「Internet Capital Markets」这个在 Solana 基金会主席 Lily Liu 布道的概念在 Believe 爆火之后在 Solana 上变得火热,而另一个「ICM」概念的 RWA 项目 Collaterize 代币 COLLAT 市值突破在近日突破 9000 万美元,现回调至 5400 万美元,自一月份发射以来于 900 万美元市值左右持续盘整,终于在 5 月 18 日 爆发,Solana 联创之一 Toly 转发了 Collaterize 的 App Demo 视频让代币暴涨,也让市场重新关注起了这两个微软前员工的 RWA 项目。

ICM 是什么?

几年前,Solana 曾提出构建「链上纳斯达克」的愿景,但随着纳斯达克自身探索上链,叙事重心也逐渐转向更具加密原生性的「互联网资本市场(ICM)」。ICM 作为传统资本市场(TCM)的替代方案,使创业者能绕过风投和 IPO,通过代币化直接向网络社区融资。以 Believe App 为代表的 Solana 项目,实现了在 X 上轻松完成项目发行与投资。

如今「ICM」已取代「链上纳斯达克」,成为 Solana 的核心叙事。Solana 基金会主席 Lily Liu 多次强调,ICM 的目标是打造全球金融基础设施,让 55 亿互联网用户都能无门槛参与资本市场。Solana 团队也正全力将其构建为链上 ICM 的关键基础设施。

2024 年 12 月底,Solana 生态 Superteam 负责人 Akshay BD 曾在 Solana 2025 营销备忘录中提到「互联网资本市场」和「F.A.T. 协议工程」两个概念。他认为在 2024 年,企业将直接「在互联网」上市,并能接触到超过十亿名持有私钥的投资者——他们用手中的资金为自己期望的未来投票,不仅限于股票,而是涵盖所有值得拥有的资产类别、文化与理念。

