, activities such as token minting, trading, arbitrage, and liquidation can generate sufficient on-chain activity to support a free transfer model.

Plasma's user base is also more "real-world utility," and they may be more willing to use various fiat-pegged stablecoins. We expect more assets (such as commodities and securities, including public and private markets) to be tokenized within the next year, making Plasma more attractive to institutional users.

Furthermore, many investors believe that MEV will become a primary value driver for the network in the long term, as it is a core component of permissionless finance. Simply put, MEV can be understood as the premium people are willing to pay for priority execution of state changes.

The top five non-stablecoin crypto assets (BTC, ETH, SOL, XRP, BNB) have their main trading pairs denominated in USD₮, so it can be inferred that the chain that can gather the most USD₮ activity will also attract more non-native assets to trade on that chain. Although this trend has not fully materialized, considering the currency network effects (especially USD₮), this vision is not far-fetched, particularly for BTC.

Returning to the example of BTC, if more BTC activity occurs on Plasma, it will lead to more sustained network usage, allowing validators and stakers to earn more rewards, rather than relying on periodic meme coin trading. For instance, in the month with the highest trading volume on Solana (January 2025), the total DEX trading volume reached $379 billion; during the same period, the BTC/USD₮ spot trading pair on Binance had a trading volume of $144 billion. Since DEX fees depend on network congestion and pool settings, the barriers to entry are lower, and fees are often lower than centralized exchanges (which have an average fee of about 0.1%). Despite the different mechanisms, the trend of decentralized trading consuming centralized trading shares is irreversible, and ultimately, most trading will occur in permissionless venues, where MEV will play a key role.

Most importantly, Plasma amplifies network effects through zero fees.

The history of successful networks tells us that user adoption is a prerequisite for monetization. In the crypto world, the value of a blockchain's native asset is often a proxy indicator of its community size and activity. If Plasma becomes the center for stablecoin trading, even if USD₮ transfers remain free, the value within its ecosystem will still manifest. This model is a long-term strategy: first capturing the market, then exploring profitability. Moreover, Plasma effectively enhances the utility of the "digital dollar," naturally aligning with the interests of large capital institutions that aim to promote the globalization of the dollar.

Alignment with U.S. Policy: The Potential of the GENIUS Act

As the adoption of crypto in the U.S. matures, compliance is becoming increasingly critical, making it an opportune time to align with policy windows and embrace regulatory benefits. Notably, the emergence of Plasma coincides with U.S. lawmakers' efforts to bring stablecoins under a federal regulatory framework.

This week, the U.S. Senate advanced the "U.S. Stablecoin National Innovation Act" (GENIUS Act), a bipartisan bill aimed at establishing a comprehensive federal regulatory system for stablecoins. If the legislation is successful, it will clearly define how to issue and manage dollar-pegged stablecoins under U.S. law, integrating them into the mainstream financial system rather than allowing them to remain in a regulatory gray area.

While the friendly attitude of regulatory agencies under the Trump administration has already positively impacted the industry, clear crypto legislation will provide innovators with a long-term predictable policy environment. This is a turning point that financial institutions have long awaited, potentially clearing obstacles for them to fully embrace stablecoins.

Plasma is naturally aligned with this regulatory trend. It focuses on fiat-backed stablecoins rather than more controversial and complex algorithmic stablecoins, so once the GENIUS Act or parallel bills like the STABLE Act in the House pass, Plasma is likely to be one of the first networks to benefit.

It is worth mentioning that U.S. policymakers, who are concerned about the dollar's global dominance, may view networks like Plasma as positive assets. By making dollar stablecoins more useful and accessible, Plasma effectively expands the global influence of the dollar in a transparent manner. Compared to domestic and foreign central bank digital currencies (CBDCs), the path taken by Plasma, combining USD₮ liquidity with BTC security, is more likely to be seen as enhancing the power of the "digital dollar."

Currently, over 98% of the market value of stablecoins is dollar-backed, and this trend is likely to continue. The GENIUS Act is expected to require stablecoin issuers to fulfill strict measures such as reserve requirements, auditing obligations, and redemption policies to protect consumer interests.

