Original Title: "RWA is Not Just Financing - Have You Been Misled by the 'RWA Gatekeepers'?"

Original Source: Ye Kai (WeChat/Twitter: YekaiMeta)

This is a rational memorandum written for potential partners.

Recently, the companies I have been advising no longer ask whether they can raise funds, but instead begin to ask some soul-searching questions; there are also third-party professional institutional partners coming for in-depth discussions, especially from strategic consulting firms, auditing firms, and so on. This is a very good signal. I have always been telling companies and institutions that RWA is not just about issuing financing; it has a much larger strategic scope. Issuing financing is actually just a small part of it, and most people have not yet seen the market opportunities within.

Let’s put the issues on the table

For more than half a year, the "RWA wealth creation story" has led companies and institutions to only see "quick money" and not "long-term gains."

Hong Kong has been passively "ripened," with a certain institution's spring tonic hastening the RWA market in Hong Kong. The asset side, funding side, and professional service side have not yet received the necessary education, yet they have been pushed onto a platform of inflated expectations.

A few platforms have set high thresholds and heavy fees with gimmicks like "sandbox" and "unique alliance chain," further solidifying the narrow perception that "RWA = financing."

If orderly and rational guidance is not provided soon, the bubble in Hong Kong's RWA market will inevitably burst, and at that time, not only will the project parties be hurt, but even the market institutions that genuinely want to delve into industrial upgrading and globalization will be swept away.

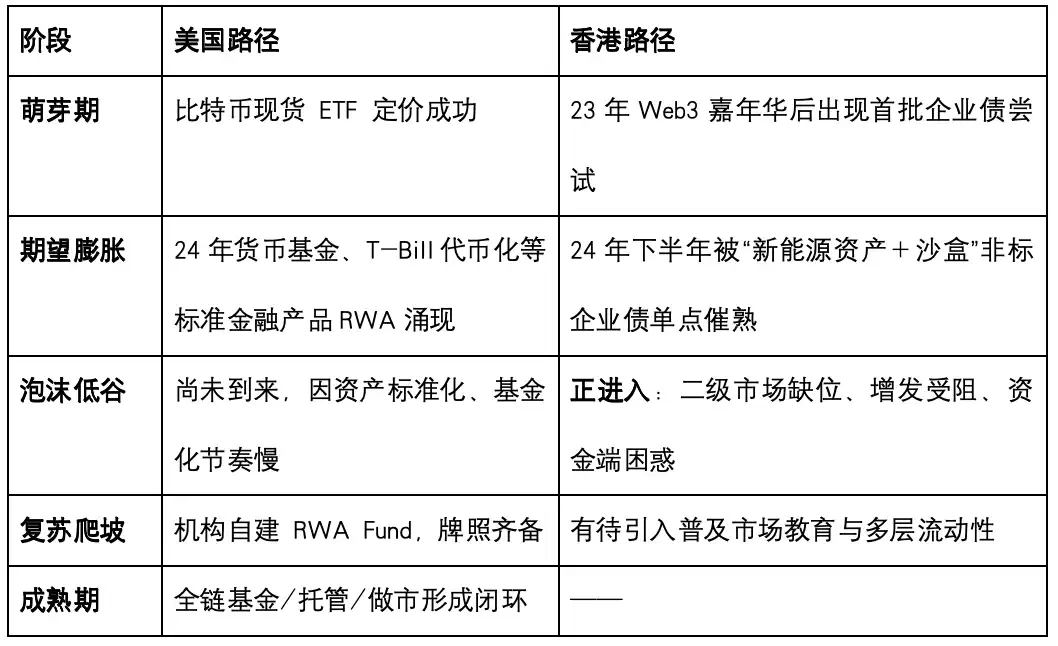

1. The Gartner Curve of RWA: The U.S. Steadily Starts, Hong Kong Passively Ripens

Key Observations

· United States: First, standardization (ETF, MMF, government bonds) is being done, and currently, the tokenization of U.S. stocks is being promoted. Although the scale is large, the risks are controllable, and it is still in the early stages.

· Hong Kong: Starting from non-standard corporate bonds, accelerated by a few institutions, the asset side has no reserves, the funding side must bring its own funds plus a 10% cost, and the service side has not yet been mass-produced. All three legs are still developing, yet they are already on the stage of inflation.

Conclusion: The primary task of Hong Kong's RWA is not to "issue a few more bonds," but to rebuild the capabilities of all three sides and provide market education.

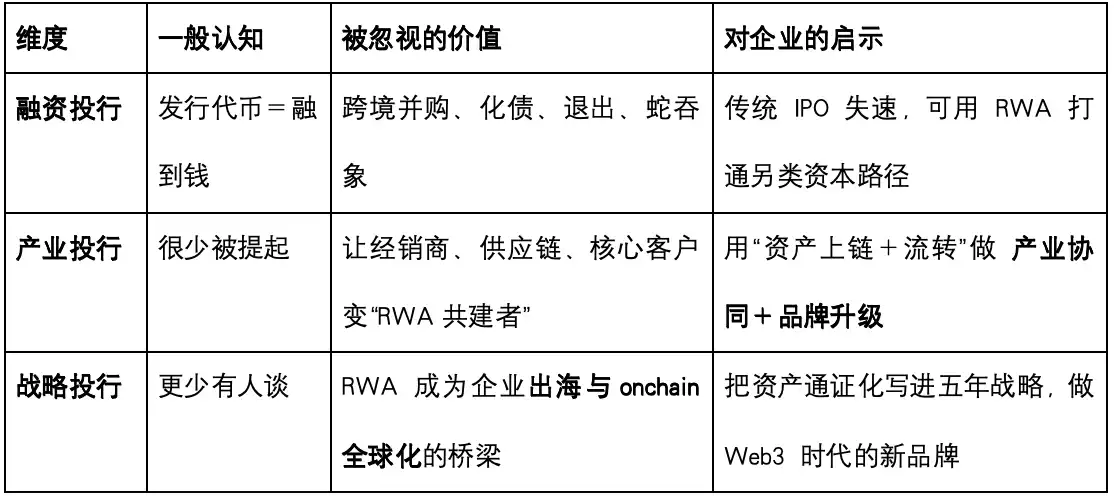

2. Financing is Just the Tip of the Iceberg: The Three Cards of RWA

Cognitive Gap - "The Insight from Selling ERP"

