原文标题:《比特币现货 ETF 实现连续 10 天净流入》

原文来源:CoinRank

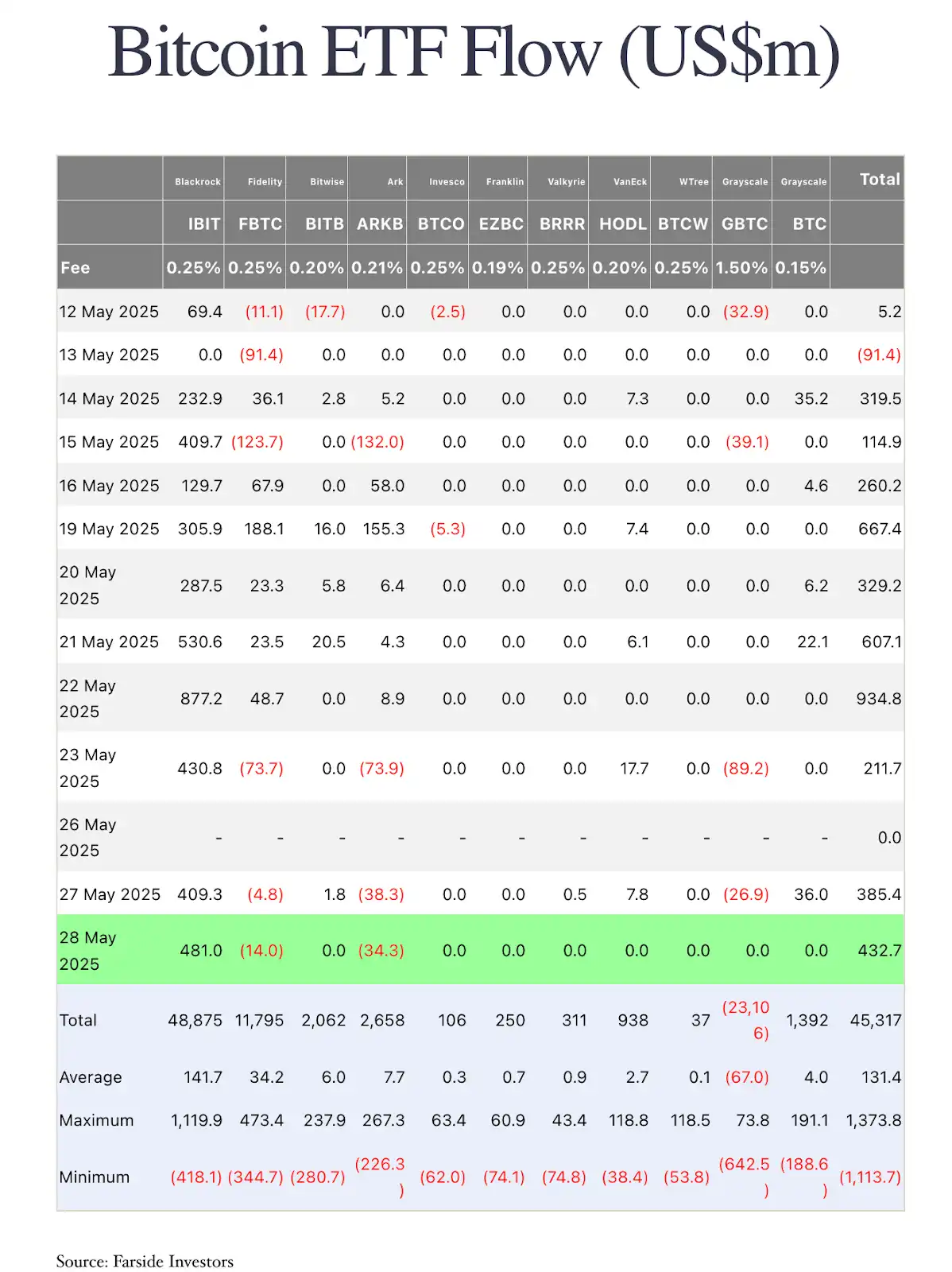

比特币现货 ETF 单日净流入达 4.33 亿美元,黑岩旗下 IBIT 领跑,反映出机构投资热情和市场信心强劲。尽管 ARKB 净流出 3400 万美元,比特币现货 ETF 总管理资产仍达 1300 亿美元,显示主流采用程度不断上升,对市场流动性产生深远影响。

