Key Points

The total market capitalization of cryptocurrencies is $3.42 trillion, down from $3.43 trillion last week, representing a decrease of 0.3% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $44.24 billion, with a net outflow of $128.8 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $3.33 billion, with a net inflow of $281 million this week.

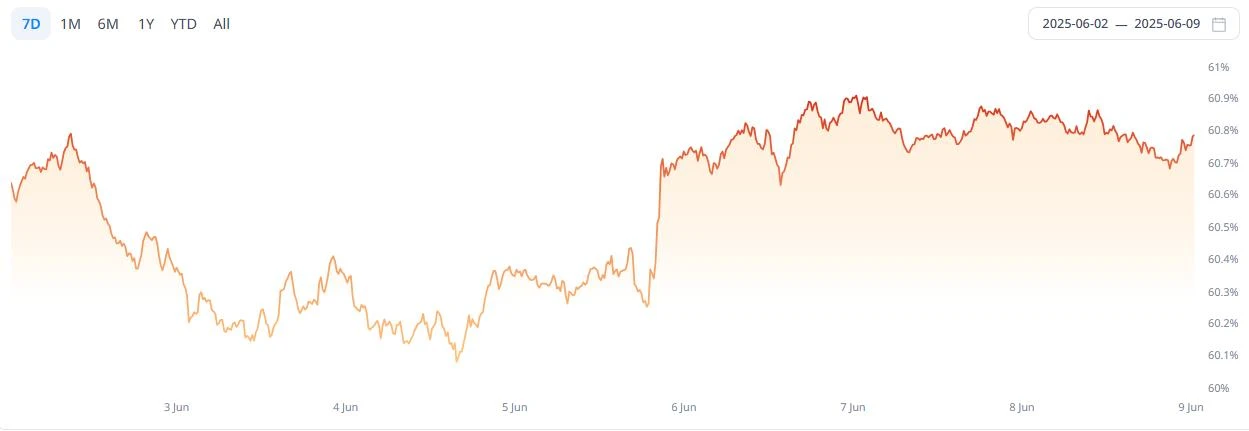

The total market capitalization of stablecoins is $254 billion. Among them, USDT has a market capitalization of $154.8 billion, accounting for 60.9% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $61.1 billion, accounting for 24.1%; and DAI with a market capitalization of $5.36 billion, accounting for 2.1%.