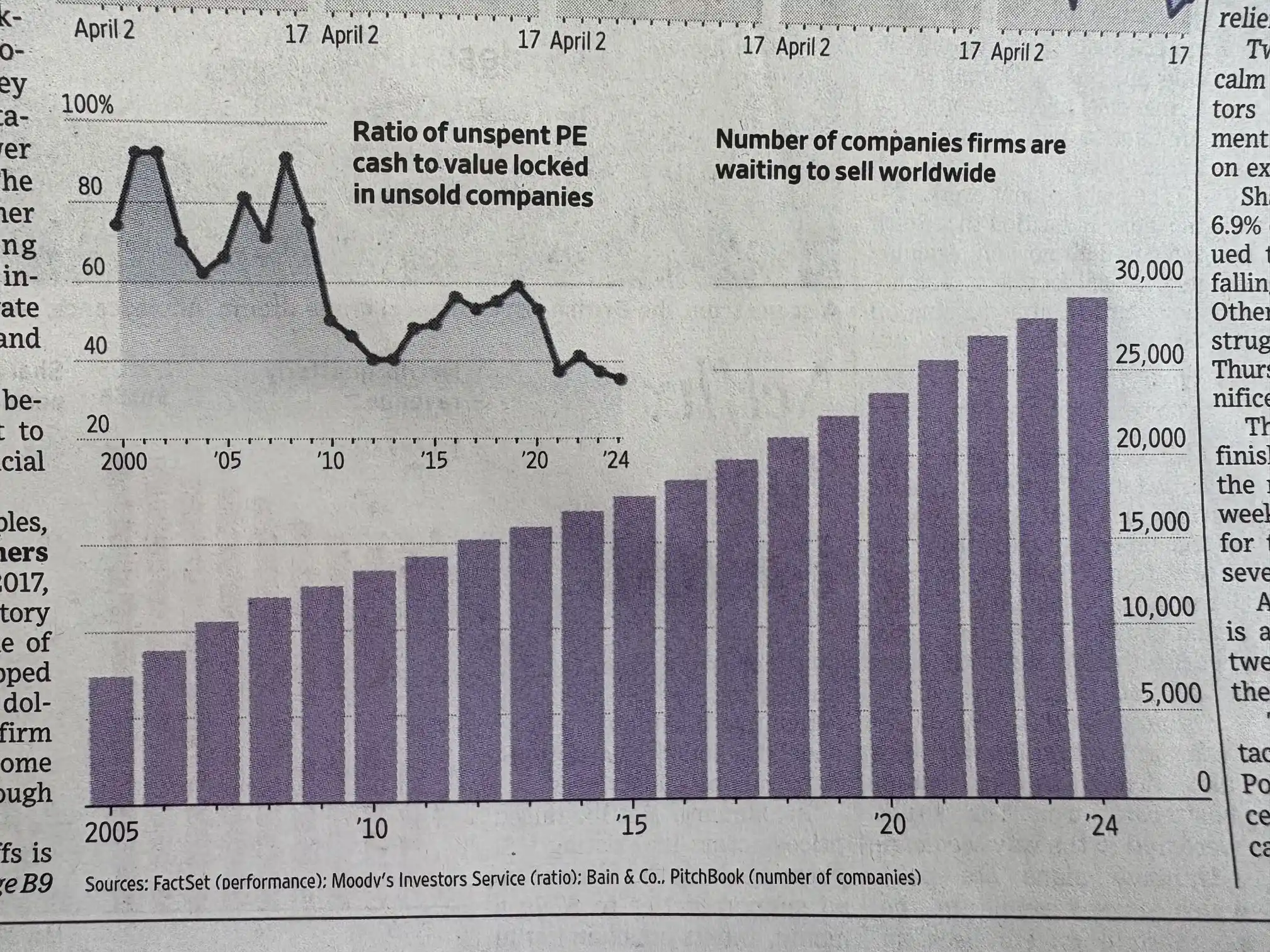

而数据表明,从 2005 年仅不到 8000 家私募股权公司需要从某个地方获取流动性,到 2024 年已经暴涨至 3 万家的需求了,似乎「在互联网上市」变得迫在眉睫。

