又是早晨七点了,每次想早点睡最后的结果都是变成天亮了,今天的信息不少,不过集中度还是挺高的,最重要的就是美联储的议息会议了,和预期中的一样,对于五月的利率没有任何的调整,鲍威尔的讲话中重点还是对于关税的不满,认为按照目前公布的关税政策来说,会带来通胀上升,经济下降以及失业率的上升。

这应该是今天比较鹰派的叙述了,反而是对于降息和缩表的问题回答的一如既往,没有前置的预期,更多的还是看数据,认为所有不利的影响都是来自于关税。所以重点应该还是要放在六月份的点阵图上。

鲍威尔讲话的时候一度让市场出现了下跌,但接下来川普对于拜登Ai封锁计划的解绑确实刺激了风险市场,再叠加对中国的谈判,市场的反应还是不错的,不过需要注意的是,虽然取消了拜登的封锁,但对中国AI芯片的限制仍然是保持的,所以这条信息对于中国来说并没有任何的变化。

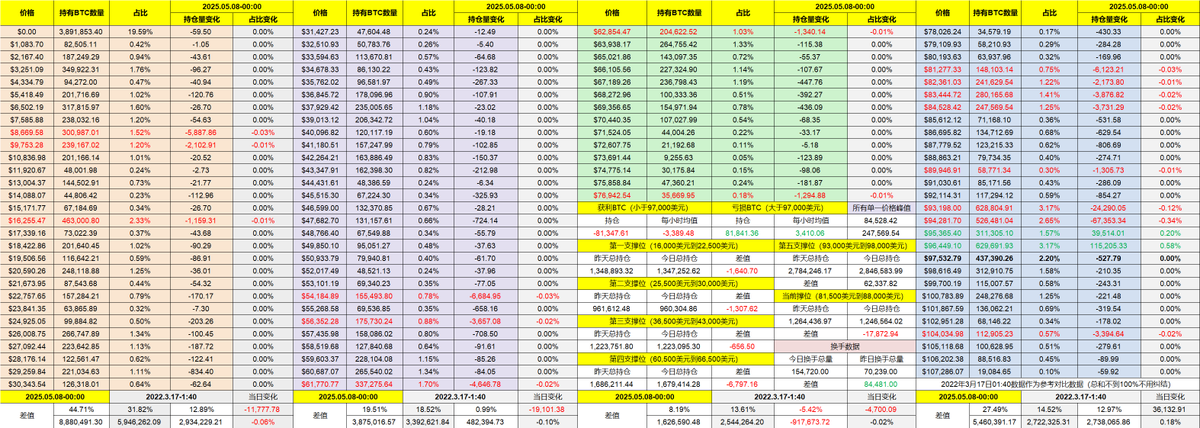

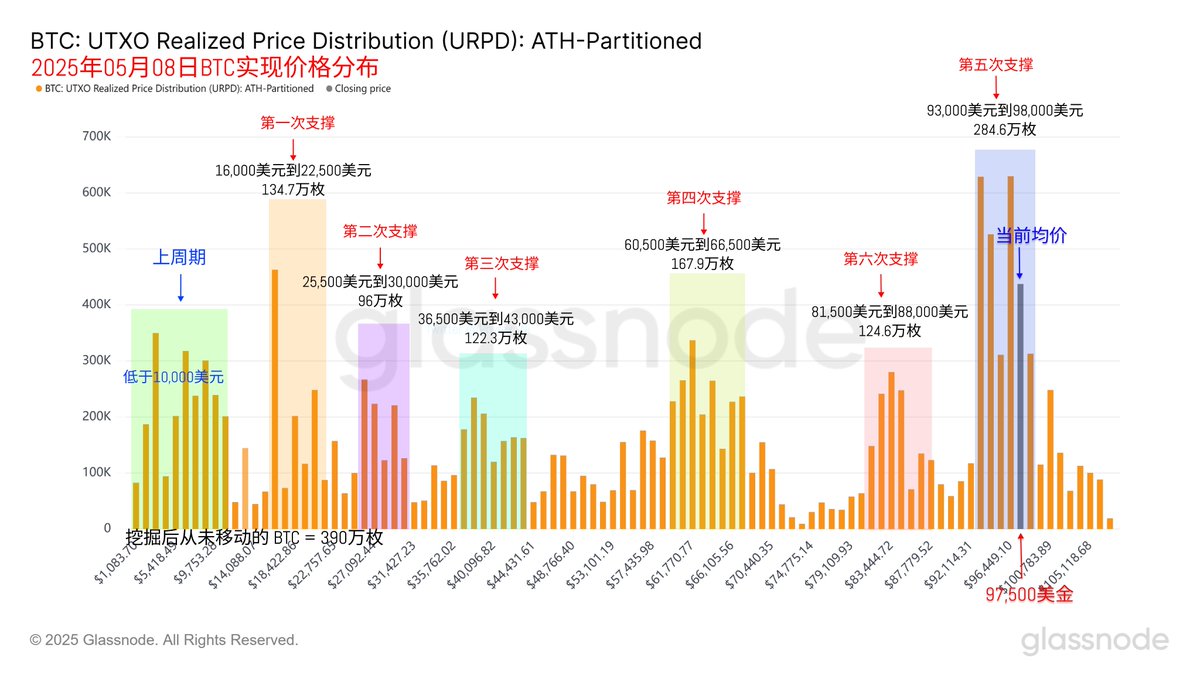

回到 Bitcoin 的数据来说,今天的价格变动比较频繁,多空的博弈增大,确实是换手率上升,尤其是短期获利投资者有大量的换手,不过目前 BTC 的价格还是比较稳定,在没有进一步的利好和利空的信息前,维持震荡可能是大的概率。

如果美股能持续上涨,那么 BTC 跟随美股上涨的概率会非常大,但美股的上涨在目前这个阶段也摆脱不了事件的推动,比如今天的英伟达就是纯粹的事件推动。

从支撑的数据来看 93,000 美元到 98,000 美元仍然非常的坚固,较早期的投资者也并没有过多参与换手的迹象,价格的稳定性还是挺强的。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。