“反向奥德赛” - Midl 流动性引导计划点评

刚刚花时间研究了 Midl 流动性引导计划,几个有趣的点:

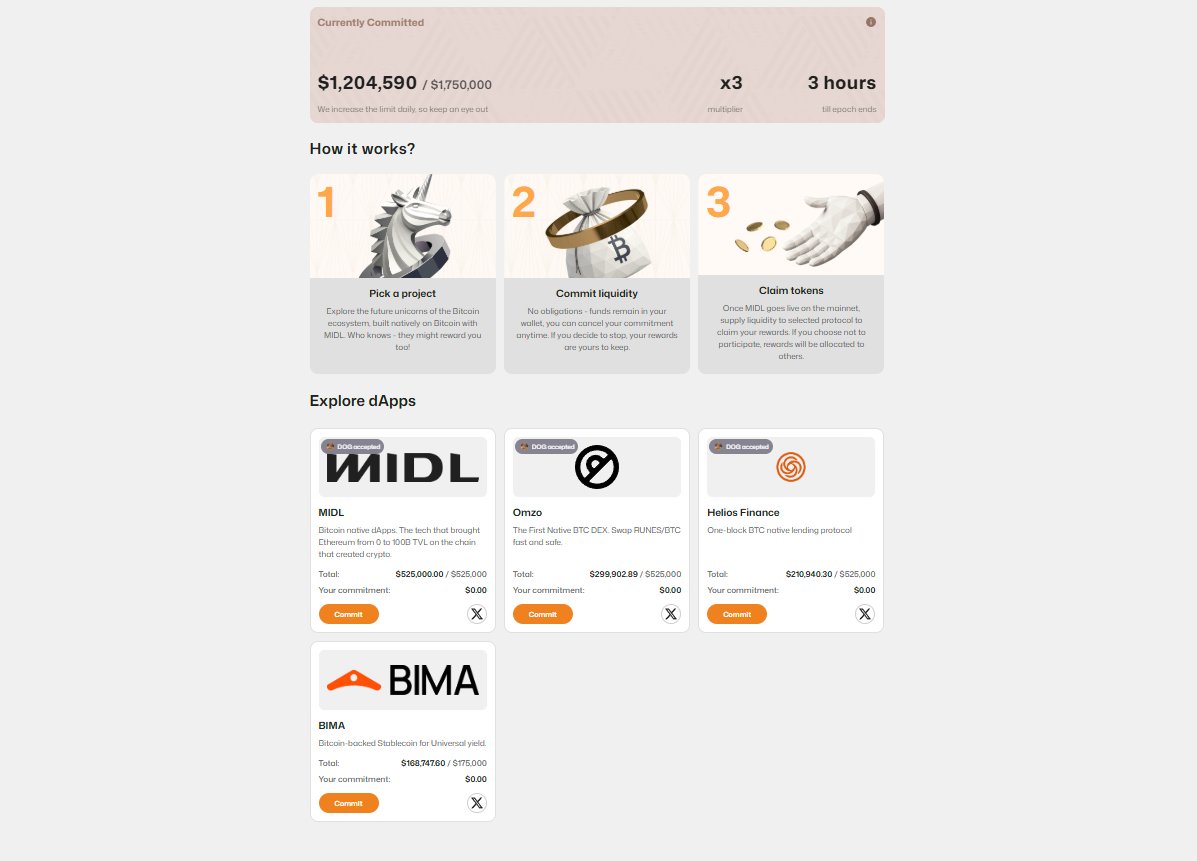

用户仅需“承诺”流动性,无需实际质押代币,即可获得保证奖励。

提供明确的代币激励,操作简单透明。

用户支持的不仅是单一项目,而是整个BTCFi生态,目前可选择“承诺”支持的项目包括:@midl_xyz、@BimaBTC、@Omzoio、@helios_finance 等。

参与步骤

① 访问官方链接:https://bootstrap.midl.xyz/

② 连接比特币或 EVM 兼容钱包。

③ 选择支持的项目并承诺流动性金额,系统将进行钱包余额快照验证。

④ 签名确认后,奖励积分开始累积,资产仍保留在用户钱包地址(不转移,仅快照)。

注意事项

奖励领取条件:在 TGE 时,需提供承诺的流动性以兑换 Midl 代币奖励。

软质押限制:若用户转移钱包中的承诺资产,奖励累积将自动停止,承诺流动性从池中扣除。

个人观点

这是一套极具创意的 DeFi 空投玩法,特别适合比特币生态(BTCFi)项目。Midl 不仅关注自身发展,还支持 BTCFi 生态中的其他项目,格局很大,值得点赞。

小小的改进建议:当前机制限制用户自由转移资产,可能对用户资金灵活性造成一定约束。建议移除此限制。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。