Evening Non-Farm Data Analysis:

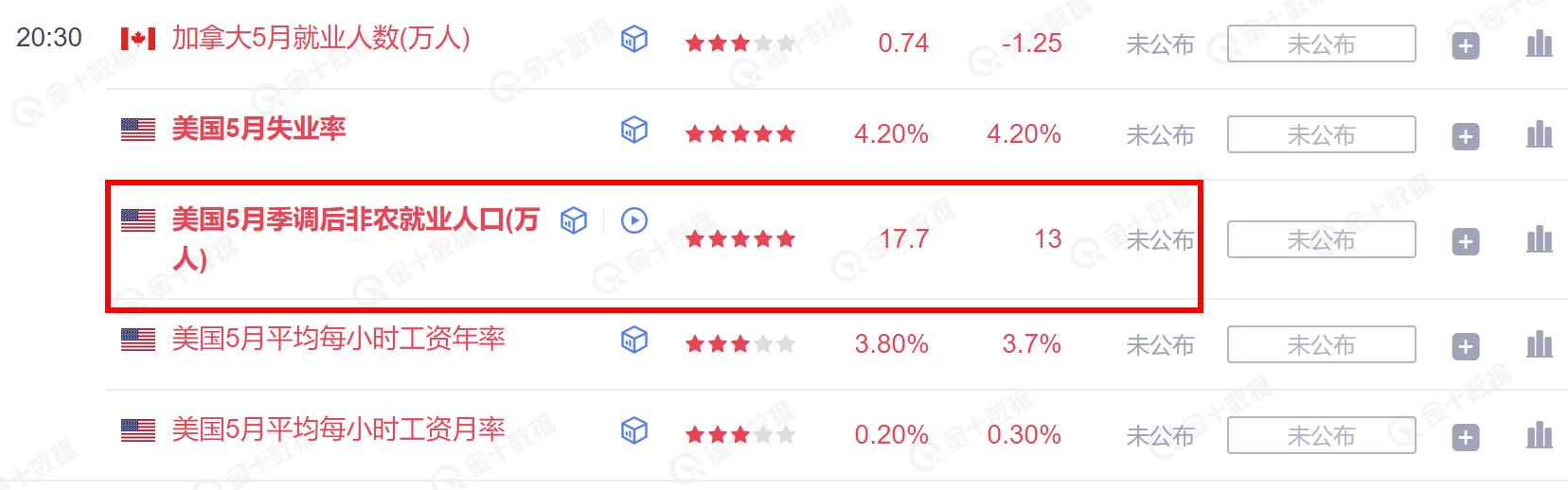

Non-farm data in April and May was negatively impacted by tariff conflicts, with employment figures being quite poor, especially Wednesday's ADP, which was far below expectations. This month's non-farm payroll is expected to be 130,000, which, although lower than last month's 177,000, is still relatively high compared to the ADP figures;

(1) If the data exceeds 177,000, it would be bearish, but given the tariffs and ADP, this possibility is very small.

(2) If the data is above 130,000 but below the previous value of 177,000, it would be a slight bearish signal. A slight bearish signal has limited impact on the trend.

(3) If the data is below 130,000, it would be quite bullish, likely leading to a wave of upward movement.

(4) Based on Wednesday's ADP data, tonight's major non-farm figures are likely to be significantly below 130,000, increasing the probability of a bullish outcome!

6.6 Technical Key Points Analysis:

BTC:

Bitcoin is looking bearish in the medium to long term between 110,000-110,500, having reached the ultimate target of 100,000 as previously stated. Next, we will wait for opportunities to signal a bullish outlook for the medium to long term!

The daily candle for Bitcoin has formed a large bearish entity. In our previous analysis, we mentioned that if it breaks below the weekly support at 102,000, it would reach the 100,000 level. Next,

Bitcoin needs to focus on the support at the round number level. If it holds, we can expect a wave of oversold rebound; if it breaks below, we may see the 97,000-95,000 area.

In the short term, continue to monitor the support near 100,000, while the upper resistance is at the 103,000 level.

After this significant drop, it is currently in a weak rebound phase, with no stabilization signal yet. The upper focus is on the 103,200-3,500 level; if it hasn't stabilized, we can look for bearish opportunities.

The support at the lower round number level is quite strong; if it tests but does not break, we can look for short-term bullish opportunities.

ETH:

Ethereum accelerated its decline after breaking below 2,550, which has now become a dividing line for strength and weakness. The support below is at 2,380, with key support at 2,320-2,300.

The upper short-term resistance is in the 2,480-2,500 range, with the key dividing line at 2,550. Before the non-farm data, we can use this range as a reference.

For more free real-time investment strategies, trading techniques, operational skills, and knowledge about candlestick patterns, you can scan the code to follow (WeChat public account: Trend Thought Notes).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。