Can Retail Investors Follow the Coins Whales Are Trading? Learn to Use AI to Identify Short-Term Dark Horses!

Market Trends and Hot Coins

Recently, the cryptocurrency market has heated up again, especially AI concept coins, memecoins, and projects related to real-world assets (RWA), which have frequently attracted capital and sparked short-term trading frenzies. For example, coins like $TAO (Bittensor), $WLD (Worldcoin), $SHIB (Shiba Inu), and $MANTRA (OM) have shown active performance recently, often driven by whale capital, leading to significant price fluctuations. Taking $TAO as an example, since May 2025, its price has surged over 20% within a few days due to the ongoing hype around the AI + blockchain narrative, with trading volume skyrocketing; $SHIB has also seen multiple price increases in a short period due to community hype and trending topics on platform X.

As retail investors, should you participate in this hot trading? The answer is yes, but with cautious operations and strict risk control. The key issue lies in the ability to "filter," that is, to accurately capture potential coins and entry timing through data and tools.

Tools and Methods for Filtering Hot Coins

In addition to tracking news sections, retail investors can use professional tools to capture coins with trading anomalies and uncover potential trading opportunities. For example, you can directly lock onto targets using indicator filtering functions, focusing on:

- Is the trading volume rapidly increasing? This indicator suggests quick capital inflow, possibly driven by large holders or institutions.

- Can the price increase exceed 15% within 1-4 hours? This can reflect heightened market sentiment or the initiation of short-term trading.

