原文标题:DeFi』s Next Evolution: How Protocols Become Platforms

原文作者:DefiIgnas

原文编译:zhouzhou,BlockBeats

编者按:本文以以太坊面临的挑战以及 Fluid v2 的创新为例,Fluid 通过将借贷与 AMM 流动性结合,创建了一个既适合大户使用,又支持开发者的平台。Fluid 的 v2 版本通过引入范围订单、借贷流动性策略和动态费用等功能,增强了资本效率,为开发者提供了构建新产品的机会。

以下为原文内容(为便于阅读理解,原内容有所整编):

DeFi 的下一个重大飞跃是协议向平台的演变。

就像苹果的 App Store 一样,协议不再是单一用途的工具,而是其他应用构建的基础。

注意到 DeFi 中的一个趋势:钱包现在在后台使用 DEX 聚合器,而不是依赖于前端应用程序。

随着 DeFi 生态系统日益复杂,Vault 策略的日益流行也表明,人们正在寻求跨多个 DeFi 协议获取最高收益。

但也有一个陷阱:协议有可能变成商品化的基础设施,而面向用户的应用则会获得大部分收益。

举个例子:

• Uniswap Labs 赚取前端费用,而 LP 的交换费用呈下降趋势,$UNI 持有者没有任何收益。

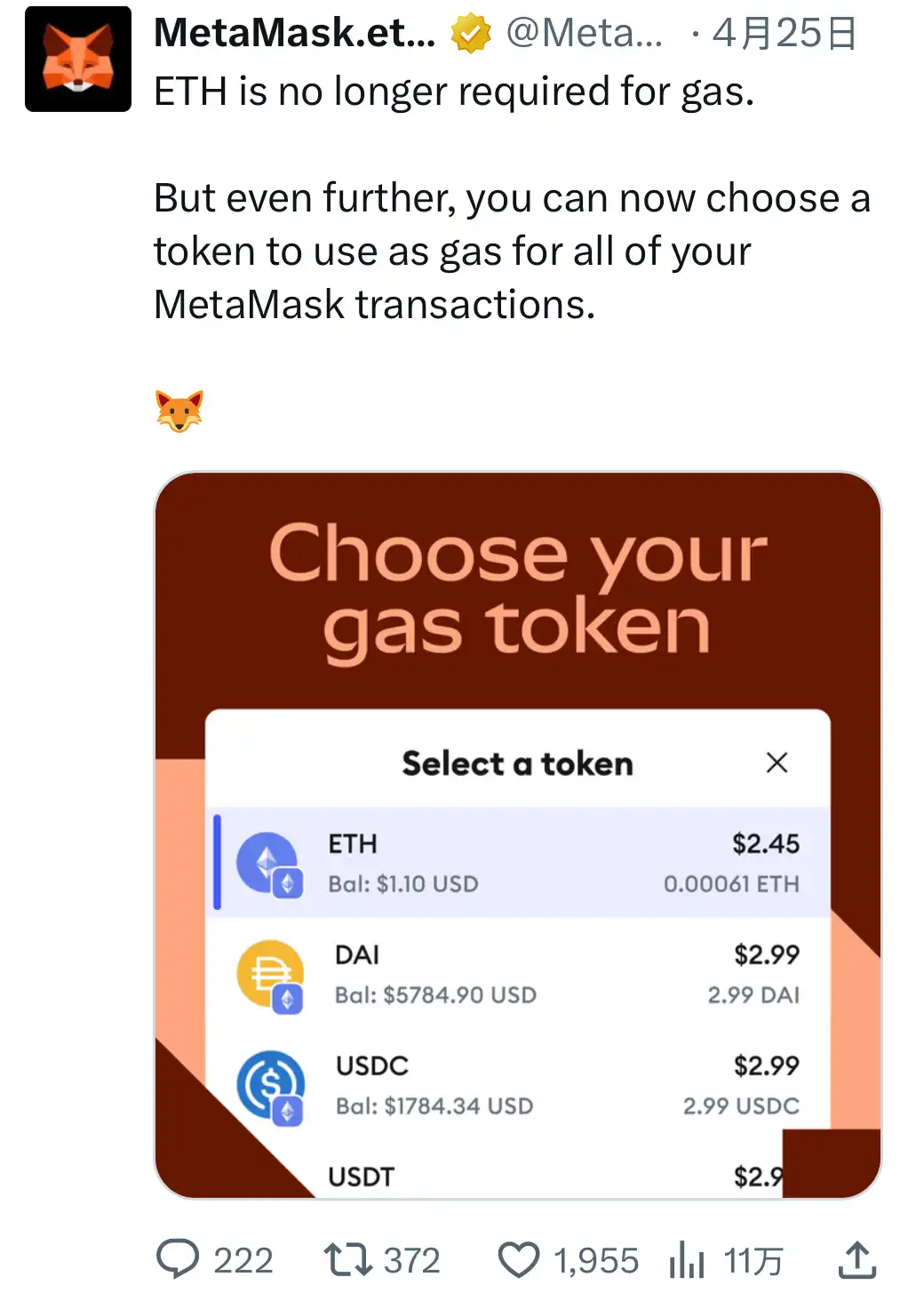

• Metamask 收取 0.875% 的费用,因为它掌握了用户。

• Compound Finance 正在成为 Morpho 金库的前端。

许多人将以太坊视为仅仅是一个基础设施,受到 L2 和 Solana 的挑战,因为它们提供更低的交易费用。

随着时间的推移,ETH 的燃料费将被抽象化,用户可以在不持有任何 ETH 的情况下使用以太坊。

这种风险是「Fat App 理论」的一部分,但不要急着埋葬「Fat Protocol 理论」。

以太坊是一个开发平台,其估值发生了变化。现在它的估值基于它产生的费用,而不是作为平台的潜力和 ETH 作为价值储存资产的角色。

