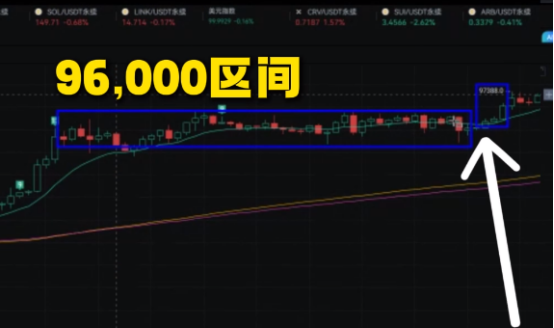

比特币经过多日的这个盘整震荡,昨天终于实现了一根大阳线拔地而起,突破了我们所谓的

之前的这个96,000这个区间。

也是一举冲上了97,500这个位置,目前日线级别这个地方有形成双顶这种迹象,但是没有完全破位。

但是有一点今天晚上是5月份的一个非农数据,所以说今天晚上的数据还是蛮重要的然后从目前情况来看,日线级别MACD有顶部背离的这种迹象,所以说短期有价格回落的这种风险,这个需要我们去注意的,那目前下方比较强势的一个点就是96,000这个点。

也就说之前这个破位也是双顶形成破位的必经一个点,如果说这个96,000破位,实体收线收到这个下方的话,短期双顶形成,有可能价格进一步回落至之前的,94,000 93,000这些位置,这个是需要我们重点关注的,更下方依旧我们要关注91,500这个位置的一个支撑情况。

这是短期比特币的一个情况,从小时图来看短期动能明显的不足,所以说短期我们也要去做好这种防范风险,另一个角度如果说你偏激进的这个情况下来看,从这个趋势线的这个角度目前没有完全跌破这个趋势线,那我个人觉得没有跌破趋势线的同时,依旧可以围绕趋势线去逢低买入做多。

如果说你对做单子啊感到比较迷茫,关注我们的公众号:KK攻略

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。