目前,比特币现货 ETF 管理的资产已占比特币总市值的 6.11%,累计净流入达 450 亿美元,成为连接加密货币与传统金融的重要桥梁。

比特币现货 ETF 净流入 4.33 亿美元,黑岩 IBIT 领跑,显示机构兴趣与市场信心强劲。尽管 ARKB 当日净流出 3400 万美元,但比特币现货 ETF 总资产已达 1300 亿美元,反映出主流采用程度持续提升及对流动性的深远影响。目前,比特币现货 ETF 管理的资产占比特币总市值的 6.11%,成为连接加密世界与传统金融的重要桥梁,累计资金净流入已达 453 亿美元。

比特币正在被传统金融逐步接受,而比特币现货 ETF 已成为投资者获取比特币敞口的关键工具。美国时间 2025 年 5 月 28 日,比特币现货 ETF 单日总净流入达到 4.33 亿美元,显示出投资者信心持续增强,对该资产类别的兴趣也在不断上升。

什么是比特币现货 ETF?

比特币现货 ETF 是一种在传统证券交易平台(如纳斯达克或纽交所)上市交易的基金。它实际持有比特币,并紧密追踪市场价格。与期货型 ETF 不同,现货 ETF 不涉及复杂的衍生品或额外费用。它为投资者提供了一个简单直接的比特币投资方式——无需学习区块链技术,也无需担心私钥管理,只需通过常规券商账户即可投资。

截至发稿时,所有比特币现货 ETF 的管理资产总额(AUM)已达 1302.91 亿美元,占比特币总市值的 6.11%。其历史累计净流入资金达 453.44 亿美元,证明了资金持续流入这些基金,从而推动了比特币在传统金融中的流动性和认可度。