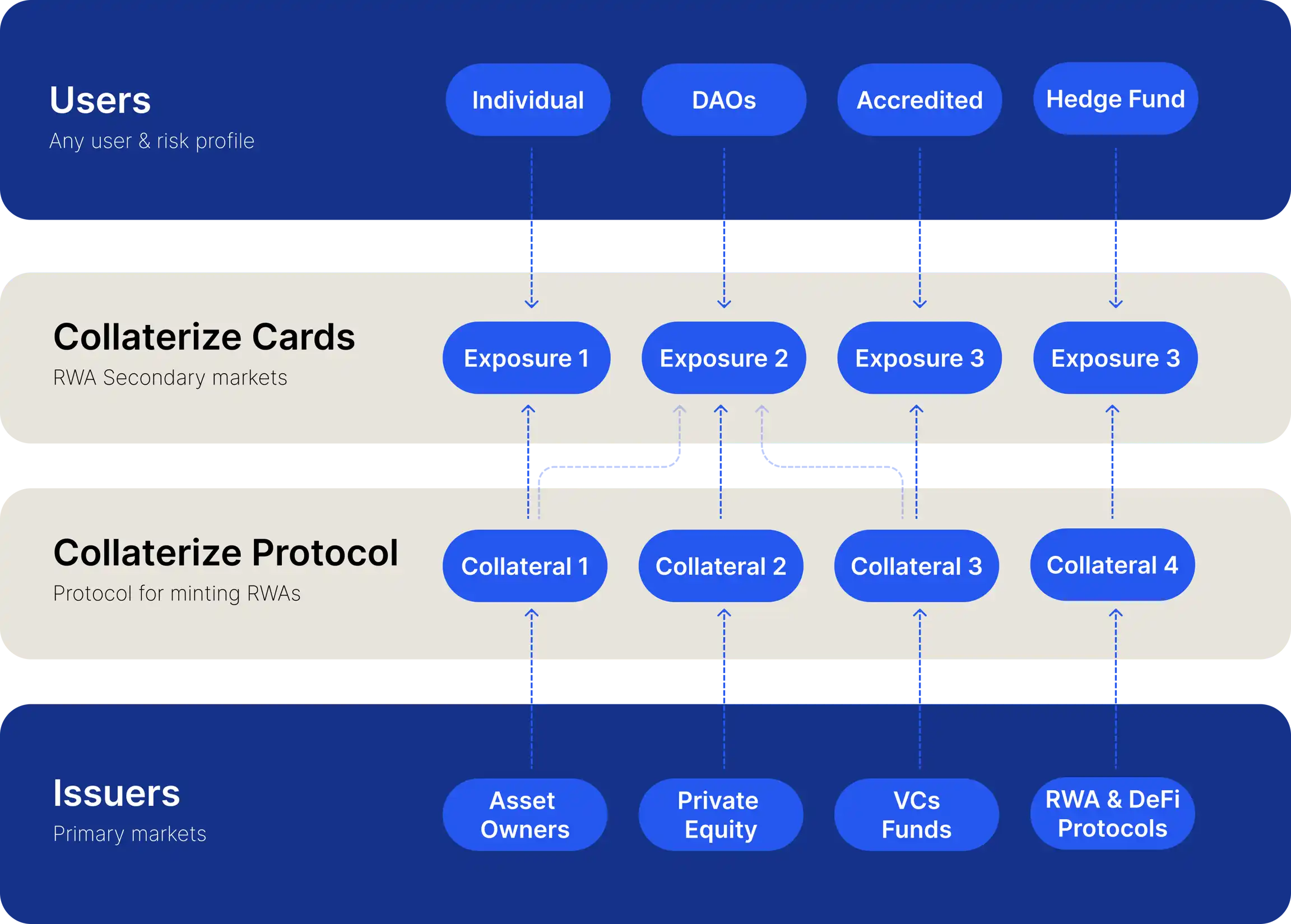

尽管依旧存在诸多批评,比如缺乏监管、项目门槛过低、容易发布误导性 token 等问题,ICM 仍具有强劲的大众采用潜力,尤其在通过简洁的用户体验、法币支付入口及病毒式叙事推广 Web3 给 Web2 用户方面。为了实现长期发展,像 Believe 这样的平台需要跳出短期炒作,推动创始人问责机制、优化 token 经济模型、构建 DAO 治理,并实现真实效用,从而将 ICM 从一场 Meme 热潮,真正转变为新的资本形成范式。在经历了 Pumpfun、Timefun、Believe 等一系列产品的更新,市场目前更需要一个更开放的、无需许可的融资和交易生态,覆盖从 meme 币到 NFT 再到初创项目的各种资产,而 Collaterize 便是在这个概念中将 ICM 的业务延展至 RWA。

RWA 也有自己的 Bonding Curve——Collaterize

Collaterize 的创始人是两个都曾任职于微软的法国人 Paul Antoine Arrighi 和 Pierre Hoffman,Paul 曾在 2015 年开启过一次自己的创业项目 OneClight,主要功能是类似于 Onkey,在网页中可以无需「输入密码」这一动作通行。而在一年后该项目并未有太大的进展,于是在 2017 年 Paul 前往在微软开启自己的另一段长达 4 年的职业生涯。

而另一个创始人 Pierre 也在同年加入微软,负责管理微软合作伙伴,确保软件资产管理服务在公共和私营部门的准确部署。而仅仅工作了一年后便离开微软,Pierre 离开之后加入 IOTA 基金会负责业务拓展。

Paul Antoine Arrighi 在 AWS Demo Day 展示 Collaterize 的 App

Pierre Hoffman 曾表示「RWA 能够实现一些以前不可能实现的功能,例如流动性、可编程性或更广泛的访问权限,因此是有意义的。我们开始看到这方面的早期案例,尤其是在美国国债或股票等公开交易的 RWA 上,但私人资产中存在更大的机会,因为这些资产目前无法进入流动性较强的市场」

