周日的作业仍然挺好写的,虽然今天 $BTC 的价格有些波动,但总的来说还是在小范围内的变化,这也说明了周末投资者的情绪还是相当稳定的,在最近24小时并没有太多的信息,最大的新闻应该就是乌克兰的无人机摧毁了俄罗斯超过40架战斗机。

应该是近期俄罗斯和乌克兰就要进行新一轮的和谈了,今天的攻击后市场分为了两派,一派认为接下来的和谈可能会很难了,俄罗斯的报复应该已经在路上了,还有一派认为这就是和谈前的秀肌肉,如果不和谈接下来的打击力度可能会更大。

其中上百架的无人机能悄无声息的进入到俄罗斯,并且储存了一定时间,才开始精准打击就说明了这里的水很深,俄罗斯的安全和防卫体系很有可能会有漏动,而且美国和欧洲也都加大了对俄罗斯的压力,继续打下去,俄罗斯的损失很可能会更大。

除了俄乌冲突以外就是贝森特今天公开表示川普的关税政策会继续执行,尤其是周五刚刚宣布对进口钢铁征收 50% 的关税,所以美国投资者的反应如何还是要看周一美股开盘以后才能知道,最起码是在CME开盘以后。

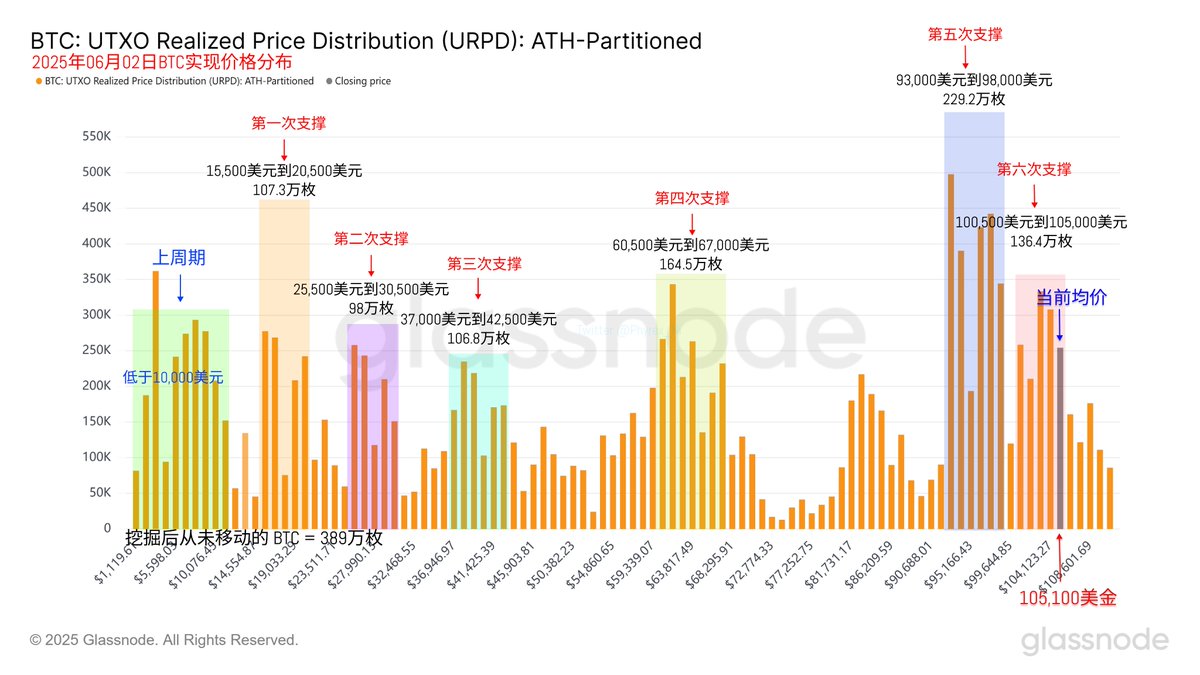

回到 Bitcoin 的数据来看,今天又是换手率交低的一天,多数的投资者还是保持着观望,只有亏损投资者最近换手较多,目前的价格仍然在向较为稳定的 100,500美元到 105,000美元之间转移,这部分的筹码虽然堆积很多,但暂时还不能视为支撑。

主要支撑区间还是在 93,000 美元到 98,000 美元之间,这个位置的稳定性还是很高的。

下周的重点数据应该就是非农就业的数据了,失业率不闹妖问题应该就不大,另外下周又要回到被川普的“嘴”统治的时间了,周一搞不好他又要对巡回法院和关税表述自己的看法了。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。