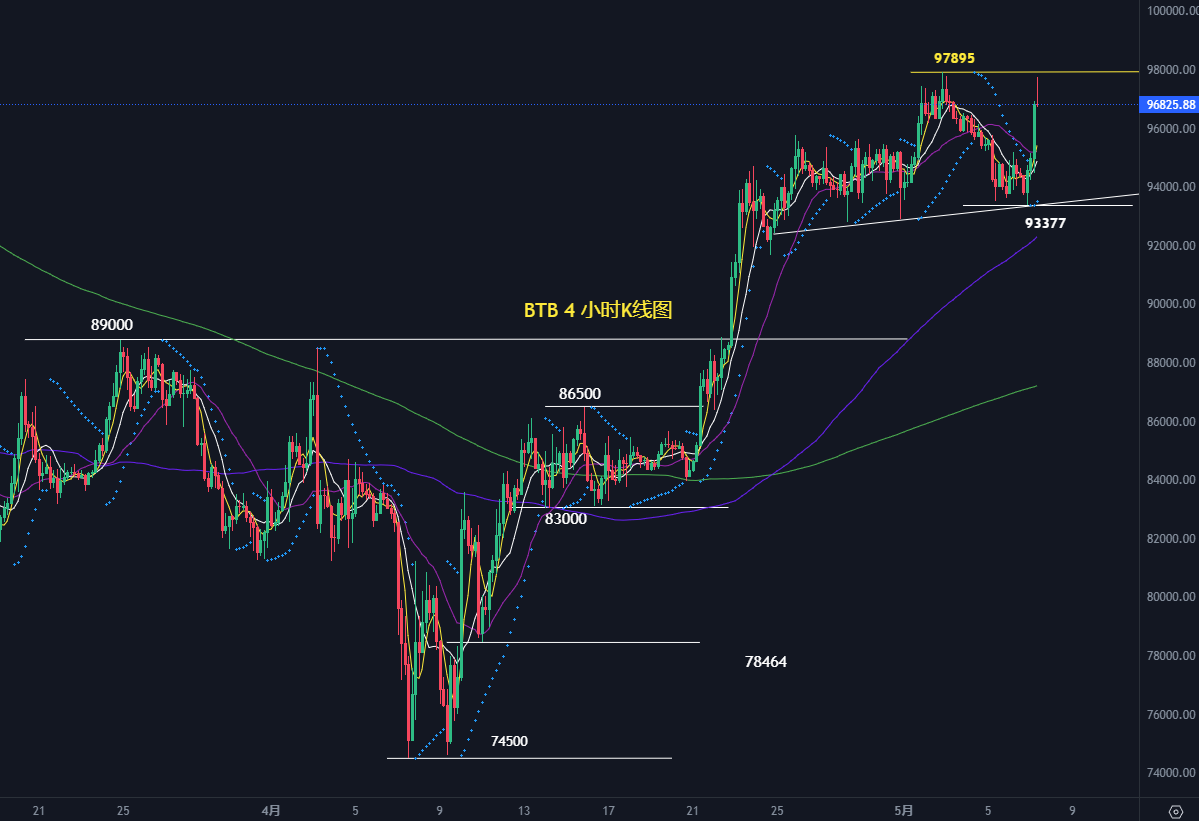

受中美接触谈判、美国新罕布什尔州近期通过的比特币储备法案、CZ、SBF寻求川普特赦等一系列集中释放的消息面刺激,今天早上BTB从94500直接拉升97500上方,直逼上周最高位97895。

技术面来看,昨天晚上BTB回调的最低位93377没有跌破上周的最低位92800,4月22日日K线长阳线向上突破89000水平压力的多头整体强势得以保持。今天早上的上涨延长了大饼日K线周期强势整理的时间周期。

近两周强势整理的形态上是一个上升三角形。上方水平压力97895;下方支撑92800/93377。这种整体强势的整理,即使站上上方阻力97895后,后市走势也会反复,

BTB4小时K线周期上,技术面近两周的强势整理已经有一条明显的支撑线,也是上升三角形的下边支撑线。一般来说,这种4小时K线周期的支撑线都会破坏失守,这就意味着短期后市的某个时间,BTB大概率会跌破93377和92800支撑,跌破两周支撑线,试探8.9万上方的平台支撑9.0万。

中美谈判还有很大变数,都是影响市场的因素,明天凌晨美联储会议大概率不会降息,降息可能会推迟到6月份,而且市场已经计价了。

BTB日K线周期上,24日均线和120日均线共振于91600,而288日均线目前仍在81800的位置上。120日均线和288日均线的距离未缩窄至5000,或者5000--3000内,大饼的上涨持续性都有很大变数。

大饼日K线再次跌至120日均线和288均线区间的中间,也就意味着后市还有机会回调试探至86500,如果试探至288日均线,大饼还有机会回调至8.4万或下方。这些机会都不失为后市性价比较高的进场机会。

交易上,大不必因为今天早上大饼因为消息面的刺激,上涨逼近97000上方又踏空产生焦虑。耐心等待上述性价比较高的中短期进场机会。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。