5 月 28 日亮点:资金流动显示情绪分化

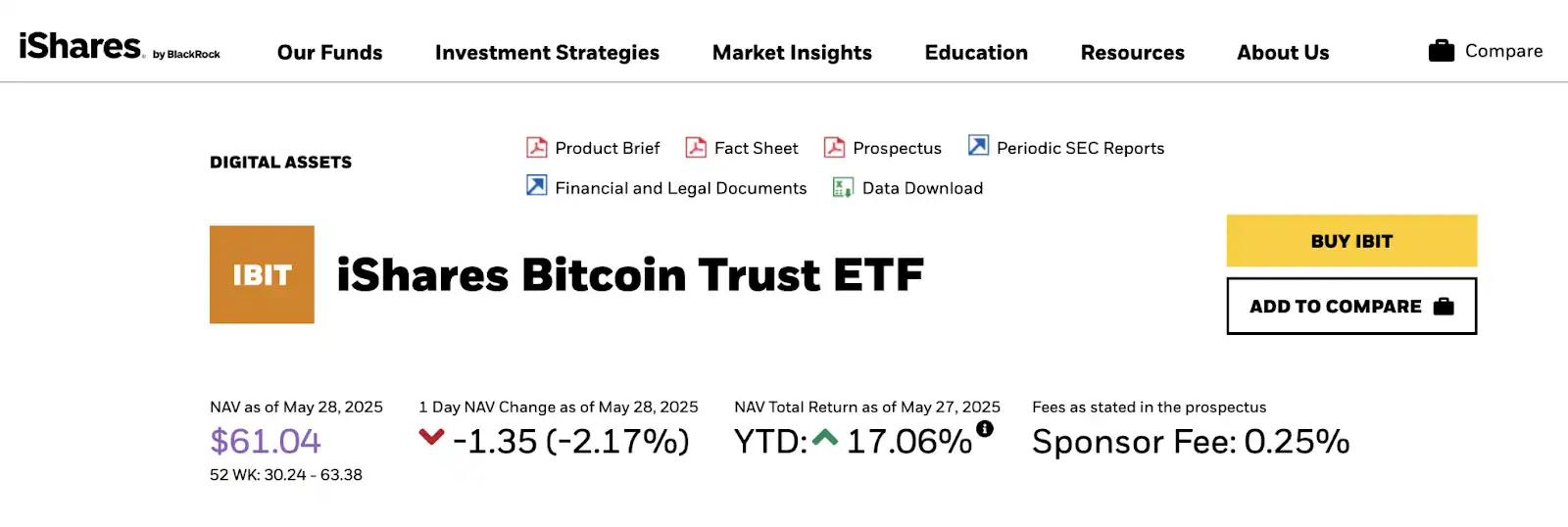

5 月 28 日,比特币现货 ETF 的单日净流入为 4.33 亿美元。其中表现最强的是黑石(BlackRock)旗下的 IBIT ETF,当日净流入达 4.81 亿美元。

作为全球最大的资产管理公司,黑石对加密资产的参与为比特币市场增添了信任与合法性。IBIT 目前的累计净流入已达 488.75 亿美元,显示其在市场中的主导地位。这也表明,越来越多机构投资者将比特币视为对冲通胀或资产多元化的工具,正加大配置。