美国、香港、以及 Collaterize 项目方所在的法国的 RWA 领域发展情况

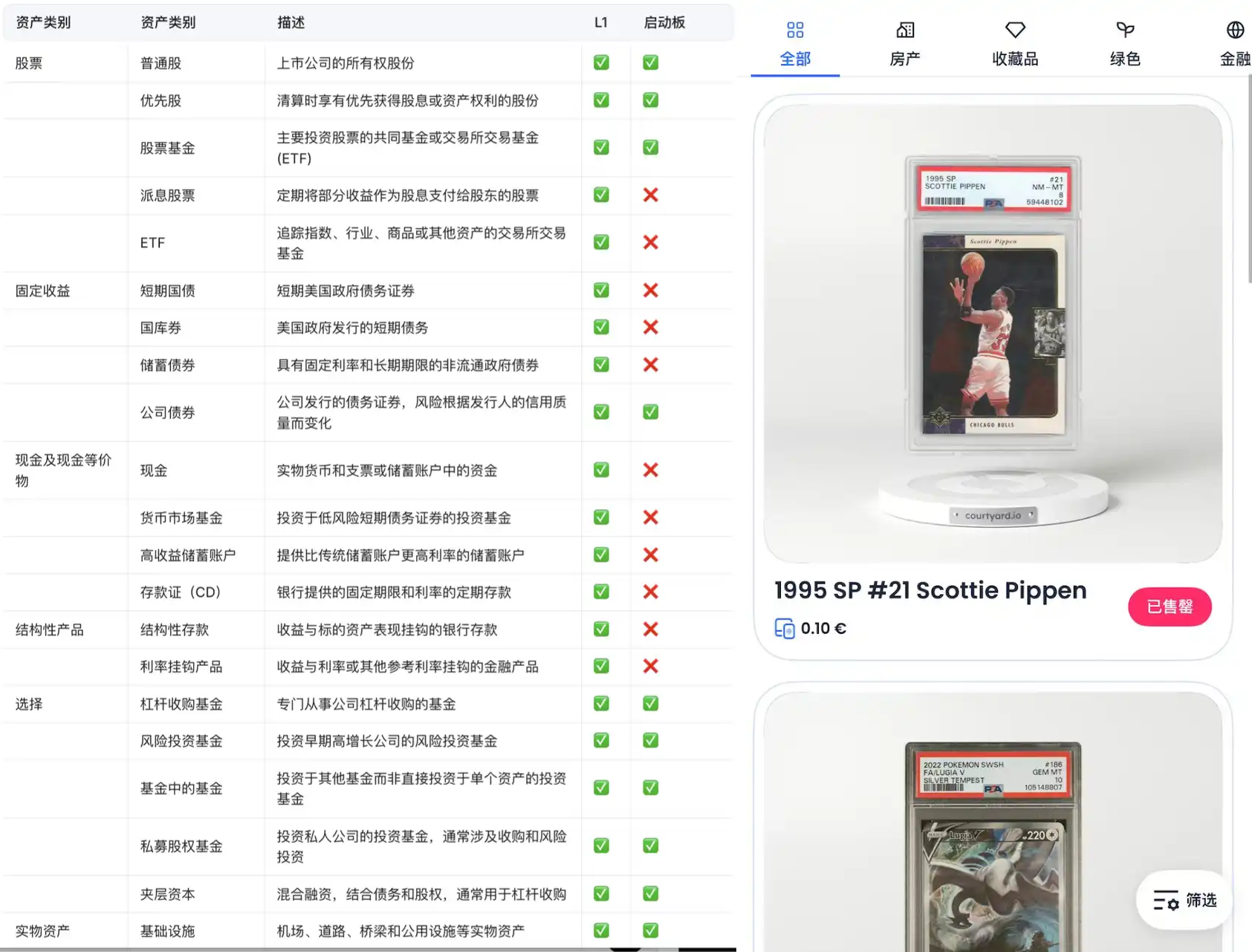

Hoffman 进一步说「如果我们能够将这些资产上链,在适当的框架下,并保持透明度。我们就可以让市场决定哪些资产具有足够的价值,可以进行交易、抵押和使用。现在感觉还为时过早,但基本面正在逐步显现」,这话与白宫加密事务负责人 David Sacks 曾提过的「万物上链」概念不谋而合,而从他们文档中支持的资产类型也在某种程度上展现了 Collaterize 的野心。

