Key Points

June's macro calendar is packed: From PMI and CPI data to FOMC and ECB meetings, it will trigger significant volatility in the Bitcoin (BTC) and Ethereum (ETH) markets.

High-impact events (such as U.S. non-farm payrolls, U.S. CPI, ECB and Federal Reserve decisions) should be prioritized for hedging and position planning for BTC Spot, ETH Spot, and staking strategies.

Medium-impact releases (manufacturing PMI, central bank meetings of Canada, Japan, the UK, and Switzerland, and various regional surveys) will affect cross-asset capital flows and indicate shifts in risk appetite (risk-on/risk-off), particularly sensitive to staking yields on platforms like XT Earn.

A rigorous operational manual: Pre-checklists, response templates, and strict leverage controls can help traders effectively manage the downside risks of spot, derivatives, and staking positions while grasping macro-driven market trends.

June is crucial for crypto traders, with a full global economic calendar, from PMI and CPI data to central bank decisions, often triggering significant fluctuations in Bitcoin (BTC), Ethereum (ETH), and other digital assets. As these macroeconomic data and events unfold, they will reshape market risk appetite and capital flows, subsequently affecting the prices of BTC and ETH. For investors participating in both BTC Spot and ETH Spot trading, accurately grasping the timing and potential impact of each data release often determines profit and loss.

This article will outline the key events of June week by week, interpret the macro and geopolitical themes worth noting, and provide practical strategies for the crypto market, including BTC staking, ETH staking, and opportunities on the XT Earn platform.

Table of Contents

How to Interpret the Economic Calendar as a Crypto Trader

Weekly Overview of the June Calendar

Week 1 (June 1–7)

Week 2 (June 8–14)

Week 3 (June 15–21)

Week 4 (June 22–30)

Interpretation of Macro and Geopolitical Themes

Exclusive Impacts and Strategies for the Crypto Market

Sample Trading Manual for June

How to Interpret the Economic Calendar as a Crypto Trader

Key Data Types:

PMI (Purchasing Managers' Index): Measures the health of the manufacturing and services sectors; a rising PMI often boosts risk appetite, driving up BTC and stock prices.

CPI/PPI (Consumer/Producer Price Index): Reflects inflation trends; inflation data above expectations typically prompts a hawkish stance from central banks, putting pressure on Bitcoin and Ethereum prices.

Employment Reports (such as U.S. non-farm payrolls): Affect Federal Reserve interest rate decisions; stronger-than-expected employment data may trigger significant volatility in BTC Spot and ETH Spot markets.

Central Bank Meetings (Federal Reserve, European Central Bank, Bank of Japan, etc.): Set policy interest rates; both dovish and hawkish stances directly impact market liquidity and risk assets, including cryptocurrencies.

Leading Indicators vs. Lagging Indicators:

Leading Indicators: PMI, initial jobless claims, etc., can provide early warnings of economic trends.

Lagging Indicators: GDP revisions, PPI, etc., are mainly used to confirm trends.

Volatility Expectations:

- – High-impact data releases (such as non-farm payrolls, CPI, central bank decisions) can cause BTC and ETH to fluctuate by 5–10%, especially more pronounced during leveraged trading or derivatives expiration.

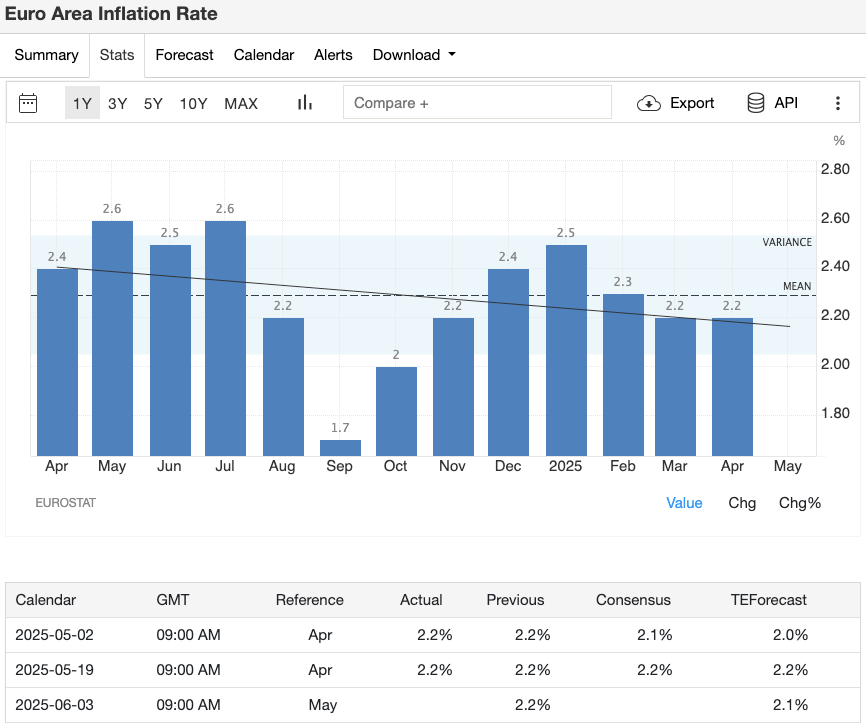

Weekly Overview of the June Calendar

Week 1 (June 1–7)

