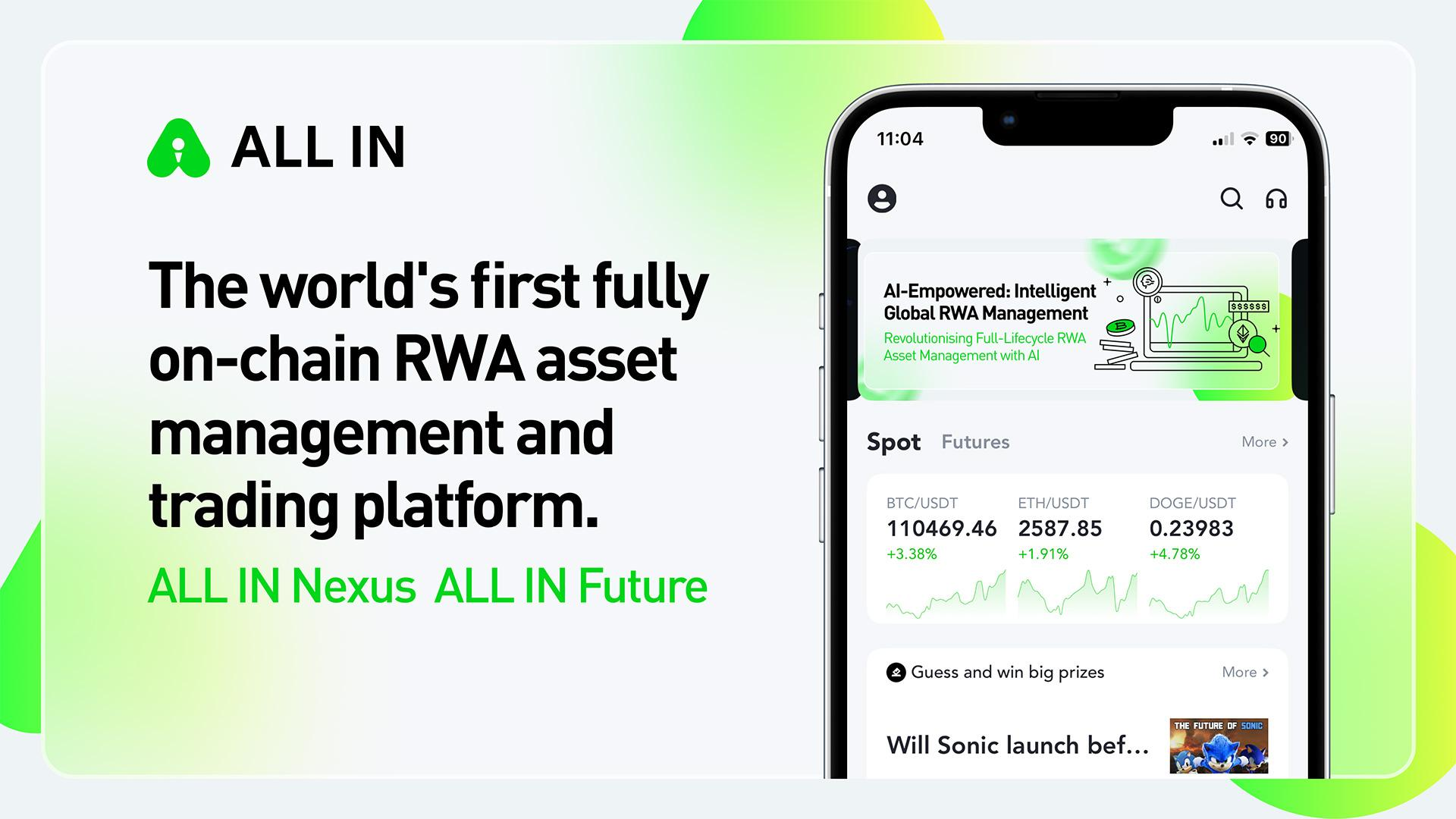

The global financial landscape is undergoing an unprecedented and profound transformation. The rise of RWA (Real World Asset) and TGE (Tokenized Governance Engine) has become a crucial bridge connecting the traditional trillion-dollar market with the efficient Web3 world. This is not merely a simple conversion of asset forms but a significant expansion of investment boundaries and a revolutionary enhancement of value transfer efficiency. ALL IN proudly announces itself as the world's first fully onchain RWA asset management and trading platform at the forefront of this unstoppable wave, with its forward-looking strategic layout and innovative strength. Our grand vision is to break down traditional financial barriers, allowing all verifiable real-world values to flow freely and intelligently enhance on the blockchain.

