Kraken just announced tokenized stocks and ETFs, but their next move could be on @inkonchain.

Inkchain is built to bring institutions on chain by integrating compliance tools into the network.

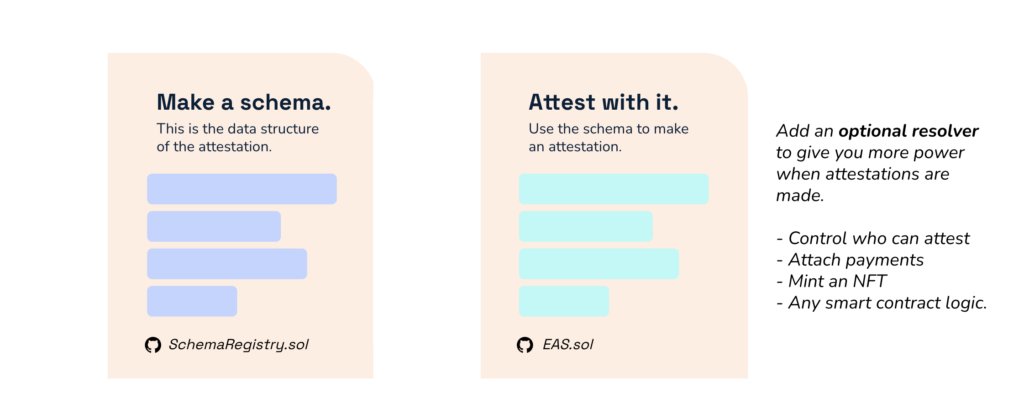

Kraken Verify uses the Ethereum Attestation Service (EAS) to create on-chain attestations linking Inkchain wallets to their verified Kraken accounts.

Through EAS, Kraken could integrate centralized services onto Inkchain and unlock compliant on-chain trading that's as intuitive as a CEX.

This opens up interesting possibilities. While Inkchain doesn't require KYC, verified wallets could potentially access regulated markets like tokenized stocks and other financial products on-chain.

Kraken's position as a major exchange provides a competitive advantage. All Kraken needs to do is integrate their offerings with Inkchain and enable verified wallets to access regulated features.

Eventually we could see a future where users enjoy the best of both worlds without leaving their wallets.

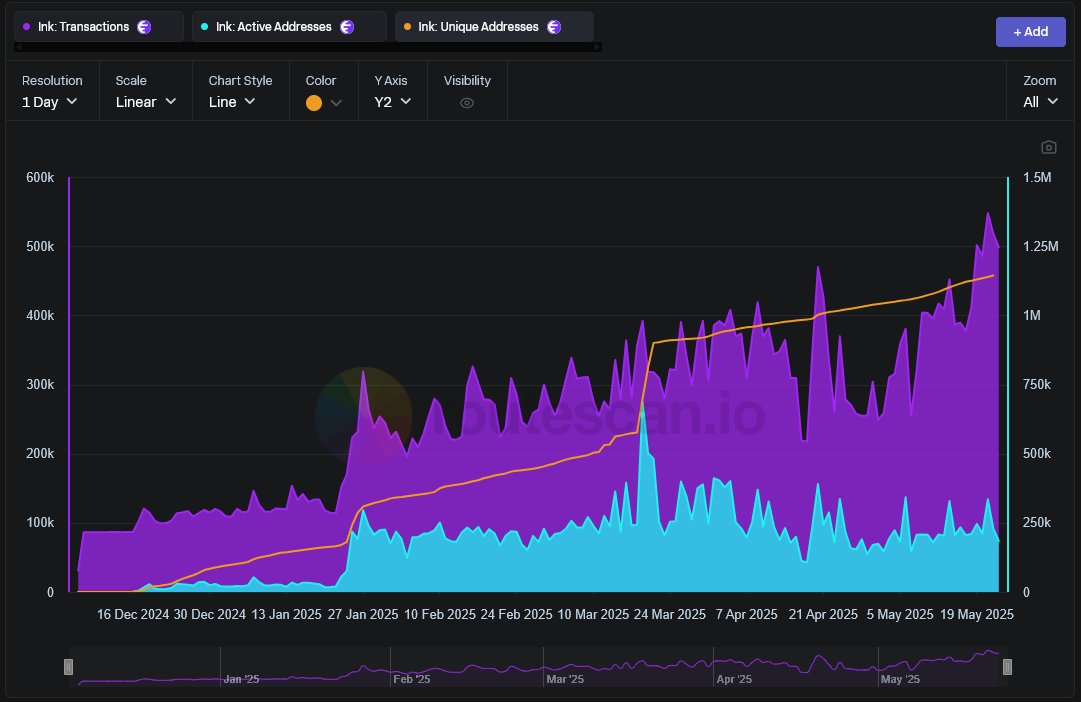

Inkchain adoption is growing:

• Hit a new ATH of 547k daily transactions on May 21st, a 4x increase since March.

• Recorded 134k daily active addresses same day.

• Passed 1.13M+ unique addresses five months after mainnet.

As tokenization gains momentum, Inkchain could become a big player in bringing RWAs on chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。