随着 Layer 2 解决方案与 L1 的紧密对接,并且 ETH 销毁机制恢复,ETH 的叙事可能会迅速发生变化。

有趣的是,Aave 在作为面向用户的应用,尤其是为大户提供服务方面表现良好,同时也作为 DeFi 的流动性中心。

或者是 Pumpdotfun,它掌握了终端用户,现在通过开发自己的 DEX 在垂直方向上扩展;而 Raydium 则通过推出代币发射平台在做相反的事情。

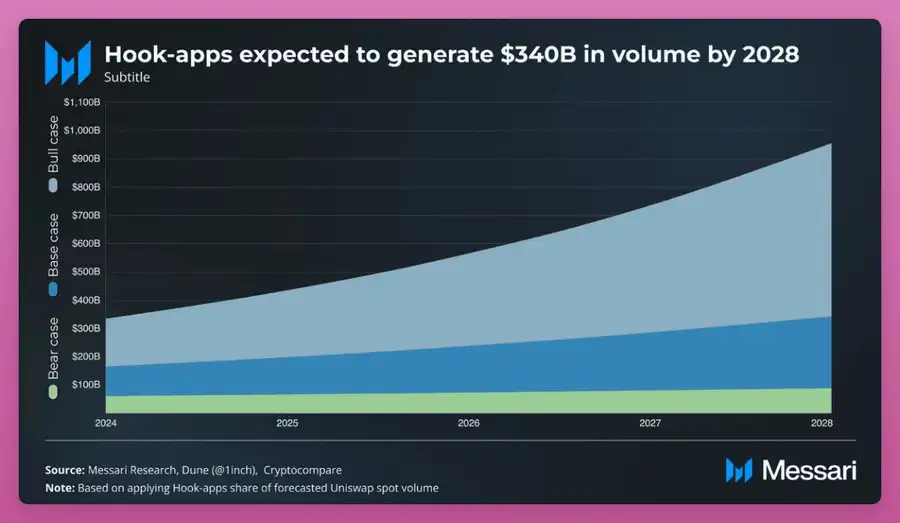

再比如 Uniswap v4 的推出,带有「Hooks」功能,类似于「插件」或「扩展」。

这些「Hooks」将 App Store 引入了 iPhone。就像苹果不再需要自己开发 iPhone 应用一样,开发者可以在 Uniswap 之上构建应用。

代币发射平台 @flaunchgg 就是一个很好的例子,利用 Uniswap v4 的 Hooks 以及 Aave 提供流动性。

Uniswap v4 的 hooks 非常棒,因为它们让开发者可以在协议之上构建应用。

虽然增长较慢(为了推动 hooks,Uniswap 启动了流动性挖矿活动),但 Messari 预计 hook 应用的采用将会加速。

我相信,那些成功从单纯基础设施演变为平台的协议将会拥有显著的溢价。这种转变有助于避免以太坊陷入的商品化陷阱。

另一个例子是刚刚发布的 Fluid DEX v2:它让开发者可以为协议进行构建。

Fluid v2 将其从一个带有 DEX 功能的借贷协议,转变为一个允许第三方开发者为该协议构建的开放平台。

即使 DEX 对终端用户进行了抽象,Fluid v1 DEX 依然凭借其被顶级 DEX 聚合器整合的优势,挑战了 Uniswap。

在 v2 版本中,Fluid 将借贷与 AMM 流动性合并,创建了一个既是面向大户的前端,又是开发者平台的协议。

你将获得:

