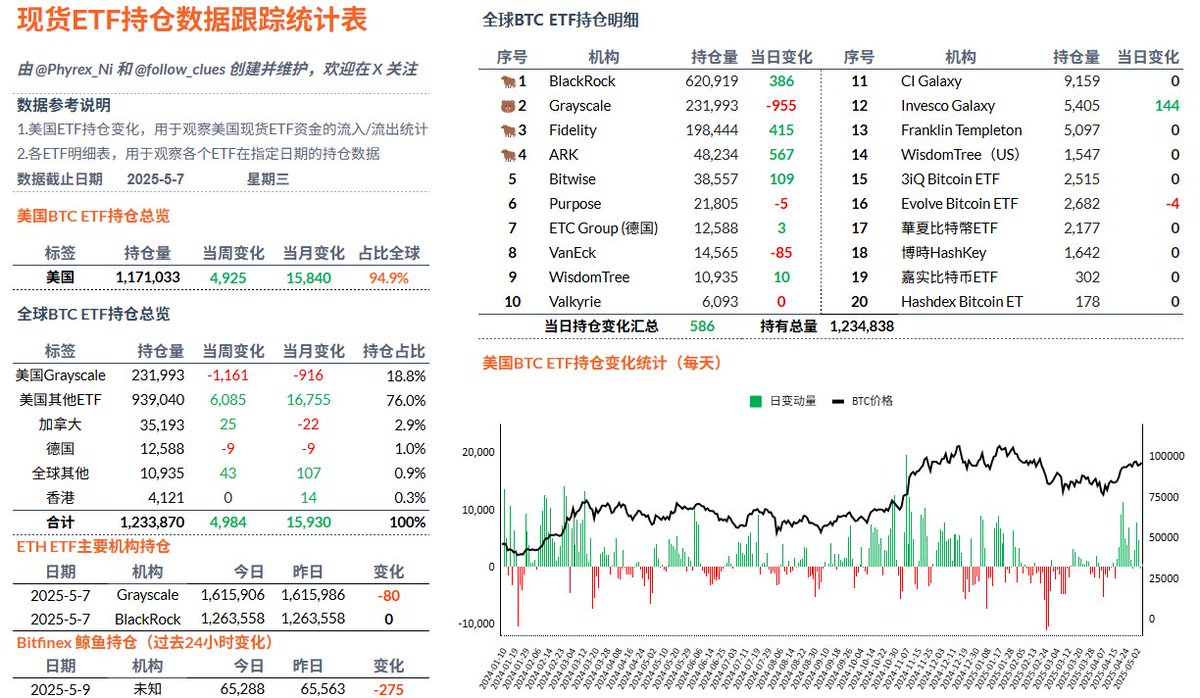

On Wednesday, the data for the $BTC spot ETF returned to net inflows, which aligns with our expectations from yesterday. The ETF market is actually no different from that of many ordinary investors; it is all about chasing highs and cutting losses. When the buying power in the market increases, the FOMO sentiment among investors starts to rise, and conversely, they tend to sell more when the BTC price drops and buy less.

Of course, from a long-term perspective, BlackRock's investors are more focused on long-term investments. During the bottoming phase, BlackRock's investors sell the least and buy the most, but during FOMO, they are also the ones buying the most. However, apart from BlackRock's investors, it seems that other ETF institutions have very few investors with a solid mindset.

I am actually quite curious about how BlackRock's financial advisors stabilize investor sentiment during BTC downturns. As of today, BlackRock's investors have seen net inflows for the 16th consecutive day.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。