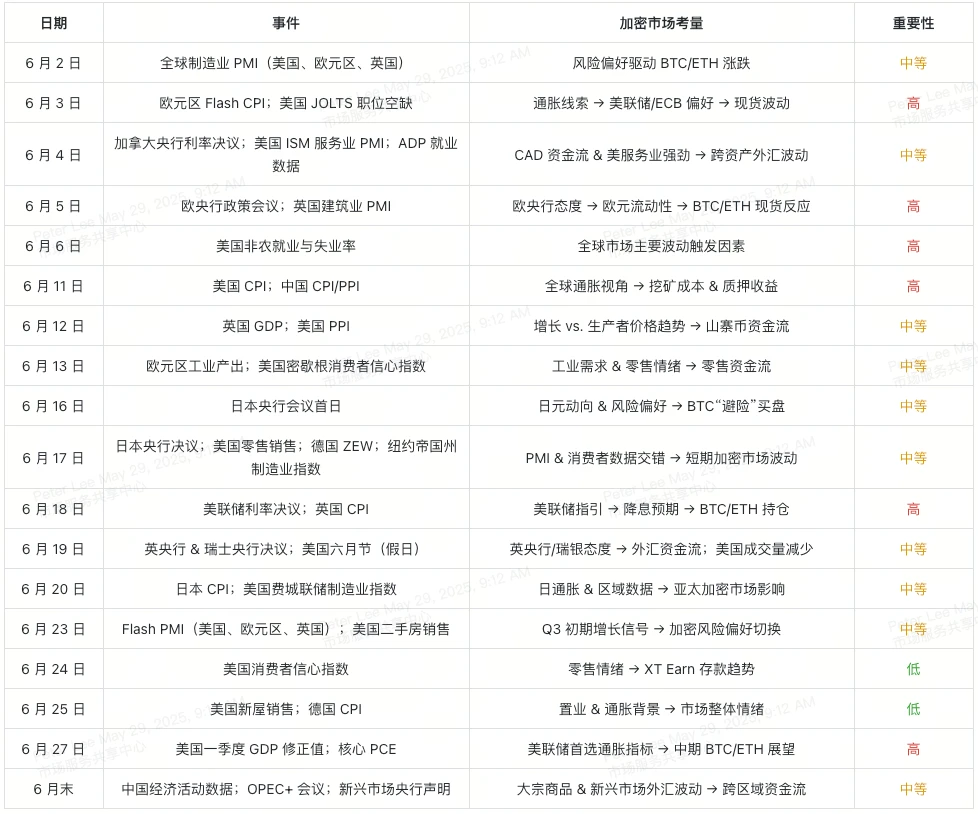

June 2 – Global Manufacturing PMI (U.S., Eurozone, UK) [Medium]

The manufacturing PMI estimated for May indicates growth conditions for the second quarter. Data stronger than expected can boost risk appetite, driving up BTC and ETH prices; if below expectations, it may trigger profit-taking in the BTC Spot and ETH Spot markets, leading to stablecoin inflows.