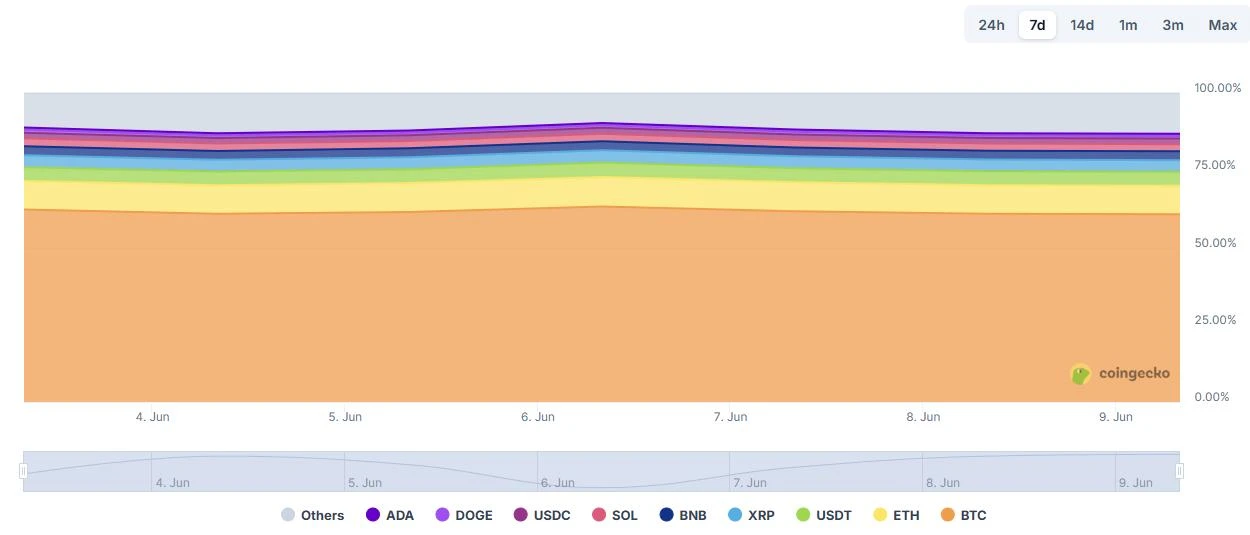

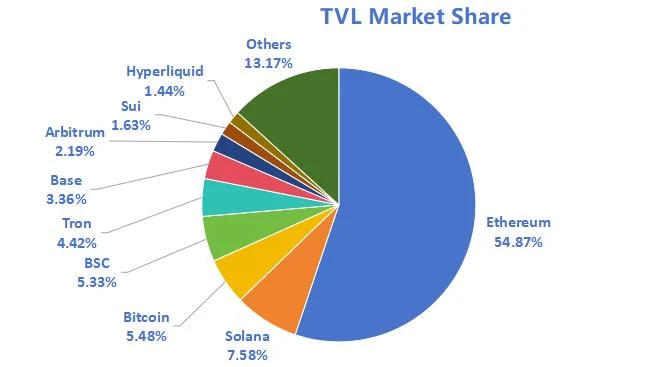

According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $111.6 billion, up from $111.1 billion last week, representing an increase of 0.45%. By public chain, the top three chains by TVL are Ethereum with a share of 54.87%; Solana with a share of 7.58%; and Bitcoin with a share of 5.48%.

From on-chain data, the trading volume on Sunday showed a downward trend for all public chains except for Sui, which saw an increase. Notably, BNBChain experienced a significant decline, down 66.7% from last week. In terms of transaction fees, all public chains showed little change except for Ethereum, which decreased by 77.8% from last week; regarding daily active addresses, all public chains showed a downward trend except for BNBChain and Sui, which had slight increases. Solana had the most significant decline, down approximately 45% from last week; in terms of TVL, all public chains showed slight decreases except for Sui, which increased by 4.3% from last week.

Innovative projects to watch: Liquid is a decentralized cryptocurrency trading protocol that allows users to deploy their own perpetual contract markets on leading exchanges and earn 50% of trading fee revenue permanently. The project is currently in the whitelist application stage, with nearly 300,000 applicants; ClipStake is an on-chain advertising incentive platform where brands upload videos and set advertising budgets, and creators make short videos to earn USDC or tokens for every 1,000 verified views; Valiant is a decentralized trading platform that aims to combine the speed of CEX with the freedom of DEX, dedicated to providing efficient trading experiences for institutional and individual users.

Table of Contents

Key Points

Total Market Capitalization of Cryptocurrencies / Bitcoin Market Capitalization Share

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Capitalization and Issuance

II. Hot Money Trends This Week

Top Five VC Coins and Meme Coins by Increase This Week

Insights on New Projects

III. New Developments in the Industry

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Capitalization Share

The total market capitalization of cryptocurrencies is $3.42 trillion, down from $3.43 trillion last week, representing a decrease of 0.3%.

Figure 1 Data Source: cryptorank

As of the time of writing, Bitcoin's market capitalization is $2.1 trillion, accounting for 61.47% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $254 billion, accounting for 7.42% of the total cryptocurrency market capitalization.

Figure 2 Data Source: coingeck

2. Fear Index

The cryptocurrency fear index is 55, indicating a neutral sentiment.

Figure 3 Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $44.24 billion, with a net outflow of $128.8 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $3.33 billion, with a net inflow of $281 million this week.

Figure 4 Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

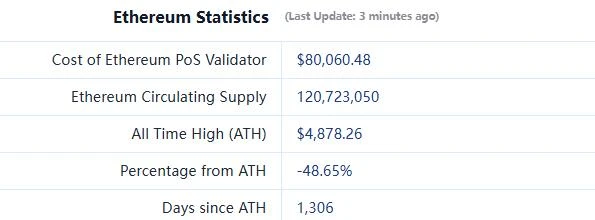

ETHUSD: Current price $2,503, historical highest price $4,878, down approximately 48.65% from the highest price.

