Global stock funds saw a net outflow of $6 billion in May, while gold funds experienced their first net outflow in 15 months. However, crypto funds recorded a record net inflow, with BTC reaching new highs on the horizon.

Macroeconomic Interpretation: Currently, market expectations for a Federal Reserve interest rate cut have been reduced to just once this year, but the upcoming May CPI data may serve as a catalyst for a shift. If the data is weaker than expected, it could reignite bets on a September rate cut, providing fuel for risk assets. If the European Central Bank's policy meeting releases dovish signals, it will further alleviate global liquidity pressures. However, the Federal Reserve's silence poses a potential threat—amid the backdrop of tariffs potentially driving up inflation, the rate cut tool is firmly locked in the toolbox, and the absence of "Fed put options" makes the market more susceptible to black swan events.

The China-U.S. trade negotiations made positive progress in London, with Commerce Secretary Howard Lutnick stating that "negotiations are progressing smoothly." The preliminary agreement on rare earth exports reached in Geneva has alleviated the risks of a full-blown trade war. Interestingly, the Moscow Exchange simultaneously announced the launch of a Bitcoin index, with data sources covering major platforms like Binance and Bybit. This move echoes the increasing reliance of Russian enterprises on cryptocurrencies for cross-border payments under Western sanctions, suggesting that cryptocurrencies are accelerating their integration into the new landscape of global trade.

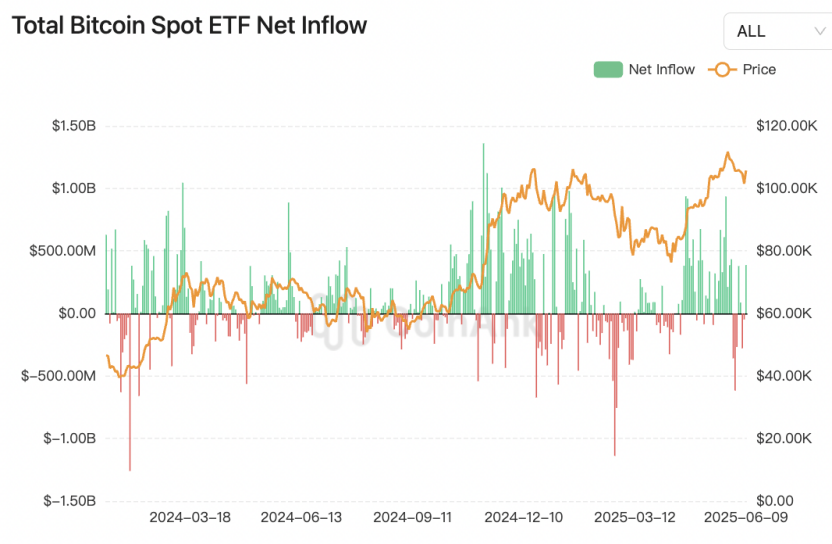

Recent data shows that 294 global crypto funds had a net inflow of $7.05 billion in May, pushing total assets under management to a record $167 billion. Behind these numbers lies a thought-provoking contrast: during the same period, global stock funds saw a net outflow of $5.9 billion, and gold funds experienced their first net outflow in 15 months. The reversal in capital flows reveals a deeper logic: investors are no longer simply categorizing cryptocurrencies as high-risk speculative assets but are viewing them as a strategic allocation to combat dollar weakness and economic uncertainty.

Market analysts have observed that Bitcoin has strongly broken through the short-term downtrend line, forming a typical bullish consolidation triangle. Although the market had expected a lackluster summer, the strength of the breakout suggests that new capital is continuously flowing in. The technical and capital aspects provide dual support. Bitcoin's intraday high has risen above $110,000, just a step away from this year's peak. The key support level of $105,000 has become a dividing line for bulls and bears; as long as it stabilizes above this level, the upward trend remains intact.

Institutional holdings also reflect confidence, with Strategy's Bitcoin holdings surpassing $64 billion, yielding a floating profit of $23.19 billion. Paradoxically, traditional financial giant Charles Schwab pointed out that the Federal Reserve is unlikely to initiate rate cuts easily in the short term. Amid the uncertainty of tariffs and a resilient labor market, decision-makers are more inclined to "stay put," which in turn accelerates the inflow of funds seeking alternative assets into the crypto space.

Regulatory dynamics are reshaping the competitive landscape. The U.S. "GENIUS Act" has made progress in the Senate, combined with Circle restarting IPO discussions and expectations for stablecoin legislation, injecting a strong boost into the Ethereum ecosystem. Ethereum's implied volatility has significantly increased, with options skew shifting towards bullish, and ETF inflows reaching $281 million in the past week. Meanwhile, Ethereum's staking volume has reached a historical high of 34.65 million coins, accounting for nearly 30% of the total circulating supply, validating its value capture ability as a settlement layer infrastructure. On-chain data clearly shows that institutional interest is shifting from a Bitcoin-dominated model to a "dual-engine driven" model.

Regarding market impact projections, BTC's "siphoning effect" is strengthening, with the wealth effect generated by institutional holdings like MicroStrategy continuing to attract traditional capital. However, the technical aspect must be cautious of the selling pressure in the historical strong resistance zone of $110,000-$115,000. If a breakthrough occurs, it will open the path to $120,000. Additionally, there are opportunities for ETH's ecosystem to surpass, with compounded staking yields, stablecoin regulatory implementation, and ETF inflows potentially driving the Ethereum/Bitcoin exchange rate out of the trough, especially when the GENIUS Act clarifies the tokenization framework, which may lead to an explosion in Ethereum on-chain asset issuance. Furthermore, the emergence of non-U.S. pricing tools like the Russian Bitcoin index, combined with the weakening of the dollar's reserve status, highlights the value of cryptocurrencies' "de-geopoliticization" attributes. However, the back-and-forth nature of U.S.-China tariff negotiations may trigger commodity volatility, indirectly suppressing risk appetite.

The massive floating profits of institutional holdings, subtle changes in ETF fund flows, and the Federal Reserve's silence during the political season all constitute short-term pullback inducements. Investors need to pay attention to two key signals: first, whether BTC can build a solid base above $105,000, and second, whether ETH spot ETF weekly inflows can maintain above $200 million. As the macro fog has yet to clear, the helm may be more important than the sail.

BTC Data Analysis:

According to CoinAnk data, in the past month, global crypto funds have performed remarkably, with nearly 300 funds attracting over $7 billion in net inflows, pushing the overall asset management scale to a historic high of $167 billion. This marks an important milestone for the cryptocurrency market. During the same period, traditional assets such as stock funds saw a net outflow of $5.9 billion, and gold funds also experienced a rare outflow for the first time in 15 months, highlighting that investors are viewing crypto assets as strategic tools for diversified investment portfolios rather than merely high-risk speculative assets. This reflects a demand for hedging against dollar weakness and global economic uncertainty.

This shift in capital indicates that cryptocurrencies are gradually becoming a mainstream allocation. We believe the inflow trend will continue but stabilize, indicating an increase in market maturity, which helps enhance the attractiveness of crypto assets as inflation hedges. For the crypto market, this phenomenon may accelerate institutional capital entry, improving overall liquidity and price stability. However, high volatility and regulatory uncertainty still pose risks, and attention should be paid to potential short-term fluctuations triggered by policy changes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。