原创 | Odaily星球日报(@OdailyChina)

作者 | Ethan(@ethanzhang_web3)

RWA板块市场表现

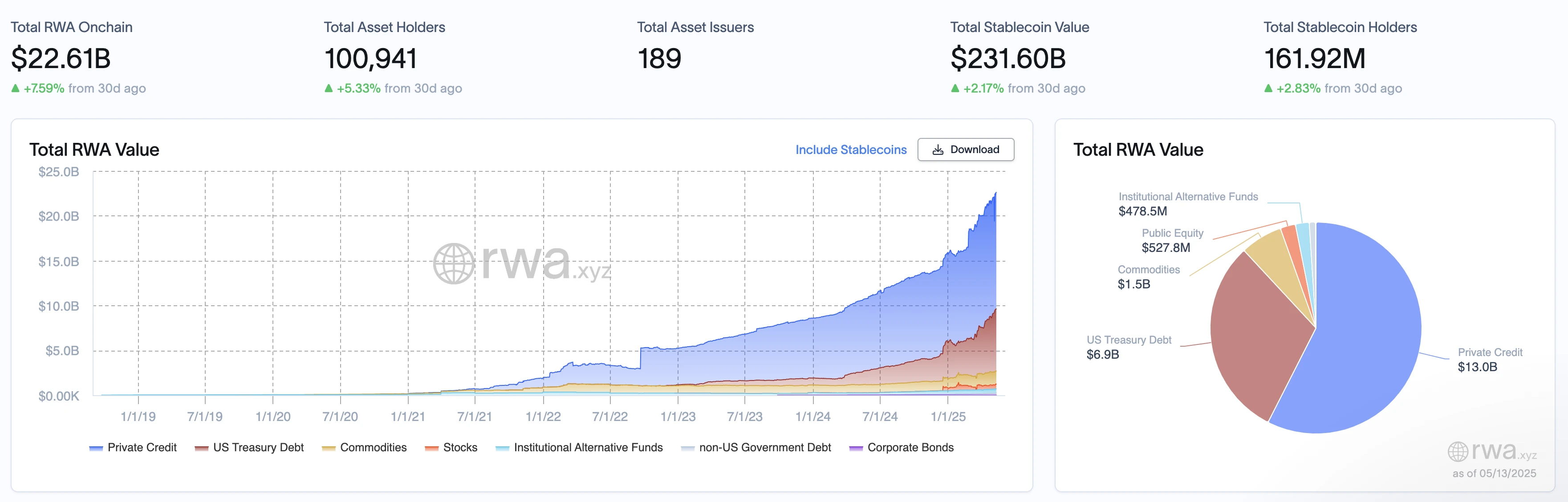

根据 RWA.xyz 数据,截至 2025 年 5 月 13 日,RWA 链上总价值达到 223.8 亿美元,较 30 天前增长 7.59%。链上资产持有者总数为100,941人,较 30 天前增加5.33%,资产发行数量为 189 个。稳定币总价值为 2316 亿美元,较 30 天前增长 2.17%,而稳定币持有者数量为 1.6192 亿人,较 30 天前上升 2.83%。

从历史趋势看,RWA 链上总价值自 2019 年以来呈现显著增长,尤其在 2023 年后加速上升,2025 年初达到峰值,显示出代币化资产的快速普及。资产类别分布中,私人信贷(Private Credit)占据主导地位,价值为 130 亿美元,占总价值的 58.09%;美国国债(US Treasury Debt)价值为 68 亿美元,占30.38% ;商品(Commodities)为 15 亿美元,占 6.7% ;机构另类基金(International Alternative Funds)为 4.785 亿美元,占 2.14%。股票(Stocks)、非美国政府债务(non-US Government Debt)和公司债券(Corporate Bonds)占比相对较小。

从上周数据对比来看,本周资产类别分布与上周相比变化微小,但仍可观察到一些趋势。私人信贷(Private Credit)价值微增至130亿美元,占比从57.64%升至58.09%,其主导地位得到进一步巩固。美国国债(US Treasury Debt)价值和占比(68亿美元,30.38%)保持不变。商品(Commodities)和机构另类基金(International Alternative Funds)价值略有增长,但占比变化不大(6.7%和2.14%)。股票、非美国政府债务和公司债券占比依然较小,投资者对这部分资产的配置兴趣较低。

总结:私人信贷持续吸引资金流入,反映出投资者对高收益、另类资产的偏好,而美国国债的稳定性使其成为避险资产的首选。投资者可考虑在私人信贷领域寻找机会,同时关注美国国债作为组合稳定器的作用,但需警惕股票和公司债券市场潜在的低迷风险。

上周重点事件回看

据报道,5月8日,美国参议院以48票对49票否决了稳定币监管法案(GENIUS Act)的程序性投票,未能达到60票的推进门槛,延迟了辩论进程。两名共和党参议员Josh Hawley和Rand Paul与全体民主党投反对票,多数党领袖John Thune也将票改为反对以便未来重提。民主党因担忧特朗普家族与加密业务的关系及法案未完善的反洗钱条款而反对,参议员Ruben Gallego和Mark Warner呼吁延期以完善文本。共和党指责民主党缺乏合作意愿,称此举可能扼杀美国加密产业。