ETHBTC: Currently at 0.023672, historical highest at 0.1238.

Figure 5 Data Source: ratiogang

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL in DeFi this week is $111.6 billion, up from $111.1 billion last week, representing an increase of 0.45%.

Figure 6 Data Source: defillama

By public chain, the top three chains by TVL are Ethereum with a share of 54.87%; Solana with a share of 7.58%; and Bitcoin with a share of 5.48%.

Figure 7 Data Source: CoinW Research Institute, defillama

Data as of June 8, 2025

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Figure 8 Data Source: CoinW Research Institute, defillama, Nansen

Data as of June 8, 2025

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, the trading volume on Sunday showed a downward trend for all public chains except for Sui, which saw an increase. Notably, BNBChain experienced a significant decline, down 66.7% from last week. In terms of transaction fees, all public chains showed little change except for Ethereum, which decreased by 77.8% from last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects users' trust in the platform. In terms of daily active addresses, all public chains showed a downward trend except for BNBChain and Sui, which had slight increases. Solana had the most significant decline, down approximately 45% from last week; in terms of TVL, all public chains showed slight decreases except for Sui, which increased by 4.3% from last week.

Layer 2 Related Data

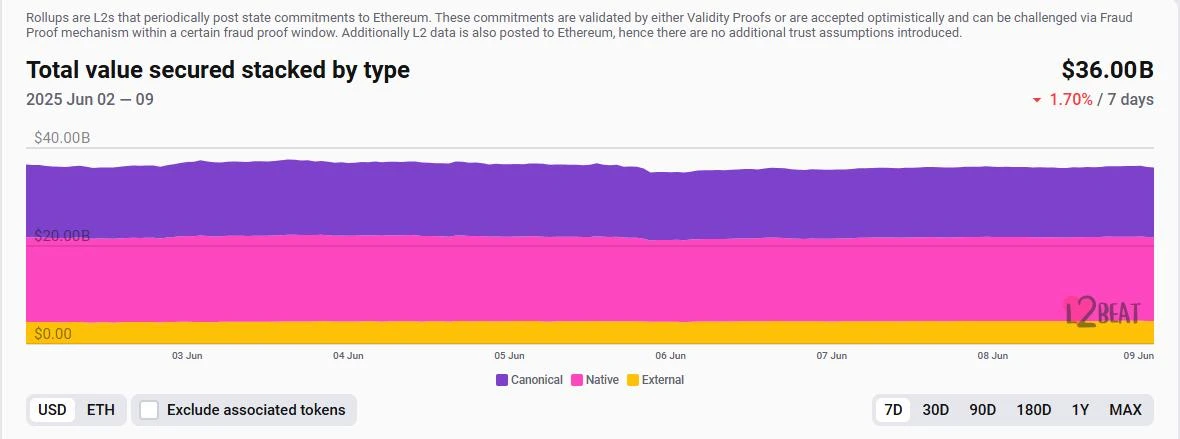

● According to L2Beat, the total TVL of Ethereum Layer 2 is $36 billion, down from $37.23 billion last week, representing an overall decrease of 1.7%.

Figure 9 Data Source: L2Beat

Data as of June 8, 2025

- Base and Arbitrum occupy the top positions with market shares of 40.72% and 30.32%, respectively, with overall increases in market share this week.

