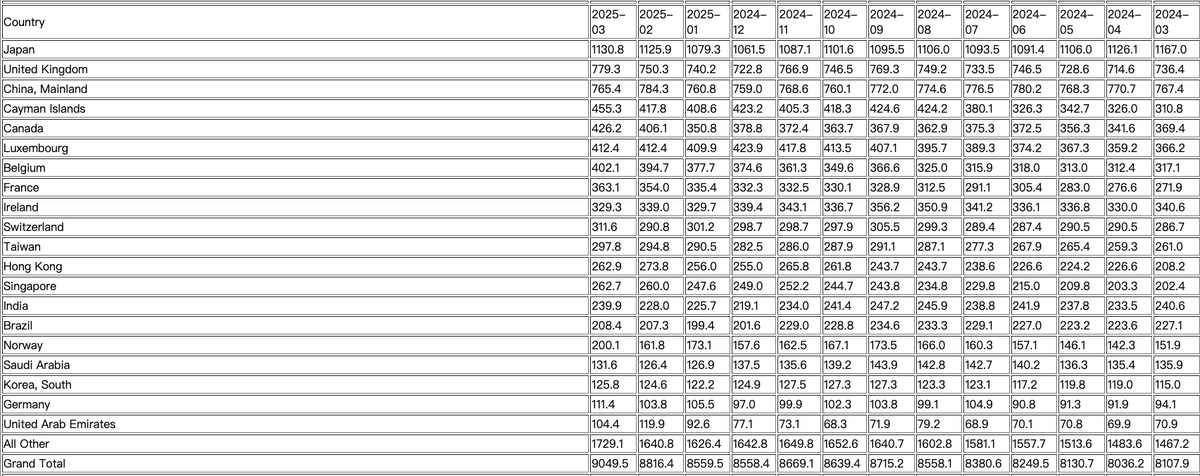

美日债务是联动的,因为日本是目前美债最大的 holder,目前持有 1.13 万亿,占了美债整体的 3% 多,但如果日本要卖这些债,意味着美债的崩盘,因为这相当于给流动性本就紧张的美债增加了巨大的负担。

当然日本不一定会卖美国国债- 一方面会有美国的压力,另一方面现在卖也很亏。

另一种可能是从swap借美元出来,但这意味着日本要背短期的高利率。另一个角度也就意味着美元qe重启 - 这对于风险市场是好是坏?

但不管哪种情景,看来美元有贬值的可能。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。