Image Credit: Trading Economics

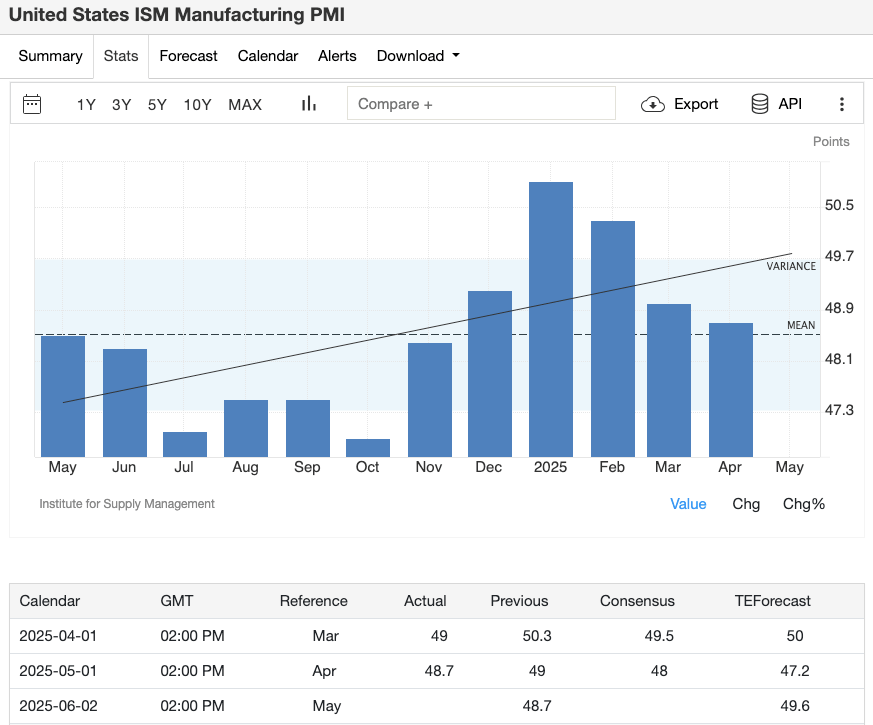

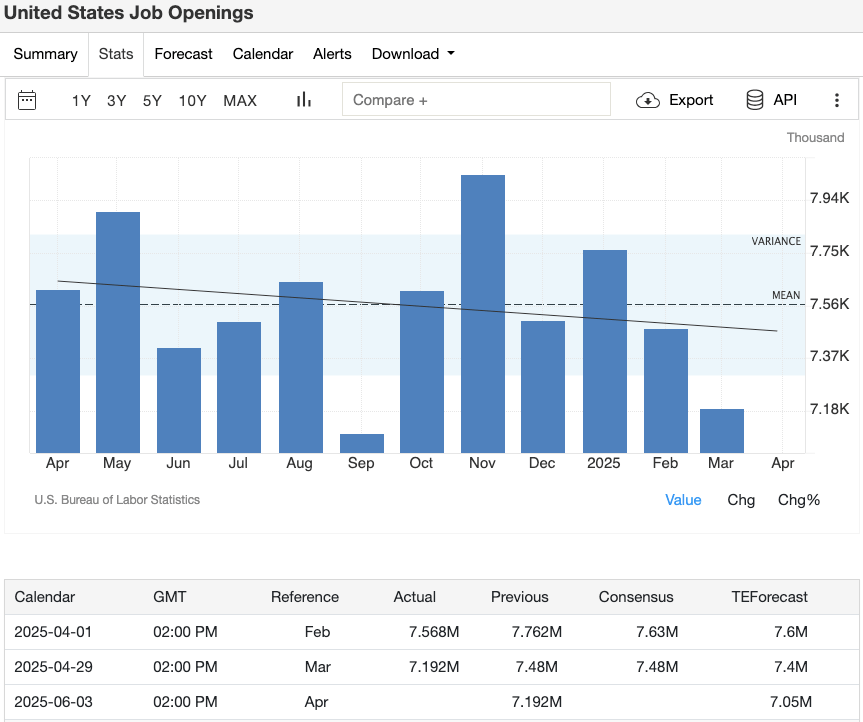

June 3 – Eurozone Flash CPI & U.S. JOLTS Job Openings [High]

The Eurozone Flash CPI is used to gauge potential inflation trends and is crucial for ECB policy; inflation rates above expectations will weaken the liquidity of risk assets. U.S. JOLTS job openings data shows a strengthening labor market, and data exceeding expectations will reinforce the Federal Reserve's hawkish stance, putting downward pressure on BTC staking yields and dragging down BTC/ETH performance.

Image Credit: Trading Economics (EU CPI&US JOLTS)

June 4 – Bank of Canada Decision & U.S. ISM Services PMI / ADP Employment Data [Medium]

A dovish or neutral decision from the Bank of Canada would benefit commodity currencies and the liquidity of risk assets, thereby supporting the crypto market. The U.S. ISM Services PMI and ADP employment data reflect the health of the services sector; if the data is strong, it typically triggers a new wave of selling pressure in the crypto market.

