本报告所提及市场、项目、币种等信息、观点及判断,仅供参考,不构成任何投资建议。

美中于瑞士举行的首次接触促成重大成果,标志着“对等关税战”第三阶段取得重大进展。

美股和加密市场迅速清除了“对等关税战”的负面定价,速度之快、幅度之大超出预期。

市场交易者开始以新范式进行交易——美国经济与就业会否出现衰退与美联储合适重启降息的博弈。

本周公布的通胀和就业数据表明通胀继续下行、就业暂时稳定——对等关税冲击低于预期。

超预期数据输入新交易框架之后,推动美股指周内大涨,黄金大跌。

本周,美联储主席鲍威尔发表重要讲话时提及重新审视“货币政策框架”,或推动降息周期迅速重启。但惠誉评价将美国国债由Aaa调至Aa1,再次表明美国国债的长远危机日益仍然笼罩在上空。

政策、宏观金融及经济数据

过去数月金融市场最大变量“对等关税战”在5月12日发生重大改变。美中在瑞士接触后宣布了90天的临时关税减让协议。美国将对中国商品的关税从最高145%下调至30%,其中包括20%的“芬太尼关税”以及10%的基础关税。 中国将对美国商品的关税从最高125%下调至10%,并暂停或取消自4月以来实施的非关税反制措施,如稀土出口限制。

此前,我们指出关税战已经进入第三阶段。美中此次的初步协议意味着第三阶段取得重大进展,叠加此后特朗普宣布无法与150个国家一一谈判的信息,我们倾向于判断关税战的冲击正逐步过去,且最终结果可能不会对全球经济在短期内形成超预期影响。

这应是美股交易者全周做多,迅速将三大股指大幅推高的原因所在。全周,纳指、标普500和道琼斯指数分别上涨7.15%、5.27%和3.41%,三大股指均已实现4周连涨。如果降息预期提升,可能会在短期内突破历史前高。

本周美国发布4月CPI数据,季调CPI月率为2.3%,低于预期,实现3月连降。15日发布就业数据显示首申失业金如数为22.9万,符合预期。而呈现企业趋势的PPI则为2.4%,略低于预期。多项数据叠加表明关税战尚未对消费形成硬数据上的损害,伴随通胀下行,重启降息正成为最佳选择。

鲍威尔本周演讲时表示,2020年引入的货币政策框架(以2%平均通胀目标为核心,允许通胀适度超调以支持就业)在当前经济环境下已不完全适用。他提到,频繁的供给冲击(如关税战、供应链问题)使得平均通胀目标制难以应对,需调整政策以更好地平衡通胀和就业目标。美联储在过去几年使用的框架中,往往追求过去一段时间CPI均值接近2%时再采取行动。而此次提及的重新审视可能推动其根据更短时间甚至单月的CPI数据便可采取行动。这无疑将提升其灵活性,以应对特朗普政府频繁政策调整所导致的数据波动。按新的框架,目前的CPI数据已经非常接近其降息的要求。

美联储重申货币政策框架背后可能还有更深层次的原因,那就是美债问题。伴随美股上涨,本周2年期和10年期美债收益率再次反弹达到4.0140和4.4840的高位。

据分析,美国今年新增1.9万亿美元债务,而今年到期置换的规模可能达到9.2万亿,其中仅6月份便高达6.5万亿。如果不尽快启动降息,不只是美国政府将继续承担高额利息,还可能面临一级市场的拍卖难题。作为“灰犀牛”,巨额债务将继续困扰美国政府,并成为影响其政治、经济、金融政策的最重要变量。我们判断美联储调整货币框架,债务及债务引发的潜在危机才是根本原因。

5月16日,评级机构穆迪将美国政府的长期发行人和高级无担保债务评级从Aaa下调至Aa1。这是穆迪自1917年以来首次下调美国国债评级,也标志着美国失去了三大评级机构(标普、惠誉、穆迪)的最高信用评级。此前,标普于2011年、惠誉于2023年已分别将美国评级下调至AA+(类同Aa1)。