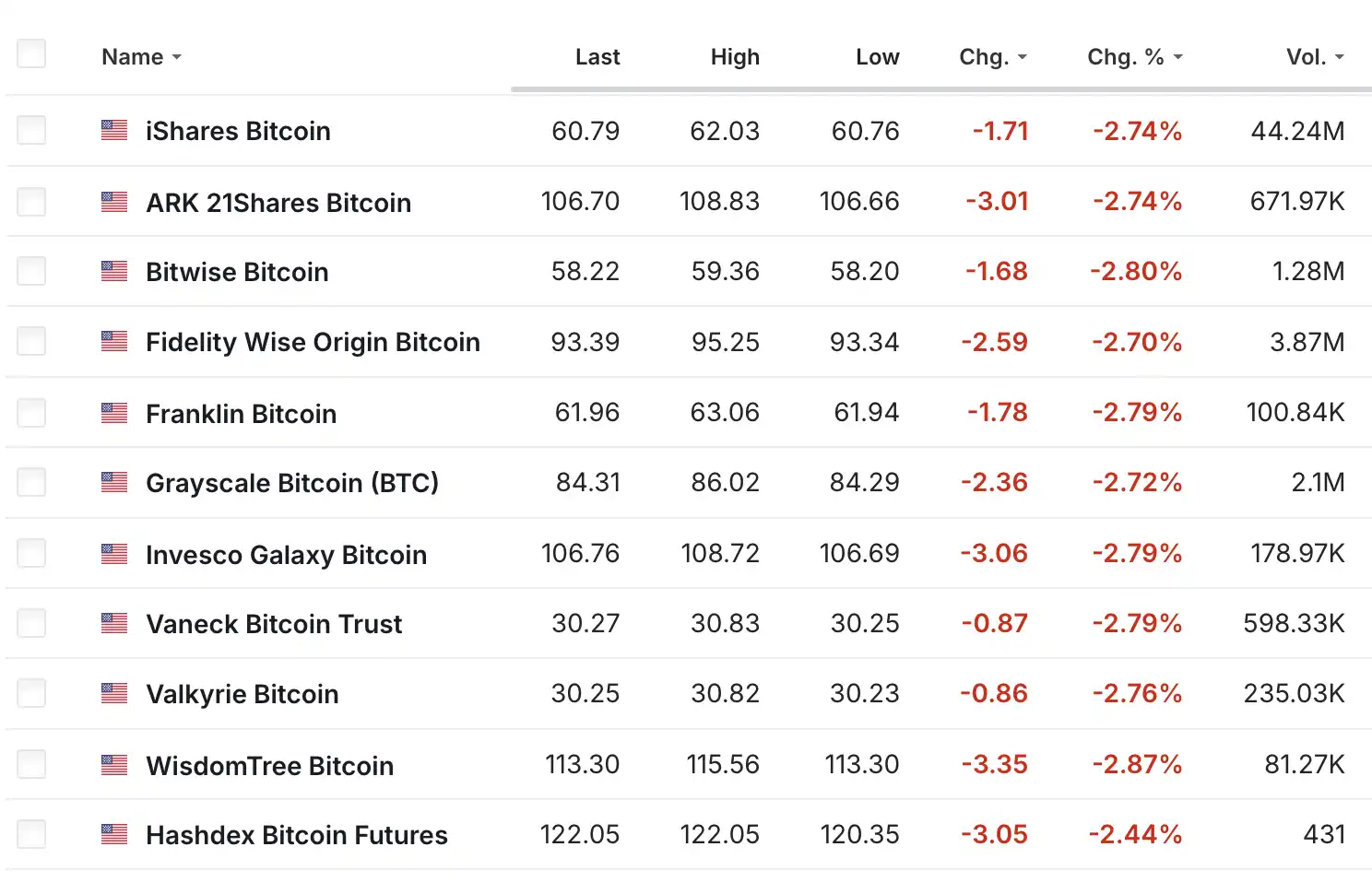

相比之下,由 Ark Invest 与 21Shares 合作推出的 ARKB ETF 当日净流出 3429 万美元,为当日最大单一流出。但即便如此,ARKB 的累计净流入仍达 26.53 亿美元,表现稳健。这类流出可能仅是短期获利了结,或是投资者将资金转向表现更强的产品如 IBIT,反映出市场内部竞争日趋激烈。

这些资金流动代表了什么?

这 4.33 亿美元的净流入表明,投资者对比特币的信心仍然强烈。在当今通胀高企、利率变化频繁、地缘政治紧张的背景下,比特币被一些人视为「数字黄金」,是一种避险资产。IBIT 的强势表现也反映出大型金融机构的信任。而 ARKB 的流出则提醒我们,短期市场情绪变化可能快速影响特定 ETF 产品的资金流。投资者可能会基于费率、流动性、或管理团队的信任度在各 ETF 产品间做出选择。

目前比特币现货 ETF 持有的比特币已占流通总量的 6.11%,这意味着其对现货市场的影响非常实际。当投资者购买 ETF 份额时,基金需要同步购买真实的比特币作为支持,这将推动现货价格上涨。

累计 453.44 亿美元的资金净流入,证明了这些 ETF 为加密市场带来了巨大的流动性,并成功搭建起通往传统金融体系的桥梁。

投资者的机会与风险

比特币现货 ETF 提供了诸多便利。它们让普通人可以轻松投资比特币,无需掌握复杂技术或自行管理数字钱包。这些 ETF 多由如美国 SEC 等机构监管,为市场增添一层信任保障。像黑岩这样的大型机构的参与也带来了稳定性和公信力。但风险依然存在。

比特币本质上仍是高波动资产,ETF 价格可能因政策、消息面或宏观经济事件迅速下跌。此外,大多数 ETF 会收取管理费,长期来看可能影响实际回报。投资者需认真评估自己的风险承受能力,在潜在收益与亏损之间做出合理平衡。

比特币与 ETF 的未来展望

展望未来,比特币现货 ETF 有望持续增长,并进一步加深与传统金融的融合。5 月 28 日的 4.33 亿美元净流入,以及当前 1302.91 亿美元的总资产,显示这个市场仍有广阔成长空间。

IBIT 的成功体现了机构资金的力量,而 ARKB 的净流出则提醒我们,市场仍处于动态竞争中。随着法规不断优化,未来或将有更多金融机构推出自有的比特币 ETF,进一步拓展市场。

对投资者而言,比特币现货 ETF 是进入加密领域的便捷通道。但若想获得长期成功,必须理解市场趋势,密切追踪资金流向,并时刻保持风险意识。

本文来自投稿,不代表 BlockBeats 观点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。