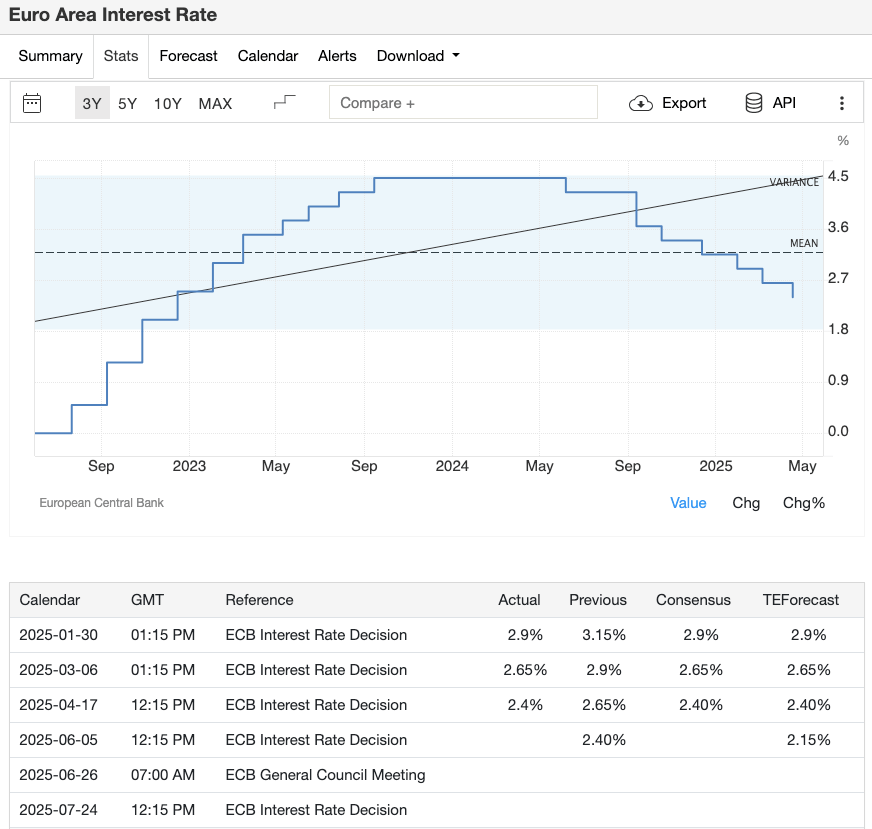

June 5 – ECB Policy Meeting & UK Construction PMI [High]

The ECB will discuss whether to continue raising interest rates or to hold steady; dovish signals usually release liquidity, driving a rebound in BTC/ETH, while hawkish comments may trigger a pullback. The UK Construction PMI serves as supplementary data; if it falls short of expectations, it will correspondingly weaken the market gains brought by the ECB's favorable outlook.

Image Credit: Trading Economics

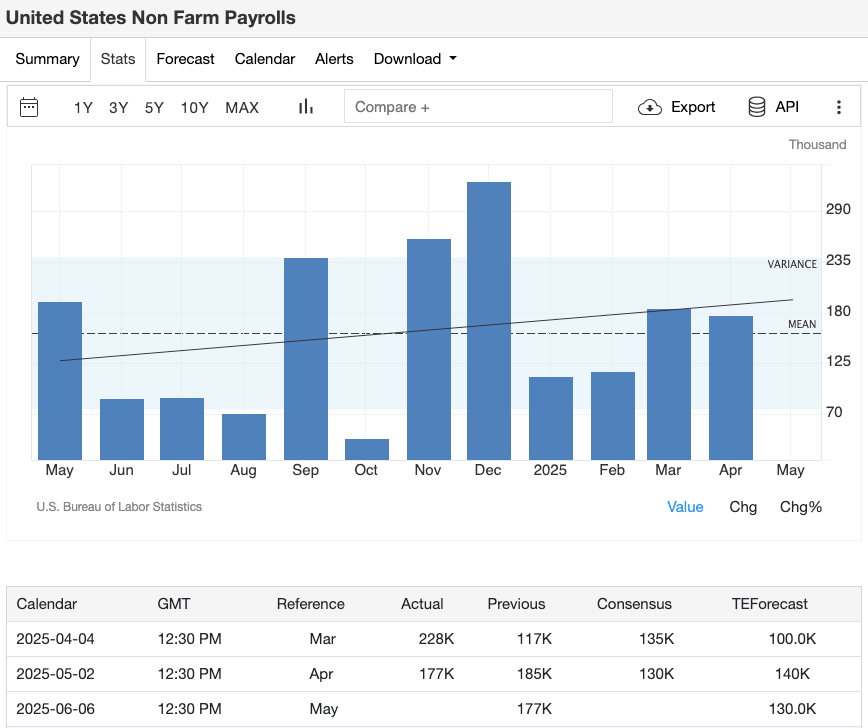

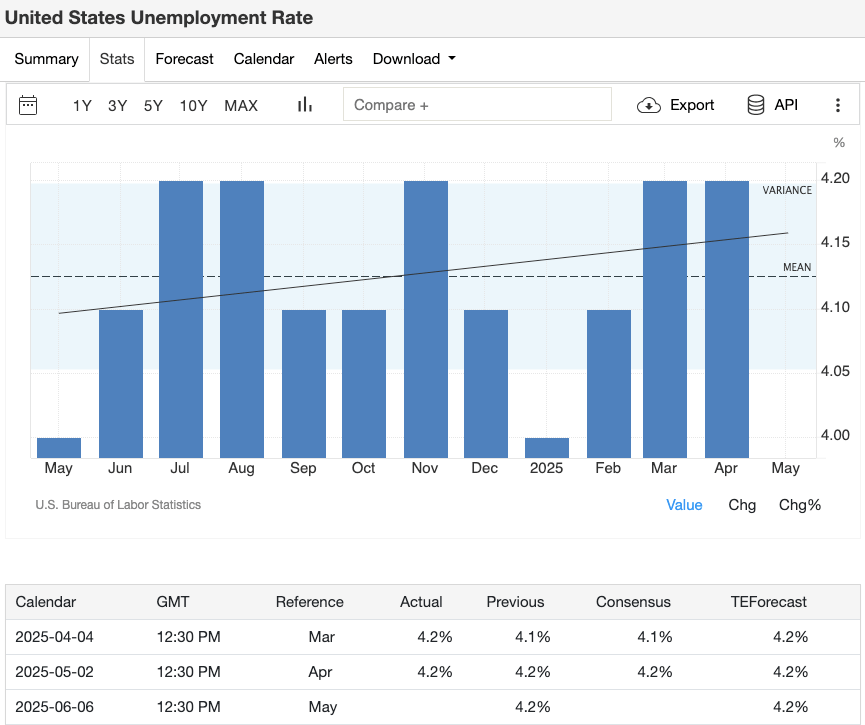

June 6 – U.S. Non-Farm Payrolls & Unemployment Rate [High]