Industry Overview: RWA Ignites a New Trillion-Dollar Market Landscape

Currently, the global financial market is experiencing a profound paradigm shift. The traditional financial system has inherent pain points, such as low capital flow efficiency, price distortion due to geographical barriers, limited trading hours, high costs, and insufficient asset liquidity. With the empowerment of blockchain technology and the Web3 concept, these issues are seeing historical breakthroughs. The successive launch of Bitcoin and Ethereum ETFs marks the blurring boundaries between the crypto market and traditional finance. The concept of CeDeFi proposed by Changpeng Zhao (CZ) and the successful practices of projects like BounceBit clearly indicate that the combination of centralized and decentralized finance will accelerate the widespread adoption of cryptocurrencies, offering higher returns and stronger asset liquidity to global investors, and propelling finance towards a more open and efficient future.

RWA and TGE are the core driving forces of this transformation. RWA maps various real-world assets, such as real estate, stocks, bonds, commodities, and even intellectual property rights, onto the blockchain, converting them into digitally tradable tokens. This goes beyond simple asset digitization, representing a deep reform of traditional financial models. The TGE technology, as a key engine for empowering governance and value capture, further perfects the lifecycle of on-chain assets. The combination of RWA and TGE enables fractional investment in assets, significantly lowering the investment threshold of traditional finance, making investments from as little as $100 possible, and empowering a broader public to participate in global quality asset allocation. Moreover, the 24/7 nature of on-chain trading and instant settlement capabilities significantly enhance the global liquidity and trading efficiency of assets. The authoritative forecast by the Boston Consulting Group (BCG) further confirms the explosiveness of this trend, predicting that the global RWA tokenization market size will soar to an astonishing $16 trillion by 2030.

Market practices have already taken solid steps. For instance, the globally renowned cryptocurrency exchange Kraken has successfully launched the xStocks service, tokenizing U.S. stocks like Apple and Tesla on the Solana blockchain, providing non-U.S. investors with a more convenient and low-cost way to access U.S. stock assets. Coinbase is also attempting to issue on-chain token versions of its stock on its Ethereum Layer 2 network, Base. These real cases clearly demonstrate that RWA and TGE are strong tracks connecting trillion-dollar real assets, prompting the market to shift from simple sentiment trading to more equitable value discovery. RWA is becoming the core engine of the "second half" of the cryptocurrency era. ALL IN aligns with this historical trend, bearing the grand mission of connecting the real and digital worlds and empowering value flow.

The Core Positioning and Value of the ALL IN Platform

The ALL IN platform upholds the grand vision of becoming a digital asset hub, committed to thoroughly revolutionizing the interaction model between traditional assets and the crypto world through the deep integration of fully onchain RWA and smart trading, empowering all verifiable values to flow freely and intelligently enhance on the blockchain.

Our core philosophy is to build an innovative ecosystem deeply integrating fully onchain RWA, AI smart trading, and Web3 infrastructure. This multidimensional combination aims to provide users with efficiency, transparency, and intelligent experiences beyond traditional finance.

To ensure the security of user assets and the stable operation of the platform, ALL IN regards compliance and security as the cornerstone. We actively expand our global compliance footprint, with business coverage in over 60 countries and holding financial licenses in multiple countries, strictly adhering to global regulatory frameworks. In terms of technical security, we employ leading technologies such as cold wallet isolation and multi-signature to build an SSS-level security system, ensuring zero-risk custody of user assets. ALL IN has also established a safeguard fund to cover full compensation for unexpected situations like slippage, downtime, and pinning, providing users with ultimate security and confidence.

