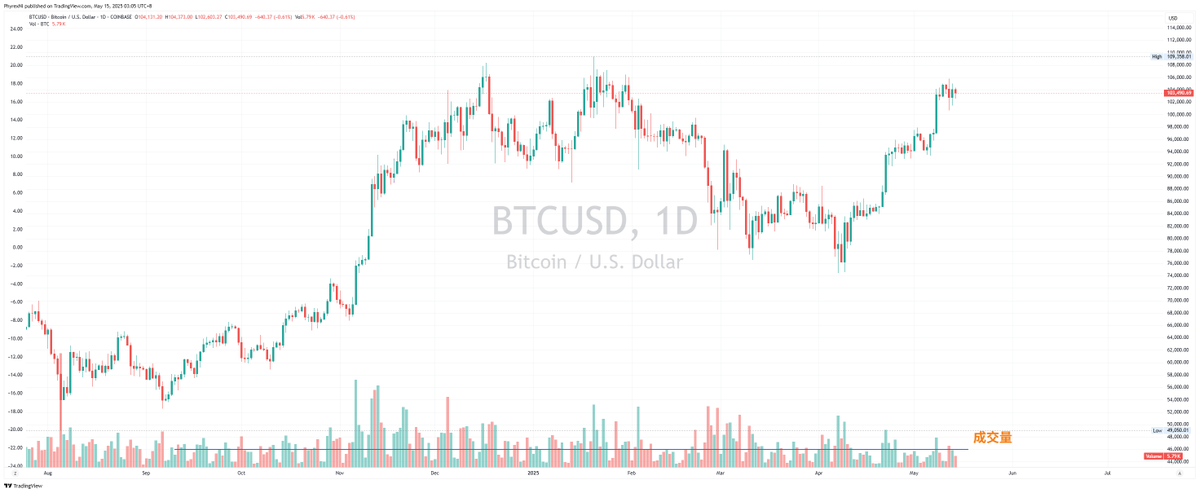

今天的作业挺简单的,既没有什么重要的事件,也没有经济,宏观和政策上的变化,所以不论是 美股 还是 $BTC 都维持着小幅震荡的趋势,并没有太大的变化,但从成交量的数据中可以明显看到成交量是在下降的,这最起码就说明了投资者并没有进入 FOMO 的趋势,反而非常的谨慎。

通过 ETF 的数据也能看到传统投资者和现货投资者都出现了观望的状态,不仅仅是 BTC ,即便是涨幅更高的 $ETH 也是同样的情况,价格的持续上涨可能还是需要有利好来推动,暂时有些上涨乏力的状态,当然目前的抛售也仍然是很低的,周报里写的交易所存量也是在持续下降的,在没有新的利好和利空数据前,暂时先看震荡吧。

换手率的数据也体现出了这一点,周内连续三天换手率都是在持续下降的,而价格的变化幅度并不大,说明投资者目前的交易意愿并不大。

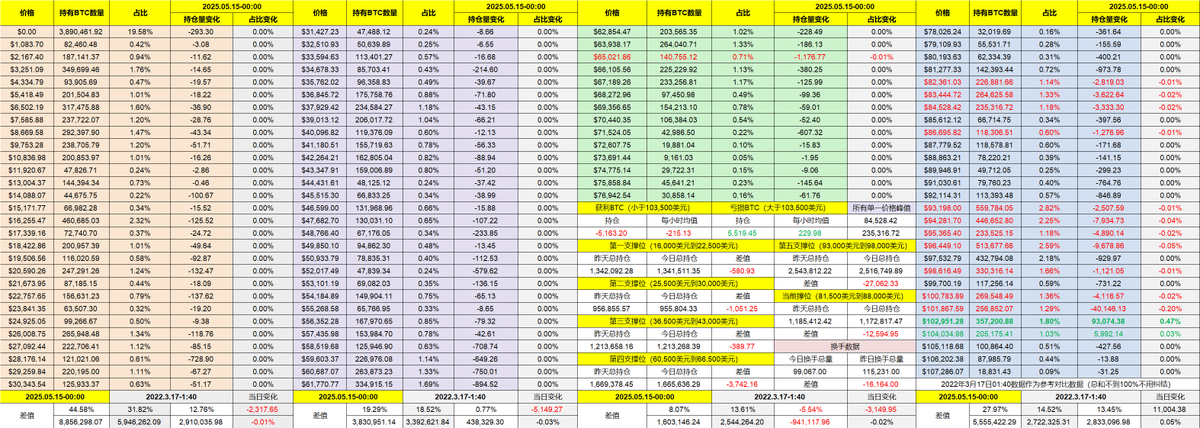

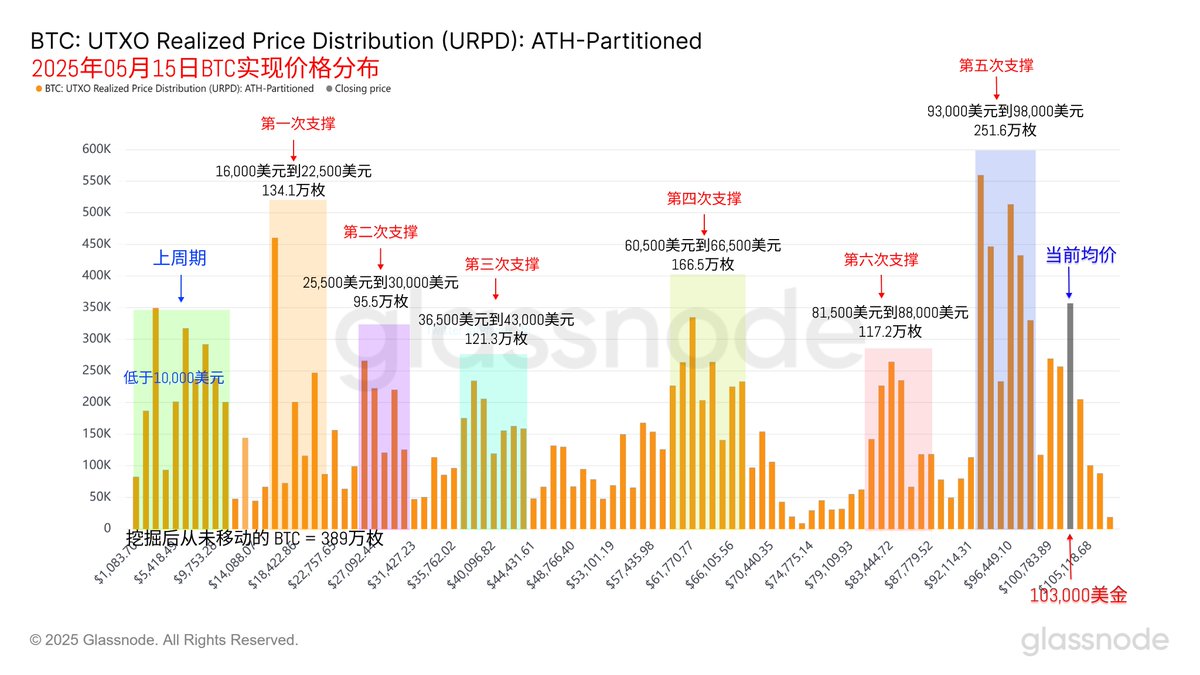

支撑的数据也仍然非常的稳定,93,000 美元到 98,000 美元的支撑位还是非常坚固的,虽然 102,000 美元开始有大量的筹码堆积,但作为支撑力还差距很大,这个位置几乎都是短期投资者。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。