The non-farm payroll report is a "ballast" for market volatility. If the number of new jobs falls short of expectations or the unemployment rate rises, it will strengthen market expectations for a Federal Reserve rate cut, leading to a significant rebound in BTC and ETH; conversely, stronger-than-expected data typically results in rapid sell-offs in the spot and derivatives markets.

Image Credit: Trading Economics (US NFP&Unemployment Rate)

Week 2 (June 8–14)

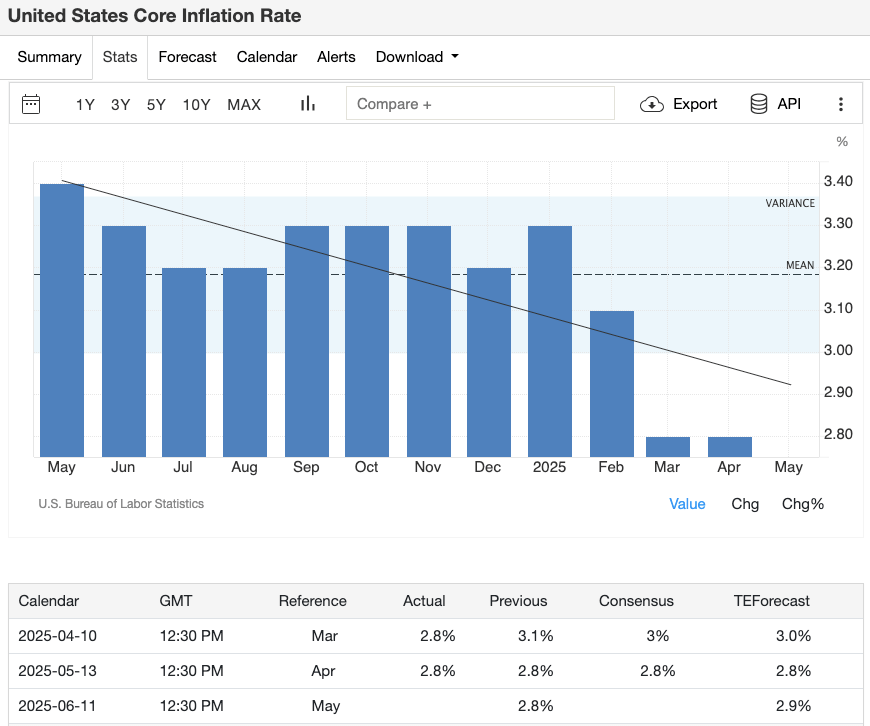

June 11 – U.S. CPI & China CPI/PPI [High]

The U.S. CPI is the primary indicator for the Federal Reserve to measure inflation; if the data exceeds expectations, it often drives up U.S. Treasury yields, leading to a pullback in the crypto market. China's CPI and PPI data determine miners' costs and the economics of computing power—rising producer prices will compress Bitcoin staking yields, dragging down BTC prices.

Image Credit: Trading Economics

June 12 – UK GDP & U.S. PPI [Medium]

UK GDP growth reflects the flow of pound funds and cross-asset risk appetite: when growth exceeds expectations, crypto assets often strengthen; if it falls short, it can easily trigger risk-averse sentiment, leading to sell-offs. U.S. PPI typically leads CPI; when producer prices unexpectedly rise, it pushes real yields higher, creating downward pressure on Ethereum prices.

June 13 – Eurozone Industrial Production & U.S. Michigan Consumer Sentiment Index [Medium]

Growth in Eurozone industrial production reflects the vitality of the real economy; strong data typically attracts risk assets in both traditional and crypto markets. The Michigan Consumer Sentiment Index measures retail sentiment; when the confidence index rises, it often leads to more users depositing funds into XT Earn for Bitcoin and Ethereum staking.

