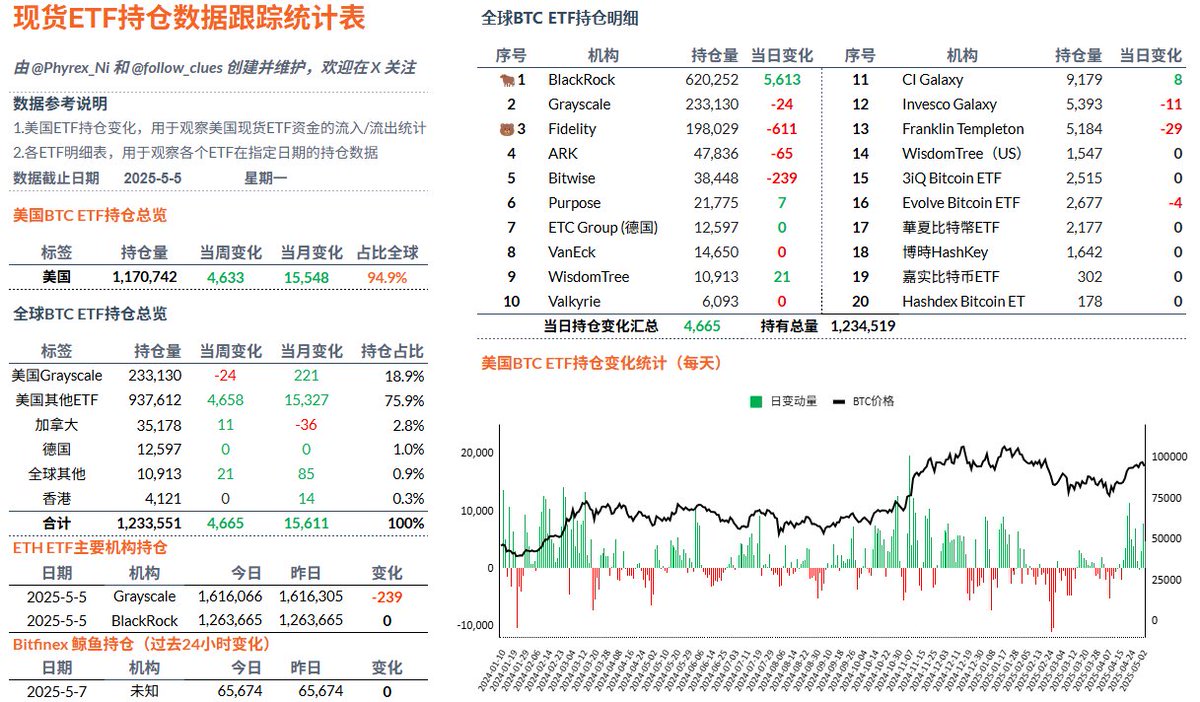

周一 $BTC 现货 ETF 虽然从数据来看还是不错的,起码仍然保持着净流入的趋势,但除了贝莱德的投资者有超过 5,600枚 BTC 的净流入以外,其它的美国现货ETF机构不是零就是净流出,市场又回到了只有贝莱德投资者 FOMO 的阶段,历史也告诉我们,这种情况下往往是市场分歧较大的时候。

在今天的数据中能看到美债的收益率开始下降,黄金的价格在上升,美股的跌幅在逐渐的扩大,虽然有了 BTC 州战略储备的初次通过,但价格始终难以回到 96,000 美元,市场的情绪并不高,或者是对于美联储明天的议息会议做出避险的动作。

当然今天10年期美债的拍卖也在从市场中抽取流动性,首当其冲的就是美股,加密货币受到的影响还少一些,这也是 $BTC 能维持几乎不变,再次和美股背离的原因,但如果明天的美联储出现了系统性的利好或者利空,BTC和票普500在大方向上依然会保持一致。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。