ALL IN's Ten Product Matrix—Building a Comprehensive RWA Service Ecosystem

The ALL IN platform has meticulously crafted a ten-core product matrix, building a comprehensive and robust ecosystem. This aims to provide global users with one-stop RWA asset management and trading services, covering the complete lifecycle of RWA assets from issuance to trading, and then to asset management:

● Spot Trading: Covers cryptocurrencies and RWA assets, integrating CEX liquidity with DEX transparent settlement to ensure efficient and transparent trading.

● AI Contract Trading: Offers leverage up to 100x and bidirectional opening functions, with AI algorithms optimizing the risk-reward ratio, empowering users' smart trading strategies.

● Fun Betting: Based on hot events for betting, participating with USDT to achieve instant profits, bringing users a dual experience of fun and earnings.

● Web3 Gaming: Implements a play-to-earn model, enhancing user asset value through game interaction, expanding the boundaries of on-chain entertainment.

● Multi-Chain Wallet: Employs cold storage and biometric technology to provide users with a one-stop secure management entrance for RWA and crypto assets.

● Crypto Card (U Card): Innovatively connects the cryptocurrency and fiat worlds, supporting users in conveniently using digital assets in daily consumption, achieving borderless global payments.

● IM System: Built-in encrypted communication and social functions, constructing a secure and efficient community interaction platform, empowering users with real-time communication and information sharing.

● ALL IN Labs: Integrates incubation and strategic investment, dedicated to supporting innovative projects in the RWA and Web3 fields, providing technical, financial, and market support, and promoting the prosperity of the platform ecosystem and industry development through strategic capital allocation.

● ALL IN Smart Chain: The core infrastructure of the ALL IN platform, aimed at providing high-performance, high-security, and highly scalable blockchain solutions, offering solid foundational support for the issuance, circulation, and application development of RWA assets, promoting the vigorous development of the Web3 ecosystem.

● Staking Ecosystem (ALL IN Nexus): An important staking ecosystem under the ALL IN platform, by staking RWA assets to mint platform tokens (ANT), thereby gaining returns, driving a positive cycle of the ecosystem, providing deep liquidity and diverse value-added opportunities for RWA assets.

How ALL IN Empowers RWA Core Values—Asset Management and Value-Added Innovation

The ALL IN platform deeply understands that the true value of RWA does not stop at the on-chain mapping of assets. The key lies in how to achieve the maximization of RWA asset value and effective risk control through professional asset management capabilities. We are committed to providing unprecedented RWA asset management and value-added solutions, aiming to occupy a core position in the trillion-dollar RWA market.

In the grand strategic layout of the ALL IN platform, ALL IN Nexus plays a key role in connecting RWA assets with on-chain value cycles, being an important part of ALL IN's grand plan for fully onchain RWA asset management. ALL IN Nexus, through its innovative asset management model, especially by introducing the essence of the Ve(3,3) model, aims to provide strong liquidity support and diverse value-added opportunities for on-chain RWA assets. This model effectively addresses common DeFi issues of liquidity mining pressure and value capture challenges by incentivizing long-term locking and optimizing liquidity allocation, thereby assisting in the value discovery and efficient value addition of RWA assets. ALL IN Nexus, as the key engine for providing users with long-term value addition potential for RWA assets, further consolidates ALL IN's leadership position as a global fully onchain RWA asset management and trading platform.

ALL IN's Future Outlook: Co-Creating a New Chapter in RWA Digital Finance

The ALL IN platform, with its forward-looking strategic layout, comprehensive ecosystem, and deep cultivation of the RWA track, is accelerating towards the future of digital finance. We firmly believe that through the ALL IN platform, the boundaries between traditional finance and digital assets will be completely broken, and global quality RWA assets will truly achieve borderless flow and intelligent value addition. ALL IN sincerely invites global investors and partners to participate in this profound financial transformation and jointly build a transparent, efficient, and intelligent digital asset ecosystem, opening a new era of value interconnection.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。