Week 3 (June 15–21)

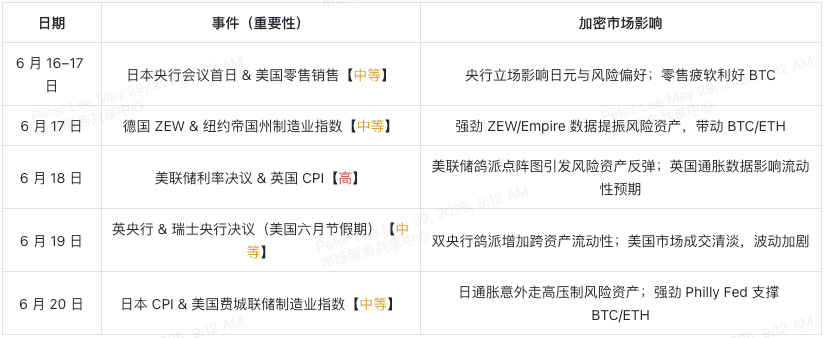

June 16–17 – Bank of Japan Meeting & U.S. Retail Sales [Medium]

The Bank of Japan meeting and any adjustments to its yield curve control could change the flow of yen funds and global risk appetite. An unexpected dovish stance may boost the crypto market, while hawkish signals could trigger a pullback. U.S. retail sales reflect consumer spending; if the data is weak, it often boosts BTC prices due to market expectations that the Federal Reserve will maintain a dovish stance.

June 17 – Germany ZEW Confidence Index & New York Empire State Manufacturing Index [Medium]

The Germany ZEW Investor Confidence Survey showcases the outlook for Europe’s largest economy; a rebound in the index usually boosts global risk assets, including cryptocurrencies. The New York Empire State Manufacturing Index provides insights into the health of U.S. regional manufacturing; strong data often accompanies stock market gains, driving BTC and ETH higher.

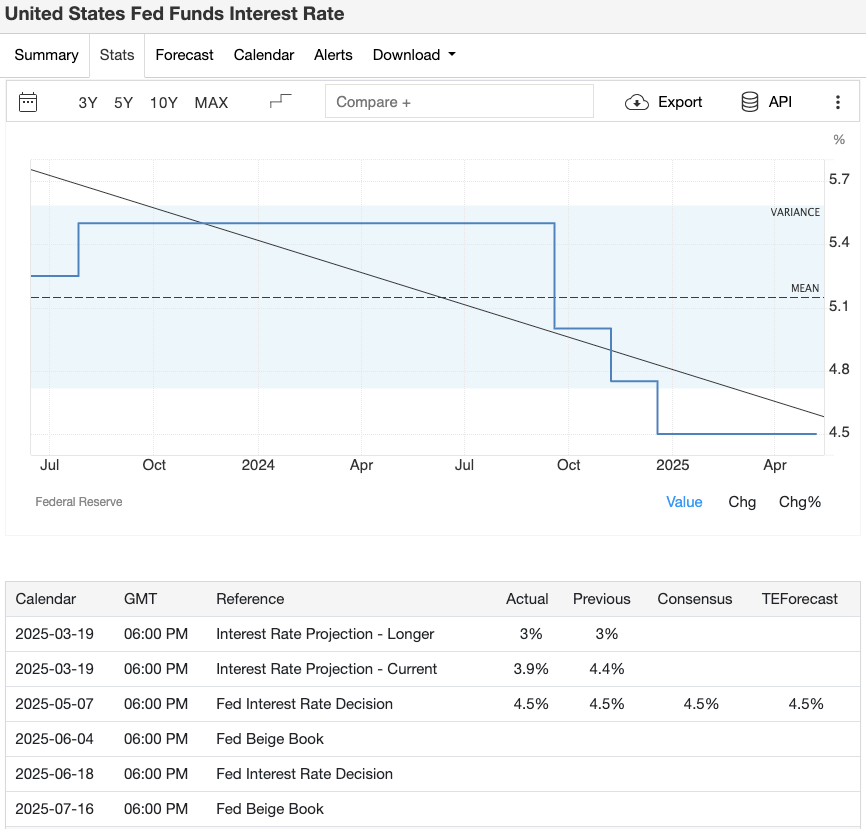

June 18 – Federal Reserve Interest Rate Decision & UK CPI [High]

The FOMC interest rate decision and updated "dot plot" in June is the second major event of the month. Dovish guidance is expected to lead to a broad increase in risk appetite (pushing BTC/ETH up), while hawkish signals may trigger rapid sell-offs. The UK CPI, as a global inflation reference, will also affect liquidity expectations in the crypto market.

Image Credit: Trading Economics

June 19 – Bank of England & Swiss National Bank Decisions (U.S. June Holiday) [Medium]

The policy announcements from the Bank of England and the Swiss National Bank will simultaneously affect the flow of pound and franc funds. If both central banks release dovish or neutral signals, it will promote cross-asset liquidity, benefiting the crypto market; if there are unexpected hawkish signals, it will tighten market conditions. Trading volume may be lower during the U.S. June holiday, potentially amplifying intraday volatility.

June 20 – Japan CPI & U.S. Philadelphia Fed Manufacturing Index [Medium]

Japan's CPI provides the latest clues on domestic inflation pressures; if it rises unexpectedly, it may prompt the Bank of Japan to reassess its monetary policy, affecting the yen and market sentiment. The Philadelphia Fed Manufacturing Index measures the intensity of U.S. regional factory activity; strong data typically boosts risk assets, driving BTC and ETH higher.