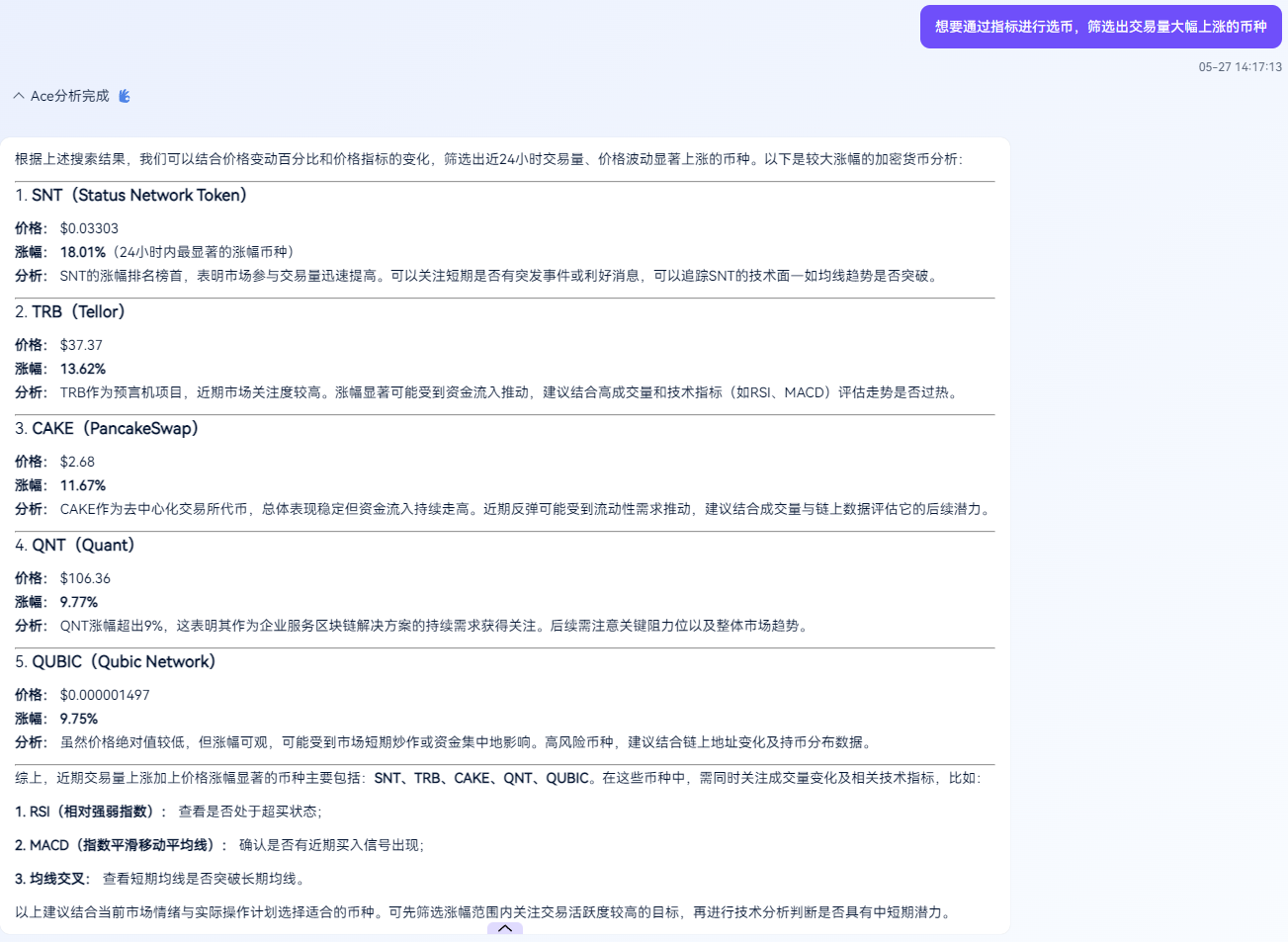

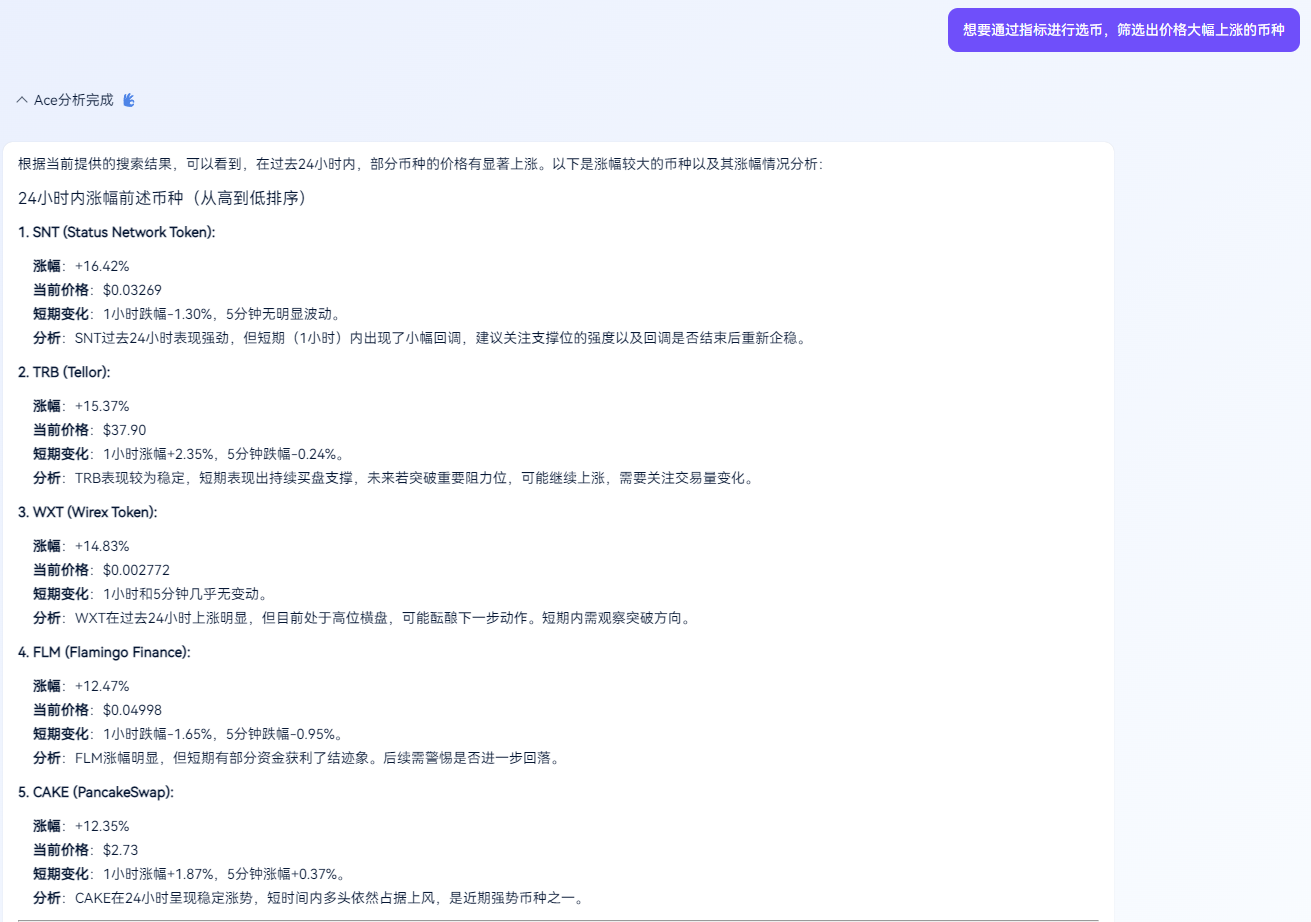

If you are not familiar with indicator filtering or want a simpler and more efficient method, you can directly use the AI intelligent filtering function. Just input your target, and the AI will automatically filter out coins that meet the criteria, while also integrating platform sentiment, on-chain data, and other information to provide suggestions.

After filtering, retail investors can add the coins to their watchlist and further observe them in conjunction with technical indicators and on-chain dynamics to accurately grasp the entry timing. Below is a strategy that can be referenced.

Light Positioning Strategy: Capturing Short-Term Opportunities

Light Positioning: When a coin breaks through a key resistance level and trading volume significantly increases, take a small position to chase the rise, quickly capturing short-term momentum, and strictly set stop-losses to control risk.

Operational Steps:

- Confirm the breakout: The price breaks through recent highs or important resistance levels, and trading volume increases by more than 2 times.

- Combine technical indicators for judgment: RSI between 50-70 indicates strong momentum but not overbought. MACD shows a golden cross, and the histogram is increasing, confirming an upward trend. At the same time, the Bollinger Bands are expanding, with the price close to the upper band but not touching it.

