🧐 Binance Launchpool Project No. 70 - Huma Finance (HUMA) | Programming "Credit" for the Real World, Creating a Web3 Payment Financial Network (PayFi) —

Huma Finance @humafinance is one of the few projects that launched on Binance while simultaneously passing through Alpha and Launchpool;

My research and interest in it mainly stem from several articles by @thecryptoskanda and @DrPayFi, and I didn't expect it to reach Binance so quickly;

In my previous tweet, I also discussed Huma through @KaitoAI, noting that I had been quietly researching it without writing anything or obtaining an airdrop.

So, moving forward, I need to write more to help myself understand, assist others in their knowledge, and earn some points along the way—why not!

First, let me explain why I want to write:

It's because I believe many people have not yet realized that Huma Finance could be a watershed moment for the entire RWA (Real World Assets) sector. This project is not here to "tell a narrative"; it is here to rewrite the paradigm of "credit."

Read on ⬇️

1️⃣ What is Huma Finance (HUMA)?

Let me explain it in the simplest terms—

Past DeFi addressed the problem of money;

Huma aims to solve "how to use future money."

Huma is a lending protocol network built on Revenue & Receivables, aiming to create a PayFi network that serves global liquidity needs, with the core concepts being:

💳 Income-backed lending: Unsecured, but provides credit based on future stable cash flows.

📈 Receivables Factoring: Unlocking liquidity of corporate receivables through tokenized payroll data, sales data, invoices, etc.

🤝 Supporting real-world payment scenarios: Such as supply chain finance, cross-border settlements, salary advances, NGO funding distribution, etc.

The logic behind it is simple:

It's not about what assets you have, but how much income you will have in the future, how much you owe others, and how much "receivables" you have—these can all become part of your credit and be assets that can circulate.

It sounds like a Web3 version of Stripe Capital + Klarna + NGO distribution tools—but it goes deeper than you might think.

2️⃣ The financial needs of the real world are not about the compound interest of whales, but the circulation of small and micro enterprises:

You might think the endpoint of DeFi is institutions, but the larger market is:

NGOs that pay salaries monthly;

Individual workers wanting to advance their income;

Cross-border merchants pressured by supply chains;

Startup teams that cannot provide collateral.

They don't need leverage; they need cash flow.

The core of Huma is not a "lending platform," but a PayFi network that allows future cash flows to be monetized.

Understanding this point helps grasp the core role of HUMA;

2️⃣ Why is Binance launching HUMA?

Why Binance?

Because it understands that liquidity needs to be ignited by narratives, but trust must be built through real-world cases.

Huma has more than just a narrative; it has:

The ecosystem integration of Circle and Request;

Real distribution scenarios in collaboration with the UNDP;

Multi-chain deployment + enterprise API integration capabilities;

Credit characterization solutions from institutions to individuals.

To put it plainly, it aligns very well with Binance's strategic focus on "RWA (Real World Assets) + DeFi."

Currently, RWA is one of the few narratives still maintaining growth and financing vitality, and Huma is one of the rare protocols focused on "cash flow assets" rather than "real estate, bonds" type RWAs, deeply tied to stablecoins, offering greater composability and universality.

Conclusion—

The future of DeFi is not about a 10-fold increase in TVL, but about 1 billion more people in the real world being able to use it to make money.

HUMA is not just RWA; it is the starting point of "income finance"!

You could say it is "unsecured lending V3," or you could say it is the beginning of "cash flow asset tokenization."

But I prefer to say—

Huma is the first protocol to truly attempt to package, chain, split, and trade credit, and it may even be the central engine of the on-chain identity economy.

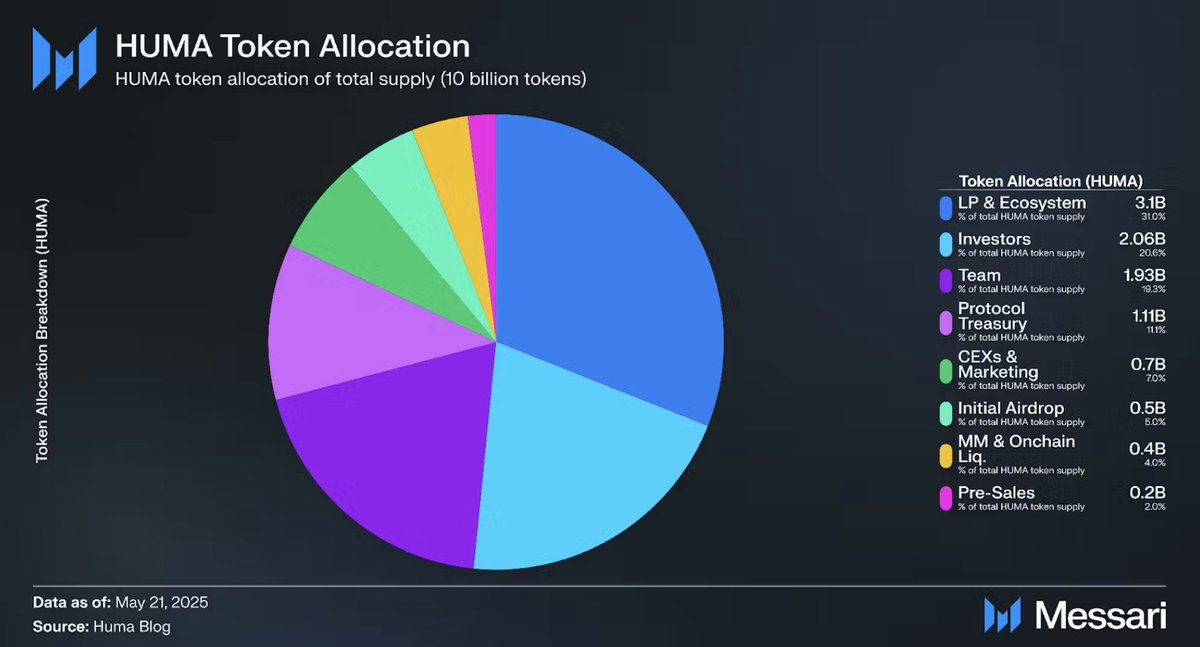

Currently, after launching on Binance, the price is in a state of fluctuation. I think it’s a good time to enter, especially since Huma Finance has partnered with KaitoAI, allocating 0.5% of tokens to community contributors, and has launched on Binance. It currently has both heat and breadth;

What it lacks is just an opportunity!

Binance #humafinance #KaitoAI

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。