Week 4 (June 22–30)

June 23 – Flash PMI & U.S. Existing Home Sales [Medium]

The Flash PMI for the U.S., Eurozone, and UK provides a preview of economic growth: when the data exceeds expectations, it typically boosts risk appetite, pushing BTC/ETH higher; if it falls short, it may trigger sell-offs. U.S. existing home sales, while also an economic reference, have a relatively small direct impact on the crypto market.

June 24 – U.S. Consumer Confidence Index [Low]

The Consumer Confidence Index reflects the level of optimism in retail: if it significantly exceeds expectations, it may bring more funds into the crypto market; if it falls short, it will suppress risk appetite. However, such data generally does not trigger significant volatility.

June 25 – U.S. New Home Sales & Germany CPI [Low]

U.S. new home sales and Germany CPI provide background information on the housing market and inflation: even if unexpected volatility occurs, it usually only has a brief impact on risk assets, with limited influence on the sustained trends of Bitcoin and Ethereum.

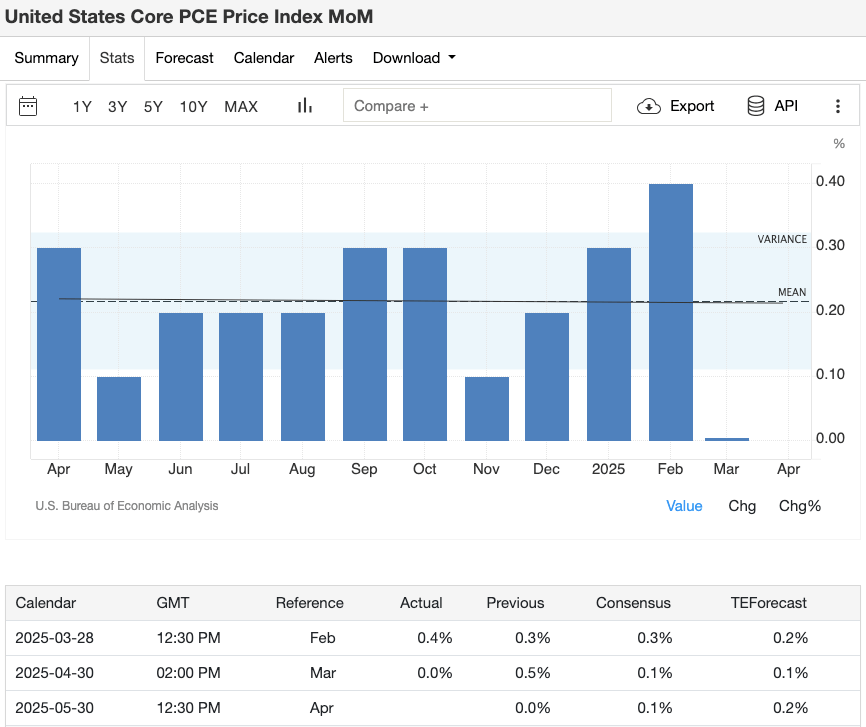

June 27 – U.S. Q1 GDP Revision & Core PCE [High]

The Q1 GDP revision and Core PCE (the Federal Reserve's preferred inflation indicator) will reshape market expectations for the timing of rate cuts: if the data remains high, it may exert downward pressure on BTC/ETH; if the data is low, it may trigger a sustainable rebound in the crypto market.

Image Credit: Trading Economics

End of June – China Economic Activity Data, OPEC+ Meeting & Emerging Market Central Bank Statements [Medium]

During the end of the month, various economic activity data from China, OPEC+'s decisions on production cuts or increases, and statements from emerging market central banks will all impact commodity prices and emerging market currencies. The resulting cross-regional capital flows may bring intermittent volatility to the crypto market.

Macroeconomic and Geopolitical Themes of Focus

Inflation Trends:

The CPI/PPI data for the U.S. and Eurozone in June is crucial. If inflation continues to rise, the Federal Reserve and the European Central Bank may maintain a hawkish stance, putting pressure on BTC and ETH prices; conversely, a cooling of inflation may trigger a "risk appetite" rebound in BTC spot, ETH spot, and altcoins.

Central Bank Shift Signals:

Traders should carefully study the FOMC meeting minutes and ECB press conferences to capture hints about the timing of rate cuts. If a shift signal appears early, it may drive capital from fixed income into BTC staking, XT Earn, and ETH staking, narrowing the spread between staking yields and Treasury yields.

Trade War Hotspots:

Potential tariff announcements or escalations between the U.S., China, and the EU often trigger cryptocurrency sell-offs in sync with the stock market. One can hedge risks through stablecoins or shorting altcoins, leveraging the "safe-haven" demand brought by significant macro data releases.

