工作日的最后一天,短期最后一个麻烦也解决了,周五的非农数据数据还不错,失业率继续维持在上个月的 4.2% 并没有继续提升,这对于美国经济来说算是利好了,毕竟刚刚度过了 GDP 的风波,失业率也让四月的经济数据没有太难看,然后就业的数据虽然低于前值但超过预期,尤其是下修了前值数据后,差距更不明显了。

只有工资水平有少许的下降,年率是上月一样,月率减少了 0.1% ,这个数据也是美联储喜闻乐见的,所以这次的非农数据短期内帮美国摆脱了经济衰退的困扰,虽然可能还有些下行,但温和下行的标签也被打上了。

风险市场也因此再次上涨,第一目标还是回到 2月25日 因为关税导致的下跌,目前还有5%左右的空间,在美股闭盘前纳指和标普都上涨了超过 1.5%, $BTC 也较为稳定的在 97,000 美元附近,尤其今天还是周五,接下来的两天更是市场情绪会占位主导。

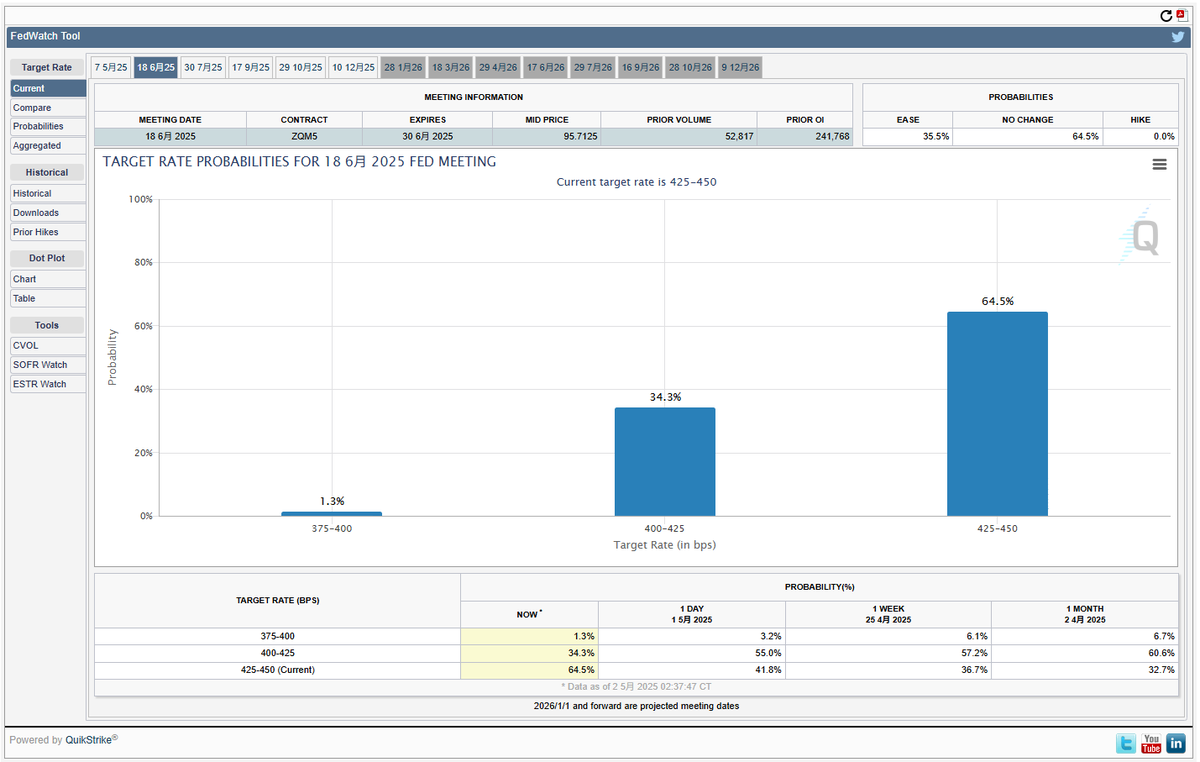

在关税的问题上今天仍旧是美国和中国扯皮的一天,但关税的问题已经被市场有了足够的预期,想来只要川普不吓搞不会有太大的影响,但也正是因为如此,市场对美联储的降息预期也在下降,从四次下调到三次,并且不在预期美联储会在六月降息。

