基本面:

1、美SEC主席或对加密经济商规则进行彻底改革,允许经纪商担任数字资产托管人的现行框架或需被废止重建,同时表示正在考虑允许对冲基金自主托管加密资产。此表态利好大型资金直接参与加密市场,有望推动流动性和交易量提升;同时也会打击“合规套利”现象,对现有托管机构构成威胁,提升市场信任度。短期内或将导致一些币种和平台Token出现波动,特别是与托管相关概念币种出现大幅下跌。

2、继 Pectra 升级成功部署后,以太坊核心开发者已将注意力转向下一次重大升级“Fusaka”,计划于 2025 年底上线,旨在降低 Layer 2 扩容解决方案和验证者的运营成本。

技术面:

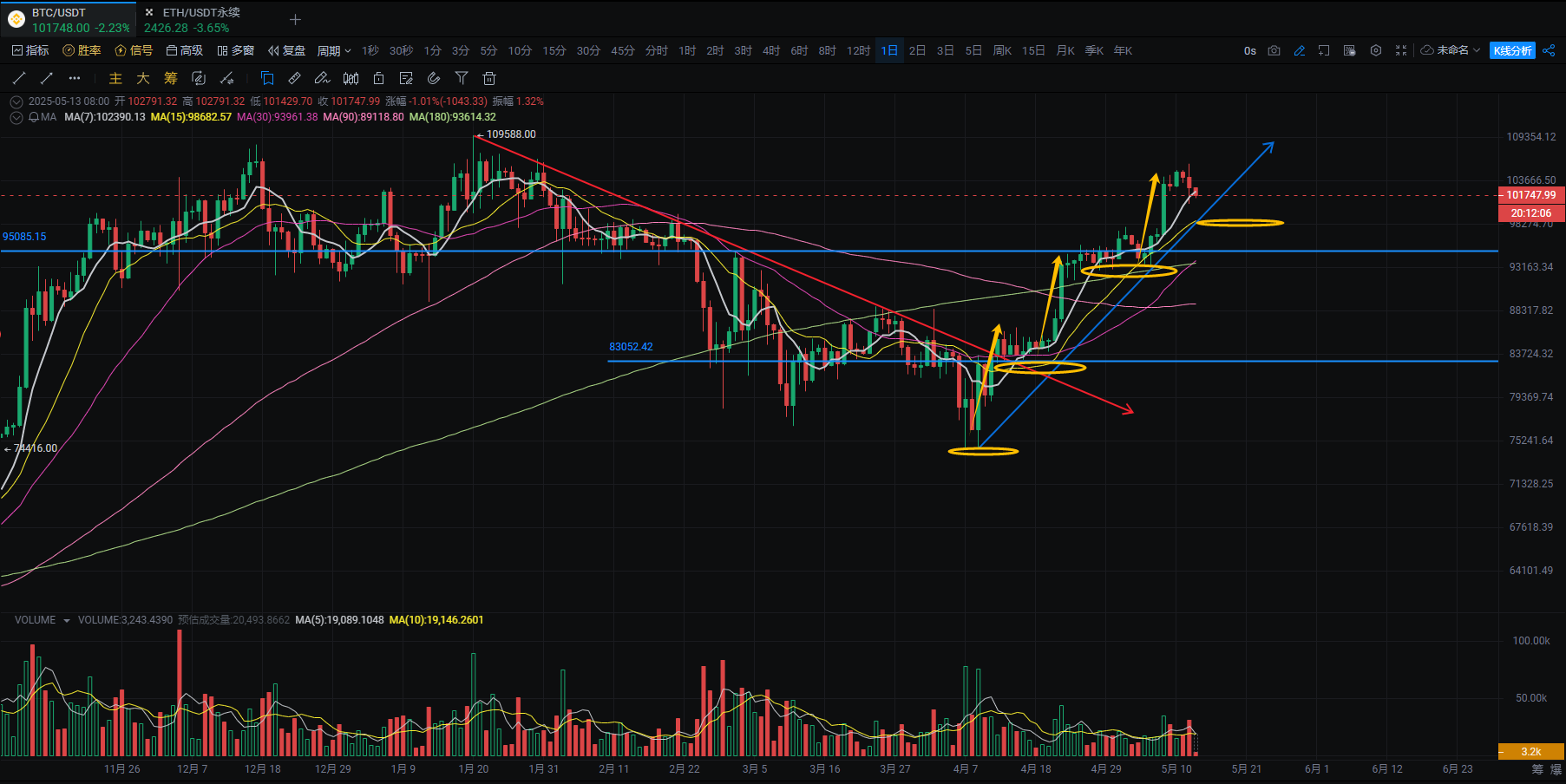

BTC:日线走势整体上保持震荡上行的趋势,K线依旧处于下方蓝色趋势线上方,目前处于第三浪上涨之后的调整阶段,短期内行情进入阶段性调整中,本周下方重要防守关注98一线。4小时线来看,近几天的行情处于103-105区间震荡,昨日冲高1058回落,走出三连阴走势,跌破近期高位震荡的箱体底部103一线,短期行情有待进入调整。日内操作上,上方重点关注1028-1038位置压力,下方重点关注1008-998位置支撑!

ETH:日线级别前两日冲高2600回落,日线形成双针探顶走势,今日持续回调,以太短期内进入阶段性调整阶段,符合预期走势。整体上依旧保持多头趋势,这只是上涨过程中,面临2600-2800区间的抛压,行情有待通过阶段性调整,从而形成新的一线蓄力盘,为后期突破2800,上攻3050位置做准备。从四小时线来看,多次冲高2600回落,下方2400点一线是近三日的低点。从1800位置开始上涨过程中,在2280一线位置形成支撑,短期内以太调整底部位置有待形成,重点关注2350-2280位置,等待以太新的底部点位确定即是买入机会。日内操作上,上方重点关注2460-2490位置压力,下方支撑重点关注2380-2350位置支撑。

山寨:昨日明确讲到山寨有待进入阶段性调整,在上涨趋势不变的前提下,正常的调整空间大概是20-30%左右,从而形成新一浪上涨行情的底部位置,出现新的买入机会。前两日跟随以太走势,日线多次冲高回落收上影线,今日持续下跌,目前走出实体阴线,短期内的山寨还有待继续回调,目前大部分山寨尚有20%的回调空间,调整结束之后,会出现明显一线底部位置,届时可以参考以太企稳来把握山寨新的买入机会!

和悦:昨日明确讲到大饼上方关注1058位置压力,昨日最高点刚好到此位置,下方重点关注1023,走势基本符合预期。包括以太点位基本符合预期走势,同时明确讲到本周山寨将会进入适当的调整中,今日山寨集体回调。日内短线操作上关注上方研报分析,目前持仓XRP和以太。

币市波动大、入市需谨慎、个人看法、不做建议、仅供分享

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。