Global Risk Events:

The ongoing conflict in Ukraine and tensions in the Taiwan Strait will stimulate safe-haven demand. While gold is typically the preferred safe-haven asset, Bitcoin also exhibits "digital gold" properties; during heightened geopolitical risks, it is advisable to monitor the performance of both asset classes.

Crypto Market-Specific Influences and Strategies

Event-Driven Volatility Management:

- Adjust positions in advance using the calendar: 1–2 hours before major events like non-farm payrolls, CPI, and FOMC, consider reducing leverage or tightening stop-losses. After the event release, observe the initial "spike and drop" of BTC/ETH before deciding to enter positions.

Hedging Strategies:

When holding large spot positions, one can hedge BTC spot using futures or options.

On XT Earn, one can flexibly switch between Bitcoin staking returns and stablecoin yields to manage risk. Similarly, ETH staking can serve as a defensive tool during market downturns, locking in stable returns.

Correlation Monitoring:

- Track the correlation coefficients between Bitcoin, Ethereum, and major stock indices in real-time; if the correlation coefficient spikes (>0.8), it indicates that crypto assets may be moving in tandem with stocks, necessitating a strategy adjustment, such as favoring directional trades over long combinations.

Altcoin Rotation:

- During the "risk appetite" phase following the release of dovish data, some funds can be shifted from BTC/ETH to high β altcoins or DeFi tokens. As macro uncertainty rises, revert to BTC spot and ETH spot, as they typically exhibit better resilience during market sell-offs.

Leverage Risk Control:

- Avoid using excessive leverage before major events. The crypto market is inherently volatile, and combined with event-driven short-term fluctuations, it may quickly trigger forced liquidations. Maintain leverage ≤3× to manage price fluctuations within 5%.

Summary: June Trading Example Manual

Pre-Event Preparation Checklist:

Confirm current positions in BTC spot, ETH spot, or derivatives markets.

Check the open interest of major futures contracts to gauge market heat.

Set price alerts for key price points to ensure timely follow-up.

Response Templates:

If CPI exceeds expectations: reduce BTC/ETH long positions by 20%, and transfer 10% of funds into stablecoins or XT Earn.

If CPI falls short of expectations: allocate additional funds, buying an extra 10% of BTC spot, and increase the proportion of ETH staking.

Risk Management Rules:

Each trade position should not exceed 2% of the portfolio.

Use trailing stop-losses: set BTC at 3%, and altcoins at 5%.

Closely monitor margin ratios, maintaining at least 30% backup margin for leveraged positions.

Final Summary

For crypto traders, grasping the June economic calendar is crucial as it connects macro data with digital asset volatility. Aligning BTC spot and ETH spot strategies with PMI, CPI, and major central bank events, while fully utilizing Bitcoin and Ethereum staking tools on XT Earn, will enable more precise timing for entry and exit, effective risk management, and seizing opportunities from market fluctuations. Remember to set calendar reminders, practice various response plans in advance, and remain flexible throughout June. As macro forces and geopolitical trends jointly drive traditional and crypto markets, disciplined preparation will help you navigate the third quarter and beyond with stability.

Frequently Asked Questions

What is an economic calendar? Why is it important for crypto traders?

An economic calendar lists the release times of key macro data and central bank decisions (such as CPI, PMI, etc.). Tracking these events helps traders anticipate market volatility in advance, allowing for reasonable entry and exit arrangements and hedging strategies.

How do interest rate decisions affect Bitcoin and Ethereum?

Interest rate hikes typically tighten market liquidity, putting pressure on non-yielding assets like Bitcoin and Ethereum; conversely, dovish stances or rate cuts release liquidity, often triggering rebounds in cryptocurrency markets.

Should I close positions before major data releases?

This depends on individual risk preferences. Many traders reduce leverage or cut positions 1–2 hours before high-impact events (such as non-farm payrolls, FOMC) to avoid sudden, severe volatility.

How can I hedge crypto exposure during macro events?

You can short BTC/ETH using futures or options, or allocate funds to stablecoins. On platforms like XT Earn, flexibly switching between Bitcoin/Ethereum staking and stablecoin yields is also an effective risk management strategy.

What is the difference between "high," "medium," and "low" importance labels?

– High: Highly likely to trigger significant volatility in the crypto market (e.g., U.S. CPI, FOMC).

– Medium: Significantly impacts risk appetite and market direction (e.g., various PMIs, regional surveys).

– Low: Provides background reference but usually has limited direct impact on prices (e.g., new home sales).

How should I apply this calendar to my daily trading?

Sync the timing of major events to your calendar, set price alerts for BTC and ETH, prepare response templates, and check the manual before daily trading to ensure your position strategies align with the day's events.

Quick Links

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with more than 1 million monthly active users and over 40 million user traffic within the ecosystem. We are a comprehensive trading platform supporting over 800 quality cryptocurrencies and more than 1,000 trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading options including spot trading, margin trading, and contract trading. XT.COM also features a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。