今天的主要事件应该就是两件,一件是 $BTC 自身的,终于美国有第一个州,新罕布什尔州 通过了包含有加密货币在内的战略储备,允许每年用不超过 5% 的州资金购买市值超过 5,000 亿美元的贵重金属和加密货币,其中市值达到这个等级的加密货币只有 Bitcoin ,而新罕布什尔州可以调动的资金大概在 2.8亿 至 7.7亿 美元之间。

虽然不算是一个很大的数量,但也确实是创造了历史,很多小伙伴认为这种落后的州没有什么资金实力,在 新罕布什尔州 的带动下,会有越来越多的州通过 Bitcoin 的战略储备,比如今天又提交了第二份 亚利桑那州 的 BTC 战略储备 SB1373 给州长霍布斯,本周日的时候霍布斯以 BTC 不适用于养老金投资否决了全美第一个两党一致通过的 SB1025 ,这次的 SB1373 并没有包括养老金,就看五下周二了。

另外一件事就是最近两天美国连续拍卖了3年和10年的美债,两次拍卖都挺顺利的,唯一需要注意的是美国国内的购买力在大幅提升,而其它国家的购买力在削弱,这就代表了美债会更多的从美国投资者手中吸取流动性,而接下来还有30年期的美债要拍卖,这可能也是美股在没有利空情况下连续下跌的原因之一。

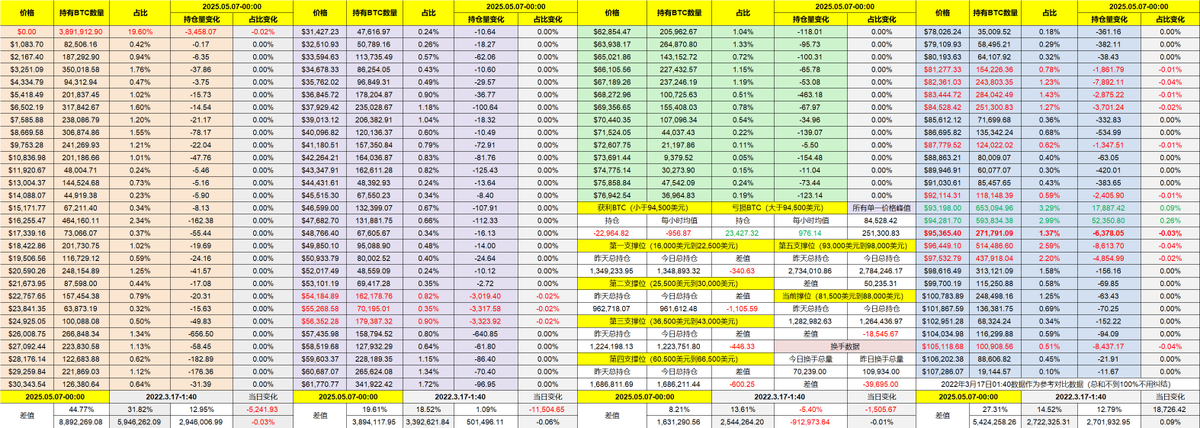

回到 Bitcoin 的数据来看,今天的换手率在持续的下降,即便是 BTC 战略储备通过了也暂时并没有激发太大的成交量,目前为止成交量甚至低于昨日同期,这也说明了目前的价格已经有“买不动”的趋势,不排除是投资者在美联储议息会议前选择避险。

所以更重要的还是要等明天美联储的议息会议和鲍威尔的讲话,利率五月是没有调整的可能了,就看看鲍威尔是鸽派发言还是鹰派发言吧。

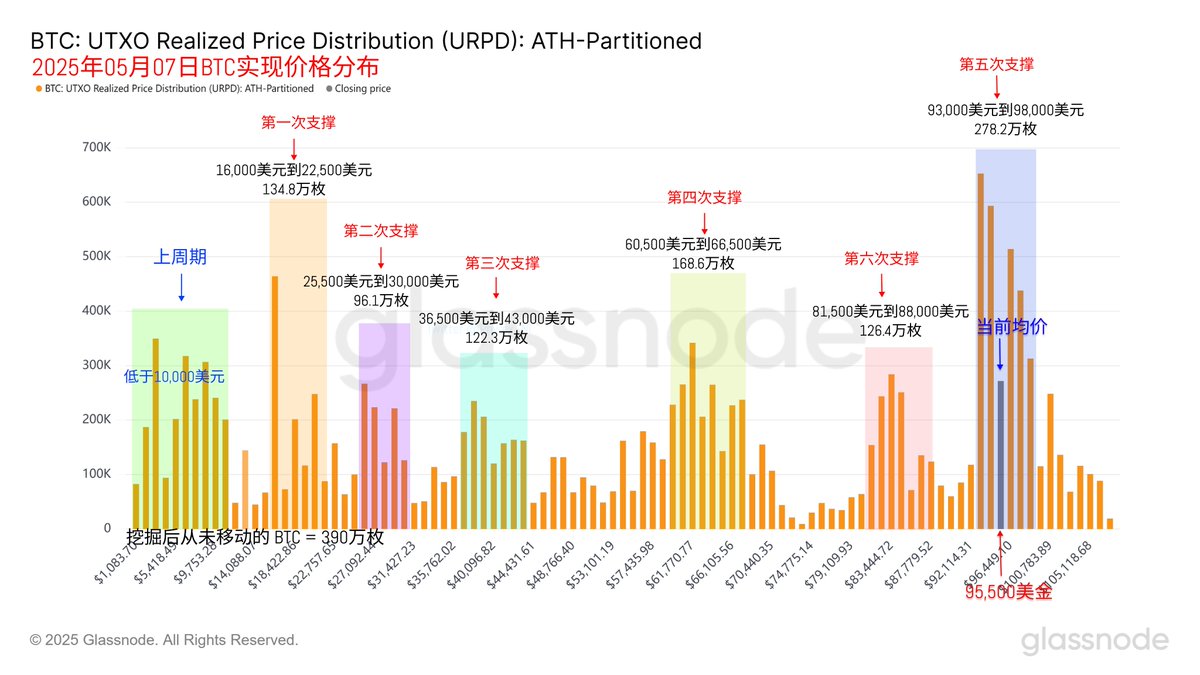

支撑数据仍然是在 93,000 美元到 98,000 美元非常的坚固,这个数据已经经过了太长时间的考验了,从来就没有错过,密集筹码集中区的磁吸效应非常好用,但目前这个支撑区也是阻力位,寻求向上突破的话还是要有更强大的利好效应。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。