债务“灰犀牛”成为中长期影响美国利率和金融市场稳定的最重要指标。

加密市场

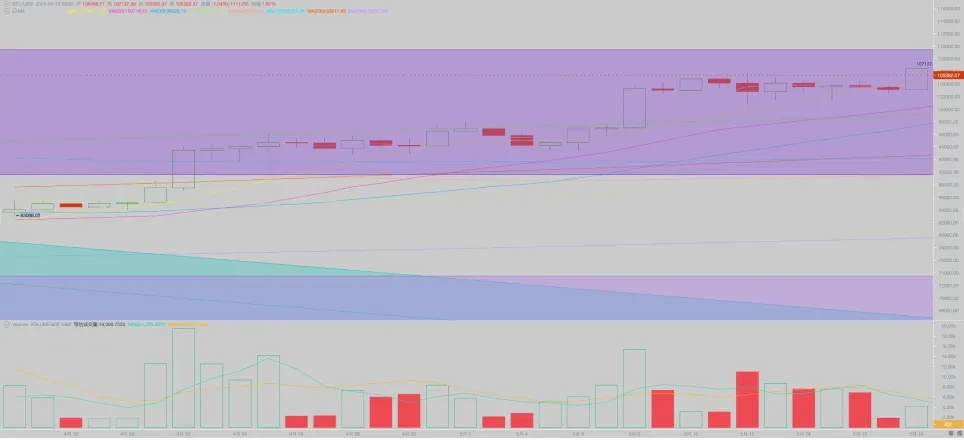

此前BTC领先美股完成对“对等关税战”清除的定价,逼近前高附近,本周美股大幅上涨之后大部分时间都维持高位盘整,及至周日突然拉升至106692.97美元,最终全周以2.24%收涨。

技术指标上,全周运行于“第一上升趋势线”之上,逼近“特朗普底”上沿。超买指标得到一定修复。量能与上周接近持平。

资金进出

本周全市场维持了相对旺盛的资金流入,两通道流入25.27亿美元,其中稳定币18.80亿,BTC ETF和ETH ETF合计6.47亿美元。

4周来,ETF通道资金流入一直在下降,这一点值得关注。

场内借贷资金处于扩张阶段。合约市场处于本轮行情的二次扩张阶段。

抛压与抛售

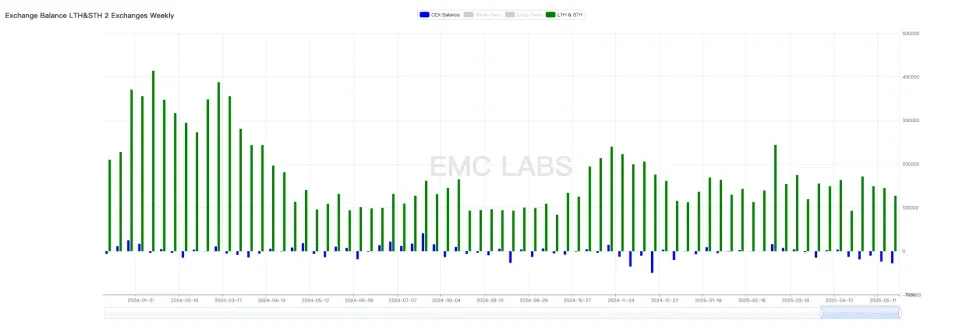

在重返10万美元之后,部分抄底资金进行了止盈操作。而伴随流动性恢复,部分长手进行了少量抛售。整体来看,“长手减持短手增持”的阶段并未完全打开,经过更多历练压力的长期买家在期待更高的价格。

中心化数字货币交易所BTC流入流出统计

从减持规模来看,本周流入交易所的BTC为127226枚,已经连续4周下降,流出交易所的规模达到27965枚,为今年以来最高。抛售规模减少,购买规模加大,在外部条件具备时往往意味着后市价格的快速拉升。

周期指标

据eMerge Engine,EMC BTC Cycle Metrics 指标为0.875 ,处于上升期。

关于EMC Labs

EMC Labs(涌现实验室)由加密资产投资人和数据科学家于2023年4月创建。专注区块链产业研究及Crypto二级市场投资,以产业前瞻、洞察及数据挖掘为核心竞争力,致力于以研究和投资方式参与蓬勃发展的区块链产业,推动区块链及加密资产为人类带来福祉。

更多信息请访问:https://www.emc.fund

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。