Figure 10 Data Source: footprint

Data as of June 8, 2025

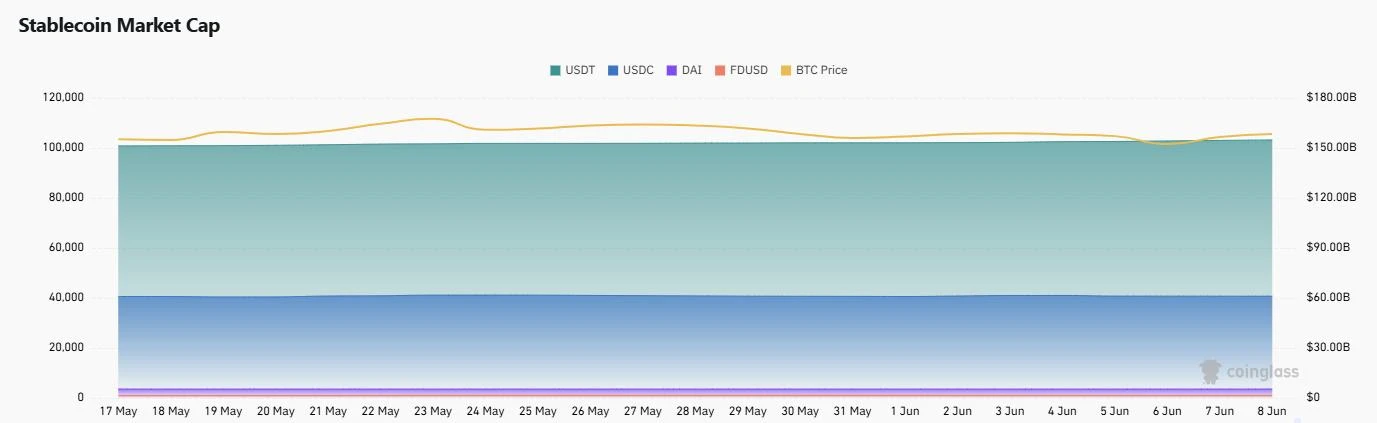

7. Stablecoin Market Capitalization and Issuance

According to Coinglass, the total market capitalization of stablecoins is $254 billion. Among them, USDT has a market capitalization of $154.8 billion, accounting for 60.9% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $61.1 billion, accounting for 24.1%; and DAI with a market capitalization of $5.36 billion, accounting for 2.1%.

Figure 11 Data Source: CoinW Research Institute, Coinglass

Data as of June 8, 2025

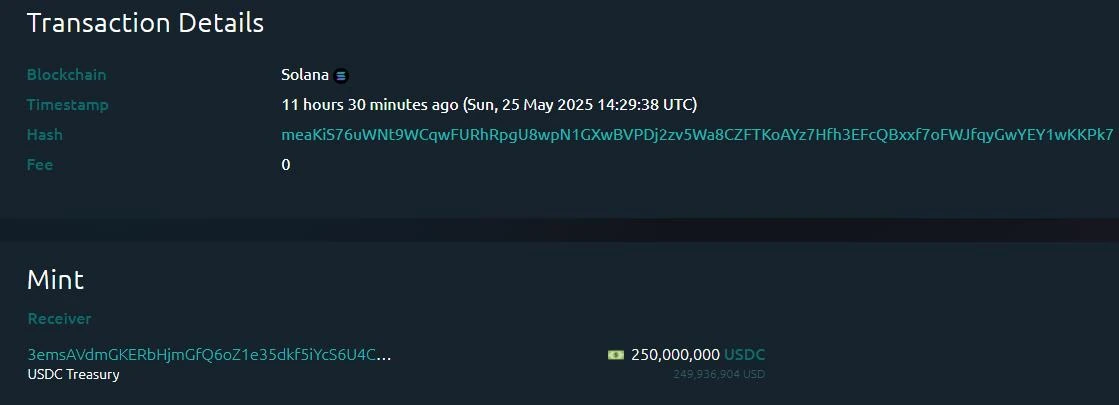

According to Whale Alert data, this week USDC Treasury issued 1 billion USDC, and Tether Treasury issued 52 million USDT. The total issuance of stablecoins this week is 1.252 billion, compared to last week's total issuance of 57.05 million, representing an increase of approximately 2,096% in stablecoin issuance this week.

Figure 12 Data Source: Whale Alert

Data as of June 8, 2025

II. Hot Money Trends This Week

1. Top Five VC Coins and Meme Coins by Increase This Week

The top five VC coins by increase over the past week

Figure 13 Data Source: CoinW Research Institute, coinmarketcap

Data as of June 8, 2025

The top five Meme coins by increase over the past week

Figure 14 Data Source: CoinW Research Institute, coinmarketcap

Data as of June 8, 2025

2. Insights on New Projects

Liquid: A decentralized cryptocurrency trading protocol that allows users to deploy their own perpetual contract markets on leading exchanges and earn 50% of trading fee revenue permanently, creating a sustainable and replicable liquidity and income loop. The project is currently in the whitelist application stage, with nearly 300,000 applicants.

