武兄问题蛮好的,最近也一直在看流动性方面的内容,按照传统的流动性数据来看,别说是现在,就是22年 $BTC 跌倒了 16,000 美元的时候,美国整体的流动性都没有太大的区别,可以看到都是在一个震荡区间内,并没有明显的突破,尤其是最近 Bitcoin 重新回到 10万 美元,但流动性反而还是下降的。

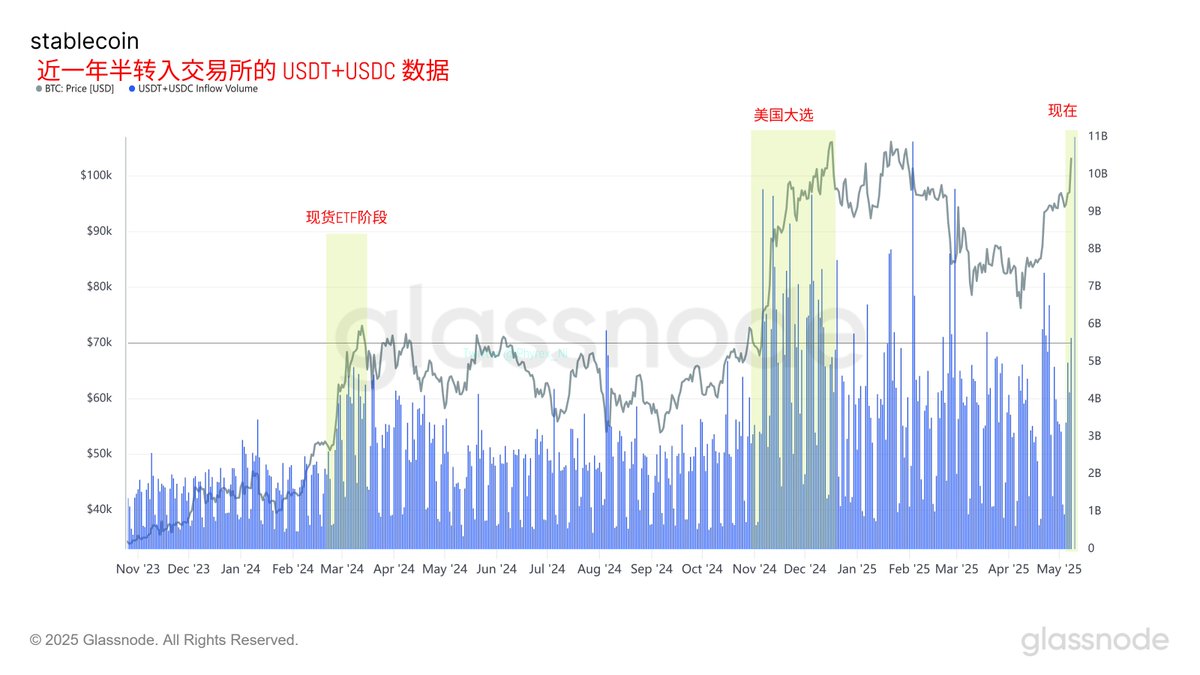

所以我标注了几个时间,可以看到21年是流动性上涨的时候带动了 BTC 和 标普500 的同步上涨,而到了2024年2月 BTC 的拉升主要是因为 ETF ,这时期虽然流动性没有太大的变化,但确实有传统资金开始买入 ETF ,等同于买入了 BTC ,实际上是带来了“定向流动性”。

接下里的2024年11月开始就是美国大选的期间,川普带动了 BTC 上涨的情绪,而到了目前,对比美股和BTC来看,在方向说虽然一直,但 BTC 明显上涨的幅度更多一些,目前已经收复了关税以来几乎所有的下跌,而美股还没有回到 2月25日的水平。

再多说一句美股,单独看标普或者纳指确实是上涨不错,但这个周期的主流资金都是在七姐妹上,和其它的赛道关系不大,而从罗素2000 和 $ETH 的数据来看,受到流动性的压制就比较明显了,几次大幅上涨都是和事件有关,虽然这次 ETH 上涨的幅度不错,但能明显看到罗素2000 在美股指数中上涨的也是最强的。

这应该就是和流动性没有太直接的关系,应该是场内资金对板块轮动的预期,上次发生这种事情的时候还是在2024年底,也出现过但,因为确实没有外部的流动性,或者是说美国没有进入货币宽松,所以流动性并没有增强。

所以,我觉得是信心导致的购买力增强,但非常有趣的是,场内资金的增加并不是非常的强烈,给我的感觉反而像是2024年2月的翻版,投资者并不看好当时的现货ETF,觉得都是 Sell the news ,已经利好落地转利空,所以很多人都在做空,或者等着价格下跌。

结果呢,根本没有下跌,直接从46,000 美元上涨到 73,000 美元,快速拉升让很多人踏空,减少了抛压的同时没有用很多的资金,但是价格也拉升上来了,而从目前来看,拉升的资金量比当时还少,就说明踏空这一波的投资者更多。

反而是美国大选这种高博弈时期才出现了大量的资金,让大量的投资者上车了。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。