Over 20 years ago, the professional understanding of Oracle FI consultants was that we were not selling ERP software, but a combination of "strategic consulting + process reengineering + system implementation." Today, RWA is the same:

First, clarify the enterprise's digital strategy and digital asset blueprint;

Then design distributed asset pools, cross-border structures, compliance paths, etc.;

Finally, address the technical aspects of "whether to issue RWA and how much to raise."

3. Why is Hong Kong's RWA Misled by the "Gatekeepers"?

1. High Thresholds and Fees: Consultant fees can easily reach seven figures plus sandbox indicators, and asset parties must bring their own funds plus a 10% funding cost.

2. Single Asset Scope: Can only do "new energy + bonds," resembling the VIE tightrope of 2005.

3. Lack of Secondary Liquidity: Platforms cannot explain "who the market makers are and where the liquidity is," and investors sign terms after hearing a few vague statements.

4. Educational Gaps: Asset parties understand it as "issuing bonds + PPT white papers," while funding parties think of it as "high returns or interest from pledges," and service parties fall into mutual pitfalls.

Result: A surge of excitement, internet celebrity traffic, sales meetings, and funding schemes flood in, rapidly inflating the bubble, while rational players are pushed out by the noise.

4. Rational Breakthrough: Three Major Levers, Five-Step SOP

1. Three Major Levers

① Asset Side: Establish an open RWA Pool - operational cash flow + penetrable data assets + SPV isolation.

② Funding Side: Set up multi-layer RWA funds (USD/HKD/stablecoins), using a standard GP-LP structure to replace "self-funded."

③ Third-Party Service Side: Introduce brokers, auditors, and strategic consulting firms in bulk to output RWA strategic frameworks and compliance templates.

2. Five-Step SOP

① Strategic Canvas (Nine-Grid) - Use a five-in-one blueprint of "assets-funding-compliance-technology-liquidity" to calibrate enterprise needs.

② Asset Pool Pre-Certification - Dual due diligence with accountants/auditors + on-chain oracles to generate distributed asset certificates.

③ Cross-Border Structure Setup - Asset confirmation SPV + primary issuance in Hong Kong + secondary markets and liquidity pools in Singapore/Dubai + USD clearing paths.

④ Market Making & Secondary - ATS market making + AMM liquidity pools + stablecoin collateral lending, ensuring T+0 exit channels.

⑤ Continuous Information Disclosure - DAO + disclosure oracles, synchronizing asset net value/rent/cash flow, allowing investors to "watch the market" rather than "watch people."

(The following is the RWA nine-grid strategic canvas from Huaxia Digital Capital, generated with ChatGPT to prevent it from being copied by various experts and used for AI training, provided only for directional reference.)

(ChatGPT generated image)

5. What is Huaxia Digital Capital Doing? - RWA Strategic Services & Business School

· RWA Business School: Three Course Lines

Basic Introduction (RWA vs. ABS/REITs)

Practical Model of Asset On-Chain (Sandbox + Real Data)

Cross-Border Mergers & Acquisitions + Alternative Exit Design

· RWA Strategic Services:

Enterprise strategic canvas nine-grid and 3-5 year Onchain Globalization blueprint

Design RWA Fund + full process for cross-domain SPV

Bind market makers, auditing firms, and cross-border law firms to form a streamlined delivery process

- Partner Program:

Recruit partners from brokerage, trust, consulting, auditing, FA, quantitative funds, etc., to jointly promote the "RWA Standard Package" at inclusive prices.

6. Ten Soul-Searching Questions for Truly Committed Enterprises

Can RWA replace IPOs and become a "double insurance" for going global and financing?

How to include distributors and suppliers in the Token Cap-Table?

Can RWA be used for "snake swallowing elephant" asset acquisitions?

Can existing assets be securitized with RWA to complete exits and debt resolution?

How to combine RWA to transform into a "new brand in the Web3 era"?

After assets are on-chain, how should information disclosure and internal controls be restructured?

If traditional IPO listings are unsuccessful, can RWA open alternative capital paths?

How to participate in the new financial ecosystem through RWA?

Is DAO governance of assets feasible in family businesses?

Should RWA be included in the company's five-year development plan?

Conclusion: Rather than chasing the wind, it is better to create the wind

RWA is not a single action of "issuing bonds + fundraising," but a reconstruction project that integrates strategic investment banking, industrial investment banking, and financing investment banking.

View the bubble as a signal: it indicates that market education, strategic standards, and liquidity are still blue oceans.

View the gatekeepers as a whetstone: they force us to deliver SOPs that can truly operate in the secondary market.

View the wilderness as a mirror: any imagination detached from cash flow will appear illusory amidst the sounds of cicadas and flowing streams.

May we have built bridges by the time the next wave of capital heat arrives, allowing real assets and global funds to flow freely on-chain, rather than just "telling stories" in live streams or conference rooms.

ARAW Always RWA Always Win! The RWA market will quickly find its place amid wild growth in 2025. If you are interested in the RWA market and investment banking partnerships, you can add WeChat YekaiMeta to introduce yourself and join the RWA discussion group.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。