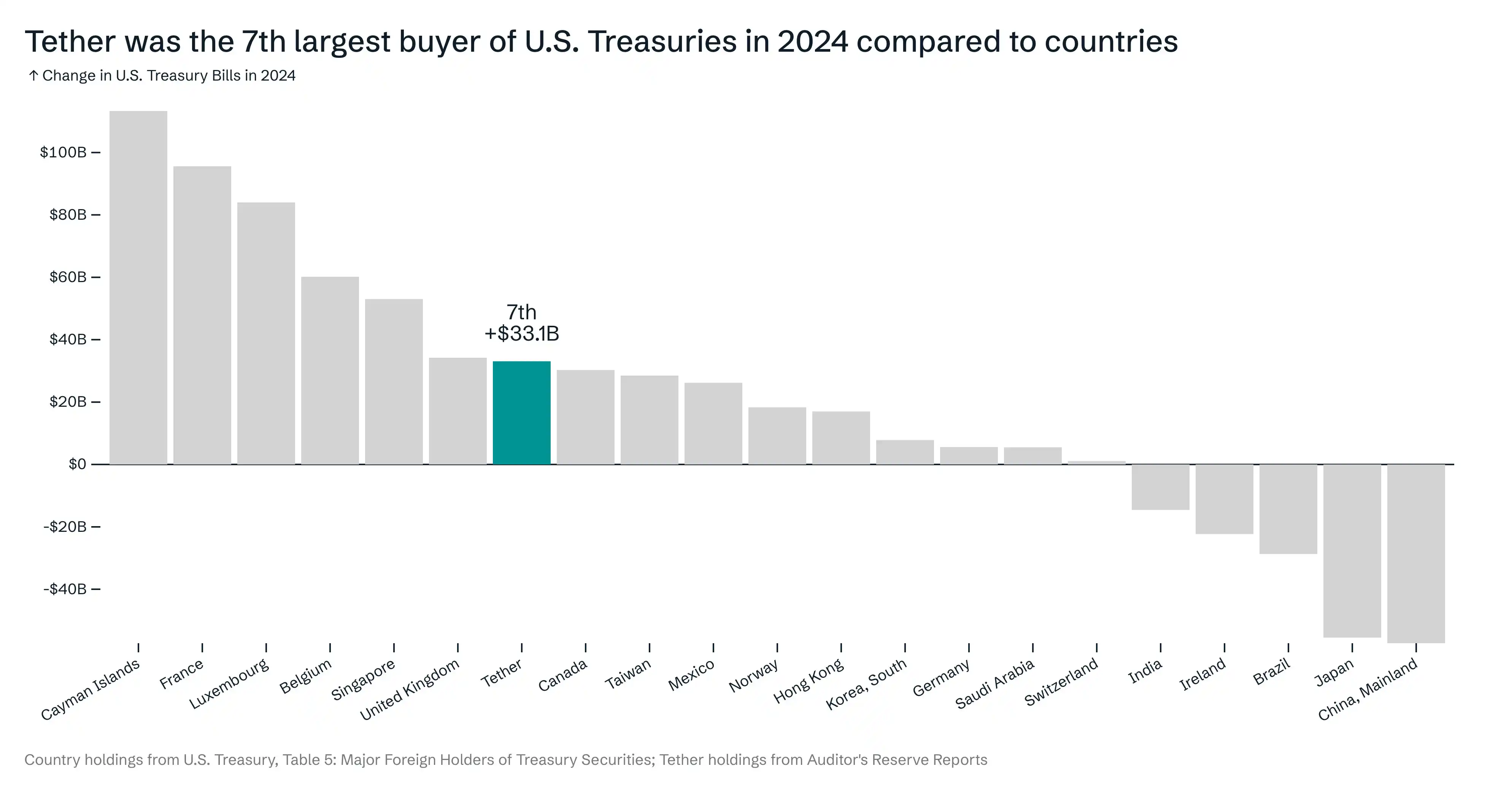

Furthermore, the continued growth of stablecoins, in the context of countries like China potentially using U.S. Treasuries as a geopolitical tool, may become an important source of short-term demand for U.S. Treasuries. Although it is currently difficult to quantify the direct impact of stablecoins on the yield curve, Tether and Circle have already held over $120 billion in short-term U.S. Treasuries (approximately 3-month maturity), demonstrating their stable and sustainable purchasing power on the short end of the yield curve.

https://x.com/paoloardoino/status/1902689997766922318/photo/1

Total Supply of USDT

Future Outlook: Plasma's Role in Core Financial Infrastructure

Plasma's vision is to become the core financial infrastructure of the digital age, just as TCP/IP became the core infrastructure of the information age. This vision, while ambitious, is also reasonable. Its goal is not to create a new currency but to upgrade the circulation of USD₮—the currently dominant digital dollar—globally, further solidifying the dollar's hegemonic position.

However, this journey has just begun. Plasma needs to prove its security and reliability in large-scale use cases, attracting a wide range of validators to participate, not only current crypto users but also new user groups—whether they are individual users, fintech companies, or large institutions. At the same time, Plasma will face competition from existing mainstream platforms such as Tron, Solana, and various Ethereum Layer 2 networks, as well as new chains specifically designed for payment scenarios. However, given the global scale of the payment market, this field is vast enough to accommodate multiple winners. In an industry where everyone is always chasing the next universal L1 or the next wave of memecoin hype, Plasma's focus on stablecoins appears pragmatic and clear.

In summary, Plasma is not trying to "reinvent the wheel." What it does is leverage USD₮—the largest and most liquid dollar-pegged stablecoin in the world—and promote its global dissemination and adoption through a zero-fee transfer mechanism. Stablecoins have proven to be one of the core killer applications in the crypto industry, and this view is not controversial. We believe that the aggregation and dissemination of USD₮ on Plasma will not only enhance the distribution efficiency of USD₮ but also bring significant secondary and tertiary effects, thereby injecting vitality into further on-chain innovation and economic activity. For these reasons, we believe Plasma is poised to occupy an important position in this multi-trillion-dollar opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。