The movement of $TAO on the evening of May 21st fits this strategy: the price broke through the recent high of $440, trading volume increased by over 2 times, RSI was below 70, and the Bollinger Bands were expanding with the price close to the upper band. If retail investors chased the rise with a small position after confirming the breakout and set a stop-loss (e.g., at $420, with a risk of about 4.5%), they could effectively capture short-term profits (target $460, with a return of about 4.5%).

AI Filtering Assistance: $TRB Case Analysis

Through the AI intelligent filtering function, the coin $TRB (Tellor) has shown potential signals: trading volume surged over 200%, the price broke through previous highs, RSI remained in the 50-70 range, MACD showed a golden cross, and the Bollinger Bands were expanding. These signs indicate that $TRB may be entering a short-term trading cycle, meeting the conditions of the light positioning strategy. Of course, future trends still need market validation, but it is undeniable that the AI filtering function greatly saves manual analysis time, helping retail investors quickly identify potential coins. Retail investors can add $TRB to their watchlist, closely monitor its technical indicators and on-chain data, and combine the above strategies for precise operations to seize short-term opportunities.

Retail investors participating in hot coin trading need to grasp the "quick in and out" principle, using indicator filtering or AI intelligent filtering functions to quickly lock onto potential coins, and develop strategies in conjunction with technical indicators (such as RSI, MA, trading volume) and on-chain data. However, regardless of the strategy, strict stop-loss and take-profit measures are key in such situations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。