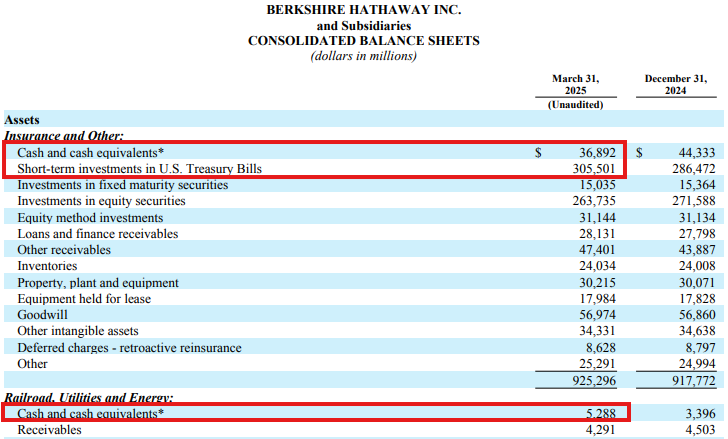

沃伦·巴菲特的伯克希尔·哈撒韦在 2025 年第一季度再次出售了部分资产换取了更多的现金,目前的现金量已经达到了历史最高的 3,477 亿美元。

巨鲸已经在开始筹集更大的现金,并且作为一个美元的死多头,巴菲特也在说可以持有其它(国家)的货币。并且对近期风险市场的波动表态认为,“如果伯克希尔股价下跌 50%,我会看到机会,而不是恐惧。”

---这里开始是我说的,未必是对的---

接下来的市场很有可能是机会和风险并存,经济可能没有我们想象的那么好,继续维持高利率必然会增加衰退的风险。

从 1945年 开始美国联邦基金利率超过 4.5% 的情况下仅有两次没有发生经济衰退,其中 1966年 虽然没有经济衰退但也是明显的经济下滑,只有 1984年这次是顺利度过的,经济没有受到影响。

而历史上利率超过 4.5% 的,连现在一共是九次,其中有七次不是衰退就是经济大幅下行,只有一次是顺利度过,那么这次会不会是例外?

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。