ClipStake: An on-chain advertising incentive platform where brands upload videos and set advertising budgets, and creators make short videos to earn USDC or tokens for every 1,000 verified views. ClipStake has received support from AllianceDAO.

Valiant: Based on FogoChain, Valiant is a decentralized trading platform that seeks to combine the speed of CEX with the freedom of DEX, dedicated to providing efficient trading experiences for institutional and individual users.

III. New Developments in the Industry

1. Major Industry Events This Week

The Solana ecosystem's DePIN smart wearable device project CUDIS announced that it has officially opened the CUDIS token airdrop application. The first season airdrop will distribute 50 million CUDIS to over 60,000 active community users, with top active users receiving over 60,000 CUDIS, the top 100 receiving over 13,000 CUDIS, and the top 1,000 receiving over 4,000 CUDIS. Users must connect a verified Solana wallet and claim the S1 airdrop by August 31.

Fufuture, in collaboration with the Web3 social platform DeBox, has officially launched BOX-BTC and BOX-ETH perpetual options trading pairs. The first trading incentive event started on June 6 and will last for 20 days, open to all on-chain users, with a total prize pool of 652,000 BOX tokens and 52,000 FU points. The collaboration aims to explore the synergistic development of derivatives trading and the Web3 social ecosystem.

Hong Kong's "Stablecoin Ordinance" will take effect on August 1, 2025. The "Stablecoin Ordinance" was published on May 30, 2025, with the main purpose of regulating activities related to stablecoins and establishing a licensing system for regulated stablecoin activities in Hong Kong.

2. Major Upcoming Events Next Week

Skate is a universal application layer that enables applications to run on thousands of chains with a single state. SKATE is the foundational utility and governance token of the Skate protocol, with an initial total supply of 1 billion, of which 10.00% is allocated to the team, 18.00% to the ecosystem and reserves, 10% for initial airdrops, and 45.50% for the community. Skate's release date on X is June 9, along with a promotional video, which seems to hint at the TGE date.

The eco-social prediction market Upside, based on the Base chain, is set to launch on June 10.

ZEROBASE, in collaboration with Guinness World Records, has initiated a global privacy challenge, which will end on June 15. All participants will collectively complete a decentralized trusted setup ceremony to generate public parameters for a zero-knowledge proof system. These parameters will serve as the trust foundation for multiple privacy applications, promoting the implementation of zero-knowledge technology in the Web3 ecosystem. All users who successfully participate in this challenge will become co-holders of the Guinness World Record and receive a participation certificate from Guinness.

3. Important Investments and Financing from Last Week

Avantis raised $8 million, with investors including Pantera Capital, Founders Fund, Flowdesk, Symbolic Capital, and others. Avantis is an oracle-based synthetic derivatives protocol that allows users to trade cryptocurrencies and real-world assets with leverage of up to 100 times and earn returns by providing USDC liquidity as market makers. (June 3, 2025)

Rails raised $14 million, with investors including Slow Ventures, Kraken, CMCC Global, Quantstamp, Round13 Capital. Rails is a self-custodial cryptocurrency exchange that utilizes a centralized order book to drive optimal trade execution while combining a self-custodial decentralized solution on the blockchain to provide transparent fund custody, thereby protecting user funds and gaining user trust. (June 4, 2025)

IOST raised $21 million, with investors including DWF Labs, Presto, Rollman Management. IOST is a decentralized blockchain network based on the next-generation consensus algorithm "Proof of Believability" (PoB). IOST launched its public testnet on June 30, 2018, and migrated to the mainnet in February 2019. (June 6, 2025)

Reference Links:

- Liquid: https://x.com/tryliquidxyz)

- ClipStake: https://x.com/ClipStake_X

- Valiant: https://x.com/ValiantTrade

- Avantis: https://x.com/avantisfi

- Rails: https://x.com/rails_xyz

- IOST: https://x.com/IOST_Official

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。