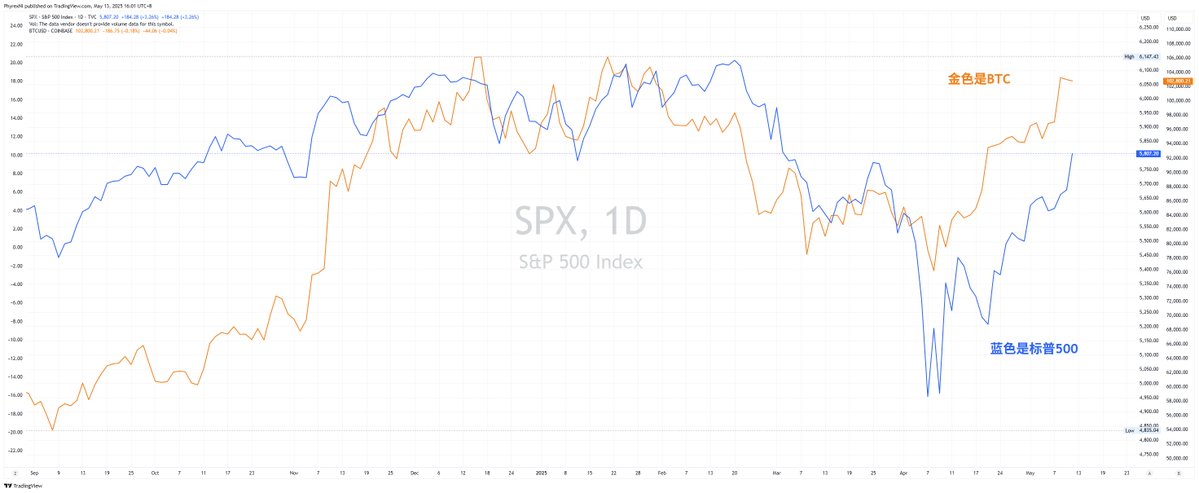

猫叔说的其实挺有意思的,我记得以前我经常用数据来告诉大家 $BTC 和美股在很大程度上都是保持一致性的,当时还是 Bitcoin 跟涨不跟跌的时候,然后就是 BTC 大幅领先的时候,到了今天反而反过来了,虽然还是聊的 美股和 BTC 的相关性,在大方向上还是一致的。

目前在美股没有看到系统性的风险,同样在加密货币也没有看到系统性的风险,而上涨动力不足的原因昨天也在作业中有猜测,但这种情况应该还是会随着美股的回调而重新平衡。

虽然不招待见,但我还是要说,目前市场的流动性不足以支撑整个加密货币市场实现21年的那种牛市。最多就是 BTC 能走出黄金 10年 慢熊,而 $ETH 能不能复制出 BTC 的这条路,可能还是要看“华尔街”的想法。

PS:建议大家多看看现货 ETF 的数据,ETF 的购买者和美股是高度重合的,他们虽然也会追涨杀跌,但可以看到多数投资者对目前加密货币市场的 FOMO 情绪。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。