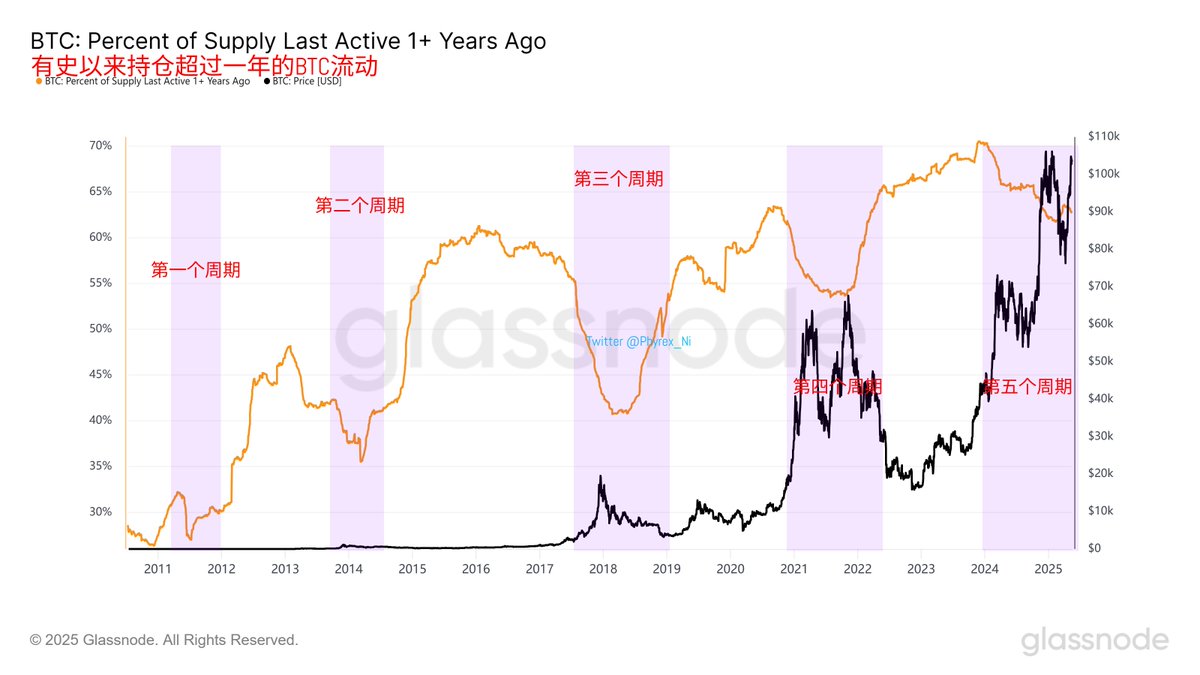

Considering that the data from long-term investors is likely from exchanges, especially with large funds being long-term deposits, it is quite probable that it comes from exchanges or custodians. Therefore, for "investors," I personally suggest looking in two directions. The first is to observe investors who have held positions for over a year; historically, this data has never been wrong.

From a broader trend perspective, when investors who have held positions for over a year start to distribute, it corresponds to price peaks, while when they begin to accumulate, it often corresponds to price lows.

Thus, the greatest benefit of this data is not to tell you who is selling. There are many reasons for long-term investors to exit, which could be due to exchanges, OTC, or simply changing addresses. However, the end result is that the exit of long-term holders leads to price increases, or price increases drive the exit of long-term holders; neither is the main point.

The focus should be on the detailed data to see if it is a distribution cycle. If it is a distribution cycle, theoretically, there is still an opportunity for price increases, as this data has never been wrong. Of course, this is only useful for $BTC. However, if Bitcoin's trend is not good, then 99% of other tokens may not perform well either.

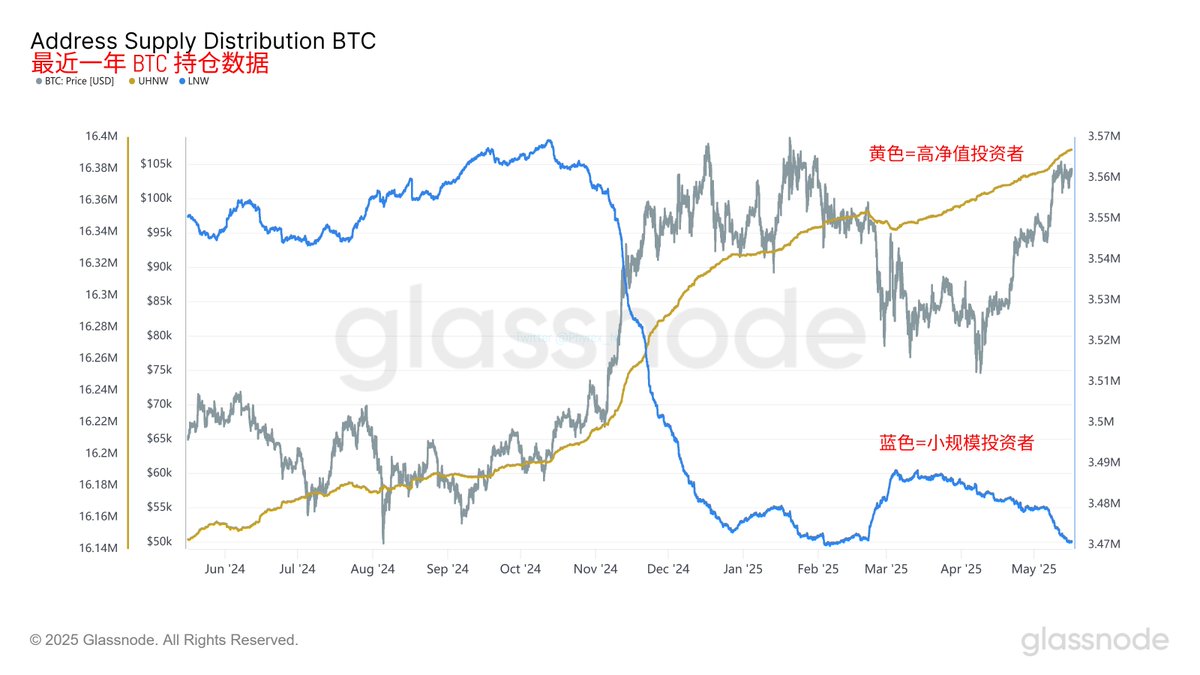

The second data point to look at is investors holding more than 10 BTC, which represents high-net-worth investors. Although the price may not necessarily rise when high-net-worth investors choose to buy, it is important to understand that the price trend of BTC is largely determined by more investors holding coins, or in simpler terms, by large holders.

Currently, high-net-worth investors hold a total of 19,391,774 BTC, while small-scale investors hold 3,471,056 BTC.

I recall a joke from before about a laid-off worker who unexpectedly won 500,000. He had no idea how to spend it. First, he asked a circle of friends he usually played cards and drank with, then he asked his former boss. His friends suggested he start a business, while his boss advised him to buy a house. In the end, he chose to start a business, and the outcome is needless to say.

When you feel confused in this market, you don't necessarily have to follow high-net-worth investors, but understanding what they are doing and why they are doing it may be more important.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。