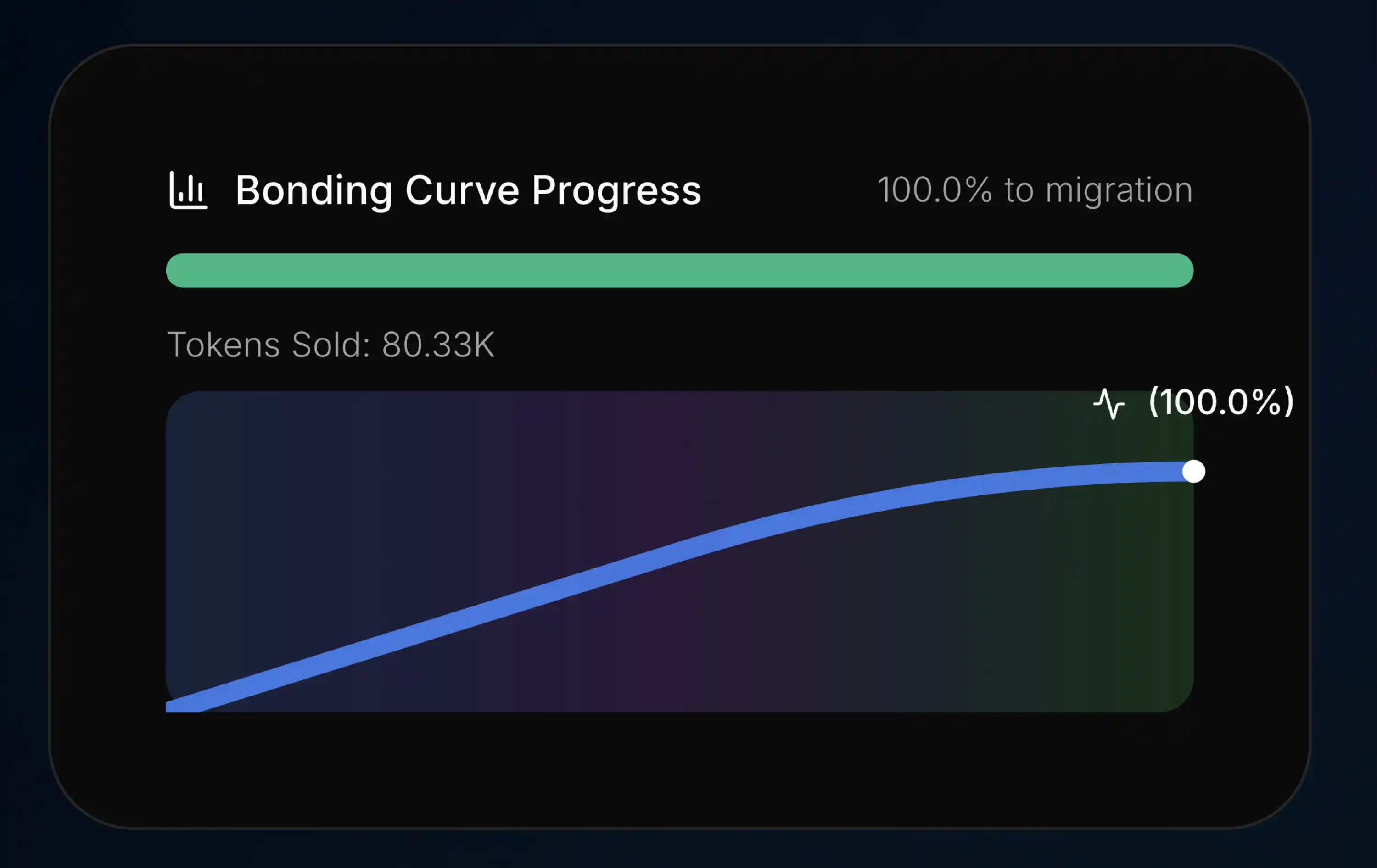

Collaterize 支持将任何 RWA 代币化的功能,从棒球卡到房地产,从公司股权到代币。比较特别的该协议采用动态债券曲线,一旦达到目标,资产便可在 Meteora 上交易,当前 Meteora 已审核该债券曲线方案。基于 Solana 的协议对交易收取 1% 的费用,迁移到 Meteora 时收取 5% 的费用。另外 15% 的费用将进入 Meteora 流动资金池。

当然创建代币的流程则不如 Believe 或者 Pumpfun 的 Bonding Curve 模式这般容易,在代币上线时会经历 Collaterize 相对严格的审查。首先申请者需要持有 100000 枚$COLLAT 然后投递申请,Collaterize 会审批公司是否具备多个纬度的可持续性,包括具备清晰的商业模式与增长计划,能够创造稳定收入并拓展新市场;拥有良好的盈利记录和可预测的现金流等。此外,特定高价值收藏品和奢侈品可被考虑为资产,前提是具备权威评估、明确出处及保险存储等保障。

根据公开的信息可以得知,当下 Collaterize 合作的最高价值的产品是即将发行的位于法国的房产「Token」,这次合作是 Collaterize 与 ARP(Asset Realty Partners)合作后首次推出的产品,ARP 在 2025 年 3 月的 MIPIM「国际房地产展」上宣布与 Collaterize 合作。

这家成立于 2006 年的房地产综合服务公司来头也不小,总部位于法国巴黎,由 Pascal Roth 创立。他在德国抵押银行工作近 20 年后,创建了 ARP 以提供专业的房地产服务,该集团当前管理数十亿欧元的资产。