• 默认情况下,范围订单会赚取收益(没有闲置流动性)。

• 借贷提供流动性策略(DeFi 首创)。

• 为开发者提供 Hooks + 动态费用、永续合约等功能。

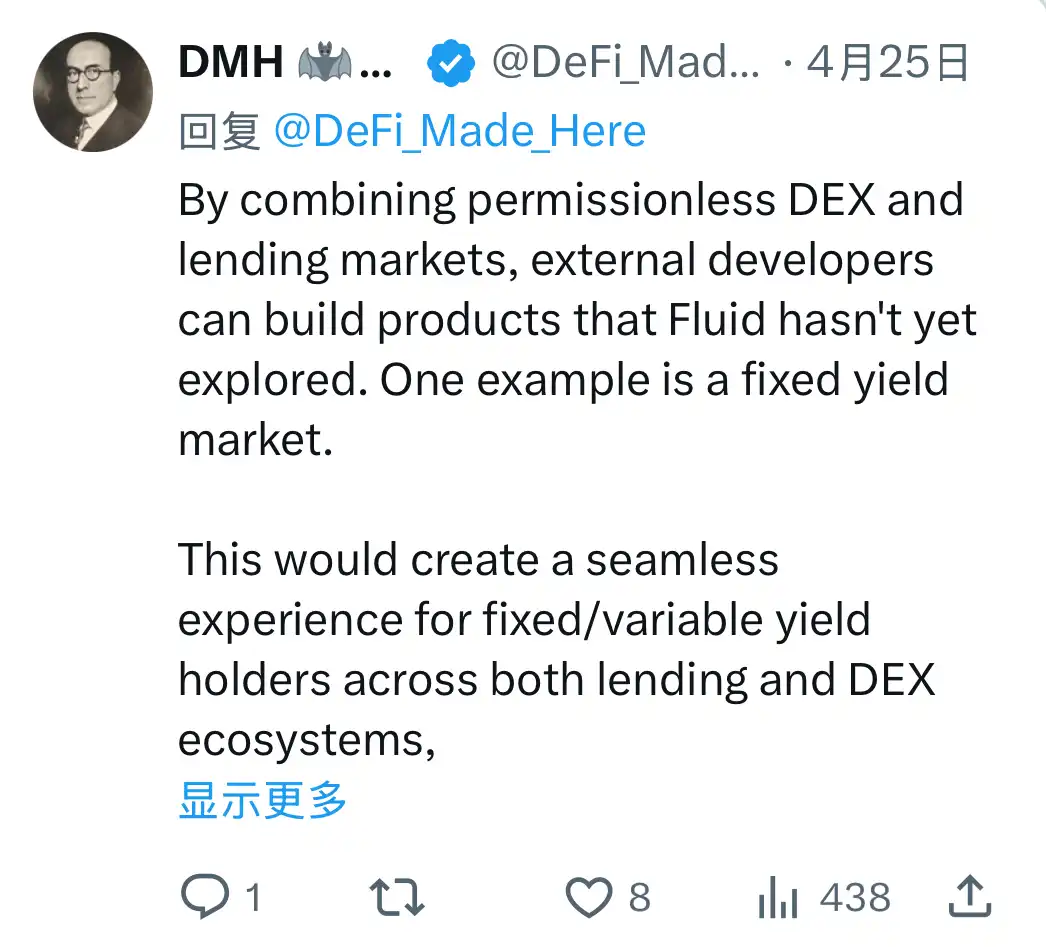

Fluid 将推出无许可的 DEX 和借贷市场,开发者可以在 Fluid 上构建新产品。

正如 @DeFi_Made_Here 所写,这是一个固定收益市场。

关键的是,价值流回协议:每一个 hook、跨抵押仓位或在 Fluid 上构建的永续合约应用,都与生态系统共享费用。

我相信,v2 版本的 DEX 和 Fluid 的资本效率将帮助避免商品化陷阱:就像 Aave,它是大户的前端;

就像 Uniswap v4,它是开发者平台。通过在协议层整合借贷和 AMM 逻辑,并提升资本效率,它成为了债务驱动 LP 等策略的最佳平台。

协议不需要在基础设施和应用之间做出选择,有了$FLUID,它们可以同时具备这两者的特点。

免责声明:我持有$FLUID 代币。

「原文链接」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。