Superstate推出“Opening Bell”,支持SEC注册股票链上发行与交易

Superstate 宣布推出“Opening Bell”平台,支持 SEC 注册股票直接链上发行与交易,该项目将率先在 Solana 链部署,实现传统股权与区块链基础设施的原生融合。Superstate 近期已联合多家机构向 SEC 提交框架提案。

据5月7日公告,全球支付平台Stripe在101个国家推出稳定币账户,支持用户发送、接收和持有美元稳定币余额,功能类似传统银行账户。该服务支持Circle的USDC和Stripe于2024年10月收购的Bridge平台发行的USDB稳定币,覆盖阿根廷、智利、土耳其等国家。当前稳定币市场总值已超2310亿美元,特别是在高通胀和金融基础设施匮乏的发展中经济体,稳定币作为价值储存和交易媒介的需求持续增长。

Visa Ventures200万欧元投资稳定币基础设施平台BVNK,推动稳定币支付全球化

Visa 通过其风投部门 Visa Ventures 对稳定币支付基础设施平台 BVNK 进行投资,这是 Visa 首次直接投资该领域初创公司,被视为对稳定币作为全球支付基础设施潜力的有力验证。BVNK 当前年处理量达 120 亿美元,客户涵盖 Deel、dLocal 等企业。

此前消息,稳定币基础设施公司 BVNK 完成 5000 万美元 B 轮融资,Haun Ventures 领投。

BioSig与Streamex合并打造纳斯达克上市的RWA公司

据报道,BioSig Technologies 与Streamex Exchange Corp.签署了合并意向书,拟通过全股票交易在纳斯达克上市一家RWA公司。Streamex提供基于Solana的商品市场代币化基础设施,目标是将2.1万亿美元矿业和142万亿美元全球商品市场链上化。合并后,Streamex股东将持有公司约19.9%普通股,转换优先股后增至75%。BioSig CEO Anthony Amato表示,此举将提升增长潜力,Streamex联合创始人Henry McPhie和Morgan Lekstrom称其为传统金融的进化。

热点项目最新动态

Plume Network

介绍:Plume Network 是一个专注于现实世界资产(RWA)代币化的模块化 Layer 1 区块链平台。它旨在通过区块链技术将传统资产(如房地产、艺术品、股权等)转化为数字资产,降低投资门槛并提高资产流动性。Plume 提供了一个可定制的框架,支持开发者构建 RWA 相关的去中心化应用(dApp),并通过其生态系统整合 DeFi 和传统金融。Plume Network 强调合规性和安全性,致力于为机构和零售投资者提供桥接传统金融与加密经济的解决方案。

最新动态:5月9日,宣布与 Lorenzo Protocol(@LorenzoProtocol)合作,将其金融抽象层引入 Plume 生态,降低原生 BTC 和其他 CeFi 产品的 RWA 质押和可持续收益的摩擦成本。同日宣布与 Hyperliquid 集成,PLUME 代币上线 Hyperbridge。

5月12日,宣布其主网旅程的第一步:Plume Alpha,标志着主网部署的初步阶段。Plume 的目标是让链上 RWA 体验像原生加密资产一样无缝,用户可以在 Plume 上进行 RWA 的质押、交换、借贷、借款和投机。这一阶段为后续功能(如资产代币化和治理)的解锁奠定了基础。

R2Yield(R2)

介绍:R2Yield是一个融合实物资产(RWA)、传统金融(TradFi)和去中心化金融(DeFi)的稳定币收益协议,旨在通过区块链技术为用户提供稳定的收益机会。其核心产品R2USD 是一种由实物资产支持的稳定币,资产包括链上代币化的美国国债、货币市场策略和房地产租金收入等。这种设计让R2USD 兼具稳定性和收益生成能力,打破了传统稳定币(如 USDT 和 USDC)不直接为用户产生收益的局限。主网预计将于 2025 年第二至第三季度正式上线。

最新动态:5月8日,测试网的积分仪表板更新,用户可查看通过铸造、质押和提供流动性等任务获得的积分。5月9日,宣布测试网地址数量已突破 200,000,累计交易笔数已超 10,000,000 笔。

自测试网上线以来,R2已完成在 Plume、ETH Sepolia、Arbitrum Sepolia 等多个测试网络的部署,短短一周内吸引超 90,000 名用户参与。

相关文章推荐

《RWA周报|民主党阻挠立法致稳定币立法出现分裂;报告预测2025年RWA板块市值达500亿美元(4.30-5.8)》

RWA上周周报:梳理行业最新洞察及市场数据。

《转载解读丨RWA 代币化:关键趋势和 2025 年市场展望》

在加密市场从“概念”转向“实业”的关键阶段,Real World Asset (RWA) Tokenization 无疑是连接链上与链下资产世界的核心趋势。该报告内容兼具深度与实操性,从J.P. Morgan的ABS试点,到Franklin Templeton的链上货币基金,再到300亿美元规模的房地产资产入链,精准的案例和数据将有助于我们明确RWA市场趋势。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。