而这并不是他们第一次尝试「碎片化房地产资产」,其在 2020 年通过控股子公司 Beefordeal 进入房地产众筹市场,该平台允许投资者以最低 1000 欧元的资金参与房地产项目,提供约 10% 的潜在回报,截至 2023 年,平台已经累计融资超过 1100 万欧元。

不过即使在现实世界的合作阵容如此豪华,Collaterize 还是逃不过一个悖论。当前阶段,Crypto Native 用户会本能性的拒绝审查机制导致他们排斥合规化的资产协议,而传统资产用户对 Crypto 的接口和资产形式并不接受,从而形成了这样「合规与用户需求双错位」的市场悖论。

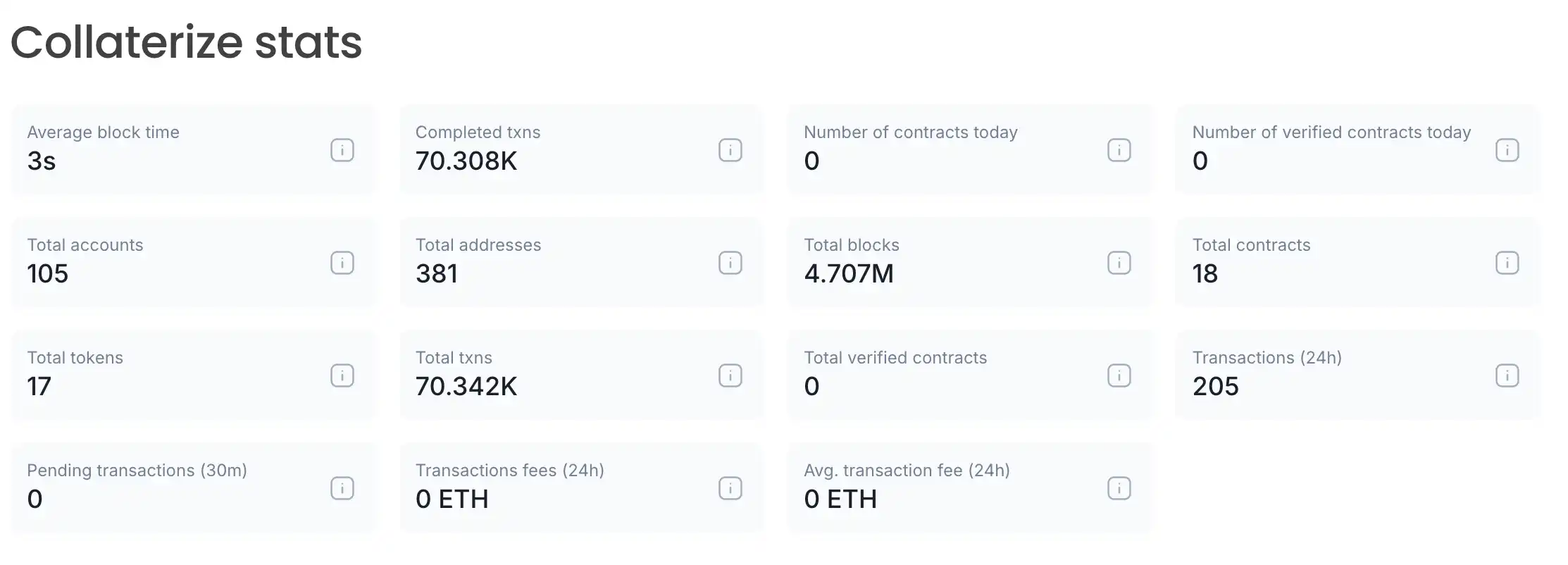

根据 Collaterize 的链上信息,在项目成立的四个月后该区块链的活跃度依然十分低,直到今日总交易 tx 才仅仅 7 万次,而总地址数也仅仅 381 个,如果仅对比这一数值,甚至不如一个数十万市值的 Meme coin 的持有人数。但无论如何,RWA 还存在一个相当漫长的发展期,背后 75 万亿美元的市场潜力虽然无限,但不管是法规、基础设施还是审查都存在十分大的不确定性。

但新的时代一直都需要新的探索者,Collaterize 作为其中的一员也同样在这片无垠的海洋中寻找「可能」存在的宝藏。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。