Dubai, UAE, May 7, 2025 — In the aftermath of the largest hacking incident in cryptocurrency history, Bybit has demonstrated a model of market resilience, transparency, and user trust. An independent report released by leading institutional-grade cryptocurrency market data provider Kaiko shows that Bybit restored its liquidity to pre-incident levels within just 30 days — a feat unprecedented in the industry following similar crises.

On February 21, 2025, Bybit experienced an organized cyber attack that resulted in the unauthorized withdrawal of $1.5 billion worth of assets. Although this incident shook the global crypto ecosystem, Bybit responded swiftly, leveraging its robust infrastructure to ensure uninterrupted trading. In the following weeks, the platform's liquidity, trading depth, and user confidence recovered at an astonishing pace.

Rapid Recovery in 30 Days, Thanks to Market Structure Innovations

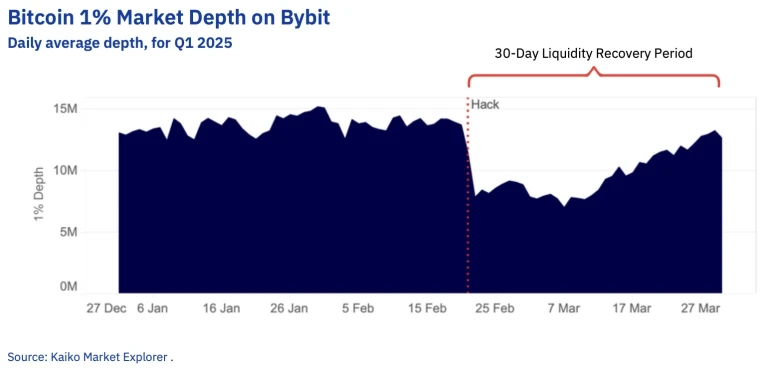

According to Kaiko's analysis, Bybit's Bitcoin liquidity, measured at 1% market depth, recovered to an average daily volume of $13 million by the end of Q1 2025, fully returning to pre-hack levels. Liquidity across all levels of the order book has been restored, ranging from 0.1% to 8% around the mid-price, indicating deep participation from institutional market makers.

One of the key factors contributing to this recovery was the launch of the "Retail Price Improvement (RPI)" order on February 20 — the day before the incident. This feature is exclusively available to retail traders placing manual orders through Bybit's website or app and is not open to API access. RPI orders are submitted by institutional market makers and are designed to optimize the execution price for retail traders. During the period of market volatility following the incident, RPI orders effectively stabilized the trading environment, tightened spreads, and protected manual users from the impact of high-frequency algorithmic trading.

Altcoin Market Recovers in Sync, Spreads Narrowed

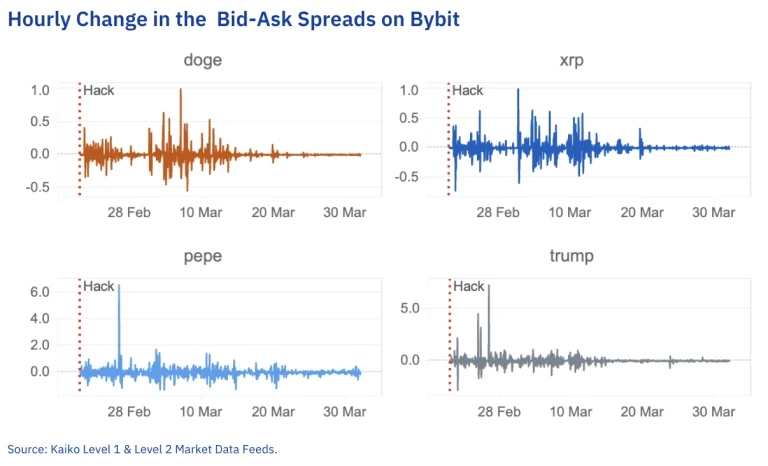

The recovery of liquidity was not limited to Bitcoin. By March, over 80% of the market depth of the top 30 mainstream altcoins by market capitalization had returned to pre-incident levels. Major tokens, including high-volatility assets like DOGE and XRP, saw their spreads significantly tighten, reflecting reduced execution costs and restored market-making confidence.

The volatility of bid-ask spreads — a key indicator of market pressure — continued to decline in March, indicating improved order book stability and increased participation from liquidity providers.

Trading Volume Recovery Outpaces Past Market Crises

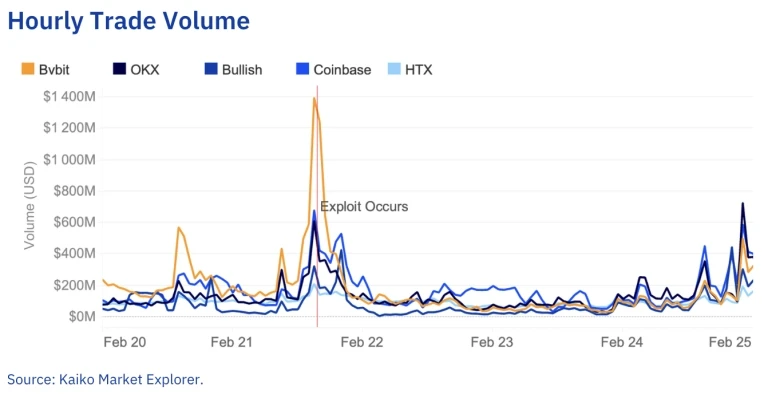

Despite macroeconomic uncertainties leading to a cautious overall market sentiment, Bybit's trading volume recovered faster than in previous similar incidents, such as the 2016 Bitfinex hack or the 2023 SEC case against Binance.US.

Kaiko data shows that, following the incident, Bybit's hourly trading volume surged to $1.2 billion. Although trading volume briefly dipped over the weekend, it steadily rebounded thereafter, highlighting user stickiness and ongoing trust in Bybit's market resilience.

Winning Trust Through Transparency

The Kaiko report notes that Bybit's high level of transparency during the crisis recovery process is one of the key reasons for its outstanding performance. In contrast to other platforms that experienced prolonged liquidity damage during similar events, Bybit quickly rebuilt market confidence and trading stability through open communication and timely market mechanism optimizations.

As the cryptocurrency market matures, the competitiveness of exchanges is not only reflected in their performance during bullish periods but, more crucially, in their ability to respond during crises. Bybit's rapid liquidity rebound and user-centric continuous innovation have set a new benchmark for resilience in the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。