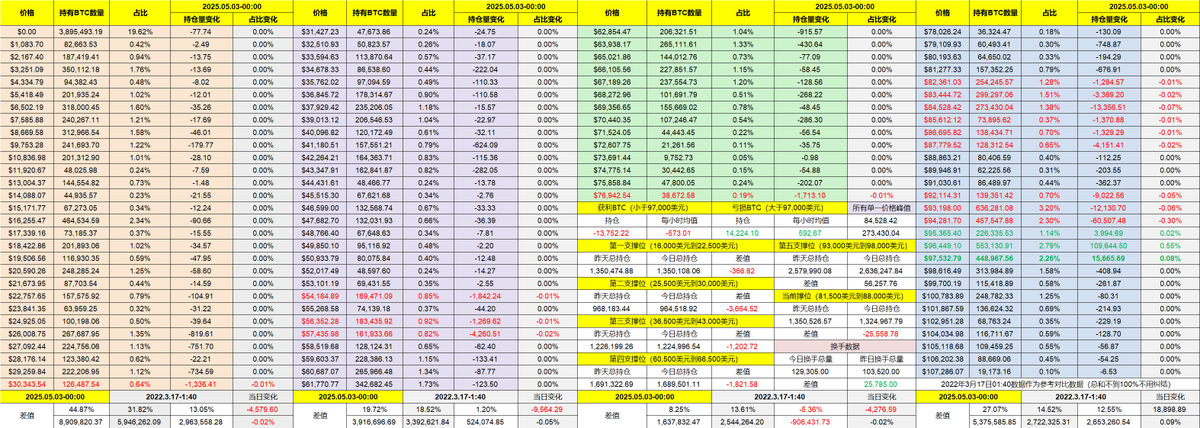

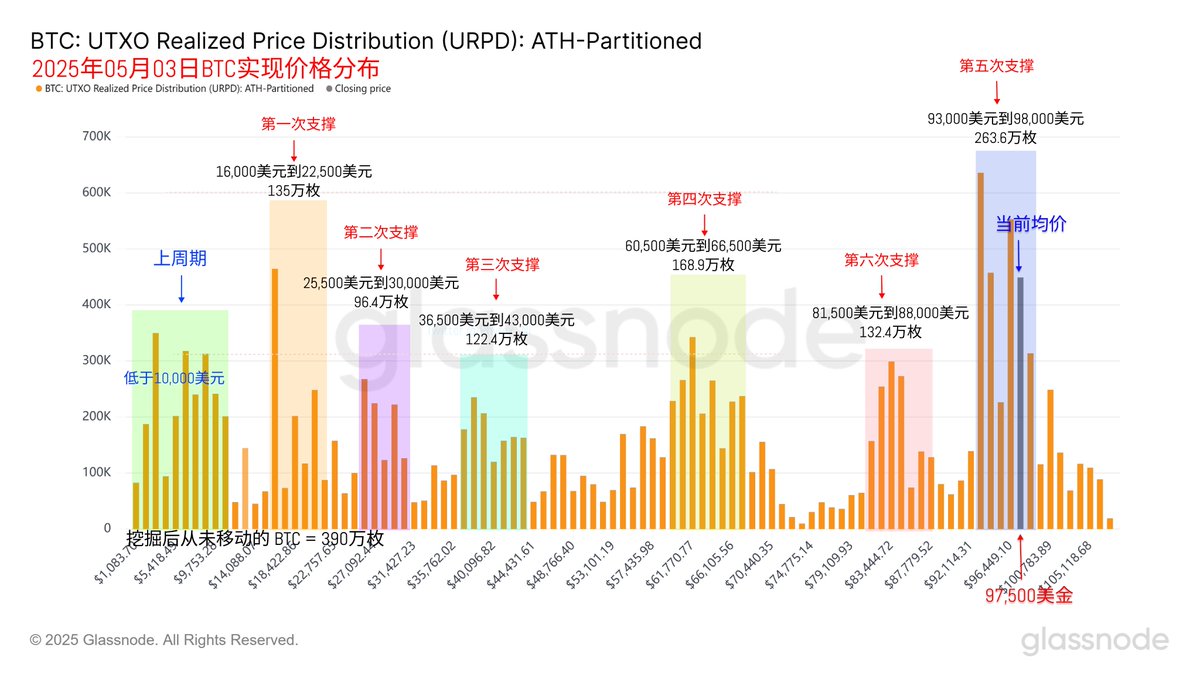

回到 Bitcoin 的数据来看,市场的表现还是比较平淡的,但短期投资者还是出现了提前离场的迹象,而且换手率增加了一些,毕竟超过 97,000 美元的 $BTC 已经让第一季度被套的投资者回本,如果第一季度还有抄底,那么现在还是有不错的利润。

另外也像之前说的一样,93,000 美元到 98,000 美元之间既是很稳固的筑底位置,也是现在的阻力位置,现在这个区间的BTC已经汇集了超过 260万枚,几乎是短期市场的整体流动性了。

仍然是只要这个区间的投资者不出现崩溃,价格上还是有不错的乐观。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。